TRON stablecoin transfers totaled $694.54 billion in Could 2025. Whale wallets, outlined as these sending transactions over $1 million, accounted for $411.2 billion—59% of the month-to-month quantity, in response to CryptoQuant.

The community now processes over 2.4 million USDT transfers each day, reflecting elevated use by high-value accounts. TRON’s USDT exercise has surpassed Ethereum in each quantity and provide in 2025.

TRON Stablecoin Provide Surges to $79B

The provision of USDT on TRON grew from $58 billion to $79 billion in six months. Throughout Could, the typical each day USDT quantity reached $23.7 billion. The rise in quantity and provide displays elevated demand for large-scale stablecoin funds throughout blockchain programs.

CryptoQuant analyst JA Maartunn stated:

“Stablecoins are becoming a key part of crypto adoption… On-chain data also shows that whales are actively using stablecoins.”

Charts from CryptoQuant spotlight constant month-over-month progress in USDT transfers on TRON.

TRX Switch Quantity Tops $121B in Could

In parallel with stablecoin progress, TRX month-to-month switch quantity reached 490.3 billion tokens, valued at $121.2 billion. This enhance displays broader use of TRX for facilitating high-throughput transfers on the community.

TRX helps the transaction layer on TRON, which permits high-frequency and low-fee USDT actions. The rise in TRX quantity suggests larger utilization throughout decentralized purposes and providers.

TRON Now Leads USDT Transfers Throughout All Chains

As of Could 2025, TRON holds the biggest share of USDT provide and transaction quantity amongst blockchains. Whale-sized transfers and high-frequency exercise have made the community the highest channel for stablecoin stream.

CryptoQuant metrics affirm TRON’s lead in international stablecoin circulation. TRON stablecoin transfers proceed to dominate each day volumes and large-value settlements.

Stablecoin Market Projected to Attain $2 Trillion

A forecast by the U.S. Treasury estimates the stablecoin market may attain $2 trillion by 2028, pushed by tokenized belongings, institutional use, and broader cost adoption.

TRON’s rising exercise illustrates how stablecoin infrastructure is scaling. With whales transferring over $400 billion in a single month and each day transactions exceeding 2 million, TRON stays central to stablecoin-based monetary programs.

TRON Value Types Symmetrical Triangle, Bearish Breakdown Targets $0.2434

June 14, 2025 – TRON (TRX) fashioned a symmetrical triangle sample on the 1-hour chart, following a pointy decline earlier this week. The price is now buying and selling at $0.2704, barely beneath the 50-period exponential shifting common (EMA) positioned at $0.2723.

The symmetrical triangle started forming after a big drop on June 11, with price compressing into tighter highs and lows. This chart sample indicators market indecision and sometimes precedes a breakout within the route of the previous transfer—on this case, downward.

A confirmed break beneath the triangle’s decrease help may push TRX down by roughly 10%, inserting the following goal close to $0.2434. This stage matches prior help from early June, marked by larger quantity and historic consolidation.

Trading quantity has remained low through the formation of the triangle, which regularly results in a breakout as soon as momentum returns. The bearish construction stays legitimate so long as TRX holds beneath the EMA and fails to shut above the triangle’s higher resistance.

If sellers regain management and momentum accelerates beneath the help line, a transfer towards $0.2434 stays possible within the quick time period.

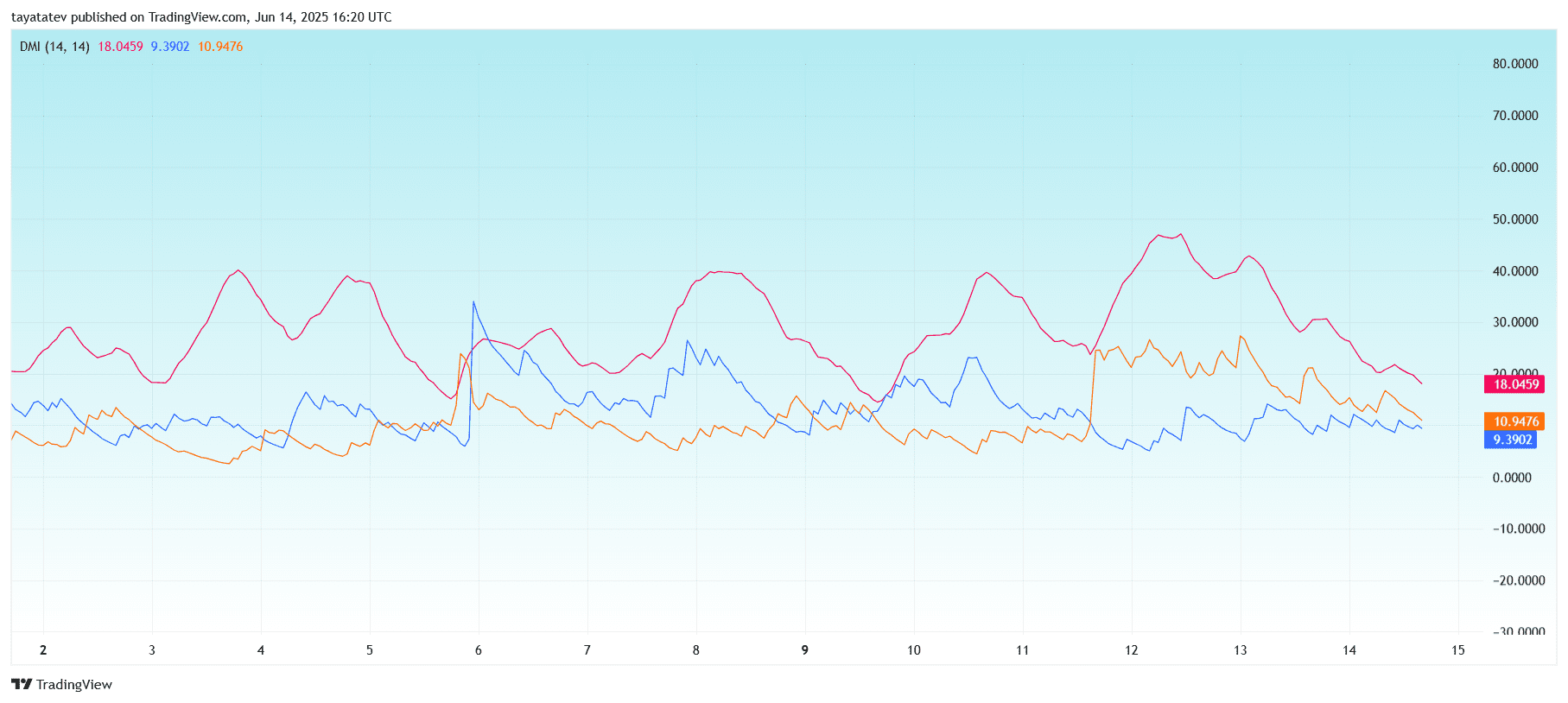

TRON DMI Indicator Reveals Weakening Pattern Energy Forward of Potential Breakdown

June 14, 2025 – The Directional Motion Index (DMI) on TRON’s (TRX) 1-hour chart signifies declining pattern power. The Common Directional Index (ADX), proven in crimson, has fallen to 18.04, signaling a weak and fading pattern.

The +DI line (orange), at present at 10.94, sits barely above the –DI line (blue), which is at 9.39. The slim hole between the directional indicators displays indecision between patrons and sellers. This comes as TRX trades beneath the 50-period exponential shifting common (EMA) and stays inside a symmetrical triangle sample.

Earlier this month, a stronger ADX studying above 40 confirmed pattern momentum. Nonetheless, the latest decline beneath 20 means that the pattern is dropping power. When the ADX drops underneath 20, price motion usually turns into range-bound, or prepares for a breakout from consolidation.

This weakening pattern power aligns with the triangle formation seen within the price chart. If the –DI line crosses again above the +DI line whereas the ADX begins rising once more, it might affirm draw back strain.

TRX stays prone to a breakdown towards $0.2434, particularly if directional strain shifts additional to sellers and quantity will increase.

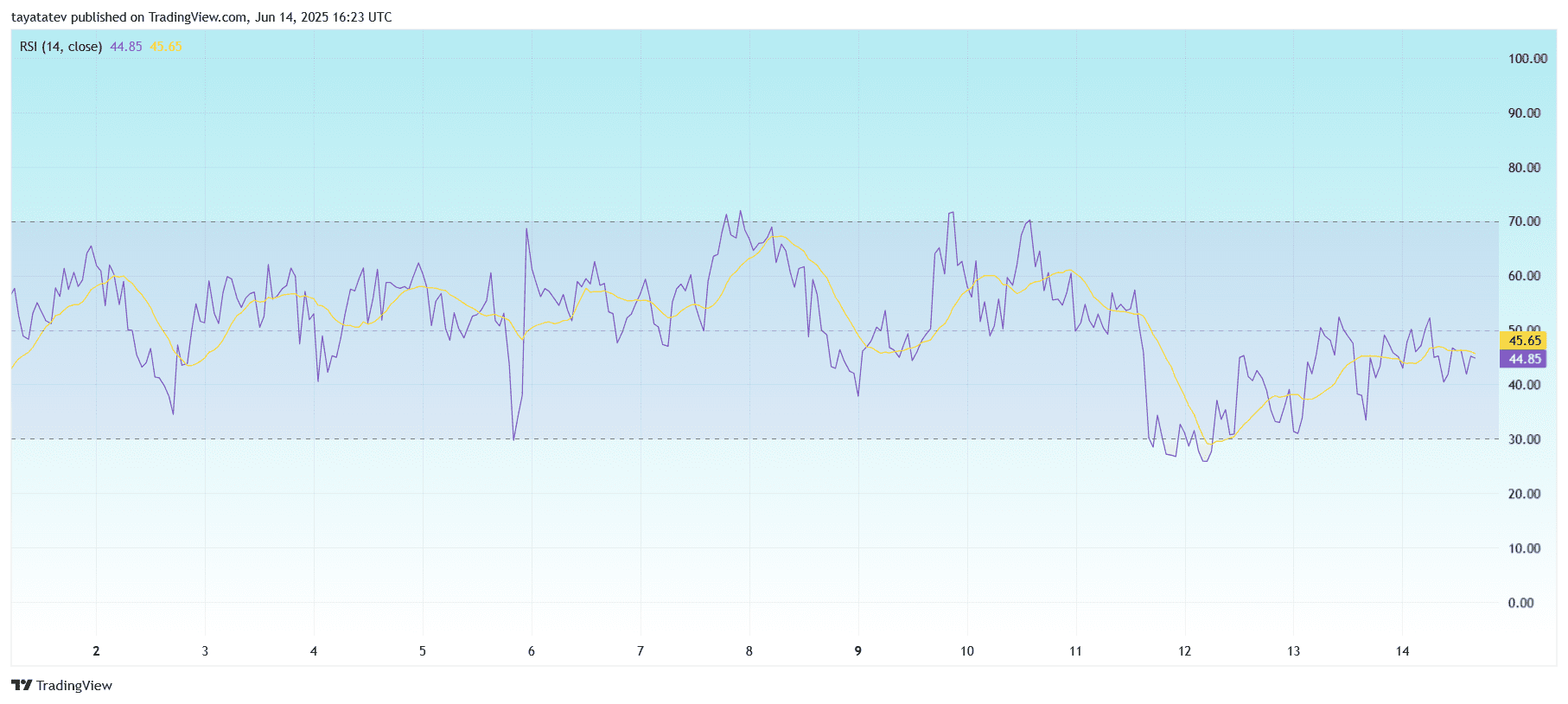

TRON RSI Stalls Under 50 as Momentum Stays Weak

TRON’s (TRX) Relative Energy Index (RSI) on the 1-hour chart stays neutral-to-bearish, hovering at 44.85, barely beneath its sign line at 45.65. This stage suggests weak momentum, with patrons but to regain management after the latest price drop.

The RSI has failed to interrupt above the mid-level 50 mark since June 11, following a pointy decline that pushed the indicator near oversold territory. Restoration makes an attempt have stayed capped beneath the impartial line, signaling a scarcity of robust bullish strain.

The sideways motion close to the 45 vary, mixed with rejection from the 50 stage, displays hesitation out there. TRX could keep range-bound or lean bearish except the RSI climbs decisively above 50 with rising quantity.

If price drops beneath the symmetrical triangle help seen in earlier charts, RSI may shortly fall towards the oversold threshold at 30, indicating additional draw back danger.