Picture supply: Getty Photos

I’ve been loudly banging the drum for Duolingo (NASDAQ: DUOL) all yr lengthy. And placing my cash the place my mouth is, I’ve purchased this progress inventory twice in my ISA for the reason that begin of 2025.

Not too long ago, the Duolingo share price hit a 52-week excessive after surging 21.6% in someday (2 Could). This took the year-to-date return to 52%.

Right here’s why the inventory’s been on fireplace, and why I believe it’ll head even greater within the years forward.

C’est magnifique!

Launched in 2012, Duolingo is the world’s main language studying app, providing a ‘freemium’ mannequin alongside two paid subscription tiers. Its mission is “to develop the very best training on the earth and make it universally out there“.

The inventory’s spike to a report excessive final week got here after the agency launched implausible Q1 outcomes. Income jumped 38% yr on yr to $231m, beating analysts’ estimates for $223m.

Each day lively customers surged 49% to 46.6m, because it added extra each day customers than ever. Month-to-month lively customers elevated 33% to 130.2m, whereas paid subscribers rose 40% to 10.3m.

Adjusted EBITDA superior 27% to $62.8m and free money circulate totalled $103m. Earnings per share (EPS) of $0.72 breezed previous analyst expectations of $0.52.

Administration raised its full-year income steering to $987m-$996m, which might characterize round 33% progress.

Theoretical threat turns into actual

Now, the inventory isn’t with out threat. Again in December, I wrote: “One risk here is the emergence of an AI-powered competitor offering advanced features for free that Duolingo currently charges for.”

Lo and behold, it appears probably now we have one within the form of Google Translate. Numerous experiences say that the tech large is planning to launch an AI-powered apply mode. So this threat isn’t theoretical anymore.

That stated, not all the things Google touches turns to gold. Its try at a social media platform to compete with Fb — referred to as Google+ — by no means caught on. In the meantime, its music streaming service — YouTube Music — hasn’t stopped Spotify’s spectacular progress trajectory.

However, it’s one thing I’ll be monitoring transferring ahead.

AI-powered progress

One factor I like about Duolingo is that it’s aggressively leaning into generative AI. Its Max subscription tier, which incorporates AI-powered dialog apply classes, is attracting extra learners to signal up.

And final week, the corporate launched 148 new language programs, doubling its providing in a single day. For context, it took 12 years for primarily people to create 100 programs, however simply 12 months for AI to supply 148.

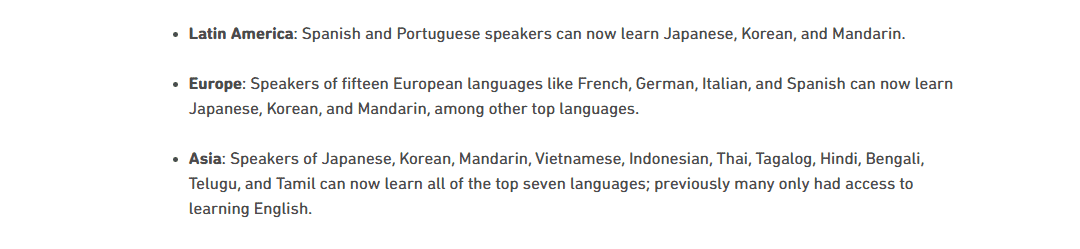

Furthermore, this considerably enhances the market alternative for Asian customers to be taught in style European languages and vice-versa:

Rising optionality

After its surge, the inventory’s buying and selling at round 22 instances this yr’s anticipated gross sales. That’s removed from low-cost, even when Duolingo beats this forecast.

Nonetheless, its programs lengthen past languages to maths and music, whereas the agency’s about to launch a chess course. So the general alternative’s increasing.

Following the outcomes, Morgan Stanley’s Nathan Feather stated: “Duolingo’s distinctive, gamified strategy to studying permits it to mix the cellular gaming and language studying markets for a $220bn complete addressable market. With sub-1% share, it’s closely underpenetrated.“

Whereas I believe the inventory’s price contemplating for long-term traders, the excessive valuation can’t be ignored. Subsequently, it may be price excited about constructing out a full place on dips over time.