The Community Worth to Transactions (NVT) ratio for Tron (TRX) has surged to its highest stage in six weeks. This metric compares a community’s market capitalization to its transaction quantity.

When the NVT ratio rises, it often signifies that the community’s market worth is rising sooner than its precise utilization. This imbalance typically factors to potential overvaluation. In TRX’s case, the spike in NVT may sign investor warning forward.

As TRX’s NVT climbs, downward price strain might observe. Traders might reassess their positions, particularly if sentiment shifts. The next NVT usually implies fewer transactions relative to market cap, which might result in a sell-off if confidence weakens.

Whereas a price correction now seems more and more doubtless, robust on-chain knowledge exhibits key assist. In accordance with IntoTheBlock’s IOMAP indicator, there’s a giant demand zone between $0.268 and $0.276. Roughly 13.89 billion TRX—valued near $4 billion—was amassed on this vary.

This focus of purchaser curiosity types a stable price ground. Traders who entered at these ranges are unlikely to promote with out revenue, which reduces the danger of a pointy price drop.

Even when TRX corrects, the token is anticipated to seek out assist above $0.276. The high-volume demand zone ought to assist stabilize costs throughout any near-term market pullback.

TRON Varieties Ascending Channel, Targets 14% Worth Surge

On June 9, 2025, the TRX/USDT 4-hour chart on Binance created an ascending channel sample.

An ascending channel is a bullish chart sample shaped by two parallel upward-sloping trendlines that join larger highs and better lows, signaling constant price appreciation.

If this breakout confirms, the TRX price may rise 14% from the present stage of $0.2842 to the projected goal close to $0.3226.

The chart exhibits TRON respecting each trendlines since early Might. After retesting the decrease boundary round $0.268, TRX bounced and now trades above the 50-period Exponential Shifting Common (EMA), presently at $0.2776. This dynamic assist line strengthens the bullish setup.

Quantity stays regular, whereas current inexperienced candles recommend renewed purchaser curiosity. A breakout above the higher channel resistance, round $0.29, would doubtless set off upward momentum towards the $0.3226 resistance stage.

If TRX breaks out with quantity assist, the ascending channel might result in a contemporary rally, particularly as market construction stays bullish.

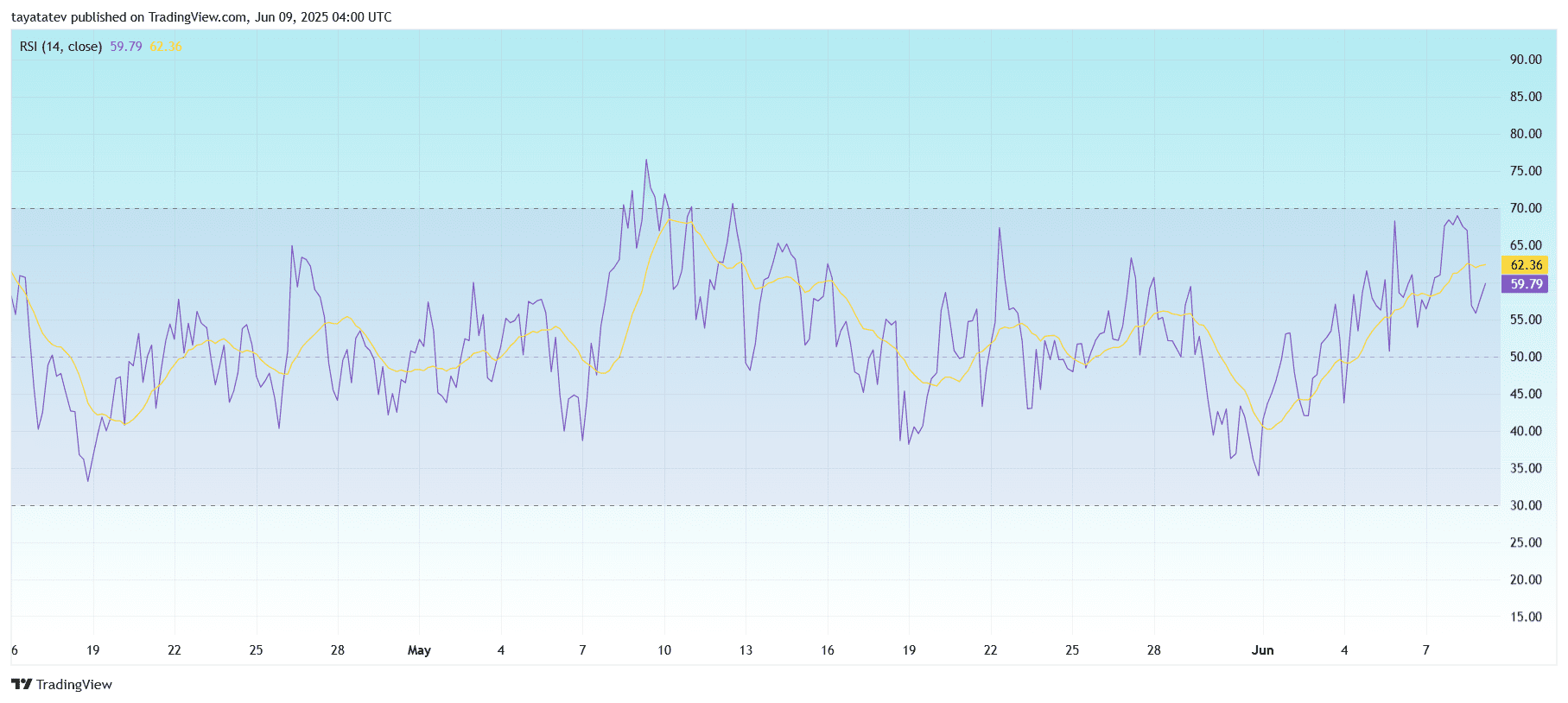

TRX RSI Holds Bullish Momentum Above 60

The 4-hour Relative Power Index (RSI) for TRX/USDT exhibits a studying of 62.36, staying above the impartial 50 stage.

The RSI is a momentum oscillator that measures the pace and alter of price actions, usually on a scale from 0 to 100. Readings above 70 recommend overbought situations, whereas readings beneath 30 point out oversold ranges.

At the moment, TRX’s RSI line continues to development upward, supported by the 14-period Easy Shifting Common (SMA) at 59.79. This crossover confirms bullish power and regular shopping for strain. Since mid-Might, RSI has maintained a constant rise, bouncing off lows close to 30 and progressively climbing into the bullish zone.

So long as RSI stays above 60, TRX is more likely to maintain momentum. If the oscillator pushes nearer to 70, the market may method overbought territory. Nonetheless, no divergence or reversal sign is seen, suggesting the uptrend might proceed within the close to time period.

Tron DMI Indicators Bullish Momentum Strengthening

On June 9, 2025, the 4-hour chart for TRX/USDT confirmed a transparent directional power shift utilizing the Directional Motion Index (DMI).

The DMI indicator consists of three strains:

-

+DI (blue): measures bullish power

-

−DI (orange): measures bearish power

-

ADX (purple): measures total development power

On the time of the chart, the +DI is at 19.61, the −DI is at 8.60, and the ADX is at 45.72. A rising ADX above 25 confirms a powerful development, and on this case, it indicators strengthening bullish momentum.

Since early June, the +DI line has remained above the −DI line, displaying consumers are in management. Because the ADX sharply rises above 40, the chart confirms that the uptrend is gaining traction. The widening hole between the +DI and −DI strains additional validates this upward strain.

So long as the ADX stays elevated and the +DI stays dominant, TRX is more likely to lengthen its upward development. No bearish crossover is seen, preserving the bias optimistic.

TRX MACD Exhibits Fading Bullish Momentum on June 9

In the meantime, he 4-hour chart for TRX/USDT reveals key indicators from the Shifting Common Convergence Divergence (MACD) indicator.

The MACD consists of two strains:

-

MACD Line (blue): distinction between the 12-period and 26-period exponential transferring averages

-

Sign Line (orange): 9-period exponential transferring common of the MACD line

-

The histogram visualizes the distinction between these two strains

On the time of the chart, the MACD line stands at 0.0025, whereas the sign line is at 0.0028. The histogram exhibits a slight unfavourable worth of −0.0003, indicating a minor bearish crossover.

This crossover indicators that bullish momentum could also be slowing. After a powerful rally in early June, the MACD strains have flattened, and the histogram has turned purple. Though the present sign shouldn’t be strongly bearish, it does recommend weakening upside momentum.

Nonetheless, the MACD stays close to optimistic territory, that means Tron shouldn’t be but in a transparent downtrend. Merchants might await additional affirmation earlier than performing, particularly if the MACD line dips deeper beneath the sign line.