Picture supply: Getty Pictures

Subsequent week, I’ll be reminded as soon as extra why I maintain Persimmon (LSE:PSN) shares. That’s as a result of, on 19 June, the inventory will go ex-dividend. These with a place earlier than this date will probably be entitled to obtain the housebuilder’s last 2024 payout on 11 July.

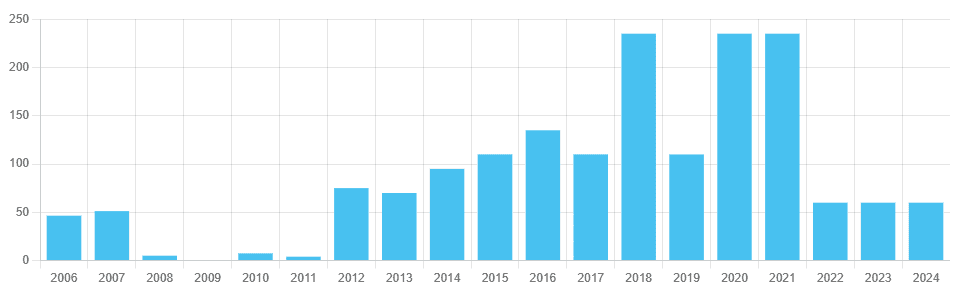

Added to the interim quantity of 20p, it means the overall dividend for the 12 months will probably be 60p, giving a present (13 June) yield of 4.3%. Though above the FTSE 100 common of three.5%, it’s low by historic requirements.

Like all these uncovered to the property market, the housebuilder’s had a troublesome few years. The pandemic compelled constructing websites to shut and the post-Covid rise in rates of interest choked off demand for brand spanking new properties. In 2025, it’s anticipating to construct 11,000-11,500 models. The 2020-2024 common was 12,716.

Understandably, to protect money, Persimmon minimize its dividend. It’s been maintained at 60p for the previous three years.

Wanting forward

However because the desk beneath exhibits, analysts expect the place to enhance by means of till 2027.

| 12 months | Dividend per share | Dividend progress | Dividend yield |

|---|---|---|---|

| 2025 | 62.01p | 3.4% | 4.4% |

| 2026 | 67.17p | 8.3% | 4.8% |

| 2027 | 73.19p | 9.0% | 5.2% |

The ‘experts’ are predicting modest progress this 12 months however a extra spectacular improve thereafter. The prediction is for a dividend of 73.19p by 2027. That might be a 22% enchancment on the 2024 payout. Nevertheless it’s a great distance wanting earlier highs. In 2018, 2020 and 2021, the group returned 235p a share.

Nonetheless, I believe the housebuilder will probably be extra beneficiant than this. From 2020-2024, its diluted earnings per share was 885.8p. And it paid dividends of 720p, which means it returned 81% of revenue to shareholders.

The analysts are forecasting a much less beneficiant dividend than this. Their predictions are for payout ratios of 66% (2025), 60.7% (2026) and 56.5% (2027).

If these have been elevated to 81%, the 2027 payout can be 104.9p — a 75% enchancment on the 2024 dividend — and the inventory’s yield can be 7.5%.

A phrase of warning

After all, relating to payouts, there are by no means any ensures.

And these forecasts might show to be inaccurate. I believe the inexperienced shoots of a restoration are beginning to present within the housing market however a sustained pick-up isn’t sure.

Rates of interest might keep increased for longer and the UK financial system stays fragile. The federal government’s emphasis on planning reforms will assist in the medium time period however the disposable incomes of consumers would be the greatest determinant of Persimmon’s earnings within the brief run.

However optimism surrounding the sector has pushed the group’s share price increased over the previous few weeks. Since 9 April, it’s risen almost 30%.

My view

Nonetheless, no matter stage of revenue it makes over the following three years, I’m assured it would return extra to shareholders than analysts expect.

That’s as a result of the corporate has no debt on its steadiness sheet. Additionally, because it owns over 83,000 plots of land, there’s no want to search out numerous extra money (over and above regular ranges of capital expenditure) to purchase extra websites.

Whereas I believe it could be some time earlier than the corporate pays a dividend of 235p a share once more, I’m moderately assured that it’s going to improve its payout this 12 months. And if the housing market recovers as I count on, it needs to be able to boost it considerably thereafter. That’s why, on steadiness, I believe it’s a inventory that traders may contemplate proper now.