Staking is now a novel technique to earn passive revenue on idle crypto holdings. The blockchain that makes use of the proof-of-stake consensus mechanism wants stake contributions to safe the community and validate transactions. By contributing to the community’s stability, customers who lock up their tokens for a interval get rewarded, and what’s sweeter than “free” cash?

Nonetheless, the most important disadvantage of conventional crypto staking strategies is that they lock up liquidity. As soon as a person has locked up their idle crypto, it’s not accessible for different features like buying and selling and even DeFi functions. So, what’s liquid staking, and what distinctive options does it introduce to customers who need to reap extra advantages from their idle digital property?

This complete information explores this idea of staking, the way it works, and its distinctive advantages. It additionally introduces some platforms the place you may follow this completely new type of staking.

What Is Staking?

Staking is a system inside the cryptocurrency house that enables customers to earn curiosity or rewards by investing in holding sure cryptocurrencies. The idea works with cryptocurrencies that use the Proof of Stake (PoS) consensus mechanism, which is one in all a number of consensus fashions for blockchain networks.

Crypto property specializing in decentralizing finance (DeFi), like Solana, which makes use of the PoS protocol, depend on peer-to-peer (P2P) transactions and good contracts and don’t require conventional banking laws. There are lots of advantages related to staking that might make you think about using your idle cryptocurrency to realize rewards.

Whenever you put cash in a financial savings account at your financial institution, the establishment rewards you with rates of interest differing based mostly in your account kind. That is just like staking advantages, the place your cryptocurrency can accumulate rewards equivalent to the curiosity you earn on the financial institution. Staking entails parking your digital property like Solana, Ethereum, Cardano, and others long-term and receiving rewards for supporting the community’s effectivity, credibility, and safety.

What Is Liquid Staking in Crypto?

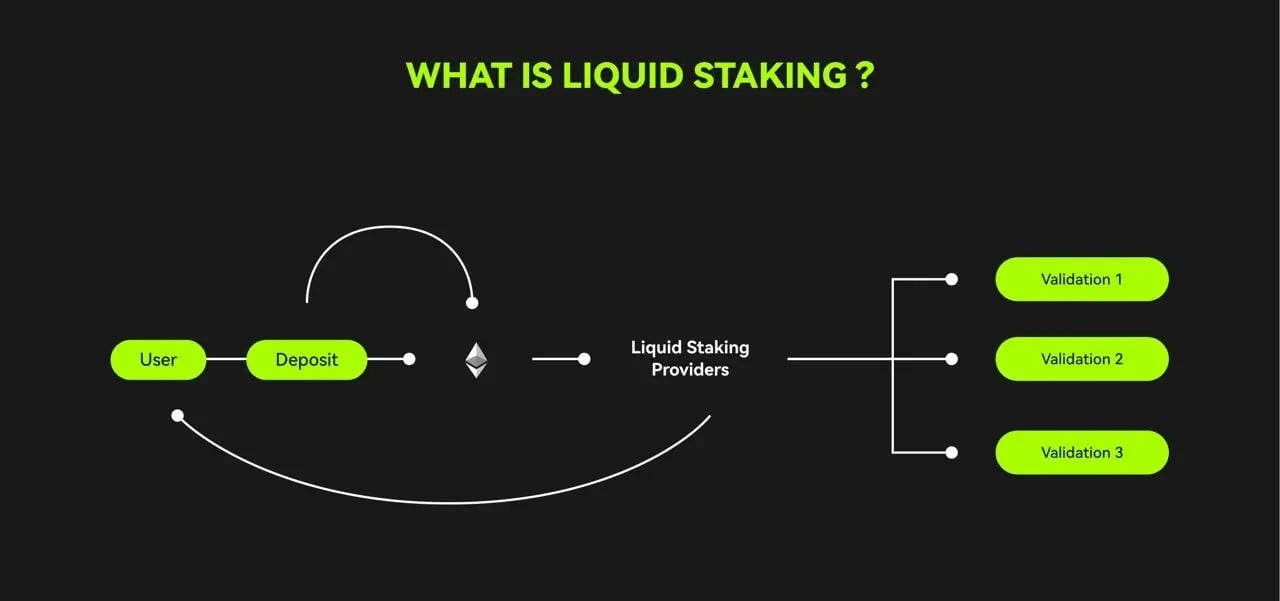

Liquid staking takes on this problem head-on because it allows stakers to have liquid property to cowl the place of their staked crypto property. The liquid staking token, often known as liquid staking derivatives has the identical worth because the staked token. Customers can freely use them for buying and selling, as collateral for crypto loans, or simply about some other monetary funding operate they will make use of inside the cryptocurrency house. This type of staking is, due to this fact, an evolution of the native staking system.

Standard staking entails merely locking idle property on a PoS blockchain and ready to earn rewards for contributing to the community’s effectivity and safety, making them illiquid. Nonetheless, liquid staking goes a step additional by enabling customers to stake their property whereas sustaining their liquidity all through the lockup interval. In brief, it entails the tokenization of staked cryptocurrencies.

Supply: OKX

This new idea gives totally different mechanisms that allow customers to stake their crypto with out compromising the liquidity of the staked digital asset. Generally, the person receives the Liquid staking token (LST) in return for his or her staked crypto. For instance, while you’re concerned in ETH liquid staking on a platform equivalent to Lido, you’re given the stETH token within the staking derivatives mannequin.

Alternatively, you may stake your crypto instantly with out changing it to an LST in a mannequin generally known as native staking, equivalent to while you stake ADA on the Cardano blockchain. Consequently, staked tokens can have extra utility and suppleness because the homeowners earn further rewards whereas sustaining liquidity.

Liquid staking issues as a result of platforms like Cardano, Lido, and others that follow it allow customers to obtain staking rewards apart from giving larger accessibility to their staked cash, which turn out to be out there for decentralized finance (DeFi) functions. Apart from enhancing the general progress and adoption of crypto by encouraging extra lively participation, this staking mannequin introduces larger flexibility, enabling customers to capitalize extra on out there funding alternatives and modify their methods consistent with rising market situations.

Liquid staking vs. Conventional Staking: Key Variations

Whether or not you’re simply starting a staking journey or have some expertise, greedy these variations will provide help to make an knowledgeable funding choice.

1. Flexibility

Conventional crypto staking fashions require customers to lock up their tokens fully. Upon getting locked your crypto for a predetermined interval, you can not entry it till the top. Your tokens are dedicated to the community’s safety, however you’re restricted in monetary flexibility. Nonetheless, in terms of the liquid idea, your property are nonetheless out there for different makes use of by way of a Liquid staking token that you simply use for DeFi actions.

2. Liquidity

Many buyers are genuinely involved about liquidity, which the common staking doesn’t present since staked property are locked in. This is usually a drawback while you want entry to your funds to answer market modifications. Alternatively, with the liquid mannequin, you continue to have entry to your funds as a result of Liquid staking derivatives allow you to leverage your staked crypto in different monetary actions, making them extra interesting.

3. Threat

Native staking exposes you to nice dangers, equivalent to these inherent in your chosen blockchain, together with community safety or validator downtime points. Apart from the larger flexibility you get pleasure from with liquid staking, you turn out to be susceptible to further dangers related to the staking protocol, equivalent to good contract weaknesses or counterparty threat associated to the platform working the staking program.

4. Rewards

When in search of rewards within the common staking program, the matter is constant and simple, however you can miss out on rising alternatives as a result of your palms are tied. Alternatively, the liquid mannequin could initially provide decrease rewards due to the lower taken by the liquid staking protocol. Nonetheless, you should use the LSTs you obtain in DeFi actions to offset the distinction.

What Are Liquidity Swimming pools in Crypto?

Liquidity swimming pools in crypto consult with a set of digital property and tokens locked up in a wise contract. They construct the muse for DeFi actions like lending, buying and selling, and different monetary actions the place conventional intermediaries are eradicated. Liquidity swimming pools in DeFi facilitate 24/7 alternatives for customers to earn passive revenue by offering liquidity. Whereas they could look easy, Liquidity swimming pools are the powerhouse that strikes complicated monetary interactions on decentralized exchanges (DEXs) and DeFi platforms.

Customers who contribute pairs of tokens to the pool are known as liquidity suppliers, and their funds transfer the lending protocols and DeFi NFT tasks. As a reward for his or her contribution, Liquidity suppliers earn a share of the buying and selling charges the pool generates, whereas others provide governance tokens and yield farming alternatives as further incentives. When customers need to conduct enterprise, they will strategy a liquidity pool as a substitute of conventional order books.

Why Are Liquid Staking Tokens (LSTs) Gaining Recognition?

Liquid staking tokens (LSTs) are rising in popularity by the day as they mix the advantages related to staking and the liquidity of conventional property. Consequently, buyers can entry their property for buying and selling, lending, and different DeFi actions whereas additionally incomes staking rewards. Among the many tangible advantages related to LSTs that make them widespread embody:

- Elevated Liquidity and Flexibility: The place conventional staking locks up property for all the lockup interval, LSTs provide a tokenized illustration of the person’s staked cryptocurrency, enabling them to commerce, switch, and use them in DeFi platforms.

- Capital Effectivity: With LSTs, customers can concurrently earn staking rewards whereas utilizing the identical staked crypto for DeFi yield farming, lending, and borrowing actions, creating capital effectivity that maximizes returns.

- Decrease Limitations to Entry: In comparison with conventional staking platforms that require a minimal of 32 ETH to run a validator observe, some LSTs like Rocket Pool and Lido Finance allow customers with smaller ETH quantities to hitch the swimming pools.

- Entry to DeFi Alternatives: Buyers can use LSTs as collateral in lending platforms, commerce them in DEXs, and supply liquidity in AMMs, enabling customers to broaden their portfolio methods.

- Cross-Chain Capabilities: Buyers can use LSTs throughout totally different blockchains, enabling them to simply leverage DeFi alternatives and staking advantages throughout totally different blockchains.

- Enhanced Yield Alternatives: LSTs mix DeFi actions and staking rewards, doubtlessly bringing a better return on funding than regular staking.

Liquid Staking vs. Pool Staking: What’s the Distinction?

Pooled staking or pool staking refers to a way that enables customers to mix their staking sources in crypto staking. Consequently, customers who pool their sources can profit individually and collectively with out using too many sources upfront. As soon as the rewards have been paid, they’re shared inside the pool relative to each participant’s contribution. The strategy can particularly profit customers who need to profit from staking however lack the sources to do it independently.

Pool staking and liquid staking may very well be comparable in lots of elements, however there are nonetheless a number of similarities and variations that you could be need to take into account earlier than you may select between the 2:

1. Liquid Staking

Liquid stakers obtain Liquid staking derivatives like mSOL and stETH relying on the asset they staked. They’ll use these property for various DeFi actions whereas concurrently incomes rewards. The tokens turn out to be their bond, indicating that what they’ve staked maintains its utility worth and liquidity.

2. Pool Staking

Buyers who take part in pool staking mix their sources to realize the minimal quota required by a platform to realize a validator node standing. The pooled property are then frozen and stay untouched all through the lockup interval. This permits customers with smaller quantities of disposable property to take part in staking with out committing too many sources.

In relation to the important thing variations between the staking mannequin into account and pool staking, you need to keep in mind the next:

- Flexibility: You should utilize your Liquidity staked tokens for different functions, like buying and selling, lending, and yield farming, which isn’t achievable with locked staking swimming pools.

- Liquidity: Funds in staking swimming pools are locked completely, whereas liquid stakers are assured of liquidity by means of LSTs.

- Threat Profile: Staking swimming pools give attention to community dangers equivalent to slashing, whereas Liquid stakers need to take care of points like good contract vulnerabilities.

Attributable to its potential advantages, Liquid stakers have made it emerge as a extra most popular possibility in comparison with different types of staking on account of their limitations. LSTs introduce larger flexibility and a better ROI. Think about your particular person circumstances, funding objectives, and out there sources when selecting between native staking, pool staking, and liquid staking.

How Does Liquid Staking Work?

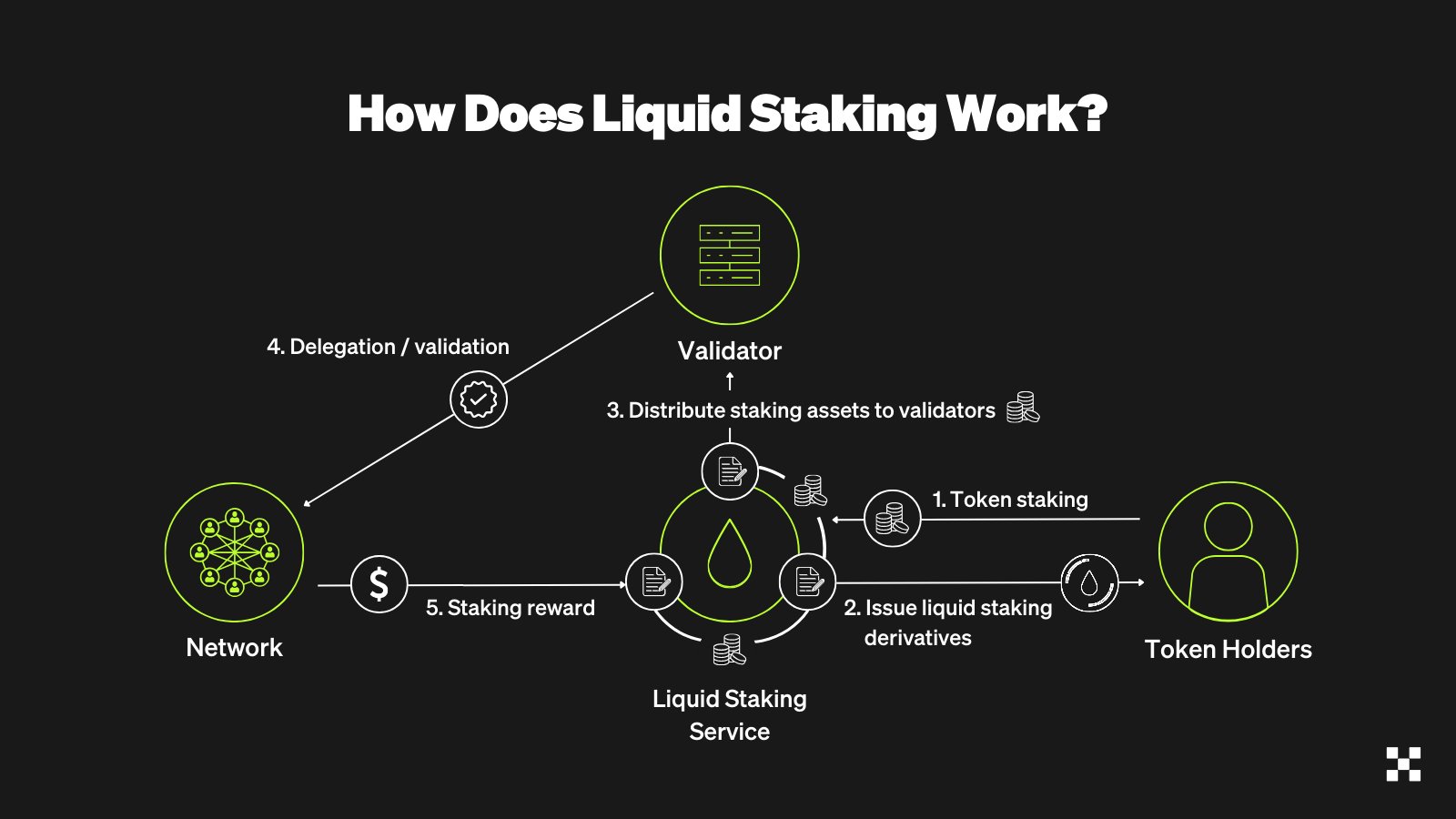

Liquid staking begins with issuing Liquid staking derivatives representing the staked cryptocurrencies. The person wants to go to a liquid staking protocol to obtain spinoff tokens representing the worth of their staked cryptocurrencies.

The investor can use the spinoff tokens in several DeFi actions whereas their authentic digital asset stays locked within the conventional staking course of. The person receives a double reward from the staked crypto property and revenue from investing within the spinoff tokens.

The next is a step-by-step information for getting began:

- Step 1: Deposit: The investor deposits a token like Ethereum (ETH) or Solana (SOL) right into a Liquid staking protocol.

- Step 2: Token Minting: The platform mints the LST in a ratio of 1:1 to the deposited cryptocurrency in order that, for instance, staked ETH yields stETH tokens.

- Step 3: Staking: The platform stakes the deposited property on behalf of the person by distributing them throughout totally different validators on PoS networks to mitigate threat.

- Step 4: Reward Accrual: As staking rewards accumulate, the person revives the spinoff token representing their staled property to make use of in buying and selling, lending, or some other DeFi exercise. Within the meantime, the gathered rewards are mirrored within the worth of LSTs.

- Step 5: Unstaking: If the investor needs to retrieve their authentic staked property, they return “burn” their staking tokens to withdraw the equal quantity of the staked token and the accrued rewards.

By following this easy mechanism, buyers can maximize the utility of their idle crypto property whereas sustaining their liquidity. By tokening their staked cryptocurrencies, they earn passive revenue. They’ll additionally discover the broader DeFi ecosystem, bridging the hole between securing PoS networks and turning into a part of the DeFi house.

Supply: OKX

A number of the most important elements of the staking course of that you simply want to bear in mind embody the next:

Validators

Validators play a crucial function in all the staking course of by guaranteeing the safety and operations in a Proof-of-Stake blockchain. Liquid staking protocols accomplice with knowledgeable node operators to keep up the safety of staked property.

Consensus Mechanisms

Staking platforms use the PoS consensus mechanism the place chosen validators stay vigilant to make sure the community stays decentralized and tamper-proof.

Liquid Staking Tokens (LSTs)

LSTs symbolize the worth of your staked crypto property, and customers can make use of them in several buying and selling or lending actions on DeFi platforms and decentralized exchanges.

Liquid Staking Derivatives (LSDs)

These are superior tokens within the staking ecosystem, representing fractional possession of the staked rewards, which gives much more flexibility for knowledgeable buyers.

What Is Restaking?

Restaking inside the crypto house refers to utilizing staked property to safe a number of protocols to boost capital effectivity and generate extra rewards. The method leverages already staked digital property in new methods, making an investor’s funds herald a larger ROI. That is achieved by means of:

- Capital Effectivity: By permitting customers to make use of their staked crypto for a number of functions as a substitute of getting them locked in a staking pool, restaking enhances the funds’ potential to generate further revenue.

- Further Rewards: When customers retake their property, they obtain rewards past the normal staking rewards, thereby incentivizing participation and cryptocurrency adoption.

- Liquid Restaking: Some platforms permit liquid restaking, permitting stakers to obtain tokens representing their property, which they will use for DeFi actions to generate extra rewards.

Advantages of Liquid Staking

There are lots of compelling advantages related to the brand new staking mannequin that transcend the normal staking technique. Apart from supplying you with larger management over your idle crypto property whilst you nonetheless get pleasure from incomes staking rewards, the next are different benefits value contemplating:

1. Unlocked Liquidity

With the liquid mannequin of skating, you don’t merely lock away your tokens for a set interval and wait idly. You get pleasure from your cryptocurrency’s liquidity by receiving LSTs, tradable property you may put money into by shopping for, promoting, or utilizing as collateral in DEXs and DeFi platforms to generate extra yield.

2. Many DeFi Protocols

The staking idea helps platform interoperability, which means you may work together with DeFi platforms throughout blockchain networks. Consequently, you may get pleasure from seamless staking and different DeFi companies, thus unlocking contemporary alternatives for monetary innovation and extra revenue.

3. Staking Rewards

You’ll nonetheless get pleasure from passive revenue generated by way of proof-of-stake blockchain. The staking pool you be a part of will share a portion of the rewards they earn with you based mostly in your LSTs shareholding.

4. Keep away from Advanced Infrastructure

The pliability that comes with the Liquid mannequin helps you handle your staked digital property extra successfully so that you simply don’t want to decide on between one since each could be executed concurrently. Consequently, you earn revenue from multiple stream with out transferring your funds from one platform to a different, which is very vital in unstable markets or when you want to entry your capital instantly.

Dangers and Limitations of Liquid Staking

Just like all different funding alternatives, particularly with new asset lessons, there’s all the time some threat related to this type of staking. Whereas all staking actions are legit, it is best to anticipate to come across the next limitations:

1. Slashing

Identical to conventional staking, the staking idea additionally carries the potential for slashing. This refers to conditions when a validator turns into negligent or malicious, resulting in penalties that scale back your staked property. Suppose staked property are liquidated and used actively for an additional objective. In that case, you could not have enough management over your staking place, which will increase the potential of an unintentional motion that might end in a slashing penalty. The answer to this drawback lies in selecting a dependable validator to mitigate threat.

2. Exploits

Liquid staking protocols use third-party platforms to transform staked property into LSSTs, introducing counterparty threat since unreliable events may simply exploit the scenario. As soon as once more, care should be taken when selecting service suppliers since a compromised third-party platform or one which experiences technical points may result in potential losses.

3. Yield Volatility

This new type of staking exposes buyers to volatility inherent within the digital asset market. Even with the advantages related to the flexibleness that this new type of staking introduces, customers should be conscious that they’re nonetheless topic to larger market fluctuations in comparison with having left their property locked quietly in conventional skating. You possibly can simply expertise losses when the worth of a liquid token decreases considerably.

Prime Liquid Staking Protocols

As this superior staking mannequin continues to realize recognition, the variety of platforms attracting customers excited about taking part is rising. Beneath is our unique record of one of the best Liquid staking platforms you can take into account taking a look at:

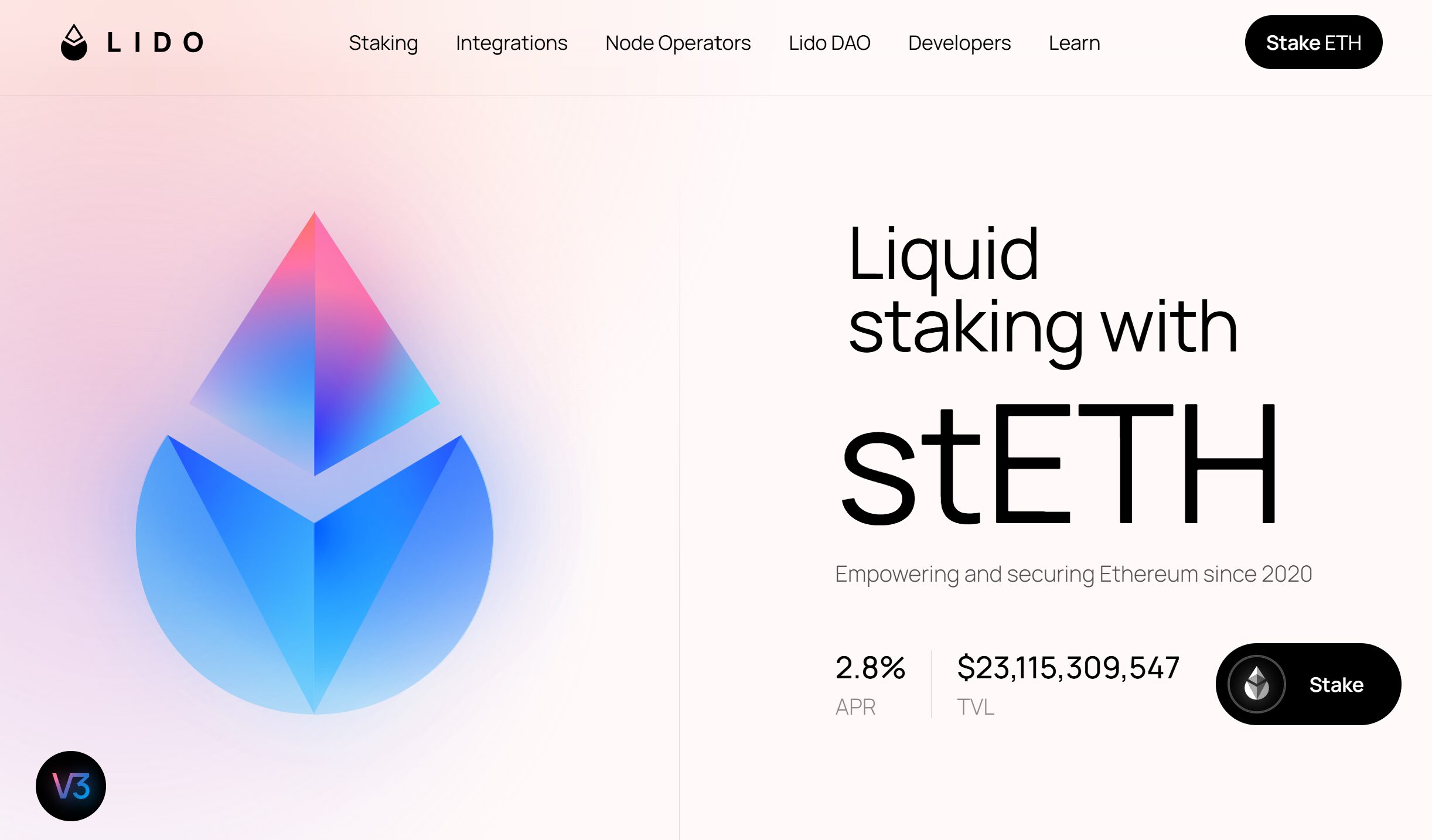

1. Lido

Lido Finance gives a centralized staking service that helps property like Ethereum, Solana, and Polygon, that are transformed to tokens like stETH and stSOL. The platform is the main staking platform, with knowledge displaying it has over $14 billion in complete worth locked (TVL)

Buyers excited about liquid ETH staking on Lido have the platform combination their deposits, and in return, they obtain stETH representing their stake within the pool. The stETH they obtain is a tradable asset that permits the investor to keep up liquidity for his or her staked ETH.

2. Rocket Pool

Rocket Pool additionally makes a speciality of ETH liquid staking, the place buyers can stake their ETH and obtain rETH tokens in return. The platform runs a decentralized staking mannequin the place customers can turn out to be mode operators in the event that they lock up ETH and RPL, the platform’s native token. Alternatively, buyers can turn out to be stakers by depositing their ETH and ready to earn rewards with out working staking nodes in order that, in return, they obtain rETH, the platform’s staking token.

How Does Liquid Staking Work With Completely different Cryptocurrencies?

Whereas the performance stays the identical, the brand new staking course of may differ throughout blockchain networks in follow. To higher perceive this, we will take into account the way it works with among the many chief cryptocurrencies:

1. Ethereum

Supply: Messari

Platforms that help Ethereum liquid staking principally create stETH, which tracks the investor’s staked ETH. Other than the common staking rewards, the person can have the token enabling them to take part in different actions inside the DeFi ecosystem utilizing the LST, which is stETH. Right here’s how liquid staking works with Ethereum:

- Stake ETH: The person deposits ETH within the liquid staking protocol

- Obtain LST: The investor receives an LST like stETH (Lido) or mSOL (Rocket Pool) rather than their staked ETH

- Use the LST: Buyers can use the LST to take part in several actions equivalent to collateral for loans, commerce on an change, or deploy in different DeFi actions. Alternatively they will deposit the LST into yield farming or commerce in an change like different crypto property.

2. Solana

Customers excited about Solana staking will obtain mSOL, an LST. They’ll use liquid swimming pools and lending platforms to permit buyers to earn rewards from their tokens whereas sustaining their liquidity. The mSOL token they obtain is a spinoff token representing the worth of their staked SOL, which can be utilized in DeFi functions or traded. The method can also be straightforward to observe:

- Stake with SOL: Stake your SOL for an opportunity to earn rewards both by delegating to a validator or instantly by means of a liquid staking protocol.

- Liquid Staking Swimming pools: The platforms stake your SOL not directly by way of staking swimming pools or good contracts. The pol delegates your staked SOL to a validator.

- Obtain LSTs: After you deposit SOL, you’ll obtain an LST like mSOL or stSOL, which represents the worth of your staked SOL, which continues to earn rewards.

3. Polygon and Others

Different chains like Polygon additionally implement staking to draw extra person exercise and let customers take part in staking. Somewhat than facilitating the normal staking program, they permit liquid staking utilizing spinoff tokens (like ankrPOL or stETH) representing the staked crypto property they will commerce or use as collateral in DeFi platforms.

Stake POL tokens: Deposit POL and obtain an LST, AnkrPOL, representing the worth of your staked asset. You should utilize the LST in several DeFi actions, together with buying and selling, lending, and borrowing.

Centralized vs. Decentralized Liquid Staking

Massive centralized cryptocurrency exchanges like Binance and Coinbase help staking, the place customers permit the platform to behave as a custodian and staking operator on their behalf. Some customers want the centralized liquid staking possibility due to its comfort, particularly newbies who could not but have the technical abilities required. Nonetheless, essentially the most important problem with centralized liquid staking is that it exposes customers to the standard counterparty dangers, equivalent to mismanagement, insolvency, or regulatory difficulties usually related to centralized platforms.

Alternatively, decentralized staking protocols like Rocket Pool and Lido Finance don’t have a single level of failure. These platforms give customers sovereignty over their crypto property as they don’t rely upon any centralized middleman. Nonetheless, for a person to take part conveniently, they should purchase some abilities related to W3b3 platforms and be conversant in DEXs and good contracts. A person should additionally account for community congestion, fuel charges, and good contract dangers as they execute decentralized staking.

Conclusion

As DeFi continues to develop, liquid staking may play an integral function in bridging the hole that has all the time existed between staking and liquidity provision for the investor. The versatile different it introduces has the potential to change how buyers work together with the DeFi utility and the proof-of-stake consensus mechanism. It’s also enhancing blockchain safety measures, which may result in higher integration inside the broader cryptocurrency ecosystem. Cross-chain staling interoperability now allows stakers to make use of property from one blockchain and make the most of their spinoff tokens in one other, additional selling blockchain interoperability.

Keep in mind that you probably have a decrease threat tolerance and like to lock up your property, conventional staking is for you. Nonetheless, should you want to maximize returns related along with your staked property and also you need to entry your funds for different DeFi functions, liquid staking is your cup of tea.

FAQs

Is liquid staking value it?

Liquid staking is usually thought of a worthwhile technique, because it permits customers to earn staking rewards whereas nonetheless sustaining entry to their property. This flexibility makes it engaging to those that need to maximize yield with out sacrificing liquidity.

What are the dangers of liquid staking?

There are a number of dangers related to liquid staking, equivalent to dangers related to good contracts, doubtlessly larger charges relative to conventional staking, and market volatility because the worth of liquidity tokens (LSTs) can fluctuate. Different dangers embody de-pegging LSTs from the underlying asset, potential impermanent loss, and present regulatory uncertainties.

Is liquid staking a taxable occasion?

Liquid staking is taken into account a taxable occasion, particularly because the conversion of staked tokens equivalent to ETH to STETH ends in rewards which can be typically topic to tax.

What’s Ethereum liquid staking?

Ethereum liquid staking refers to buyers taking part in ETH staking to safe blockchain networks and earn rewards whereas sustaining the liquidity of their staked cryptocurrencies. Somewhat than await the normal unstaking follow, liquid staking protocols provide customers tokens representing their staked ETH to make use of in varied methods.

What’s the distinction between liquid staking and lending?

Liquid staking and lending are completely totally different however associated actions inside the cryptocurrency house. Whereas lending entails loaning out funds to debtors and receiving curiosity, liquid staking allows customers to stake their crypto property and proceed incomes rewards by way of tokenized property. Lending facilitates borrowing, whereas liquid staking focuses on securing PoS networks.