On June 4, 2025, TRUMP/USDT shaped an ascending channel sample on the 1-hour timeframe.

An ascending channel seems when price strikes between two upward-sloping, parallel trendlines, usually exhibiting a gradual uptrend with managed momentum.

At present, the price trades at $11.15 and touches the decrease trendline of the channel. The 50-period Exponential Transferring Common, now at $11.25, acts as a dynamic resistance simply above the price.

If the price breaks above the higher channel boundary and confirms the breakout, TRUMP/USDT might rally towards the projected goal of $12.36, representing a ten.85% potential enhance from the present stage.

The sample has already been examined as soon as with a rejection close to the highest boundary. That spike reveals early bullish strain, however the price should now maintain above the decrease trendline and break the higher boundary for affirmation.

Quantity stays average, and bulls should regain momentum to push previous the channel resistance and reclaim the 50-period Exponential Transferring Common. A detailed above this zone would validate the upside breakout state of affairs.

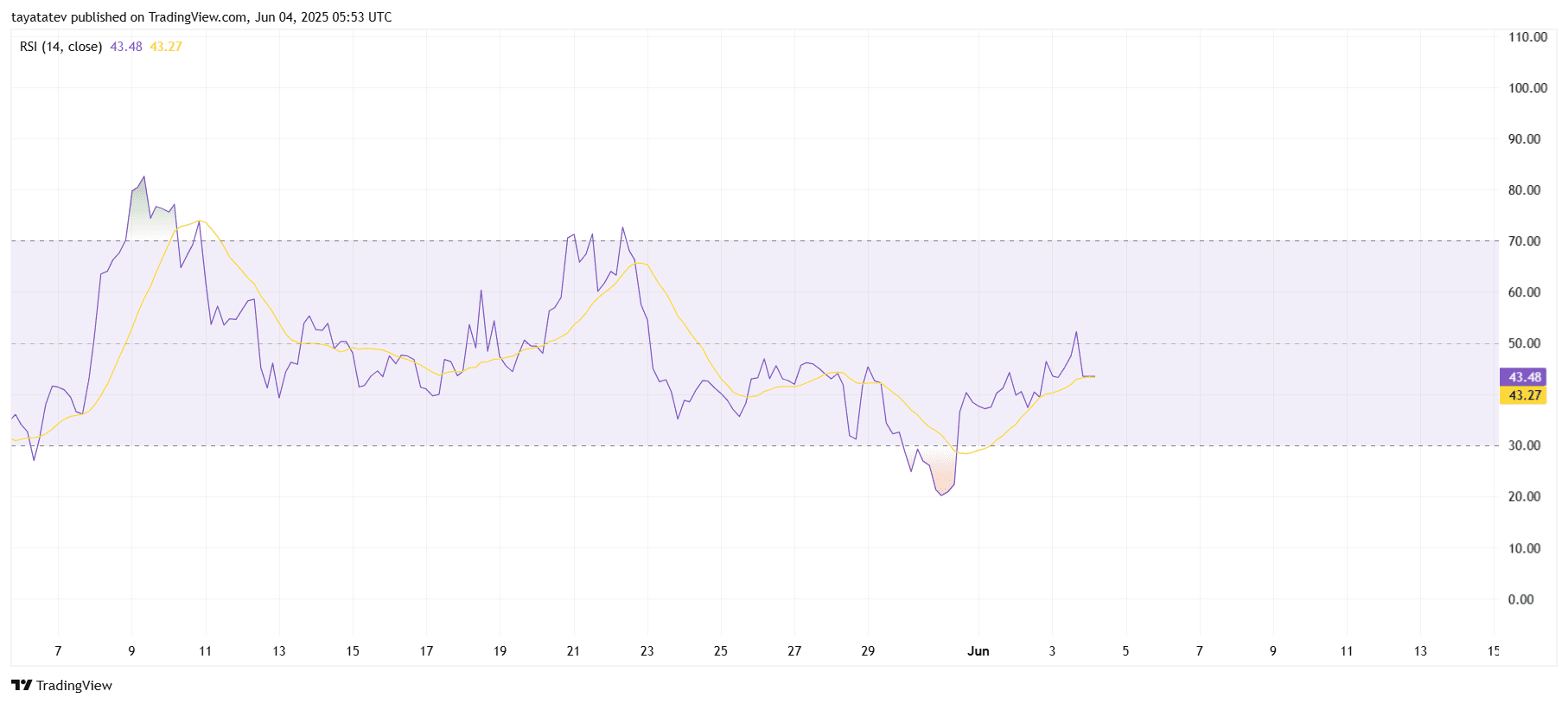

TRUMP/USDT RSI Exhibits Weak Momentum Restoration

The 14-day Relative Energy Index (RSI) for TRUMP/USDT stands at 43.48, with its shifting common at 43.27.

The Relative Energy Index measures price momentum, with values beneath 50 indicating bearish strain and ranges below 30 signaling oversold circumstances. On this case, RSI just lately bounced from the oversold zone close to 30 on June 1, exhibiting a minor restoration.

Nonetheless, the RSI stays beneath the 50 impartial midpoint, suggesting that bulls haven’t regained full management. Though the RSI line has crossed above its shifting common, the slope is flat, and no robust momentum shift is seen but.

For now, the RSI displays weak shopping for curiosity. A transparent push above the 50 stage would help bullish continuation from the ascending channel construction seen within the price chart.

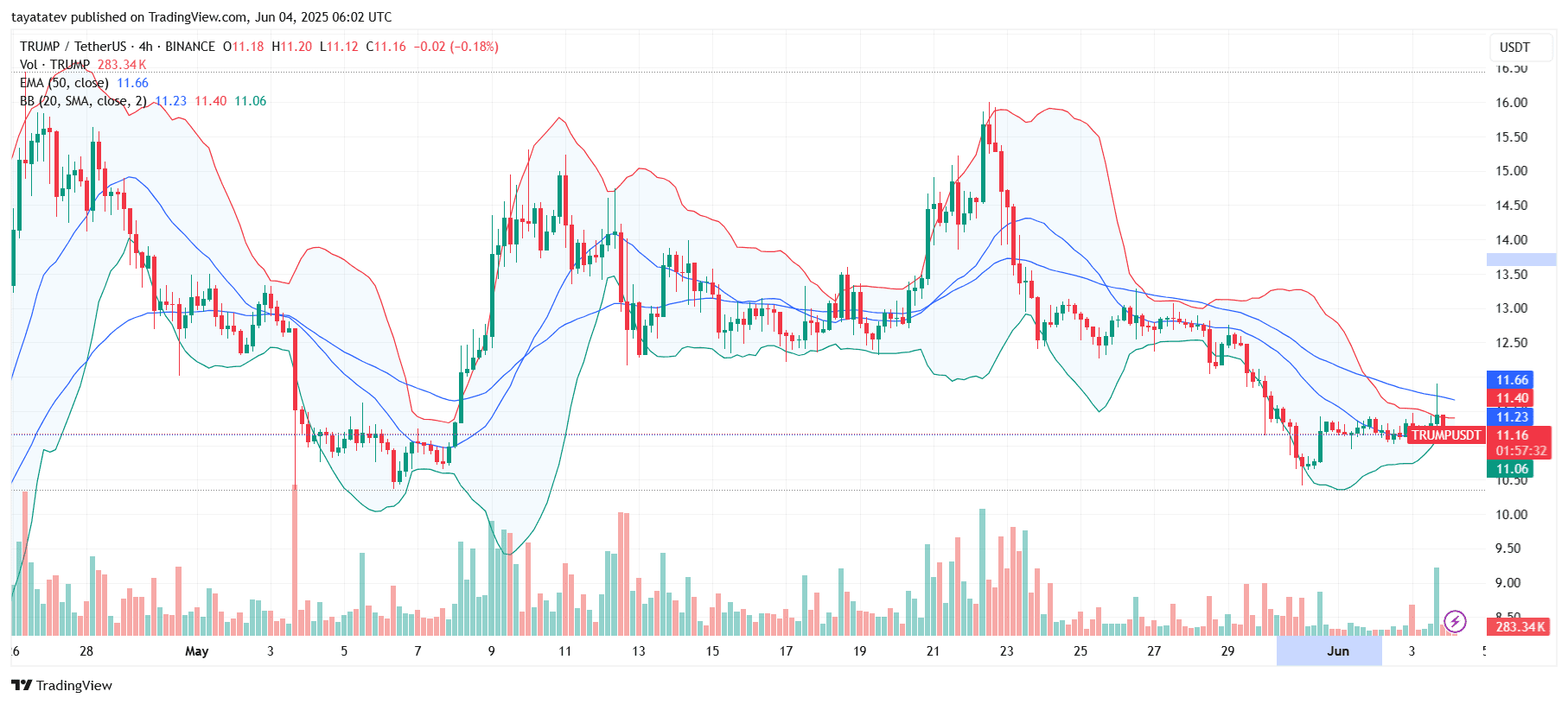

TRUMP/USDT Stalls Beneath Resistance on Bollinger Band Squeeze

On June 4, 2025,TRUMP/USDT traded at $11.16 on the 4-hour chart and moved inside a slim Bollinger Band construction, exhibiting volatility compression.

The Bollinger Bands (20-period Easy Transferring Common with 2 commonplace deviations) are tightening, with the midline at $11.23, higher band at $11.40, and decrease band at $11.06. Tight bands usually point out {that a} main price transfer might observe.

Value just lately touched the higher Bollinger Band however failed to interrupt it, suggesting resistance close to $11.40. In the meantime, the 50-period Exponential Transferring Common stands at $11.66, reinforcing overhead resistance.

Quantity spiked over the last session, however price failed to shut above the mid-band, indicating weak bullish follow-through. For upward momentum to construct, TRUMP should shut above each the higher Bollinger Band and the 50-period Exponential Transferring Common.

Till then, the squeeze continues. A break above $11.40–$11.66 may set off a pointy transfer, whereas failure to carry $11.06 dangers a draw back drop.

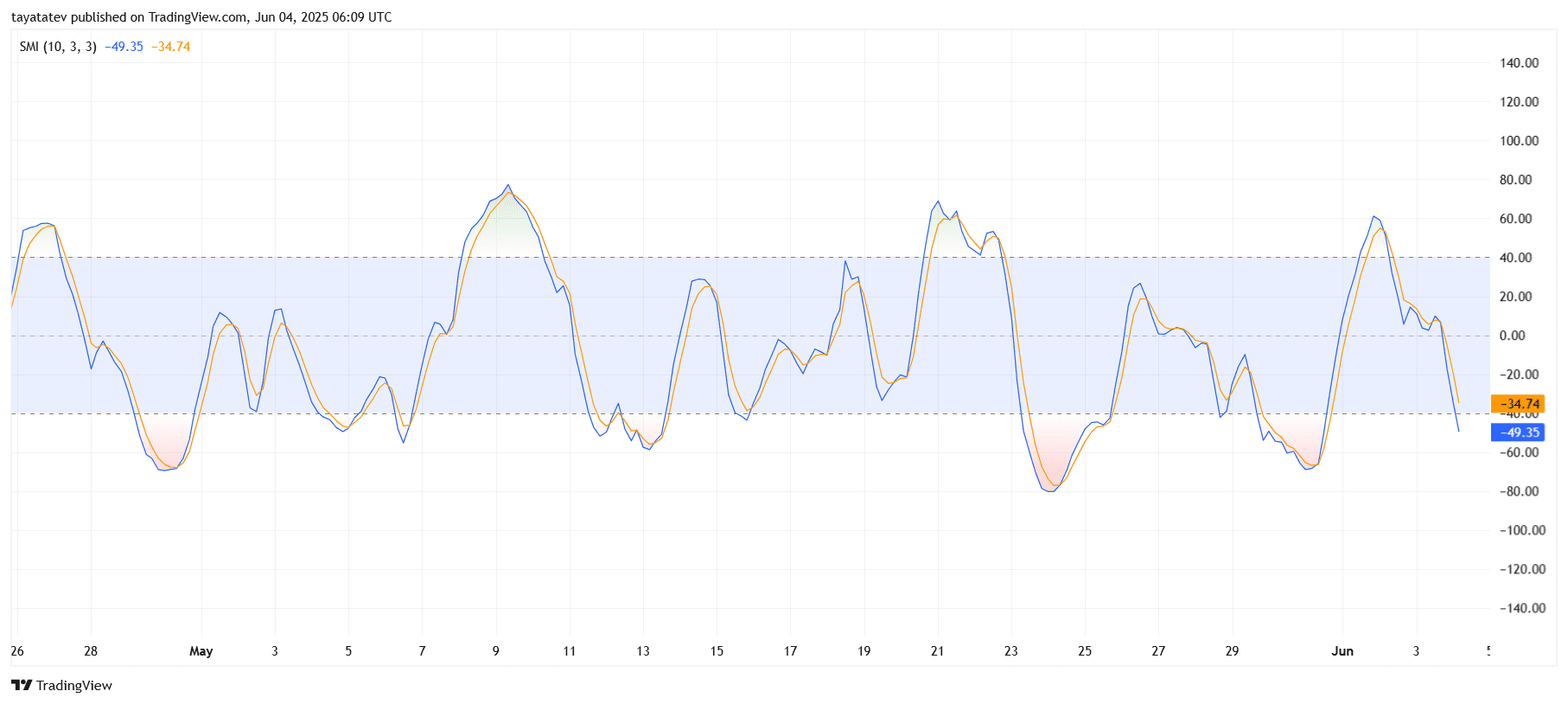

TRUMP/USDT Stochastic Momentum Index Dips Beneath Midline

In the meantime, the Stochastic Momentum Index (SMI) for TRUMP/USDT turned bearish. The SMI line (blue) sits at –49.35, whereas the sign line (orange) reads –34.74, each pointing down.

The SMI measures price momentum relative to latest highs and lows. When the blue line crosses beneath the orange sign line and each transfer below the mid-range (0), it alerts weakening bullish strain.

This chart reveals that momentum sharply reversed after reaching above the 40 stage in early June. The crossover occurred contained in the impartial zone and now developments towards the oversold area (beneath –50), hinting at rising promoting strain.

Until the traces reverse upward and reclaim the midline, TRUMP/USDT might proceed dealing with bearish momentum within the brief time period.

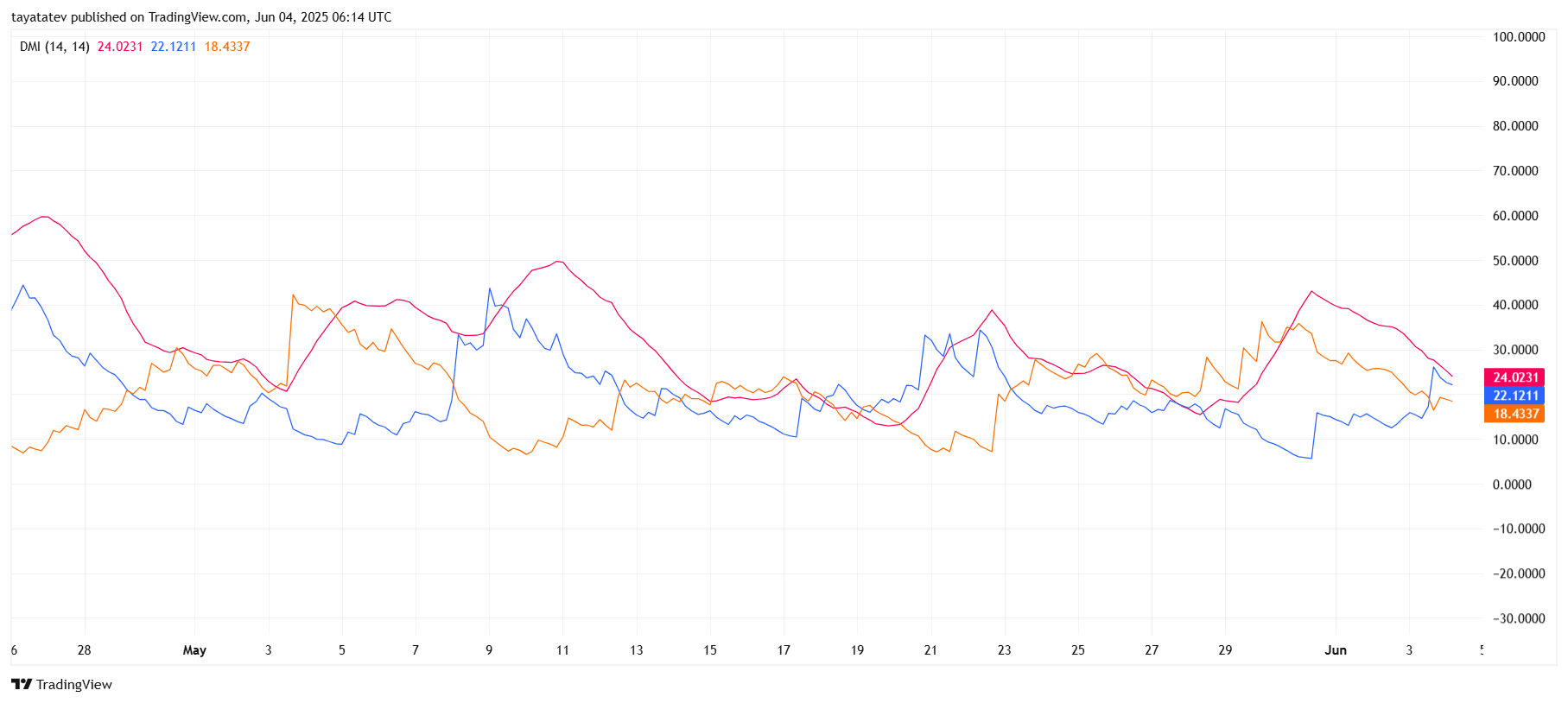

TRUMP/USDT Directional Motion Index Exhibits Weak Development Energy

On June 4, 2025, the Directional Motion Index (DMI) for TRUMP/USDT displays indecisive development power. The +DI (blue) sits at 22.12, the –DI (orange) at 18.43, and the ADX (pink) at 24.02.

The DMI signifies development route and power. When the Common Directional Index (ADX) is beneath 25, it alerts weak or no development. On this case, ADX has dropped close to 24, exhibiting a fading development.

The +DI stays above –DI, suggesting a slight bullish bias, however the hole is small, and each traces keep shut. This slim unfold confirms the market is consolidating, with neither consumers nor sellers holding robust momentum.

Until ADX rises above 25 and both DI line makes a pointy transfer, TRUMP/USDT might keep range-bound.

Trump’s Reality Social Advances Bitcoin ETF Itemizing with NYSE Arca Submitting

On June 3, 2025, NYSE Arca—the totally digital arm of theNew York Inventory Change—filed a Kind 19b-4 to checklist the Reality Social Bitcoin ETF, marking a key step towards making the fund obtainable to public buyers. The transfer brings Donald Trump’s media platform nearer to launching a spot bitcoin exchange-traded fund.

The proposed ETF goals to reflect Bitcoin’s price efficiency, providing buyers publicity to the cryptocurrency while not having to carry the asset immediately. This submitting follows a broader technique from Trump Media & Know-how Group, which just lately partnered with Crypto.com to roll out numerous digital asset merchandise.

Again in March, Trump Media and Crypto.com introduced plans to launch token baskets and ETFs branded below the Trump Media title. These merchandise will combine conventional securities with digital tokens—akin to Bitcoin and Cronos, Crypto.com’s native asset—and might be distributed globally via main brokerage platforms and the Crypto.com app, which serves over 140 million customers.

In the meantime, Trump Media revealed a $2.5 billion Bitcoin treasury plan final week in Las Vegas, reinforcing its crypto push. The agency additionally secured emblems tied to digital property, signaling long-term dedication.

Since January 2024, when spot bitcoin ETFs debuted within the U.S., whole property have surged previous $130 billion. BlackRock’s iShares Bitcoin Belief (IBIT) dominates the sector with almost $69 billion below administration.

Trump stays the bulk proprietor of Trump Media. If the ETF receives regulatory approval, it will develop into probably the most politically-linked crypto funding merchandise out there.