On Could 31, 2025, XRP/USDT on the 4-hour chart created a descending channel sample.

A descending channel types when price strikes between two downward-sloping parallel strains, indicating managed promoting with potential for breakout.

Presently, XRP trades at $2.133. The token is bouncing close to the decrease boundary of the channel and sits beneath the 50-period EMA at $2.2795. If the sample confirms with a breakout above the higher purple trendline, the price may rally 34% from the present degree.

This might push XRP to the $2.870 zone, as marked on the chart.

Quantity stays regular, whereas RSI is at 30.88, close to the oversold zone, suggesting potential bullish reversal stress. The RSI additionally reveals indicators of divergence from the falling price pattern.

Up to now, the channel has guided decrease highs and decrease lows since Could 13. Nevertheless, XRP has maintained assist at every cycle low. If patrons regain power and breach the higher boundary, momentum might flip sharply upward.

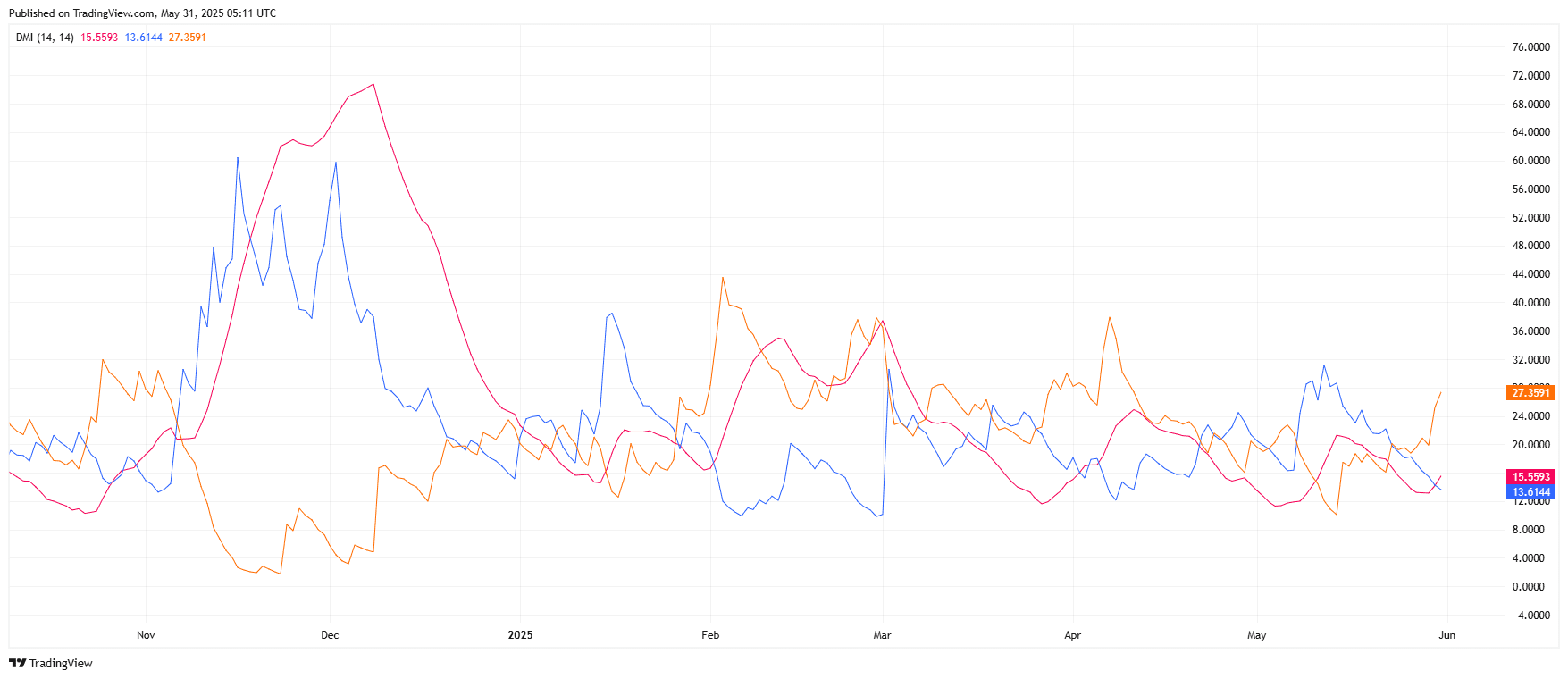

XRP Development Momentum Strengthens as ADX Climbs Above 27

On Could 31, 2025, XRP’s pattern power started rising once more, in accordance with the Directional Motion Index (DMI) on the day by day chart.

The Common Directional Index (ADX) now reads 27.3591, rising above the 25 threshold that alerts a strengthening pattern. The optimistic directional indicator (+DI) stands at 13.6144, whereas the unfavourable directional indicator (−DI) is barely larger at 15.5593, exhibiting bears nonetheless have minor management.

Nevertheless, the ADX’s upward slope confirms that momentum is constructing. For many of Could, XRP traded in low-momentum situations because the ADX remained beneath 25. This new breakout suggests the market is getting into a extra decisive section.

If +DI crosses above −DI within the coming periods whereas the ADX continues to climb, it may mark the start of a stronger bullish pattern. Till then, the token stays at a turning level, with rising stress however no clear directional breakout but.

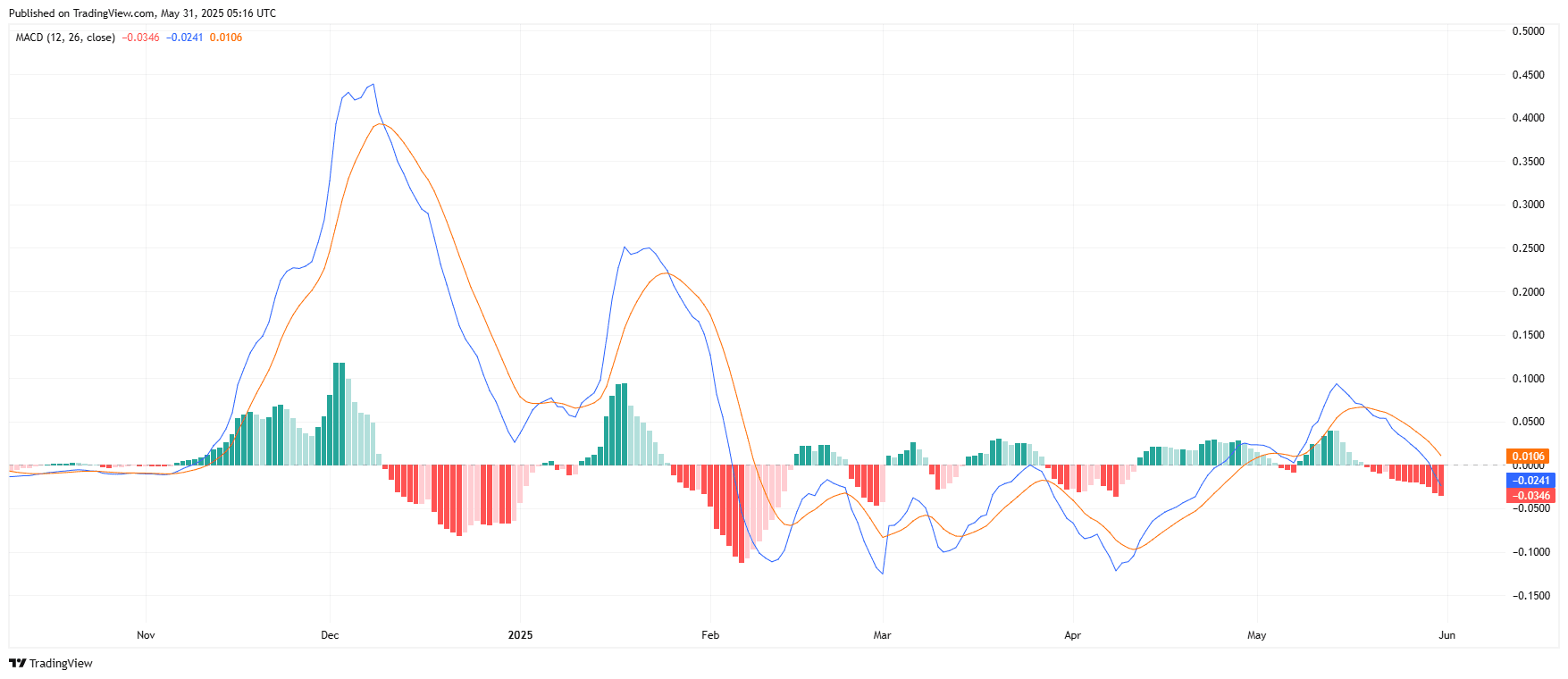

XRP MACD Flips Bearish as Sign Line Crossover Confirms Weak Momentum

On Could 31, 2025, the Transferring Common Convergence Divergence (MACD) for XRP/USDT confirmed a bearish crossover on the day by day chart.

The MACD line (blue) dropped beneath the sign line (orange), with present values exhibiting MACD at -0.0346 and sign at -0.0241. The histogram additionally shifted to deeper purple, reflecting rising bearish momentum.

This crossover alerts a change in short-term pattern route. Since early Could, the MACD had stayed above the sign line, supporting a gentle bullish bias. Nevertheless, the reversal now suggests the upside stress has pale.

Furthermore, the declining histogram bars level to rising promoting stress. If the bearish divergence continues, XRP may even see additional draw back earlier than any restoration try.

The indicator’s present place beneath the zero line additionally reinforces the unfavourable pattern.

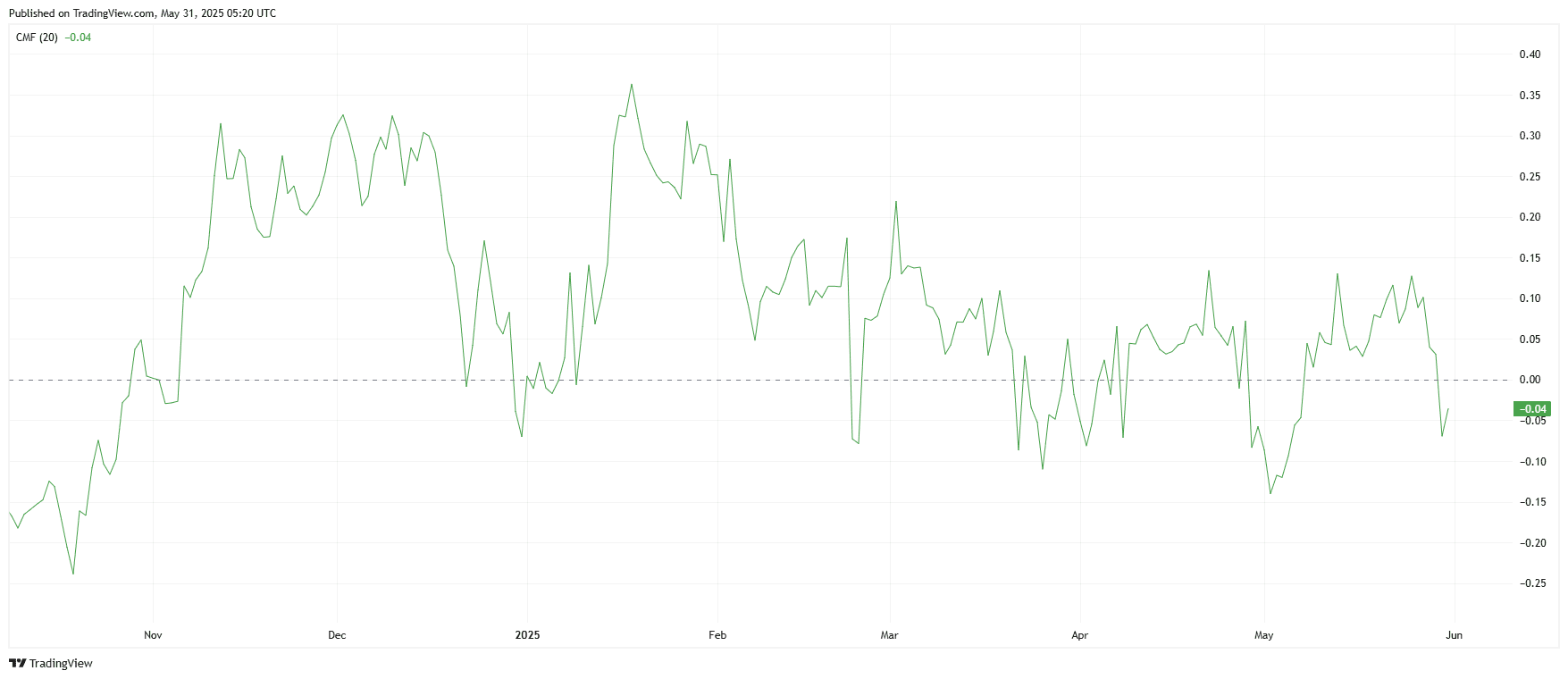

XRP Faces Weak Shopping for Stress as CMF Turns Unfavorable

On Could 31, 2025, the Chaikin Cash Circulation (CMF) for XRP/USDT dropped to −0.04, slipping beneath the impartial zero line.

The CMF measures shopping for and promoting stress utilizing each price and quantity. Values above zero sign accumulation, whereas readings beneath zero point out distribution. XRP now reveals delicate capital outflow, confirming bearish sentiment.

For many of Could, CMF stayed above zero, exhibiting some accumulation. Nevertheless, the most recent drop into unfavourable territory alerts that sellers are regaining management.

If CMF stays beneath zero and continues to say no, XRP may stay beneath stress, limiting any short-term rebound makes an attempt.