On June 6, the crypto market crash worn out $95 billion from whole market worth. The worldwide market cap dropped 3.03%, falling to $3.2 trillion, in response to CoinMarketCap. Through the decline, the Bitcoin price dropped to $101,928.79, whereas Ethereum fell 3.73% to $2,489. XRP additionally declined, shedding 3.34% to succeed in $2.13.

In line with Coinglass, crypto liquidations within the final 24 hours surpassed $595 million. Over 156,000 merchants had been liquidated through the interval. The most important single liquidation got here from a Binance ETH/USDT commerce price $9.48 million.

Amongst prime property, Bitcoin accounted for $171 million in whole liquidations, adopted by Ethereum liquidation at $143 million. XRP liquidations stood at $16.6 million, whereas Solana and Dogecoin confronted liquidations of $40 million and $22.52 million, respectively.

Out of the entire, $547 million got here from lengthy positions, whereas brief trades made up $50.08 million. This imbalance signifies a major lengthy squeeze. The sharp pressured exits pushed Bitcoin, Ethereum, and XRP nearer to crucial help zones through the crypto market crash, reflecting speedy de-risking throughout main property.

Trump–Musk Crypto Conflict Triggers Promote Strain

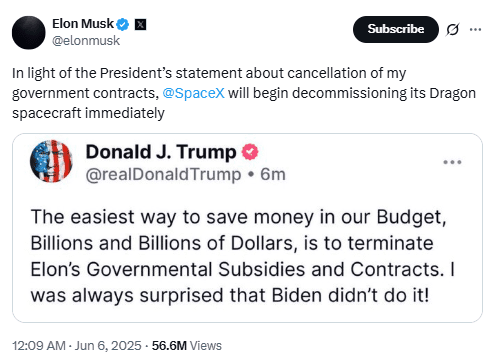

The Trump Musk crypto battle intensified on June 5. Tesla CEO Elon Musk posted on X:

“Call your Senator. Call your Congressman, Bankrupting America is NOT ok! KILL the BILL.”

Musk urged lawmakers to reject a proposed finances invoice. Later that day, U.S. President Donald Trump responded on Fact Social, saying:

“Ending Elon Musk’s federal support would save billions and billions.”

The Tesla inventory dropped over 17% after Trump’s remarks. The decline worn out round $100 billion in Tesla’s market worth. The fallout between Trump and Musk spilled into the crypto market, dragging sentiment decrease.

The crypto market crash adopted quickly after the Tesla selloff. Merchants started exiting positions, doubtless reacting to doable liquidity considerations linked to Musk’s corporations. Bitcoin price dropped alongside Ethereum and XRP because the broader market reacted to the Trump Musk crypto dispute.

Crypto Whales Dump BTC, ETH, XRP, SHIB to Coinbase

Throughout the identical day, on-chain tracker Whale Alert reported a sequence of enormous promote transactions. One whale despatched 917 BTC, price $94.3 million, to Coinbase Institutional. One other pockets transferred 26.67 million XRP to the identical change.

Crypto whales dump their property to exchanges after they put together to promote. The timing of those strikes matched the interval of elevated liquidations and falling costs. XRP whale selloff exercise added stress through the crypto market crash.

Alongside Bitcoin and XRP, whales additionally offloaded meme tokens. Whale Alert tracked a transaction involving 2.86 trillion SHIB tokens moved to Coinbase. The quantity suggests a coordinated transfer to promote through the ongoing Ethereum liquidation and Bitcoin price drop.

The sample of wallet-to-exchange transfers throughout heightened volatility indicators danger discount amongst massive holders. The crypto market crash, mixed with ongoing political stress and macroeconomic uncertainty, pushed merchants and whales to behave rapidly.