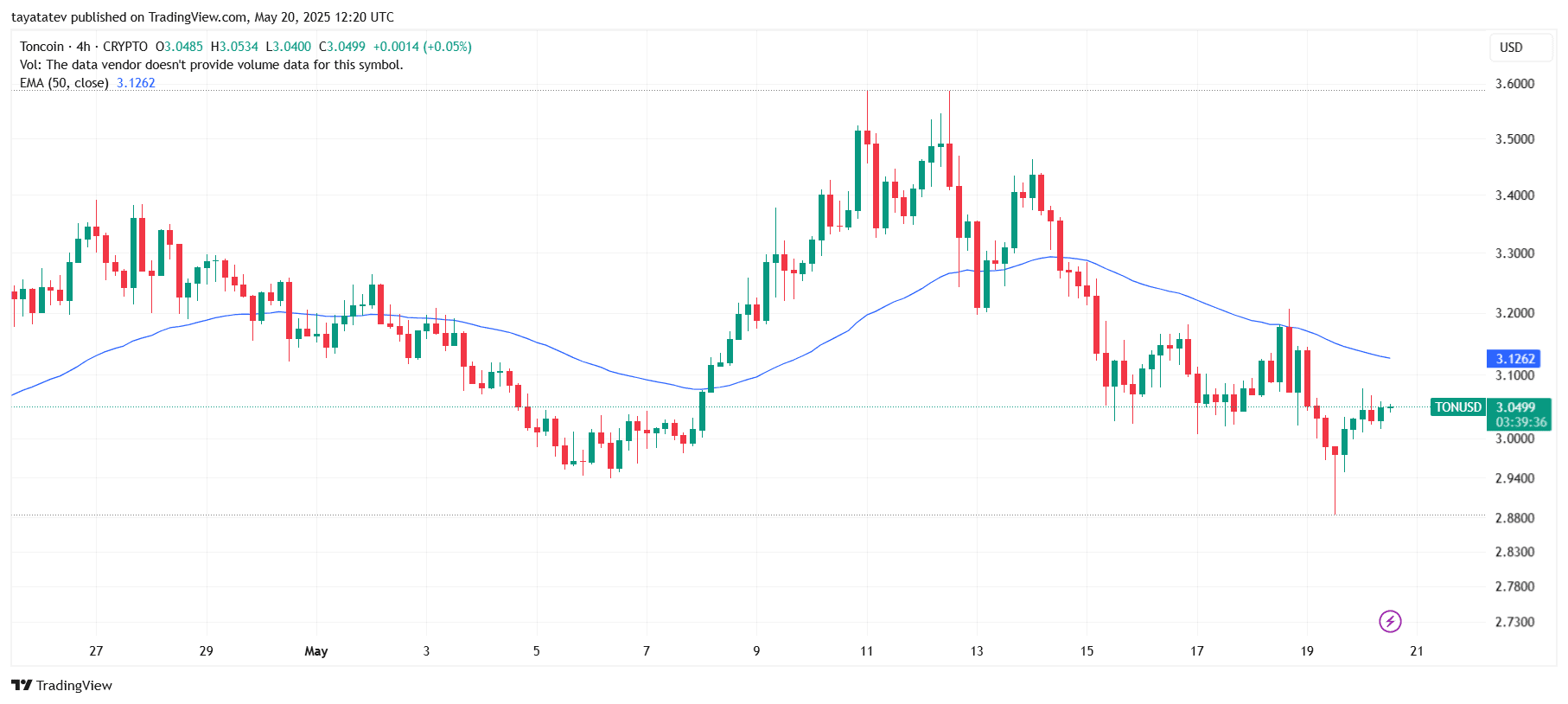

On Might 20, 2025, the 4-hour chart of TON Coin (TONUSD) shows the formation of a falling wedge sample. A falling wedge is a bullish reversal construction the place the price strikes between two downward-sloping, converging trendlines, typically indicating weakening promoting strain.

If the sample confirms, the price might surge roughly 19% from the present stage, concentrating on the $3.6278 resistance zone.

In the meantime, the 50-period Exponential Transferring Common (EMA) stands at $3.1287, appearing as near-term dynamic resistance. TON Coin has examined this EMA a number of occasions through the wedge formation however has but to interrupt above it.

On the similar time, the Relative Power Index (RSI), a momentum indicator, reads 44.67 and stays near the impartial 50 line. This implies that bearish momentum is fading, which frequently precedes an upward transfer.

As well as, the narrowing construction reveals declining volatility, a traditional signal {that a} breakout could also be nearing. If TON closes above the wedge’s higher purple trendline with sturdy momentum, it might verify the reversal and set off the projected rally towards $3.6278.

On Might 13, 2025, Telegram shut down two main Chinese language-language digital black markets—Huione Assure (also referred to as Haowang Assure) and Xinbi Assure—citing violations of its phrases of service associated to scamming and cash laundering. These platforms had collectively facilitated over $35 billion in transactions since 2021, considerably surpassing notorious darkish internet markets like Silk Highway.

Following Telegram’s motion, Huione Assure introduced its closure, stating that every one its Telegram channels and teams had been blocked. The crackdown was prompted by investigative findings from blockchain research agency Elliptic and inquiries from media retailers. Elliptic’s experiences highlighted the large quantity of illicit transactions happening on these platforms, which supplied providers reminiscent of cash laundering, stolen information gross sales, and instruments for on-line fraud.

Within the aftermath, Toncoin (TON), the native cryptocurrency of the TON blockchain carefully related to Telegram, skilled a rebound. After a pointy decline that started on Might 14, TON bounced off the $3.00–$3.05 demand zone, confirming sturdy purchaser curiosity at that stage.

The 4-hour chart reveals TON buying and selling at $3.0499 as of Might 20, 2025. It continues to carry above the important thing assist zone whereas trying to get well inside a rising channel. The price now faces instant resistance on the 50-period Exponential Transferring Common (EMA), which sits at $3.1262.

If consumers handle to push the price above this EMA, the subsequent short-term goal might be the $3.25–$3.35 vary. The latest restoration follows Telegram’s transfer to close down two main digital black markets, which can have helped stabilize sentiment throughout the TON ecosystem.

This sequence of occasions underscores Telegram’s dedication to imposing its phrases of service and the potential impression such actions can have on related digital property like Toncoin.

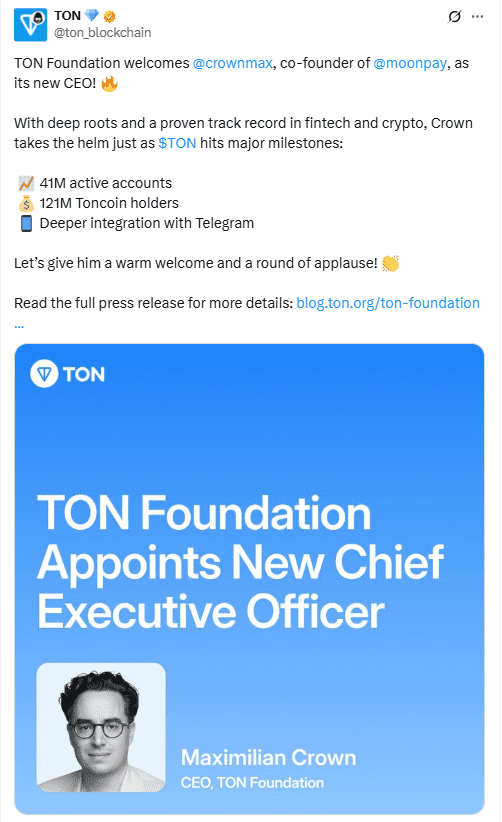

TON Basis Names MoonPay Co-Founder Maximilian Crown as New CEO

Earlier than that the TON Basis has appointed Maximilian Crown, co-founder of crypto funds firm MoonPay, as its new Chief Government Officer. The transfer follows a latest inner restructuring.

Crown joins TON as the inspiration goals to scale blockchain adoption by tapping into Telegram’s huge person base. His background in fintech and crypto funds positions him to guide this subsequent part of progress.

Simply weeks earlier than the announcement, TON secured a $400 million funding spherical from world enterprise capital corporations. This funding units the stage for extra aggressive enlargement and institutional partnerships.

With Crown now main the inspiration, TON plans to extend its deal with ecosystem integration. The muse stated he’ll oversee efforts to onboard 30% of Telegram’s lively customers to the TON blockchain by 2028.