Cryptocurrency has develop into extremely common over the previous few years, and in consequence, the decentralized finance (DeFi) area has additionally exploded in recognition. Fueling this explosion in a significant method is the DeFi core precept of eradicating intermediaries and empowering particular person customers to borrow, lend, commerce, and even earn yields straight on blockchain networks.

Nevertheless, to entry these protocols and the DeFi platforms that energy them, you’ll want a secure and dependable DeFi pockets. It is a specialised software that connects you to good contracts. That may sound difficult, however we’ll be sure it’s straightforward to digest. You’ll get the reply to “What is a defi wallet?” and find out how they handle your crypto belongings.

What’s a DeFi Pockets?

A DeFi pockets is a self-custody pockets, whether or not software program or {hardware}, that shops your personal keys and acts as a Web3 supplier in appropriate functions. This differs from a custodial pockets or change pockets, since a DeFi pockets app offers you full management over your keys, so you’re the solely one that can authorize or deny transactions linked to that pockets.

Most of those wallets function as a easy browser extension (one of the crucial common being Metamask), cell apps like Coinbase Pockets, and {hardware} wallets like Ledger and Trezor.

Whenever you go to a DeFi platform or work together with decentralized functions inside the DeFi ecosystem, like a lending protocol, decentralized change, or yield farm, your pockets will immediate you to overview and signal (authorize) transactions straight on-chain. This direct, instantaneous connection to good contracts means that you can transfer belongings round shortly, offering liquidity and incomes rewards with out being depending on centralized intermediaries.

How Does a DeFi Pockets Work?

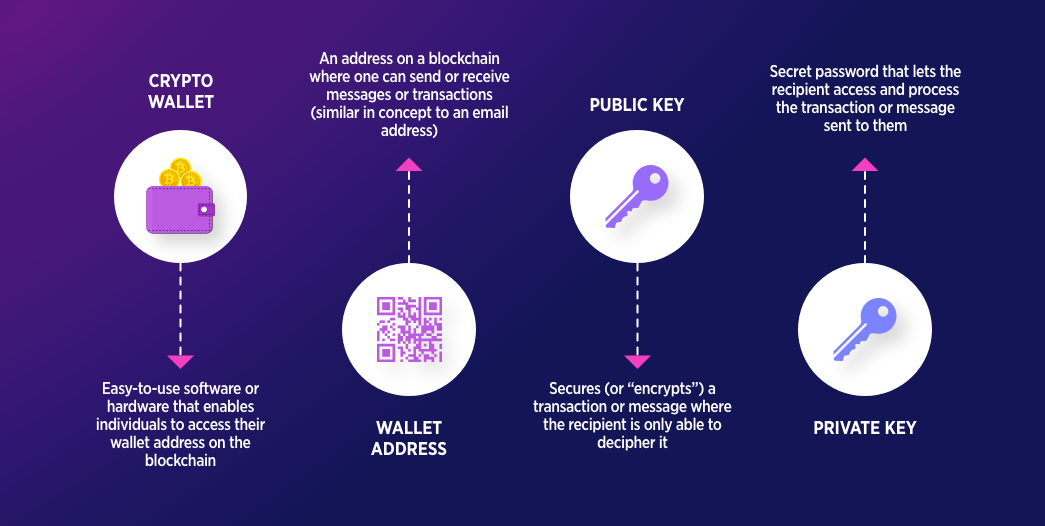

A DeFi pockets app works roughly the identical method as every other crypto pockets. It manages a pair of cryptographic “keys”, your public key, which is your pockets handle, and your personal key, which is your signature authority.

Whenever you provoke or work together with a DeFi app that acts like swapping, the pockets creates a transaction payload after which prompts you to signal it together with your key. That is sometimes only a single click on or a faucet, making it extremely straightforward, but in addition introducing some dangers.

This signature is the blockchain proof that you just personal the transaction and that it’s licensed, with out having to reveal your personal keys. The pockets then broadcasts licensed transactions to the community, the place nodes then validate it and execute the corresponding good contract.

As soon as the transaction is verified, the pockets then updates your balances and place. Beneath this course of is a large array of Web3 libraries and suppliers that assist bridge your pockets to DeFi functions.

What’s a DeFi Pockets Used for?

- Swapping Tokens on DEXs: Immediately commerce between cryptocurrencies on platforms like Uniswap, SushiSwap, or PancakeSwap with out KYC or order books.

- Offering Liquidity: Deposit token pairs into liquidity swimming pools to earn charges and governance tokens, powering automated market makers (referred to as AMMs).

- Yield Farming & Staking: Lock belongings in protocols or stake native tokens to safe networks and earn passive earnings or curiosity.

- Lending & Borrowing: Collateralize crypto to borrow different belongings at aggressive charges or lend your holdings to earn yield.

- Governance Participation: Vote on protocol proposals straight out of your pockets utilizing governance tokens, influencing upgrades and treasury allocations.

- NFT Interplay: Mint, purchase, promote, and handle non‑fungible tokens throughout marketplaces, all whereas retaining full custody of your belongings.

Varieties of DeFi Wallets

Software program wallets

Software program wallets retailer your personal keys regionally on a linked gadget, supplying you with instantaneous entry to DeFi protocols.

- Browser extensions like MetaMask and Coinbase Pockets inject a Web3 supplier into your browser, permitting you to go to dApps and approve transactions with a click on.

- Cell apps similar to Belief Pockets and Crypto.com DeFi Pockets prolong this comfort to your cellphone, usually integrating WalletConnect for seamless cross‑app interactions.

Supply: Metamask.io

{Hardware} wallets

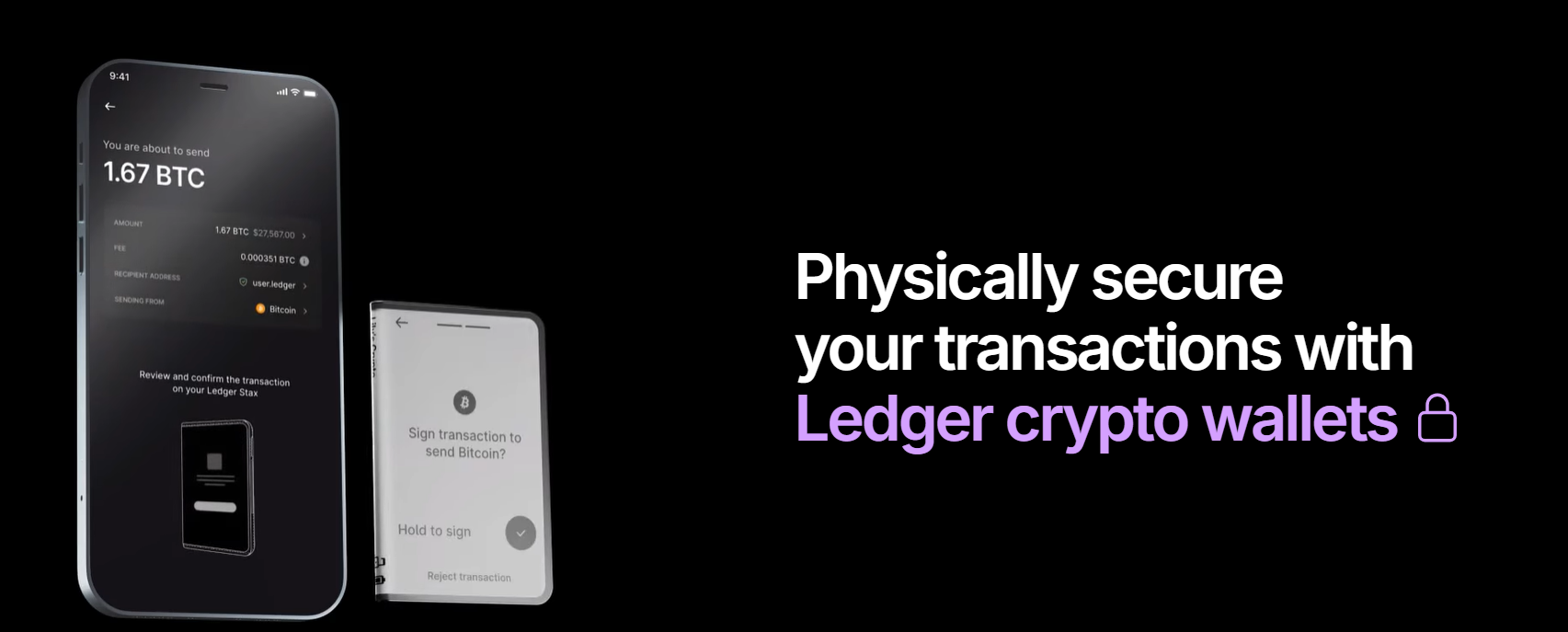

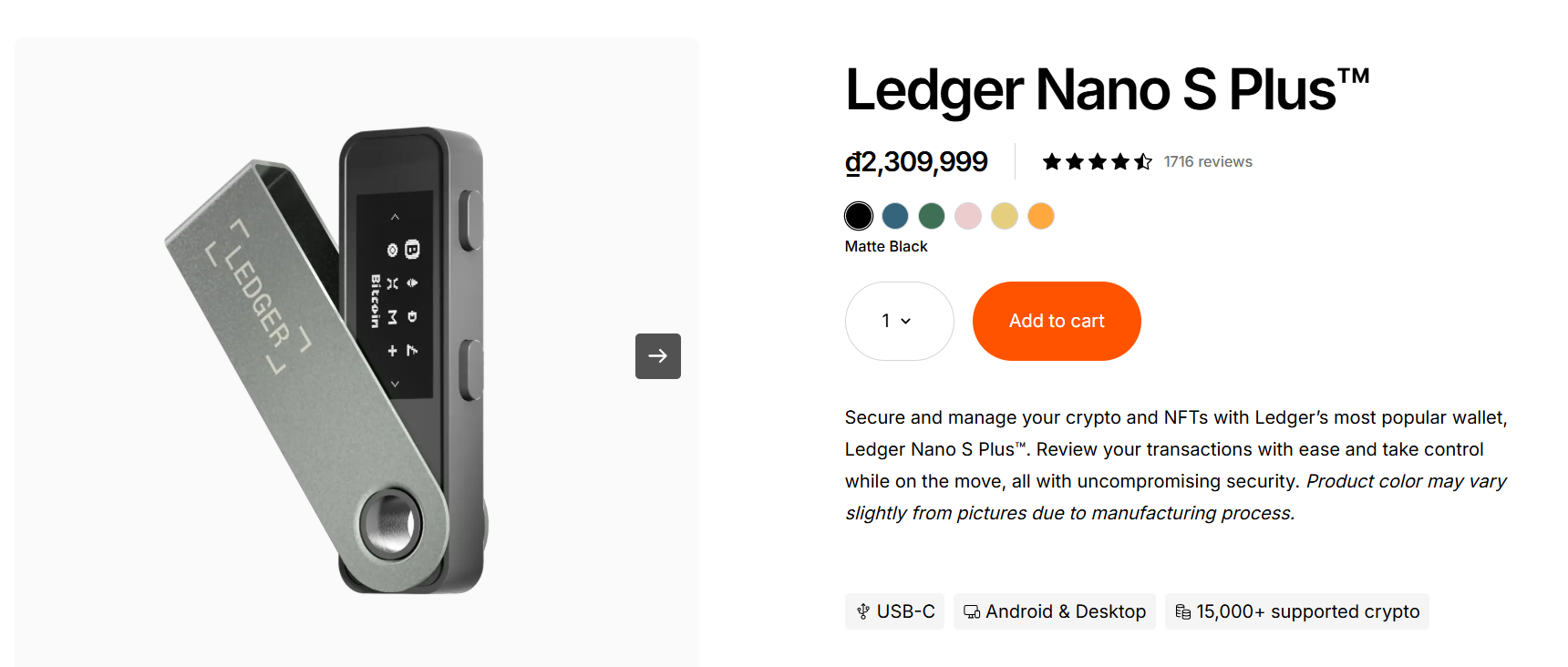

{Hardware} wallets just like the Ledger Nano S Plus and Trezor Mannequin One retailer personal keys in a tamper‑resistant, offline gadget, providing the very best stage of safety in opposition to hacks and malware.

When it’s good to execute a DeFi transaction, you join the {hardware} pockets to a Web3 interface and signal transactions straight on the gadget, guaranteeing your keys by no means depart the safe factor.

Though {hardware} wallets introduce an additional step in comparison with software program options, they excel at safeguarding giant balances and lengthy‑time period holdings.

DeFi Wallets vs CeFi Pockets: Key Variations

| DeFi Pockets | CeFi Pockets | |

| Custody | Consumer controls personal keys | Trade holds keys in your behalf |

| Counterparty Threat | Minimal—self‑custody | Increased—change hacks or freezes |

| Entry | Direct to good contracts | By means of the change interface |

| KYC/AML Necessities | Usually none | Obligatory identification verification |

| Charges | On‑chain fuel charges | Trading and withdrawal charges |

| Service Availability | 24/7, permissionless | Topic to change hours and insurance policies |

Advantages of DeFi Pockets

DeFi wallets provide you with full management over your personal keys, which fully removes any counterparty dangers and creates true self-custody. They permit permissionless entry to each monetary service conceivable 24/7 in order that anybody, wherever, should purchase, promote, or swap tokens with out the hassles of KYC or the privateness implications of intermediaries.

The composability of DeFi means you’ll be able to seamlessly mix options—swapping, lending, and governance—in a single pockets interface. This places a few of the most advanced and efficient monetary methods straight in your arms as a shopper.

Dangers of DeFi Pockets

DeFi wallets is perhaps able to unlocking highly effective monetary instruments, however additionally they introduce some fairly substantial dangers for the unprepared.

Sensible contract vulnerabilities can result in exploits, which may immediately drain funds out of your pockets throughout interplay. Phishing assaults and malicious dApps can trick you into signing transactions that routinely switch belongings to attackers, by no means to be recovered.

For those who retailer your personal keys or seed phrases incorrectly or insecurely, like in digital information or cloud storage, they are often stolen by decided attackers. Transaction errors, such as you would possibly see when sending funds to the improper handle and even the improper community, can result in irreversible loss.

Being conscious of those dangers is essential for anybody stepping into, or considering of stepping into, the DeFi area.

Key Components to Select the Greatest DeFi Pockets

1. Safety

- Native encryption of personal keys

- Restoration phrase choice

- Biometric or PIN locks on cell apps

- {Hardware}‑pockets compatibility for chilly storage

2. Compatibility and Interoperability

- Assist in your most popular blockchains

- Integration with DeFi protocols

- WalletConnect or related performance for cross‑app connectivity

3. Consumer-Friendliness

- Intuitive interface with clear prompts

- Simple navigation between swaps, staking, and lending

- Transaction previews displaying fuel prices and slippage

4. Options

- Constructed‑in token swaps and staking dashboards

- Portfolio monitoring and analytics

- NFT administration and governance voting

5. Status and Workforce

- Established improvement workforce with clear audits

- Energetic neighborhood help

- Easy, common replace course of with out crashing or rollbacks

- Sturdy monitor report of safety and reliability

6. Privateness

- No obligatory KYC or private knowledge assortment

- Non‑custodial design preserves anonymity

- Clear privateness coverage concerning utilization metrics

7. Neighborhood suggestions

- The engaged neighborhood that helps the pockets basically

- Constructive consumer opinions on boards and social media

- Experiences of clean efficiency and minimal bugs

- Responsive help channels for troubleshooting

Methods to Safe Your DeFi Pockets?

The very best methods to maintain your DeFi pockets safe are widespread safety finest practices, so staying educated and vigilant will go a great distance towards that objective.

Begin by safeguarding your seed phrase by writing it someplace secure from flood and hearth. Make sure that you retain any giant sums of crypto offline, in chilly storage, on an airgapped gadget.

Make certain you have got 2FA enabled and that you just confirm all URLs, hyperlinks, and dApp requests. Maintain your pockets apps and units up to date and patched, and periodically overview your token approvals and revoke outdated permissions.

Prime DeFi Wallets

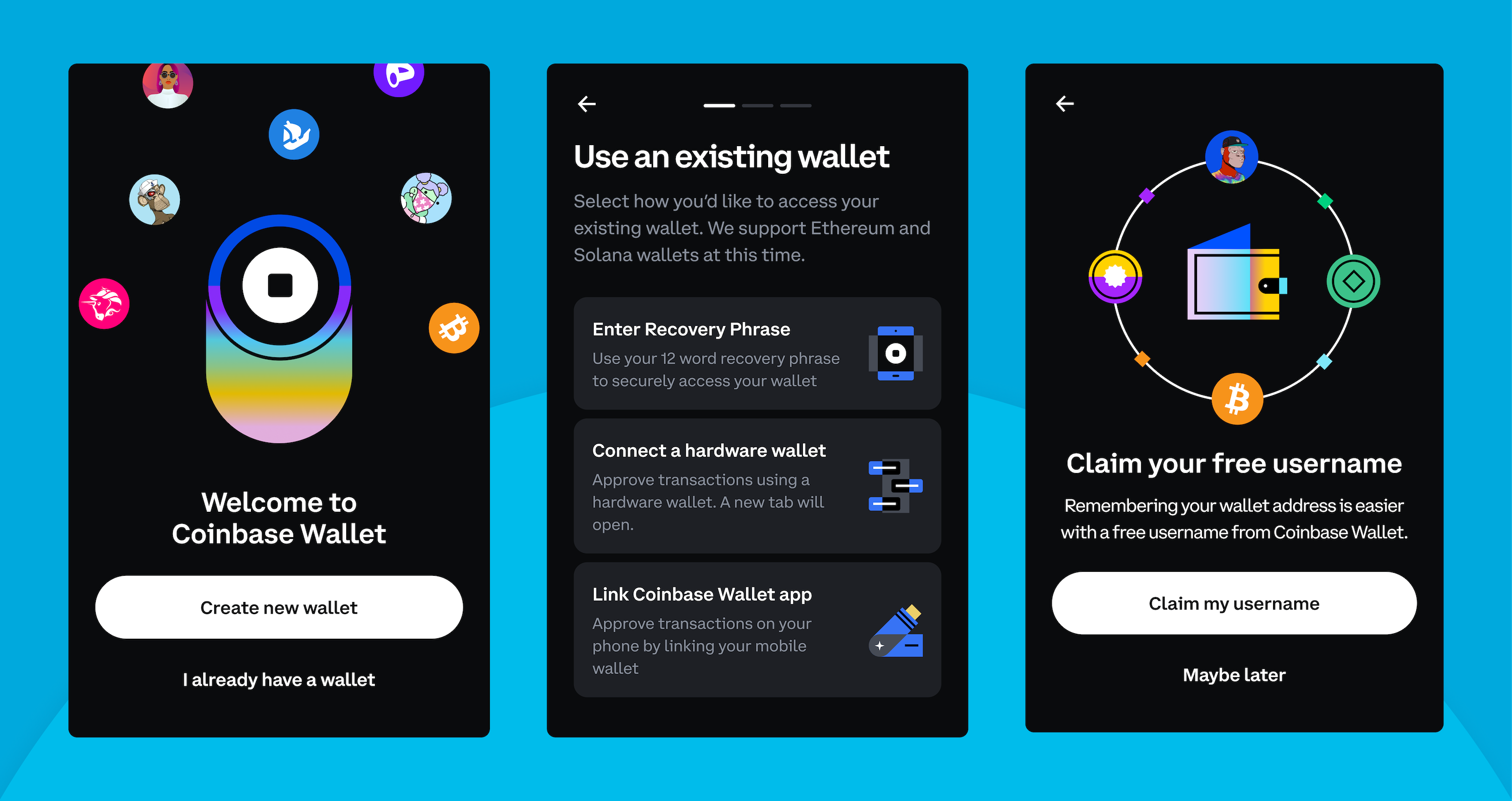

1. Coinbase Pockets

Coinbase Pockets is a cell‑first, non‑custodial pockets that helps a number of chains. Its key options embrace in‑app DEX swaps, NFT galleries, and direct integration with the Coinbase change.

Execs

- Simple setup

- Sturdy model belief

- Constructed‑in Fiat on‑ramp

Cons

- Collects some consumer knowledge

- Fewer superior DeFi analytics

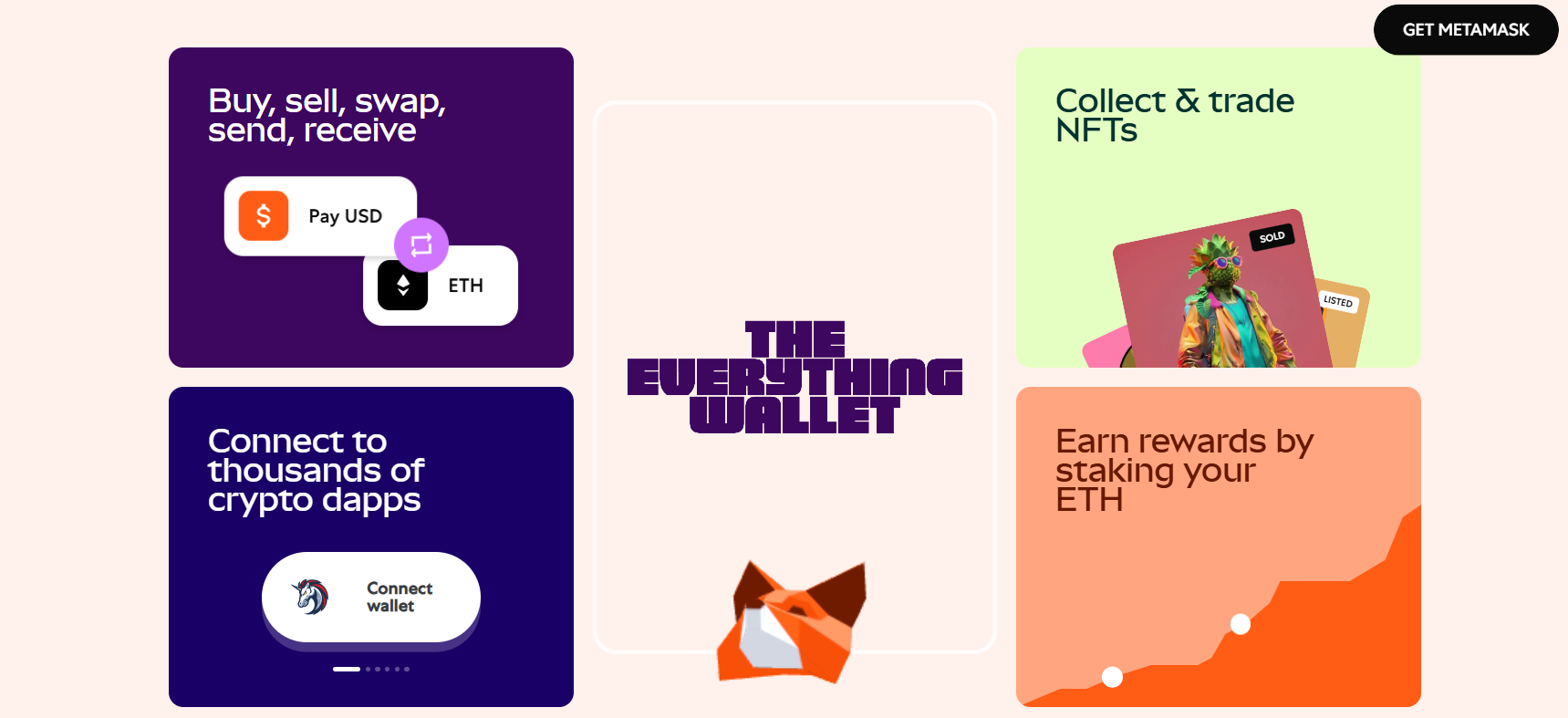

2. MetaMask Pockets

MetaMask has each browser extension and cell app for Ethereum and EVM chains. It affords deep DeFi integration, customized networks, and {hardware}‑pockets help.

Execs

- Ubiquitous Web3 customary

- In depth plugin ecosystem

Cons

- Restricted to EVM‑appropriate chains

- Phishing danger if not cautious

3. Ledger Nano S Plus

Ledger Nano S Plus is a {hardware} pockets with Safe Aspect chip. It pairs with Ledger Dwell and MetaMask for chilly‑storage DeFi transactions.

Execs

- Business‑main safety

- Bluetooth for cell use

Cons

- Upfront gadget price

- Requires an exterior interface for dApps

4. Trezor Mannequin One

Open‑supply {hardware} pockets that connects by way of USB. Appropriate with MetaMask and different Web3 apps for DeFi entry.

Execs

- Clear firmware

- Sturdy construct

Cons

- No Safe Aspect chip

- Smaller display screen

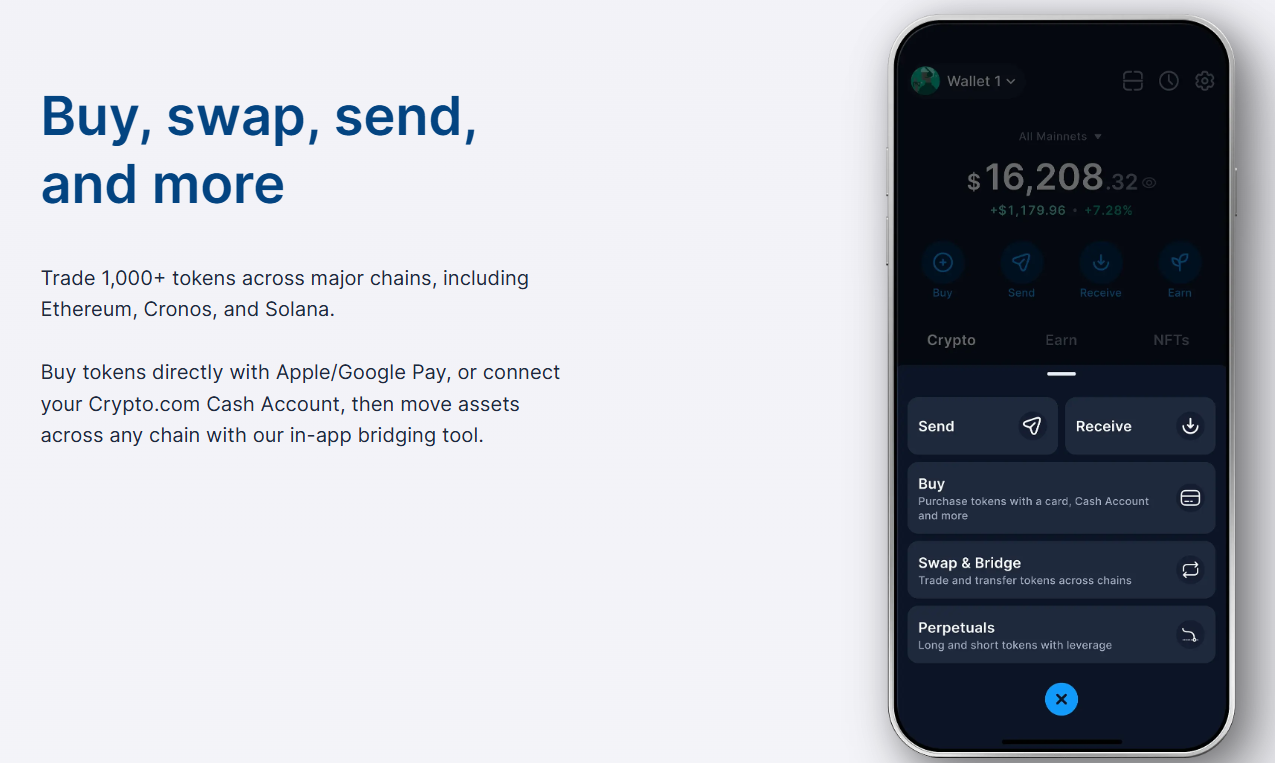

5. Crypto.com DeFi pockets

Built-in with the Crypto.com ecosystem for straightforward on‑ramp, the Crypto.com DeFi pockets is a non‑custodial cell pockets with DeFi swap, staking, and aggregator options.

Execs

- Aggressive DeFi charges

- In‑pockets yield aggregator

Cons

- Tied to Crypto.com branding

- Occasional UI complexity

Conclusion

A DeFi pockets is a necessary software for interacting with Web3 functions and accessing the DeFi area by way of good contracts. Now that you just perceive what a pockets is and the way it works on-chain, you’re prepared to soundly swap, stake, lend, and earn curiosity on the broader DeFi ecosystem.

You’ll want to put safety first, retailer seed phrases offline, use {hardware} wallets for big balances, and keep on guard in opposition to phishing assaults. That mentioned, with the best pockets geared up, you’re able to navigate a permissionless world of good contracts at lightning pace.

FAQs

Is a DeFi pockets secure?

A DeFi pockets is safe if you happen to observe typical safety finest practices. Retailer your seed phrase offline, use {hardware} wallets for big quantities in chilly storage, allow any out there 2FA, whitelist accredited addresses, and solely hook up with trusted dApps.

How do I get my cash from a DeFi pockets?

To money out your DeFi pockets, you’ll must ship belongings from the pockets to a centralized change of your selection or fiat on-ramp. From there, promote in your desired fiat foreign money and withdraw to your checking account or card.

Can I take advantage of a number of DeFi wallets concurrently?

Sure, nothing is stopping you from managing a number of wallets for various functions, one for every day transactions and one for staking, for instance. Merely import a number of seeds or join a number of browser extensions.

How do I get well my DeFi pockets if I lose my cellphone or gadget?

The first solution to get well a DeFi pockets after getting a brand new cellphone or pc is by utilizing a seed phrase. That is normally a 12- or 24-word phrase of random phrases, and it restores each your private and non-private keys, so hold it backed up securely.