Picture supply: Getty Pictures

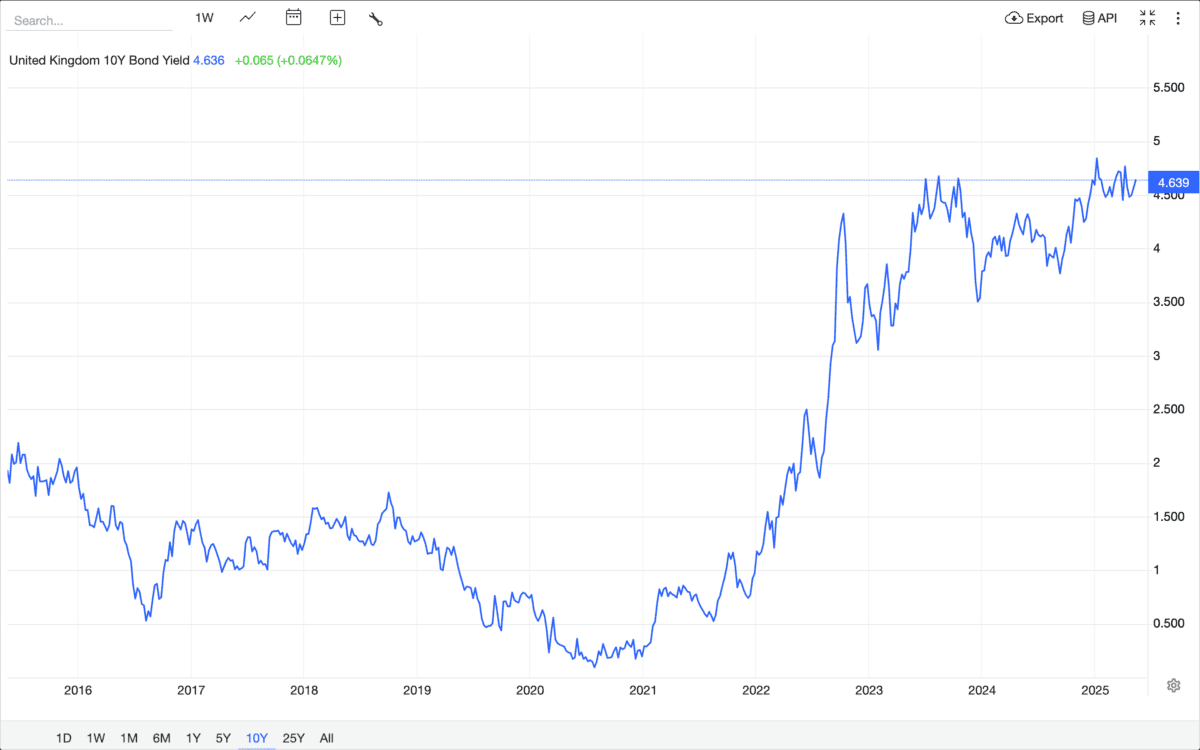

In terms of passive revenue, UK traders have a selection. And with 10-year authorities bonds providing a yield of greater than 4.6%, bonds are wanting fairly enticing proper now.

That represents a 10-year excessive and it’s one thing to be taken significantly. However I believe traders can do even higher within the inventory market.

Bond market

Regardless of the asset class, investing effectively is about being grasping when others are fearful. And the present state of the bond market suggests to me that there’s some worry round in the meanwhile.

A 4.6% yield means somebody who invests £10,000 in UK gilts can anticipate to obtain £460 annually till 2035. 5 years in the past, the identical funding would have returned round £200 per yr.

Supply: Trading Economics

With a bond, the one manner traders don’t get their anticipated return is that if the UK authorities defaults on its obligations. And that makes them a lot much less dangerous than any inventory funding.

In brief, gilts proper now supply an unusually excessive yield with a comparatively low danger. And that’s one thing passive revenue traders ought to take note of when fascinated about alternatives.

Shares

UK gilts haven’t been this enticing for greater than a decade. And whereas I’m sticking to the inventory marketplace for funding alternatives, that is one thing I’m taking account of.

I’m wanting additional forward than the subsequent 10 years, however the scenario is much more stark with the 30-year bond. The present yield is slightly below 5.5% – once more, the very best it’s been in a decade.

Supply: Trading Economics

Within the context of my very own investing, meaning I shouldn’t be shares the place I don’t anticipate to make a minimum of 5.5% per yr over the subsequent 30 years. And that’s a reasonably excessive bar.

There are, nonetheless, just a few shares that I believe may effectively make the grade. One in every of these is FTSE 250 housebuilder Vistry (LSE:VTY).

Shareholder returns

Vistry seems to be like an odd selection for passive revenue traders. The agency has just lately suspended its dividend and there’s an ongoing investigation from the Competitors and Markets Authority.

Neither of these is one thing I search for in a inventory to think about. However the share price has fallen a lot that I believe there’s an excellent likelihood it might do higher than 5.5% per yr going ahead.

For one factor, there’s an ongoing share buyback programme. At present ranges that by itself is equal to round 6.25% of Vistry’s present market worth.

The dividend was suspended earlier this yr following some accounting irregularities. However I believe these may be short-term in nature and shouldn’t derail the distribution for too lengthy.

Revenue alternatives

Bonds are unusually enticing from a long-term passive revenue perspective. Regardless of this, I nonetheless suppose I can discover higher alternatives for my portfolio within the inventory market in the meanwhile.

Vistry doesn’t seem like probably the most promising funding in the meanwhile, but it surely’s effectively price a more in-depth look. I believe its partnerships enterprise has some wonderful long-term prospects.

It’s truthful to say there are some short-term dangers and alternatives. However I’m significantly contemplating it for my Shares and Shares ISA as potential alternative to do higher than a 30-year bond.