In 2021, the Metaverse was as soon as crypto’s most trnding crypto sector. Tokens like The Sandbox (SAND), Decentraland (MANA), and Axie Infinity (AXS) surged in worth. Initiatives promised absolutely immersive digital worlds the place customers might play, construct, and earn. Main manufacturers purchased digital land, enterprise capital poured in, and even Fb modified its title to Meta to point out its dedication to the area.

These developments fueled a sector-wide rally. The Metaverse grew to become probably the most talked-about narratives in the course of the 2021 bull run, driving tens of millions of {dollars} in buying and selling quantity and hypothesis.

Nonetheless, a lot of that momentum started to fade by early 2022. Token costs dropped sharply, each day consumer numbers declined, and tasks struggled to retain consideration. The broader crypto bear market solely made situations worse. By 2023, most Metaverse tokens had misplaced over 90% of their worth.

Public curiosity light, media protection shrank, and traders shifted focus to new developments like synthetic intelligence and real-world asset tokenization. The Metaverse narrative was broadly thought-about useless.

What the Knowledge Says About Traders

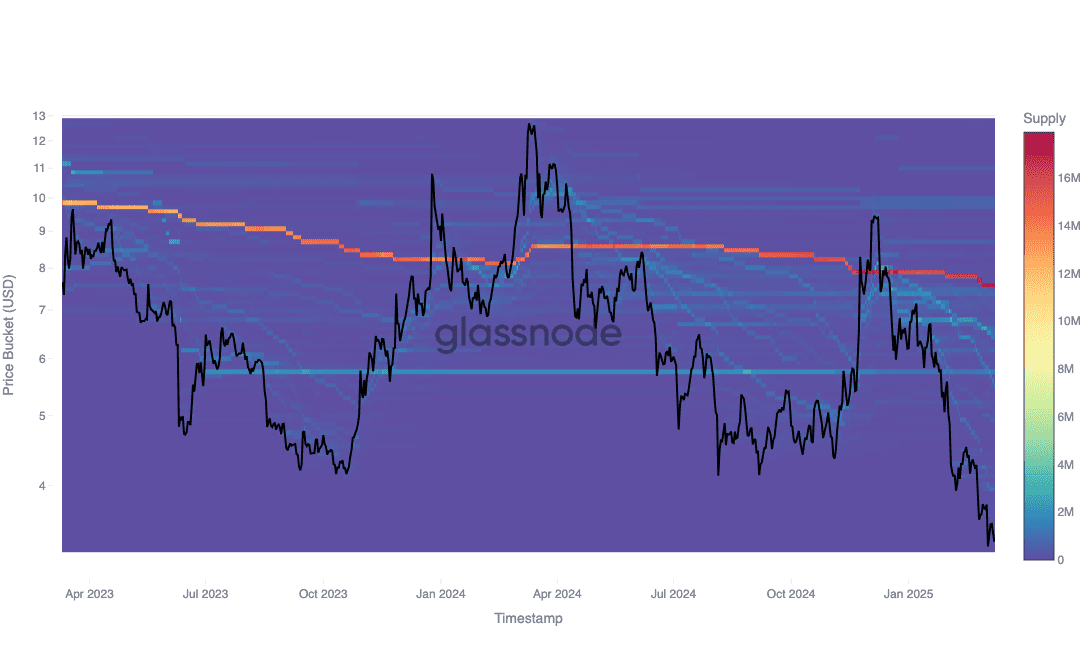

A latest report from blockchain analytics agency Glassnode suggests the Metaverse story is probably not over. The research used Value Foundation Distribution (CBD) to check how token holders have behaved on this post-hype setting.

CBD information helps analyze the place token holders final moved their property and at what price factors. By mapping this throughout price ranges, analysts can perceive whether or not traders are shopping for extra (accumulating), promoting at a loss (capitulating), or just holding on.

In contrast to market price information, which displays short-term sentiment, CBD supplies perception into longer-term conviction. Within the case of Metaverse tokens, the information signifies quiet however persistent accumulation at decrease price ranges.

The Sandbox (SAND) — Quiet Accumulation at Decrease Ranges

The price of SAND has fallen by practically 97% from it’s all-time excessive above $8, now buying and selling at roughly $0.26. Regardless of this, Glassnode’s information exhibits regular accumulation between $0.20 and $0.50 all through the latest bear market.

This sample signifies that whereas speculative curiosity has declined, some traders proceed to build up SAND, doubtless betting on its long-term utility and ecosystem improvement. Slightly than exit the sector, these holders look like averaging down their value foundation.

MANA, the native token of Decentraland, has additionally fallen from highs above $5 to round $0.23. Nonetheless, Glassnode noticed a big provide focus forming between $0.55 and $0.65 in late 2024. This means that traders responded to falling costs by re-entering the market or including to their positions.

Axie Infinity (AXS) has skilled probably the most extreme downturns amongst Metaverse property. From a peak close to $165, it now trades under $3—down over 98%. But, on-chain information exhibits accumulation continues, notably between the $5 and $10 vary.

The entire Metaverse crypto token market cap now stands at roughly $8.49 billion, far under its 2021 peak of $38 billion. Main tokens like SAND, MANA, and AXS have all seen weekly losses between 8% and 15%, whereas buying and selling quantity has dropped over 29% previously 24 hours.

Regardless of this drastic downturn, the CBD information exhibits that long-term holders haven’t solely deserted the sector. In actual fact, accumulation patterns counsel these traders might even see right this moment’s low costs as a strategic shopping for alternative.

From the skin, it would seem like the Metaverse crypto pattern is over. The hype is gone, costs are low, and fewer persons are speaking about it. However on-chain information exhibits that long-term traders are nonetheless energetic. They aren’t giving up. They’re quietly making ready for a future comeback.

Nobody is aware of if the Metaverse will turn into widespread once more. It relies on many issues—expertise, gaming developments, and new use circumstances. However for now, one factor is evident: the Metaverse isn’t useless. It’s sleeping. And a few traders are nonetheless holding on.