NAIROBI (CoinChapter.com)— United States Federal Reserve officers are taking a cautious, impartial stance on financial coverage as they await readability on the potential financial impacts of incoming President Donald Trump’s insurance policies. With inflation remaining above the Fed’s 2% goal and up to date price cuts already recalibrating coverage, officers seem hesitant to decide to additional easing.

Fed Retains Charges Regular as Trump Period Looms

Federal Reserve Governor Michelle W. Bowman hinted that the upcoming months might supply readability on the financial influence of Trump’s insurance policies.

Talking on Jan. 9 in California, Bowman underscored the significance of a cautious strategy, warning towards actions that might unnecessarily gasoline demand and reignite inflation.

Echoing this sentiment, Kansas Metropolis Federal Reserve President Jeff Schmid highlighted that the U.S. economic system is nearing some extent the place neither restrictions nor extra help are crucial. “Policy should remain neutral,” Schmid stated, as he emphasised the effective steadiness between sustaining development and combating inflationary pressures.

The Federal Open Market Committee’s (FOMC) latest minutes additional illuminated this balanced strategy. Officers expressed uncertainty over extra price cuts, acknowledging persistent inflation and its potential to delay their goal of two%.

Bitcoin Dips as Fed Maintains Impartial Stance

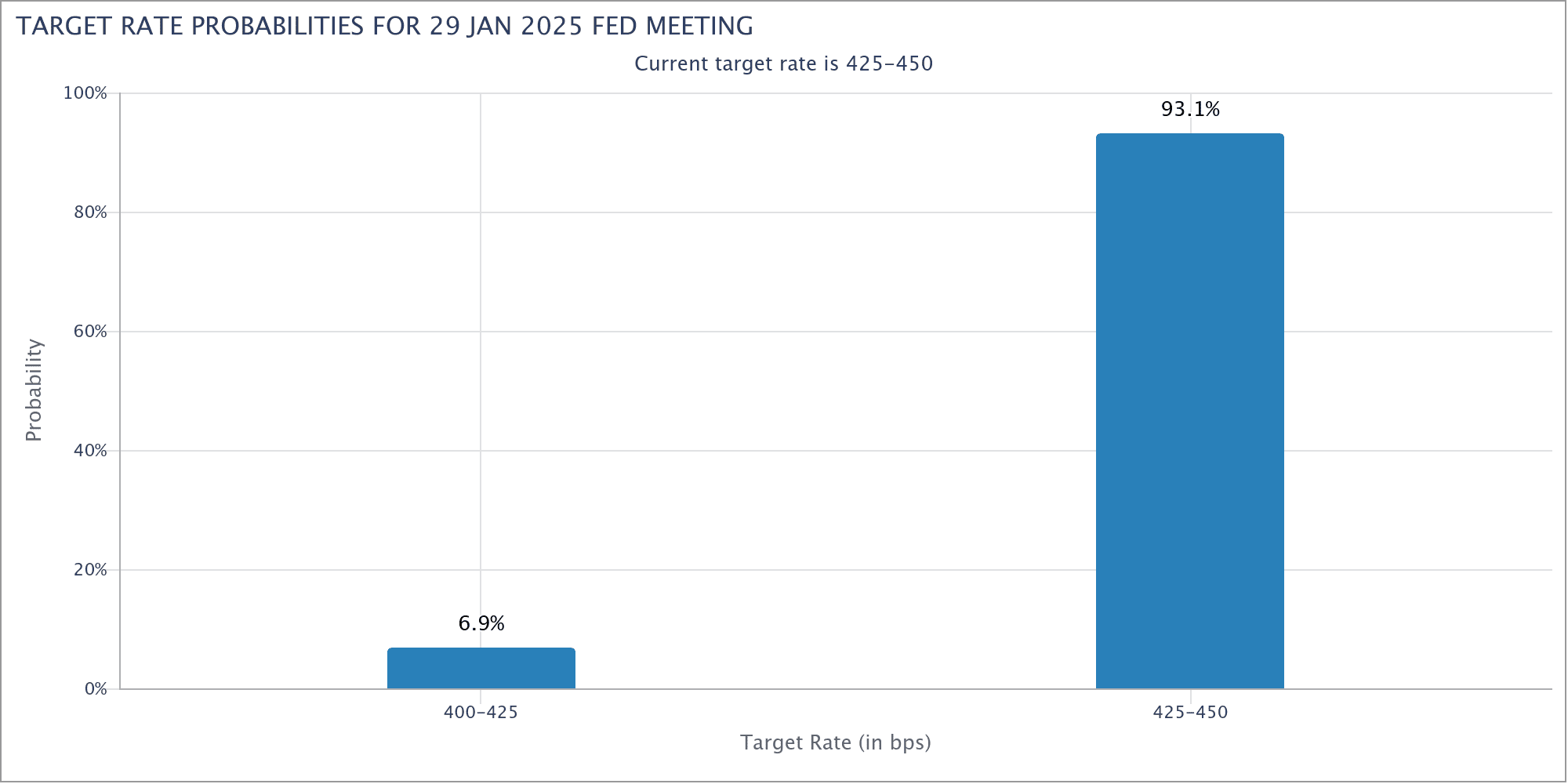

The Fed’s cautious strategy has rippled into monetary and cryptocurrency markets. Buyers have priced in a 95% likelihood that charges will maintain regular on the Fed’s Jan. 29 assembly. Nonetheless, combined financial information and uncertainty over future insurance policies have launched market volatility.

Ryan Lee, chief analyst at Bitget Analysis, attributed Bitcoin’s drop on Jan. 8 to $92,500 to sturdy U.S. financial information and the Fed’s alerts of tighter coverage.

“Cryptocurrencies become less appealing when monetary policy tightens, reducing risk appetite,” Lee stated.

The Fed’s December price minimize of 0.25% marked the ultimate step in what Bowman known as the “policy recalibration phase.” Nonetheless, Federal Reserve Chair Jerome Powell indicated solely two extra cuts in 2025, tempering market expectations for extra easing.

Fed Stresses Persistence Amid Uncertainty

Philadelphia Federal Reserve President Patrick Harker burdened the significance of pausing to guage financial circumstances. “It’s appropriate for us to wait and see how things evolve,” Harker stated, reflecting the cautious tone amongst Fed officers.

As Trump takes workplace, the Federal Reserve faces a fragile job—balancing inflation management with sustained financial development.