A latest report by Artemis confirmed that Tron leads stablecoin transaction volumes throughout key areas, together with Latin America, Africa, North America, Europe, and Asia.

In accordance with the report,

“The most popular blockchains employed to settle customer flows, as a share of value sent, were Tron, followed by Ethereum, Polygon (Ethereum L2), and Binance Smart Chain.”

Alongside rising transaction volumes, Tron additionally gained floor in market rankings. It has now surpassed Cardano to develop into the ninth-largest cryptocurrency. As of the most recent information, Tron’s market capitalization reached $25.6 billion, barely forward of Cardano’s $24.1 billion.

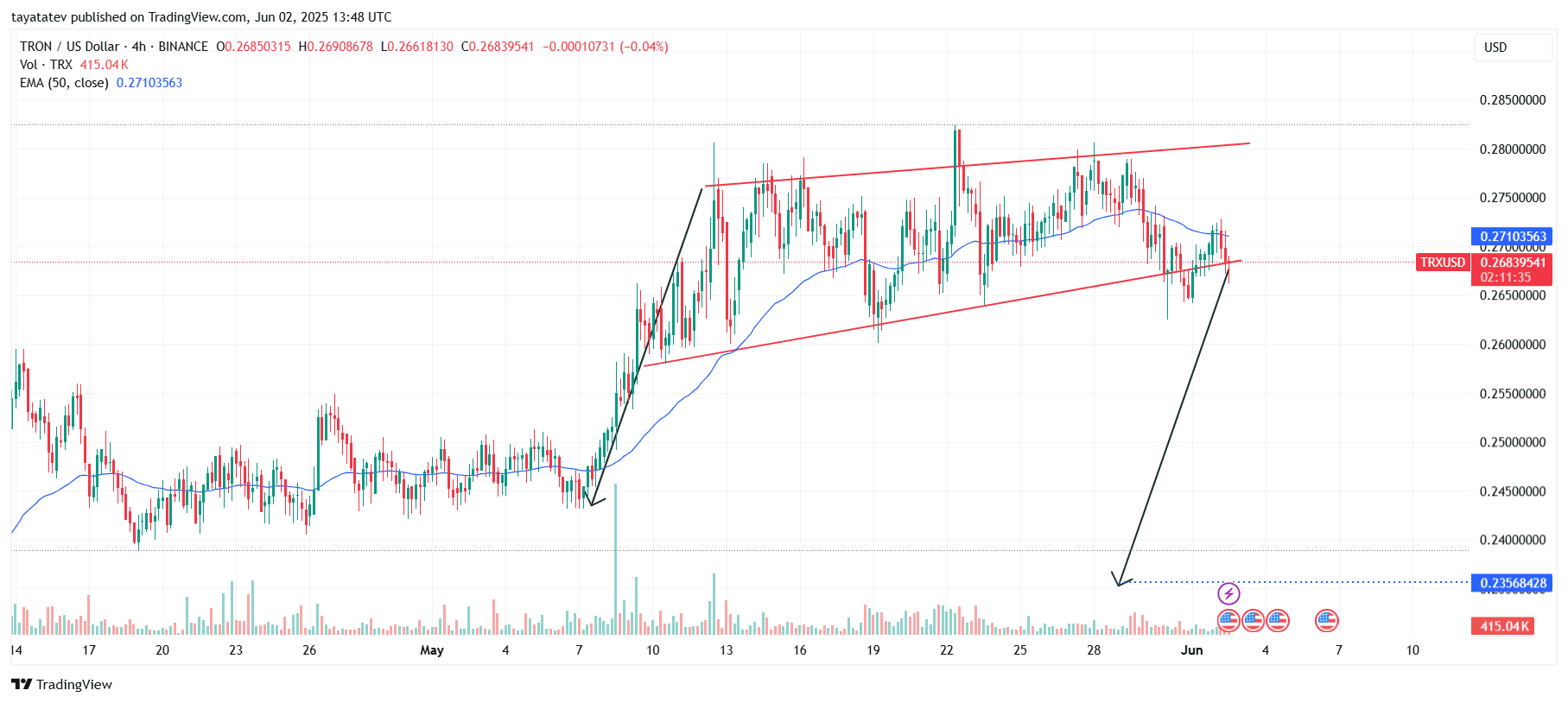

On June 2, 2025, the 4-hour TRON (TRX/USDT) chart on Binance shaped a bearish rising wedge sample.

A bearish rising wedge seems when price strikes between two converging upward-sloping trendlines. It typically indicators weakening momentum and a possible draw back reversal. On this chart, the construction developed after a robust rally, adopted by narrowing upward strikes.

TRX is now buying and selling at $0.2683. If this sample confirms with a clear breakdown beneath the decrease trendline, the price may drop roughly 12%, concentrating on the $0.2356 stage. The projected goal is marked on the chart with a downward arrow.

The price has already damaged beneath the 50-period Exponential Transferring Common (EMA), which presently sits at $0.2710. This breakdown provides additional stress. Quantity reveals no main spike but, however continuation may speed up if sellers acquire management.

In brief, if the bearish wedge confirms, TRX dangers a transfer towards $0.2356 within the quick time period.

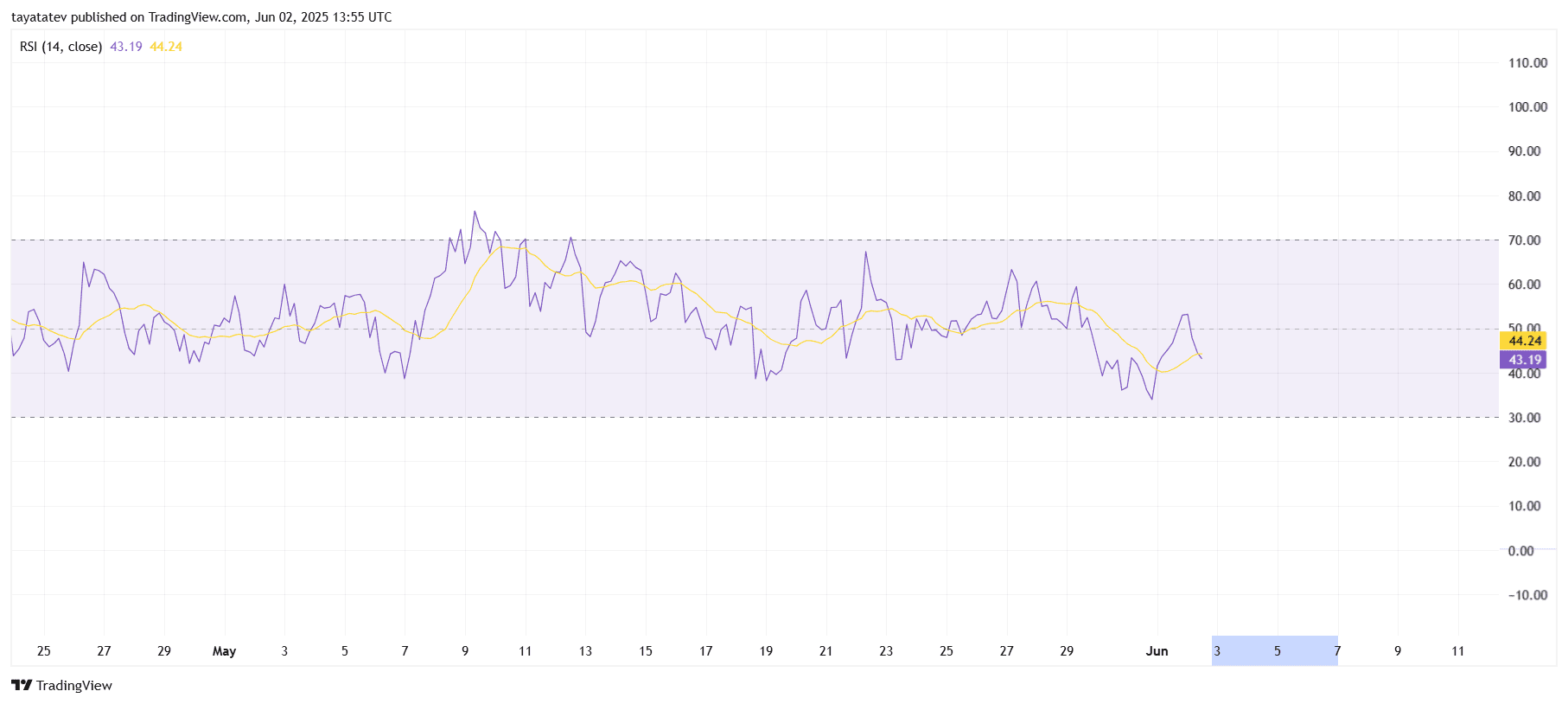

TRON RSI Dips Under Midline, Bearish Strain Builds

As of June 2, 2025, the 4-hour RSI for TRON (TRX) sits at 43.19, with its transferring common at 44.24. This locations the RSI beneath the impartial 50 mark, signaling rising bearish momentum.

The RSI has trended sideways all through Could however constantly did not reclaim robust bullish territory above 60. Every rally try confronted resistance, whereas the latest rejection close to 50 reinforces the present weak spot.

Because the RSI stays within the decrease half of the channel and stays underneath its transferring common, TRX might proceed going through downward stress until bulls regain power. If the RSI drops nearer to 30, it may point out oversold situations.

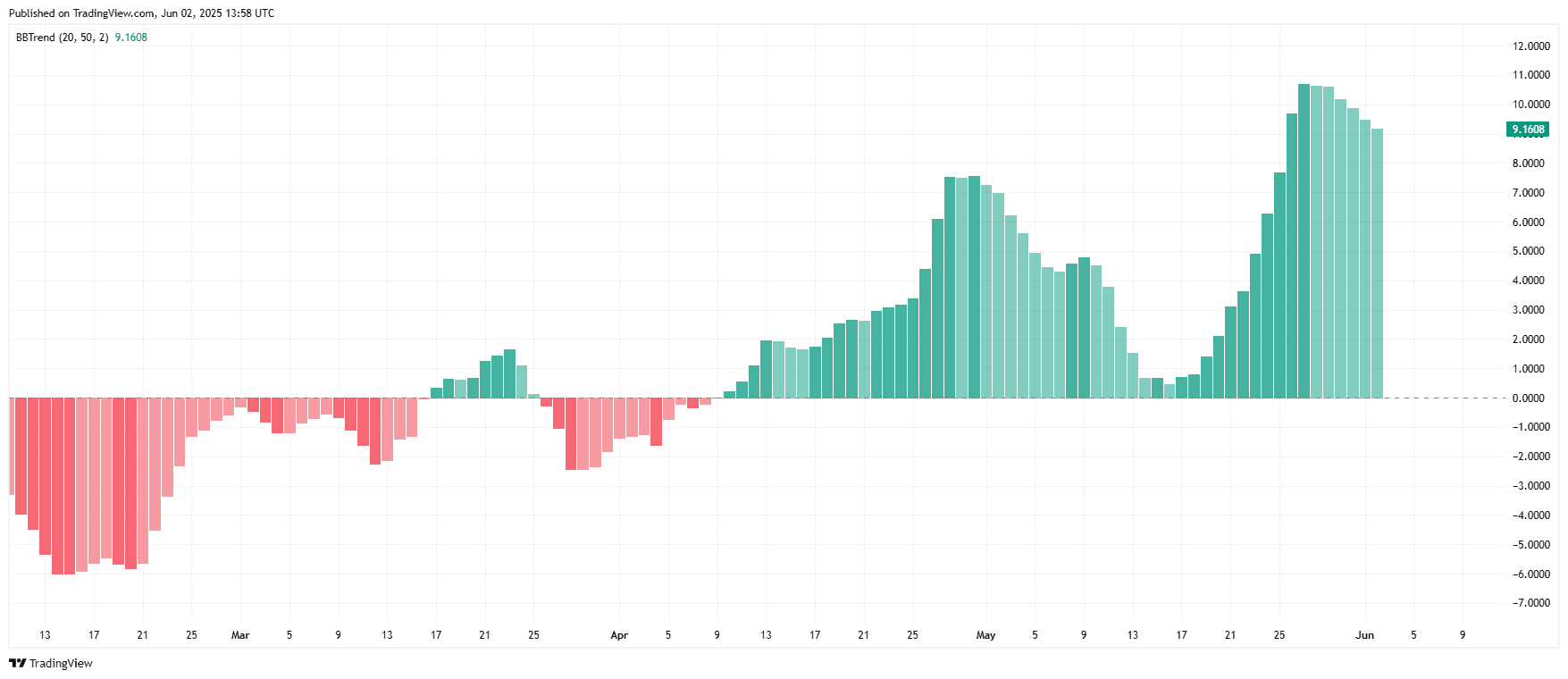

TRON BBTrend Alerts Sturdy Bullish Momentum

As of June 2, 2025, the BBTrend indicator for TRON (TRX/USDT) reads 9.16, displaying robust bullish momentum. The indicator has stayed above the zero line since mid-Could and has continued climbing, reflecting sustained upward stress.

The latest uptrend started round Could 23. The BBTrend bars grew sharply, peaking close to 11 earlier than barely pulling again. Regardless of this minor drop, the bars stay tall and inexperienced, confirming that bulls are nonetheless in management.

Earlier than this rally, the indicator had dipped beneath zero in early Could however reversed path rapidly. The present construction suggests a wholesome uptrend. Nevertheless, if the bars shrink additional or flip pink, that will be an early signal of weakening momentum.