Mid grownup man utilizing a wise telephone to watch his cryptocurrency and inventory buying and selling. He’s in his small jewelry workshop.

I had some spare money in my Self-Invested Pension (SIPP) final month after receiving some juicy tax aid from the federal government. Right here’s what I made a decision to take a position it in.

HANetf Way forward for Defence ETF

Defence shares have risen sharply in recent times as geopolitical threats have elevated. But shopping for particular person shares like BAE Techniques and Rolls-Royce comes with greater danger than a basket of shares with an exchange-traded fund (ETF).

,For this reason I plumped for HANetf Way forward for Defence ETF (LSE: NATP) this month, which has risen 56.3% prior to now 12 months and has additional to run, in my view. In its personal phrases, the fund — established in 2023 — “supplies publicity to the businesses producing income from NATO and NATO+ ally defence and cyber defence spending“.

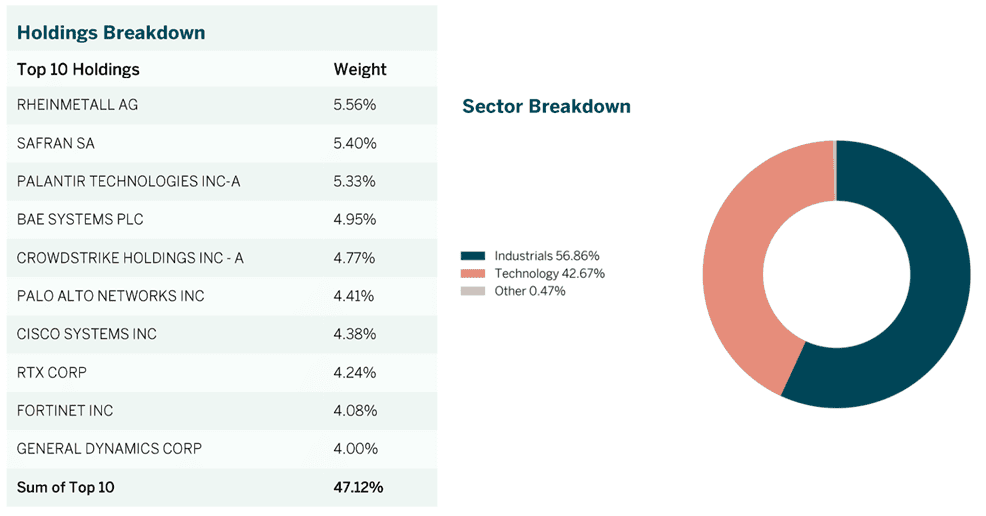

In complete, the fund holds shares in 60 completely different corporations. And in contrast to many defence ETFs, it supplies vital publicity to cybersecurity corporations (comparable to Palo Alto and CrowdStrike) alongside pure-play defence corporations (comparable to Rheinmetall and BAE). This supplies added diversification and development potential:

In response to Stockholm Worldwide Peace Analysis Institute (SIPRI) information, international defence spending leapt 9.4% in 2024. This was the steepest annual climb since 1988 — pushed largely by heavy rearmament in Europe — and meant complete navy spending rose 37% over a 10-year horizon.

Spending throughout broader European NATO members is tipped to proceed rising sharply too, in anticipation of decreased US navy help. This month, all NATO members (excluding Spain) rolled out plans to spend 5% of their home GDPs in defence by way of to 2035, primarily reflecting considerations over overseas coverage threats from Russia and China.

Whereas this HANetf permits me to unfold danger, it nonetheless leaves me uncovered to sector risks that might depress its efficiency. Indicators that NATO nations are struggling to fulfil their spending commitments might affect returns.

However on steadiness, I’m anticipating it to proceed delivering robust returns.

HSBC

HSBC (LSE:HSBA) has additionally loved wholesome share price good points of late, up 27.4% over the past 12 months. Regardless of financial troubles in its key Chinese language market, the financial institution’s guess on high-growth Asian markets — and on non-interest revenue segments like wealth administration — proceed to repay handsomely.

But at present, the FTSE 100 financial institution nonetheless provides glorious worth for cash, prompting me so as to add it to my SIPP. It trades on a ahead price-to-earnings (P/E) ratio of 9.1 instances, whereas its corresponding dividend yield is a gigantic 5.9%.

HSBC nonetheless instructions a low valuation given the dangers of US-Chinese language commerce wars on its earnings. It additionally displays the potential affect of falling rates of interest on its margins.

Nonetheless, I believe the potential advantages of proudly owning HSBC shares outweigh these dangers. The financial institution has the dimensions to successfully capitalise on booming inhabitants and wealth development in Asia, and is promoting low-growth Western belongings to higher concentrate on these rising markets. It’s additionally aiming to slash $1.5bn from its value base by the tip of 2026 to spice up profitability.

I additionally like HSBC due to its deep steadiness sheet. A CET1 capital ratio of 14.7% supplies it with substantial monetary energy to take a position for development whereas nonetheless returning capital to shareholders by way of massive dividends and share buybacks.