NAIROBI (CoinChapter.com) — Bitcoin price continues to hover under $90,000 regardless of renewed bullish indicators. Whale-driven spoofing on Binance, weak onchain retail information, and combined macro sentiment are driving the present stall, whereas change outflows and ETF demand counsel robust underlying accumulation.

Whale Liquidity Video games Maintain Bitcoin Beneath $87.5K

Bitcoin hit $87,500 on March 20, its highest degree in two weeks. It has since pulled again to round $83,951, nonetheless up 2.7% over the previous week.

In response to Materials Indicators, giant gamers are deploying spoofing techniques on Binance to stop upward momentum. The agency blamed a whale labeled “Spoofy” for putting high-volume ask orders close to $89,000 to suppress price motion.

“If you are wondering why Bitcoin price hasn’t been able to rally past $87.5k yet, the reason is price suppression from Spoofy the Whale,” Materials Indicators wrote in a March 20 publish on X.

Their information reveals these giant orders dominating above price, preserving BTC in a decent vary, with $76,000 providing little assist under.

Retail Is Right here—However Not Onchain

CryptoQuant CEO Ki Younger Ju challenged the idea that retail hasn’t entered the market.

He argued on March 19 that ETF inflows—somewhat than onchain information—now mirror retail curiosity. “Retail is likely entering through ETFs — the paper Bitcoin layer — which doesn’t show up onchain,” Ju defined.

Roughly 80% of spot Bitcoin ETF inflows have come from retail buyers since January, totaling $35.88 billion, per Farside information. This exercise bypasses conventional wallets and exchanges, preserving onchain metrics like realized cap artificially low.

Ju beforehand predicted the bull market was ending, however later clarified that he expects Bitcoin to take six to 12 months to interrupt its all-time excessive.

Coinbase Premium, Outflows Sign U.S. Accumulation

Knowledge from CryptoQuant reveals the Coinbase premium index reached its highest degree since Feb. 20 after BTC rose 5% on March 19. A rising premium typically displays robust U.S.-based shopping for.

Bitcoin’s Coinbase premium index. Supply: CryptoQuant

Analyst Woonminkyu famous that the 30-day EMA of the index not too long ago crossed the 100-day EMA—traditionally a bullish sample.

“This implies the presence of large players,” he wrote. The indicator helps the view that establishments and whales are accumulating by way of regulated platforms like Coinbase Superior.

Bitcoin Alternate Netflow. Supply: CryptoQuant

Bitcoin Alternate Netflow. Supply: CryptoQuant

In the meantime, CryptoQuant analyst CryptoOnCain noticed the biggest Bitcoin change outflow on a 90-day common since Jan. 2023. Alternate netflows turning unfavorable typically sign accumulation, as cash are withdrawn for long-term holding.

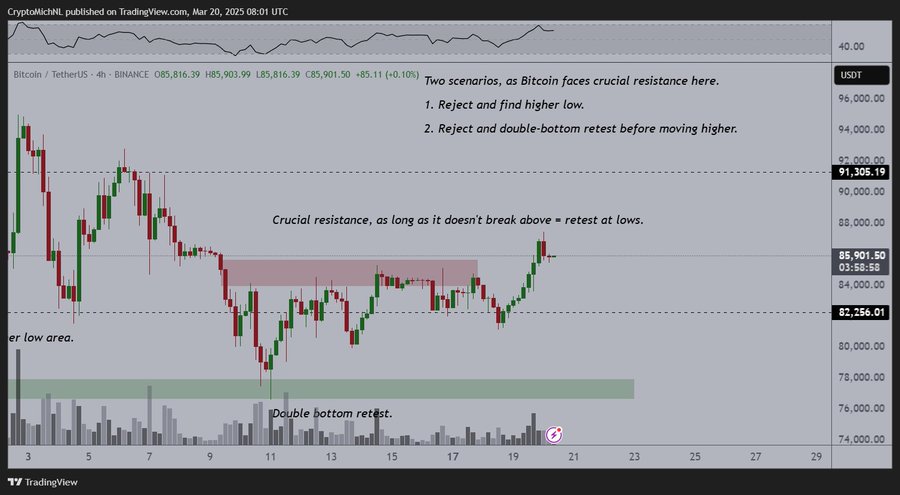

Bitcoin Construction Nonetheless Fragile as Merchants Watch Key Ranges

Bitcoin’s bounce again above $85,000 adopted weeks of decline. Nonetheless, market sentiment stays combined.

CryptoQuant analyst Crypto Dan famous that latest corrections keep inside a typical 30% pullback vary. “Massive liquidations have not occurred,” he stated, suggesting present situations don’t but mirror a bear market.

“Uncertainty in the market is an unavoidable element,” he added, pointing to geopolitical dangers and macro pressures.

Bitcoin Spent Output Revenue Ratio (SOPR). | Supply: CryptoQuant

Bitcoin Spent Output Revenue Ratio (SOPR). | Supply: CryptoQuant

On the technical entrance, Daan Crypto Trades stated $84,000–$85,000 stays a crucial zone for bulls. Shedding that degree dangers a deeper retrace into skinny liquidity.

Michael Van de Poppe expects a retest of $90,000 if Bitcoin can maintain its construction. However merchants like Koroush AK and Max from BecauseBitcoin warned that suppressed price motion and weak RSI might delay a breakout.

Regardless of ETF inflows and bullish Coinbase premiums, Bitcoin price stays stalled under $90,000. Whale spoofing, cautious sentiment, and weak development momentum proceed to weigh on short-term upside.