Picture supply: Getty Pictures

The FTSE 100 is the primary enviornment for traders who’re looking for to make an above-average passive earnings. The likes of Lloyds, Shell, Authorized & Basic, and Taylor Wimpey are among the many London inventory market’s best-loved dividend shares.

Many Footsie corporations have qualities that make superb dividend candidates. These embody market-leading positions in mature industries, broad geographic footprints, and rock-solid stability sheets.

That is all nice, however at present I’m not occupied with speaking about FTSE 100 dividend heroes.

I believe there could also be higher UK shares to purchase for dividends proper now.

Small speak

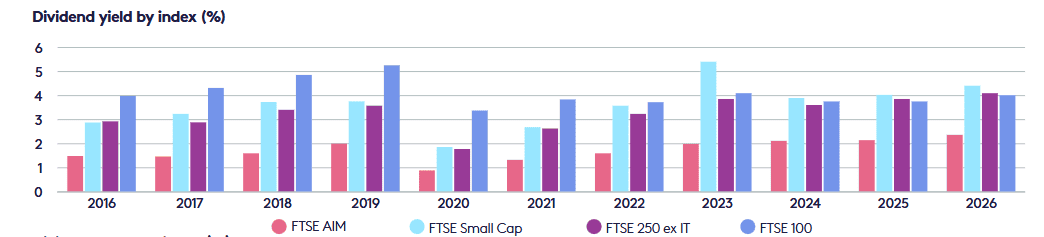

A recent report from Octopus Investments has caught my eye this week. It exhibits that the potential dividend yields on the FTSE 250 (when excluding IT shares) and the FTSE Small Cap index beat that on supply from the FTSE 100:

But, this yield superiority is nothing new. As you possibly can see, the dividend yield on small-cap shares has crushed that of the broader Footsie for the previous two years.

And dividends amongst FTSE Small Cap corporations are tipped to develop strongly between 2025 and 2026, leading to yields of 4.03% and 4.41% respectively.

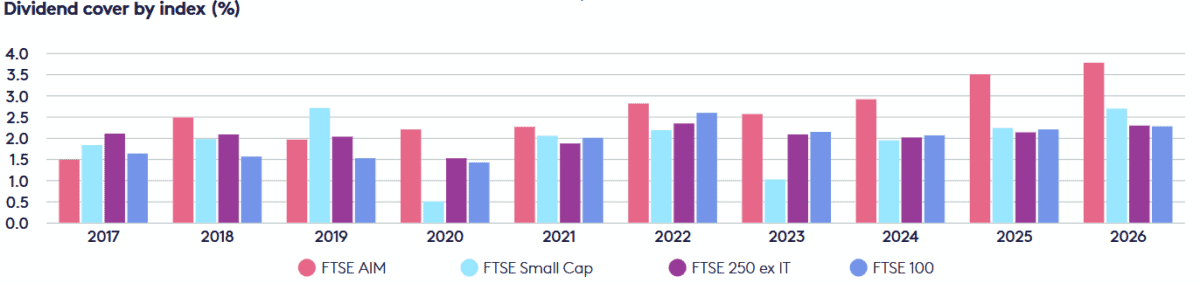

In fact yields are primarily based on dealer projections that aren’t set in stone. Nonetheless, excessive dividend cowl for the following two years supplies payout estimates with loads of metal.

The truth is, as you possibly can see, dividend protection for the FTSE Small Cap, FTSE 250 (ex IT), and FTSE Different Funding Market (AIM) indexes additionally surpass that of the FTSE 100:

These superior yields and dividend protection replicate expectations that earnings outdoors the FTSE 100 are about to take off. In response to Octopus Investments: “both the FTSE AIM index and the Deutsche Numis Smaller Companies Index are expected to deliver 22% compounded annual earnings growth for the two years to December 2026.”

Three high dividend shares

I personal a number of Footsie shares in my very own portfolio for passive earnings. However Octopus’ research exhibits it may possibly additionally pay to contemplate dividend shares from outdoors the FTSE.

Radiator producer Stelrad — with its ahead yield of 5.9% and powerful dividend cowl of two occasions — is one small cap I’m taking a look at. I’m additionally contemplating pawnbroker Ramsdens — the dividend yield and dividend cowl listed here are 5.1% and a pair of.3 occasions, respectively.

However Social Housing REIT (LSE:SOHO) is on the high of my purchasing record at present. The dividend yield right here for 2025 is 9.2%.

Please be aware that tax therapy is determined by the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is supplied for info functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation.

Dividend cowl is way much less spectacular, at 1.3 occasions. In principle, this might see the corporate undershoot dividend forecasts if earnings disappoint.

Nonetheless, Social Housing’s deal with the steady residential property market vastly reduces (if not completely eliminating) this menace. What’s extra, tenants typically obtain monetary assist from central and native governments, offering lease assortment with added robustness.

Below actual property funding belief guidelines (REIT), no less than 90% of the agency’s annual rental earnings have to be paid out in dividends. With its robust progress potential, I’m assured eye-catching dividends at Social Housing will proceed to climb.