Will Bitcoin’s $100K milestone set off one other sell-off? Discover previous traits, present market indicators, and altcoin impacts on this BTC price prediction article. Keep ready with key buying and selling insights.

$100k as a psychological barrier

Traditionally, Bitcoin (BTC) has confronted vital resistance at main psychological price ranges, with $100,000 being a notable milestone. In late 2024, when BTC briefly touched $100k, it triggered a pointy sell-off.

This phenomenon, typically pushed by profit-taking from short-term merchants and institutional gamers, noticed BTC retreat by 10-15% inside days. The $100k stage, considered as a euphoric peak, prompted holders to lock in beneficial properties, resulting in heightened volatility and a brief correction.

Such habits aligns with earlier milestones like $10k in 2017 and $50k in 2021, the place fast surges had been adopted by pullbacks as market sentiment shifted.

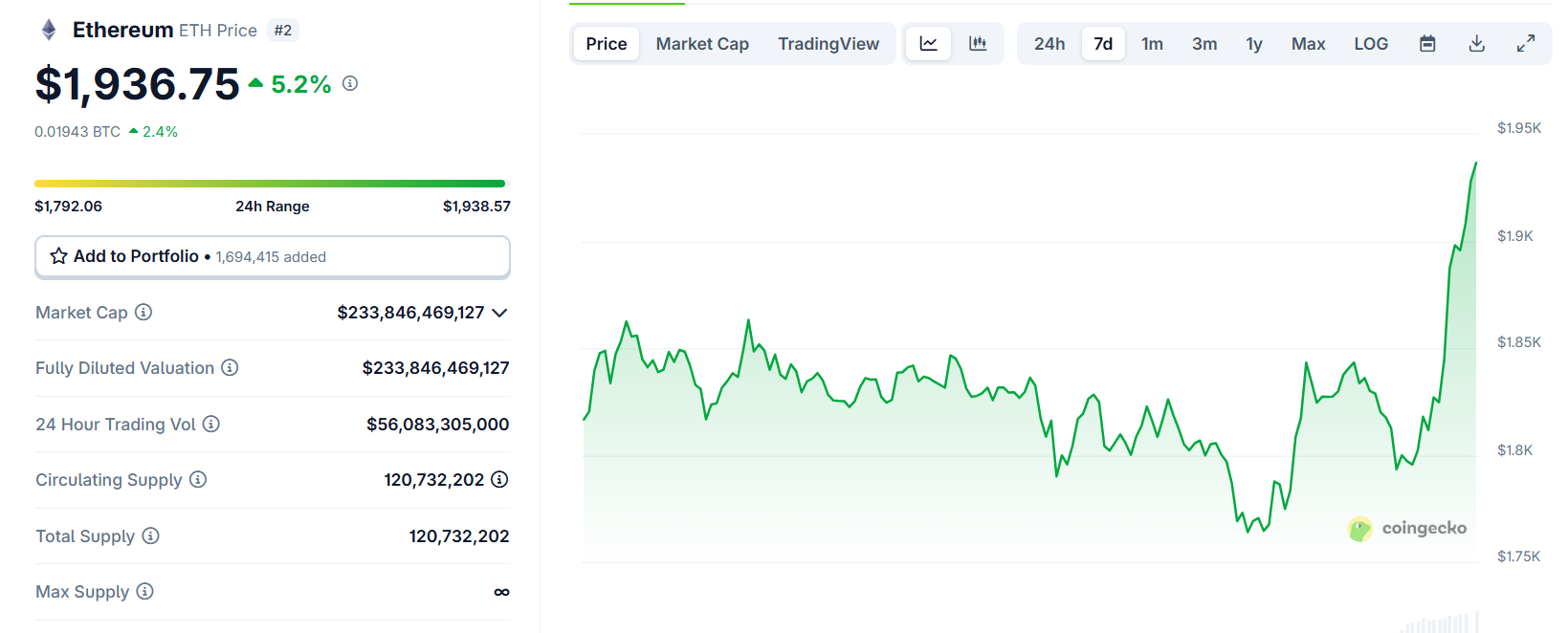

Supply: CoinGecko

What’s going to occur when BTC reaches $100k once more?

In 2024, as BTC rallied from $80k to $100k, buying and selling quantity spiked, and leverage in derivatives markets soared, indicating speculative fervor. Every time BTC neared this stage, on-chain knowledge confirmed elevated exercise from whale wallets transferring to exchanges, a sign of potential promoting strain.

As talked about by @FastOptical, there will likely be an enormous promote wall at $100k:

100k will likely be an enormous promote wall to get by cc @ChainStatsPro market depth, orderbooks snapshot. $btc pic.twitter.com/xDtyJ2j5ho

— Liquidity Value (@FastOptical) Could 8, 2025

Nonetheless, not each strategy led to a dump. For example, in Q3 2024, BTC consolidated round $95k for weeks and not using a main correction, supported by sturdy institutional shopping for and ETF inflows.

The important thing differentiator seems to be market circumstances: overheated sentiment (excessive funding charges, extreme leverage) typically precedes sell-offs, whereas regular accumulation mitigates dumps.

As of Could 2025, with BTC hovering round $98k, low leverage and balanced sentiment recommend a attainable breakout above $100k, although vigilance for sudden shifts stays important.

Altcoin follows Bitcoin

Altcoins usually observe Bitcoin’s price motion, amplifying its actions. When BTC surged to $100k in 2024, main altcoins like Ethereum (ETH) and Solana (SOL) rallied 20-30% in tandem, solely to face sharper corrections throughout BTC’s pullback.

Supply: CoinGecko

This correlation stems from market psychology: BTC’s dominance drives capital flows, and a BTC sell-off typically triggers panic in altcoin markets. Smaller-cap altcoins, with decrease liquidity, are hit hardest, typically dropping 40-50% in hours.

Commerce with warning

For merchants, this dynamic underscores the necessity for warning. Key concerns embody:

- BTC Dominance: A rising BTC dominance index typically indicators altcoin underperformance, particularly throughout corrections.

- Liquidity Administration: Keep away from over-leveraging altcoin positions, as volatility spikes throughout BTC dumps.

- Selective Alternatives: Altcoins with sturdy fundamentals (e.g., layer-1 protocols with excessive developer exercise, DEX, DeFi) might recuperate sooner post-correction.

- Danger Mitigation: Set stop-losses and diversify publicity to scale back draw back threat throughout BTC-led volatility.

Merchants and buyers ought to strategy the $100k milestone with a transparent technique. First, observe on-chain metrics like alternate inflows and whale exercise to gauge promoting strain. Second, monitor derivatives markets for indicators of overheating (e.g., excessive funding charges or open curiosity). Third, prioritize capital preservation by decreasing leverage and securing income in altcoins throughout BTC’s strategy to $100k.

Whereas $100k might mark a historic breakout, getting ready for volatility is vital to navigating this pivotal second.