YEREVAN (CoinChapter.com) — Bo Hines, head of the Presidential Council of Advisers on Digital Belongings, confirmed the Trump administration is contemplating tariff revenues to fund a nationwide Bitcoin Reserve.

In a latest interview with Pondering Crypto, Hines mentioned the concept of making a Strategic Bitcoin Reserve (SBR) is a part of a broader U.S. financial technique. The plan marks a shift from earlier proposals that relied on gold gross sales.

“There is a finite number of Bitcoin and I think there will end up being a race to accumulate,”

mentioned Hines. He defined that the U.S. must act rapidly as international competitors for Bitcoin intensifies.

Bo Hines Outlines Bitcoin Technique in Interviews

In an prolonged interview with Anthony Pompliano, Bo Hines outlined how the Strategic Bitcoin Reserve suits into the Trump administration’s broader financial technique. He described the Bitcoin Reserve as a “budget-neutral” initiative, which means it could not depend on new taxes or borrowing. As a substitute, it could use current income streams corresponding to tariffs.

Hines mentioned tariff revenues are into account as a result of they supply a gentle, controllable supply of funding. He positioned Bitcoin, tariffs, and gold on the heart of the administration’s new method. This mixture of conventional and digital property, in response to Hines, displays the necessity to adapt nationwide reserves to the present monetary local weather.

“The strategic reserve is just the beginning,”

mentioned Hines.

“We’re thinking long-term about what assets can empower the American people and insulate us from global shocks.”

Hines identified that Bitcoin shouldn’t be being handled as a speculative asset. As a substitute, the Trump administration views it as a strategic instrument that would assist nationwide stability. The Strategic Bitcoin Reserve, he defined, would operate very similar to conventional reserves, corresponding to these held in gold or overseas foreign money.

In the identical interview, Bo Hines confirmed that stablecoin laws can also be underneath evaluation. He mentioned there’s an lively push to combine blockchain techniques into U.S. banking infrastructure. This integration, he claimed, would assist modernize monetary oversight and help regulation enforcement in monitoring digital transactions extra effectively.

The plan to make use of blockchain and stablecoins aligns with the administration’s digital asset framework. Hines offered it as a part of a coordinated push to modernize how the federal authorities handles foreign money, reserve property, and monetary compliance instruments.

Bitcoin Reserve Plan Sparks Combined Reactions

The thought of utilizing tariff revenues for the Bitcoin Reserve drew consideration throughout the crypto sector. Influencer Crypto Rover shared assist on X, whereas Cardano founder Charles Hoskinson raised doubts in regards to the tariff mannequin.

Charles Hoskinson raised issues that the Trump administration’s tariff-based Bitcoin Reserve plan might create unintended penalties for the U.S. crypto sector. In a CNBC interview Hoskinson mentioned aggressive tariff insurance policies could improve the price of importing specialised mining gear, most of which is manufactured in Asia. He warned that this might undermine the competitiveness of U.S.-based Bitcoin mining companies by lowering entry to important {hardware} and elevating operational bills. Hoskinson additionally questioned whether or not new crypto-focused taxes launched alongside tariffs would have any actual affect, calling them “largely ineffective” because of the decentralized nature of digital property and the convenience with which capital strikes throughout borders.

Some analysts additionally famous that commerce restrictions might make it tougher for miners to entry Chinese language gear. That might shift the business panorama, particularly for companies depending on low-cost imports.

Lummis Gold Swap Plan Differs From Hines Proposal

Bo Hines’s method to constructing a Bitcoin Reserve differs sharply from the trail proposed by Senator Cynthia Lummis. On the Bitcoin 2024 Convention, held in July final 12 months, Lummis launched a legislative plan to transform a part of the Federal Reserve’s gold reserves into Bitcoin. She proposed liquidating extra gold held in any respect 12 regional Federal Reserve Banks over a five-year interval.

“We will convert excess reserves at our 12 Federal Reserve banks into bitcoin over five years. We have the money now,”

Lummis advised the viewers.

Her plan targeted on reallocating current federal property moderately than relying on future income. The technique would have shifted the reserve stability away from gold and into digital property, signaling a symbolic and monetary pivot on the federal degree.

This distinction highlights two totally different financial methods—Lummis’s proposal depends on asset reallocation, whereas Hines promotes a budget-neutral method that makes use of present revenue streams. Each goal to increase U.S. crypto reserves however function via basically totally different mechanisms.

Trump Administration Eyes Broader Digital Asset Shift

Experiences point out that the Trump administration is getting ready to interview candidates to probably substitute Federal Reserve Chair Jerome Powell. Powell’s time period concludes in Could 2026. U.S. Treasury Secretary Scott Bessent said that the White Home plans to start the interview course of this fall. This would supply roughly six months to establish a successor. This improvement follows President Trump’s public requires the Federal Reserve to decrease rates of interest, as expressed in an April 4 put up on Fact Social. Bessent emphasised that whereas he’s not involved in regards to the administration undermining the Fed’s independence, there’s room for dialogue relating to the Fed’s position in financial institution regulation. He highlighted the significance of distinguishing between the Fed’s financial coverage obligations and its regulatory features, noting that the Federal Reserve shares regulatory duties with the Workplace of the Comptroller of the Foreign money and the FDIC.

Bo Hines hinted that the Strategic Bitcoin Reserve is only one a part of a wider plan. This consists of authorized frameworks for stablecoins, blockchain integration into banking, and instruments to enhance crypto enforcement.

These modifications are linked to the administration’s broader U.S. financial technique. Tariff revenues, digital property, and strategic reserves are being positioned as components of a nationwide framework.

Bitcoin Value Steady Throughout Reserve Talks

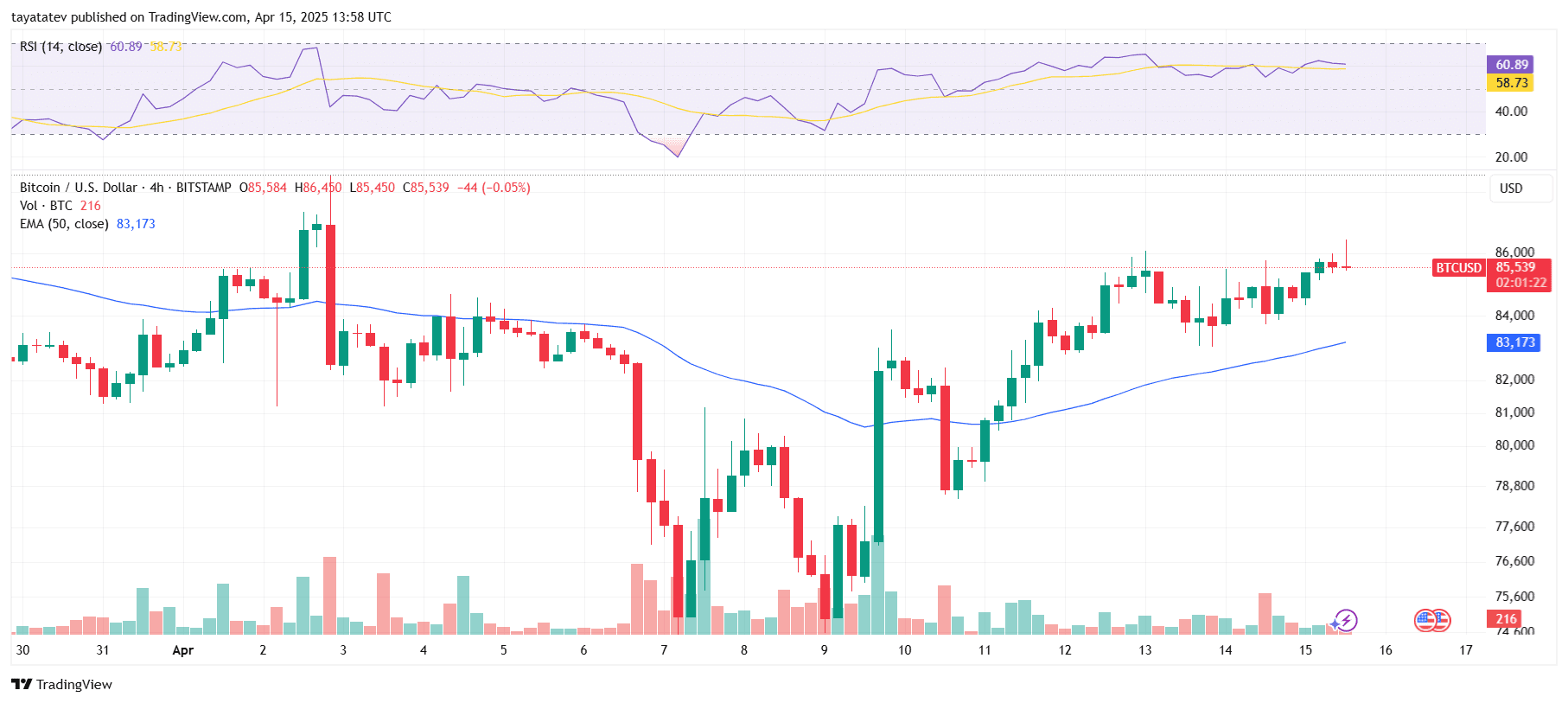

Bitcoin (BTC) traded at $85,539 on April 15, 2025, in response to 4-hour information from Bitstamp. The price was practically flat. It confirmed a 0.05% decline from the earlier candle, regardless of a quick intraday spike to $86,450. The transfer adopted regular accumulation over the previous three days. This pushed Bitcoin above the 50-period Exponential Shifting Common (EMA), at present at $83,173.

Quantity remained average, with 216 BTC traded in the course of the newest 4-hour session. The Relative Energy Index (RSI) hovered at 60.89, staying beneath overbought circumstances and suggesting impartial momentum.

Regardless of public consideration on the proposed Strategic Bitcoin Reserve and broader macro coverage modifications, BTC price motion stayed inside a good vary. The market response suggests merchants are ready for clearer alerts associated to tariff coverage, Federal Reserve management modifications, and crypto regulation earlier than making bigger directional strikes.