Picture supply: Getty Pictures

Dr Martens (LSE:DOCS), the FTSE 250 trend bootmaker, has endured a torrid time since making its inventory market debut in early 2021. After (it’s laborious to maintain up) 5 revenue warnings, the group’s shares are actually price 87% much less.

However since issuing its third quarter buying and selling replace in January, there have solely been 12 information releases to the market. Eleven of those have been in regards to the variety of shares in challenge and inventory choices. The opposite involved the appointment of two non-executive administrators. In any other case, it’s been very quiet.

Is that this a case of ‘no news is good news’? Or ought to shareholders stay anxious?

Let’s have a look.

Openness and transparency

The very first thing to notice is that inventory market guidelines require any data that’s seemingly for use by a “reasonable investor” as a part of their funding determination – and will have a non-trivial affect on an organization’s share price — to be disclosed.

Primarily based on the Monetary Conduct Authority’s steerage about what data corporations have to share with buyers, I believe we are able to assume that the absence of knowledge means nothing’s modified because the firm’s most up-to-date replace.

And this reported that buying and selling was consistent with expectations. What does this imply?

In April 2024, the corporate issued steerage on its anticipated efficiency for the 12 months ended 31 March (FY25). It warned: “We could see a worst-case scenario of PBT (profit before tax) of around one-third of the FY24 level”.

Nonetheless, it additionally mentioned there are “scenarios where the profit outturn could be significantly better than this”.

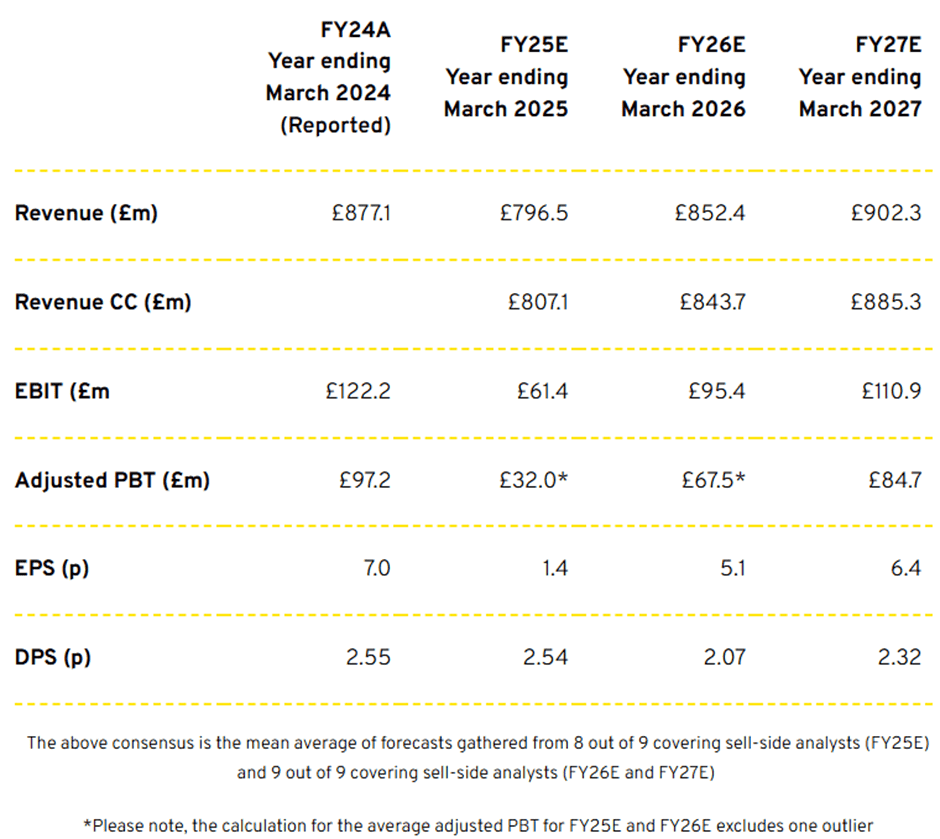

It’s laborious to know what to anticipate. Primarily based on their newest forecasts, analysts seem to agree with probably the most pessimistic evaluation. The consensus is for adjusted PBT of £32m, which is sort of precisely one-third of final 12 months’s determine.

An unsure outlook

When the corporate releases its FY25 outcomes on 5 June, I’m wondering if the share price would possibly react like that of JD Sports activities Trend? On 9 April, it launched outcomes which had been consistent with expectations. Since then, its shares have elevated 44%. It’s nearly as if buyers had been in search of affirmation that all the things’s okay.

And if Dr Martens may beat analysts’ predictions, who is aware of what would possibly occur to the share price. However…

That’s why it’s essential to take a long-term view. It’s unattainable to foretell actions from one month to the following.

However wanting additional forward, we don’t know what President Trump’s going to do with tariffs. And North America’s a key marketplace for the group. Throughout FY24, 37.1% of income got here from the Americas. Nonetheless, the bootmaker doesn’t have any manufacturing amenities within the territory. It’s subsequently susceptible to further import taxes.

The group additionally sees the area as a key driver of its future revenue. A US financial slowdown may have an effect on earnings.

To try to compensate for post-pandemic price rises, the group’s carried out a number of price rises in recent times. There are actually loads of cheaper alternate options out there which may additionally have an effect on earnings.

For me, there’s an excessive amount of uncertainty round to half with my money. Nonetheless, I believe the corporate retains a robust model with a loyal following. Its shares are additionally low-cost by historic requirements.

If it does flip issues round, there will likely be loads to shout about.