Picture supply: Getty Pictures

The market’s been punishing any development inventory that fails to reside up to excessive expectations. One new inventory in my portfolio — Duolingo (NASDAQ: DUOL) — fell sufferer to this, slumping 33% since mid-February.

Right here’s why I’ve used this dip to purchase extra shares.

Market chief

Duolingo ended 2024 with 116m month-to-month energetic customers, making it the world’s main language studying app. It provides programs in additional than 40 languages, starting from English and Spanish to fictional ones like Excessive Valyrian from Sport of Thrones.

On St David’s Day (1 March), Prince William delivered his first full message in Welsh. Seems even the Prince of Wales has been utilizing Duolingo to enhance his language abilities!

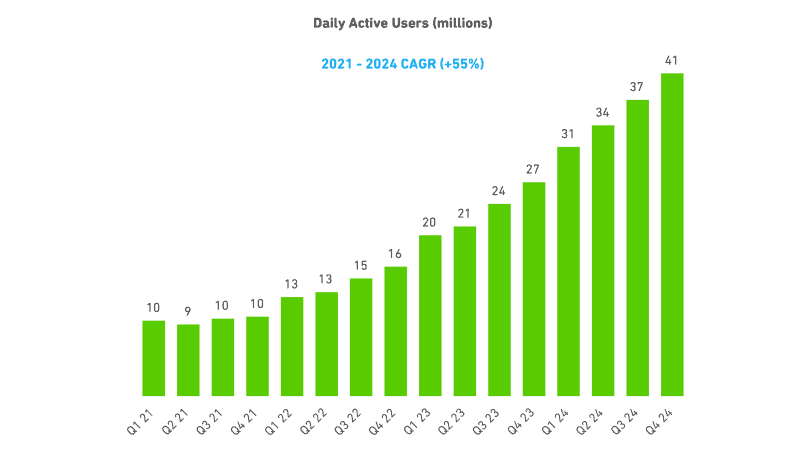

Final yr, the agency’s income surged 41% to $748m, with the adjusted EBITDA margin reaching a file 25.7% ($192m). In This autumn, every day energetic customers rocketed 51% to 40.5m, whereas paid subscribers jumped 43% to 9.5m.

Prioritising AI over profitability

These are wholesome numbers. So why has the inventory bombed? Effectively, the corporate beat Wall Avenue’s estimates for income, however This autumn earnings per share (EPS) got here up quick ($0.28 quite than $0.50).

One other difficulty will be discovered within the quote beneath:

Whereas we anticipate to proceed rising margins this yr, we are going to accomplish that at a extra measured tempo because of the investments we’re making into AI and the variable prices related to Video Name. We see an incredible development alternative forward.

CEO Luis von Ahn

Mainly, administration’s warning that strategic investments in synthetic intelligence (AI) will weigh on profitability in 2025. The video name function permits customers to have real-time, AI-powered conversations of their chosen language with Lily, one of many app’s characters. This interactive software is unique to Duolingo Max, the premium subscription tier.

My view

To be frank, I don’t actually care about revenue optimisation this yr. As a shareholder, I need administration to spend money on cutting-edge AI options that increase consumer acquisition, engagement and enhance subscriber conversion. This could finally strengthen the platform’s aggressive positioning and long-term monetisation potential.

AI and automation instruments have pushed at the least a tenfold enhance within the firm’s content material technology capability over the previous two years. As soon as programs are developed, including new customers incurs minimal further prices. In different phrases, Duolingo’s platform is very scalable, with actual money machine potential.

I not too long ago upgraded to Duolingo Max. The video name function preserves context from prior conversations in Spanish. If I point out a interest, say, Lily could deliver it up later, making interactions extra personalised and interesting.

It’s one of the crucial highly effective client purposes of generative AI I’ve skilled. But simply 5% of Duolingo’s learners use it up to now.

$1bn in bookings

Now, this funding isn’t with out threat. A spike in inflation might trigger shoppers to downgrade their paid subscriptions to Duolingo’s free providing. And inflation would possibly negatively impression worldwide journey, and subsequently the motivation to study a brand new language.

Additionally, primarily based on 2025 forecasts, the inventory’s buying and selling at an enterprise value-to-sales a number of of 12.7. That’s not low cost.

Nevertheless, Duolingo’s on monitor to surpass $1bn in bookings this yr. Income is projected to hit $1.8bn in 2028 — roughly 140% larger than final yr. I feel the inventory’s value contemplating.