Picture supply: Getty Photographs

Shares in Coca-Cola HBC (LSE:CCH) have fizzed greater on Thursday (13 February) on an in any other case flat day for the FTSE 100 share index.

At £31.98 per share, the drinks bottler has leapt 7.7% to steer the UK blue-chip index greater. A forecast-topping set of financials for the final calendar 12 months helped it rise.

Are Coca-Cola HBC shares ‘The Real Thing’ for development buyers? Let me provide the lowdown.

Sturdy numbers

The enterprise bottles, sells, and distributes merchandise for heavyweight drinks manufacturers like Coke, Fanta, and Sprite. Their enduring recognition, mixed with their robust data of innovation, help wholesome gross sales development even throughout financial downturns.

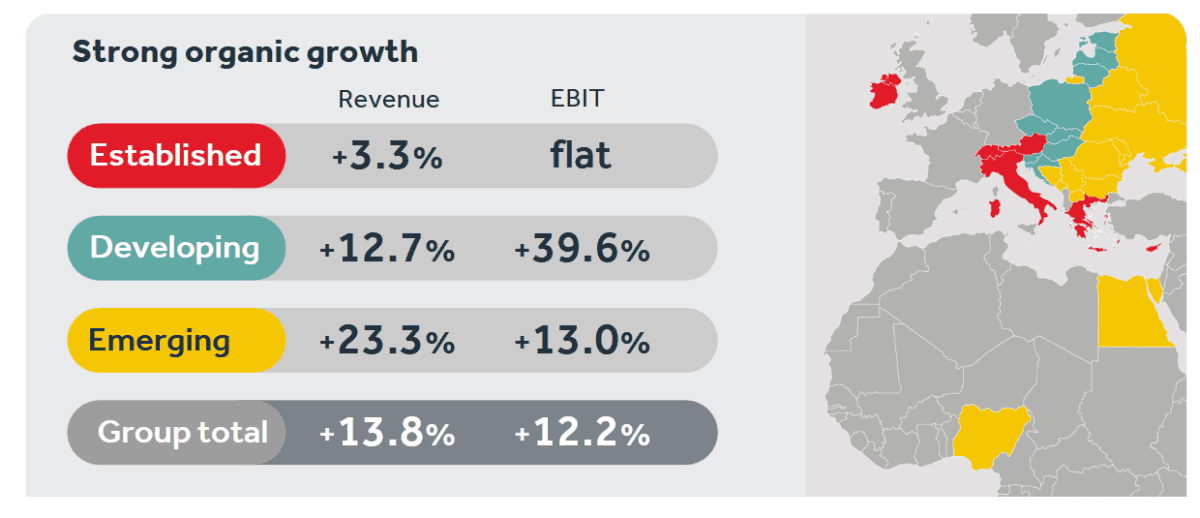

In 2024, the agency, which provides its drinks throughout a lot of Europe and elements of Africa, reported natural web gross sales development of 13.8%, to €10.8bn.

Coca-Cola HBC isn’t nearly gentle drinks, although. Certainly, the agency’s power and occasional merchandise stole the present once more in 2024. Volumes throughout these classes soared 30.2% and 23.9% 12 months on 12 months.

Tasty worth

Coca-Cola HBC shares have been one of many FTSE 100‘s biggest success stories so far in 2025. They’re up 14.8% since 1 January versus the broader index’s 5.7% enhance.

But regardless of this, the corporate nonetheless affords good worth in comparison with the Footsie’s different main client items makers.

It’s ahead price-to-earnings (P/E) ratio is 15.3 occasions, which is decrease than Unilever and Diageo‘s corresponding readings of 17 occasions and 16.3 occasions, respectively. Its P/E a number of can also be roughly consistent with Reckitt Benckiser‘s for 2025.

Coca-Cola HBC’s valuation is all of the extra enticing given its superior buying and selling momentum versus these different FTSE shares (Unilever’s share price truly slumped Thursday after it predicted gentle first-half gross sales).

A high development share?

I’m not saying that Coca-Cola HBC is completely danger free, after all.

The difficult financial panorama continues to forged a shadow, and the corporate has stated it expects natural income development to sluggish sharply, to six%-8% in 2025.

Natural earnings (earlier than curiosity and tax), in the meantime, is tipped to extend by 7%-11% this 12 months, down from 12.2% final 12 months.

A large geographic footprint additionally leaves the corporate susceptible to overseas alternate pressures. This proved the case final 12 months as, on a reported foundation, gross sales rose by a extra modest (but nonetheless respectable) 5.6%.

However context is every little thing, and people numbers are nonetheless fairly good within the present surroundings. It displays largely Coca-Cola HBC’s big publicity to fast-growing areas: gross sales in its rising and growing markets jumped by double-digit percentages in 2024.

Sturdy development can also be anticipated because the bottler executes its development priorities. It plans to seize a bigger share within the out-of-home espresso market, whereas additional product launches within the power class are possible (Monster Power Inexperienced Zero was launched in one other 16 territories final 12 months).

Metropolis analysts anticipate group earnings to develop 11% in 2025 and one other 10% subsequent 12 months. Given its market-leading labels, broad regional footprint, and powerful document of innovation, I feel it’s one of many hottest FTSE 100 development shares to contemplate as we speak.