Oleksandr Shatyrov

In March 2023, I coated Ethereum and whereas I used to be bullish on Ether I seen staking as a pleasant to have relatively than a recreation changer. On the time, I had a 4.2% staking yield on a web foundation and the time of writing that yield is simply 3.1%. I’m not shocked by that, as extra validators have come on-line the APR has tapered however with Ether costs doubling, you received’t hear me complain concerning the decrease staking yields.

Extra essential to the bull case for Ether are software, acceptance and rates of interest.

Why Curiosity Charges Are Vital To Ethereum

Whether or not you prefer it or not, cryptocurrencies are nonetheless thought-about excessive danger property and when borrowing cash turns into dearer we see that larger danger asset courses turn into considerably much less desired. I wouldn’t say that you’re higher off gathering curiosity in your fiat as an alternative of receiving staking rewards as a result of my financial institution nonetheless solely presents 1.7% curiosity which doesn’t beat the three.1% staking reward. Nevertheless, the overall thought movement is that when rates of interest decline traders are extra prepared to look into larger danger asset courses and Ethereum is a type of. Maybe, that reveals much more power of cryptocurrencies all through the upper price atmosphere that presently exists.

Why Ethereum Spot ETFs Are Vital?

Subsequent to rates of interest one other driver of Ether costs is the acceptance or software fields and I imagine that developments in these areas and extra significantly the launch of Ethereum spot ETFs has been a buoying pressure for the crypto costs. Ethereum spot ETFs might present important help to Ethereum costs as a result of it makes investing in Ethereum’s price actions extra broadly accessible through a regulated channel. All of us have seen points with crypto exchanges equivalent to FTX and Binance and it makes it comprehensible that traders would relatively not stroll the paths of Ethereum publicity through much less regulated or capricious exchanges. So, not directly a crypto ETF catches off a number of the danger and makes crypto currencies a greater accessible asset class. With catching off danger I imply the likelihood to personal the asset and never the funding itself, which stays larger danger as a result of volatility nature of cryptocurrencies.

What Is An Ethereum Spot ETF?

An Ethereum spot ETF goals to trace the Ethereum price motion and truly holds the underlying commodity. The distinction between investing in an ETH ETF and investing in ETH is that while you purchase ETH, you might have direct publicity to the cryptocurrency whereas proudly owning by an ETF means you solely personal shares of possession within the ETF however not the underlying commodity. Whereas the ETF goals to trace the price second of Ethereum, as a consequence of administration charges and provide/demand imbalances in addition to liquidity within the ETF it could possibly be the case that the ETF doesn’t fully monitor the cryptocurrency price actions one-on-one.

Which ETH Spot ETFs Are Accessible?

To evaluate which ETH ETF is likely to be most tasty, now we have to first look which ETH ETFs have been authorized. On the time of writing the next ETH ETFs are authorized:

- Grayscale Ethereum Mini Belief – NYSEARCA: ETH

- Franklin Ethereum ETF – BATS: BATS:EZET

- VanEck Ethereum ETF – BATS: BATS:ETHV

- Bitwise Ethereum ETF – NYSEARCA: NYSEARCA:ETHW

- 21Shares Core Ethereum ETF – BATS: BATS:CETH

- Constancy Ethereum Fund – BATS: BATS:FETH

- iShares Ethereum Belief – NASDAQ: NASDAQ:ETHA

- Invesco Galaxy Ethereum ETF – BATS: BATS:QETH

- Grayscale Ethereum Belief – OTCQX: OTCQX:ETHE

Which ETH Spot ETF Has The Lowest Expense Ratio?

|

ETF Identify |

Ticker Image |

Expense Ratio |

Waiver |

|

Grayscale Ethereum Mini Belief |

NYSEARCA: ETH |

0.15% |

Waived for six months on first $2 billion AUM is reached |

|

Franklin Ethereum ETF |

BATS: EZET |

0.19% |

Waived for six months on first $10 billion AUM. |

|

VanEck Ethereum ETF |

BATS: ETHV |

0.20% |

Waived for 12 months on first $1.5 billion AUM. |

|

Bitwise Ethereum ETF |

NYSEARCA: ETHW |

0.20% |

Waived for six months on first $500 million AUM |

|

21Shares Core Ethereum ETF |

BATS: CETH |

0.21% |

Waived for six months on first $500 million AUM |

|

Constancy Ethereum Fund |

BATS: FETH |

0.25% |

Waived till 1 January 2025 |

|

iShares Ethereum Belief |

NASDAQ: ETHA |

0.25% |

Diminished to 0.12% for 12 months on first $2.5 billion AUM |

|

Invesco Galaxy Ethereum ETF |

BATS: QETH |

0.25% |

No |

|

Grayscale Ethereum Belief |

OTCQX: ETHE |

2.50% |

No |

Most ETF issuers have applied a six month waiver. There are two ETFs with no waiver. The ETHE ETF goes to be see 10% of the ETHE ETF being rolled over to the Grayscale Ethereum Mini Belief and due to this fact has no waiver. The Invesco Galaxy Ethereum ETF additionally appears to don’t have any waiver and a end result from expense ratio perspective I don’t see why this might be the perfect waiver. I imagine that the Grayscale Ethereum Mini Belief is most tasty as a result of it merely has the bottom

What Does The BTC Spot ETF Inform Us?

|

Ticker |

AUM |

Charges |

|

GBTC |

17.63B |

1.50% |

|

IBIT |

20.82B |

0.21% |

|

BITB |

2.57B |

0.20% |

|

BTCO |

495.5M |

0.20% |

|

HODL |

707.47M |

0.00% |

|

EZBC |

431.12M |

0.19% |

|

FBTC |

10.12B |

0.25% |

|

ARKB |

2,734B |

0.21% |

|

BTCW |

83.4M |

0.25% |

|

DEFI |

11.81M |

TBC% |

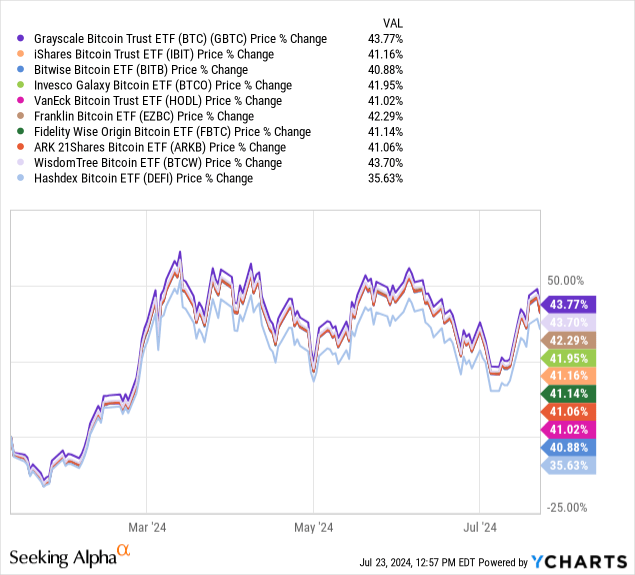

If we have a look at the BTC spot ETFs, we see that GBTC has the very best charge and most charges are round 0.2% to 0.25% with HODL being the exception with a really beneficiant waiver interval.

If we have a look at the returns, typically we see that the efficiency is extraordinarily shut and GBTC performs higher but additionally has a better charge. I’d under no circumstances draw the conclusion that larger charges are someway leading to higher returns. The GBTC ETF is transformed from a belief so it has a special launch dynamics that isn’t legitimate for all ETFs. Normally, I imagine that considerably simple decrease charges end in higher efficiency.

With that in thoughts, the Grayscale Ethereum Mini Belief can be my most popular choose.

Purchase Ether or an ETH ETF?

Whereas many analysts will doubtless deal with which ETF to purchase, I imagine that given the low charges the Grayscale Ethereum Mini Belief is the plain alternative. Nevertheless, the SEC authorized ETH ETFs beneath sure circumstances and a type of circumstances is that the underlying commodity can’t be staked at this time limit. For sponsors to stake the ETF, the principles as soon as once more must be modified and that additionally implies that in case you’re prepared to personal Ether immediately which may in truth be the extra rewarding possibility given that you may compound staking rewards as an alternative of paying an expense charge. The downside is that you may simply purchase shares of an ETF, however shopping for crypto from an trade can take longer as you might have enroll your self in a crypto trade, file all paperwork after which to purchase and promote it’s a must to validate your transaction.

In my case, if I have been to purchase or promote ETH immediately I must discover my Ledger pockets, log in, log in on the crypto trade, problem the switch after which validate the switch and pay charges. Shopping for an ETF would nonetheless end in transaction charges however buying and promoting shares would doubtless occur quicker and I don’t must go search for my {hardware} pockets to approve the transaction. So, there are execs and cons. In the meanwhile, I would like to carry the coin immediately.

Conclusion: Spot ETH ETFs Are A Large Step However There Might Be Extra

I imagine that the launch of ETH spot ETFs opens ETH to a gaggle of traders that will in any other case not have publicity to crypto as a result of course of of shopping for and promoting crypto being extra elaborate than shopping for or promoting shares or as a result of getting all paperwork so as to commerce on a cryptocurrency trade is likely to be a problem and over time some exchanges have put stress on the fame of cryptocurrencies and crypto exchanges. So, whereas ETH ETFs don’t totally catch off danger within the sense that like with any funding danger is at all times a component, they make the method of shopping for and promoting extra handy and accessible. The massive query is when the underlying commodities could possibly be staked, as a result of that will most positively be a recreation changer and will additionally decide which ETH ETFs are literally most tasty in the long term. For now, for those who can not purchase ETH-USD immediately I’d go for the Grayscale Ethereum Mini Belief.

It must also be famous that Constancy is the one self-custody ETF, the opposite ETFs principally use Coinbase as custodian. So, if you need a self-custody ETF you’ll need to contemplate FTBC as a substitute.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.