In crypto, sure platforms stand out not only for their technological innovation but additionally for the way profoundly they affect market operations and person adoption throughout the globe.

TRON community has emerged as one such pivotal participant, significantly in facilitating the expansive adoption of Tether (USDT), essentially the most broadly utilized stablecoin. This analysis delves into the function of TRON as a basic infrastructure within the crypto ecosystem and its pivotal function in enhancing USDT’s usability and attain.

TRON’s Ascendancy in Stablecoin Operations

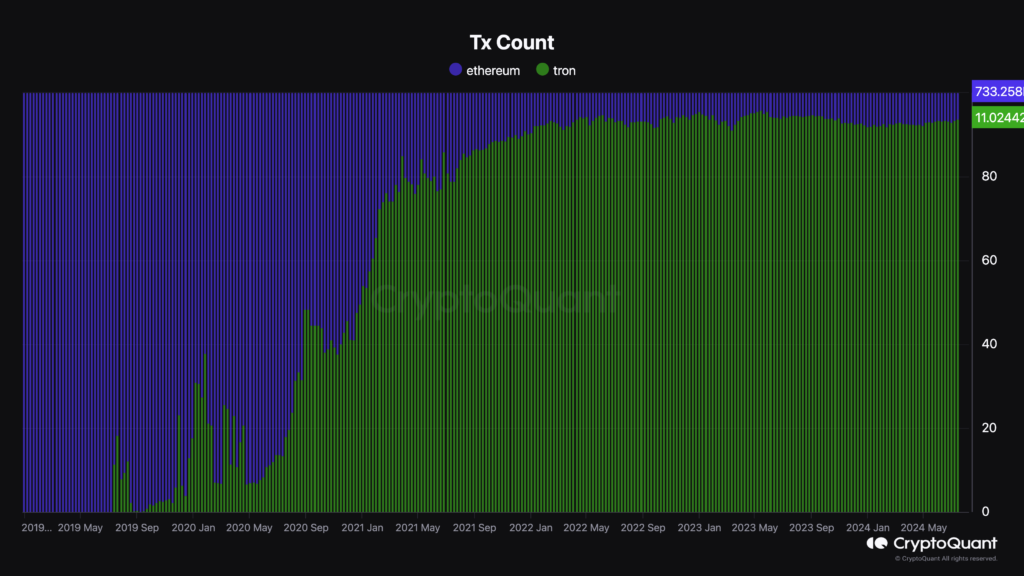

The TRON community has witnessed outstanding progress since its inception, evolving into an important hub for blockchain transactions. CryptoQuant‘s latest insights reveal that TRON’s integration with USDT has catapulted it to the forefront of blockchain transactions involving this in style stablecoin.

This integration started in 2019 and has seen a considerable proportion of USDT’s complete issuance and transactions migrating to TRON. By July 2024, the info supplied startling figures:

- TRON accounted for 53.47% of USDT’s complete issuance.

- A staggering 93% of USDT transactions occurred on TRON.

- TRON dealt with 70% of USDT’s switch quantity.

Such statistics underscore TRON’s vital footprint within the stablecoin area, suggesting a deep-seated belief and desire amongst customers for its platform when coping with USDT transactions.

The detailed analysis of USDT switch volumes on TRON reveals a broad-based adoption throughout numerous person demographics. Notably, transactions underneath $1,000, which usually symbolize retail exercise, represent 70% of the overall transfers. This excessive share factors to TRON’s recognition amongst on a regular basis customers who profit from its decrease transaction charges and sooner processing instances in comparison with different networks.

Conversely, the rising proportion of transactions exceeding $10,000 signifies an growing engagement from institutional customers. This uptick is a testomony to TRON’s sturdy infrastructure that may help bigger transactions effectively, making it a popular alternative for companies {and professional} merchants trying to leverage the soundness of USDT inside their operations.

Why TRON’s Infrastructure Issues

The explanations behind TRON’s attraction for managing USDT transactions are manifold. First, TRON provides considerably decrease transaction charges in comparison with its counterparts, notably Ethereum. This cost-effectiveness is coupled with sooner transaction speeds, guaranteeing that customers can carry out swift and economical transfers with out compromising on safety or effectivity.

Furthermore, TRON’s constant efficiency and stability reinforce its place as a dependable community for dealing with high-stakes and high-volume transfers, essential for sustaining liquidity within the fast-paced crypto market.