Picture supply: Getty Photos

Dividends could make up a major a part of the overall return of some shares over the course of time. In the mean time, the typical FTSE 100 dividend yield is round 3.5%.

Some FTSE 100 shares provide larger yields. Vodafone, for instance, yields 10.3%. But it surely has introduced a halving of the dividend, on high of a swingeing lower simply 5 years in the past.

Against this, some shares within the index have raised their dividend per share yearly for many years. They’re what are referred to as Dividend Aristocrats.

However common dividend rises – that are by no means assured to proceed – can even assist push up share costs. So Dividend Aristocrats might provide decrease yields than another shares.

Diageo

Let’s begin with one Dividend Aristocrat I’ve added to my portfolio over the summer season: Diageo (LSE: DGE).

The drinks firm owns manufacturers from Guinness to Johnnie Walker. Making and promoting premium alcohol is a profitable enterprise: final yr, the corporate managed to generate $4.2bn of post-tax income on revenues of $27.9bn.

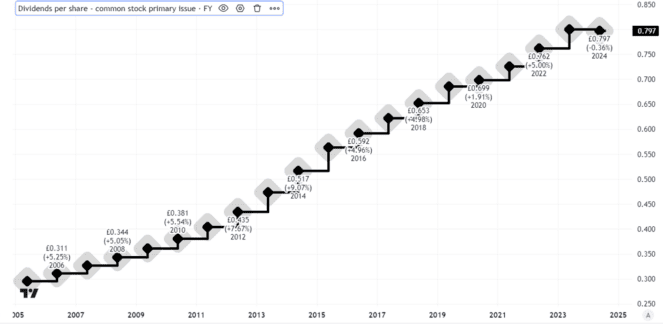

That has helped the corporate increase its dividend yearly for over three a long time, most not too long ago by 5%.

Created utilizing TradingView

The present yield is 3.3%, not far shy of the FTSE 100 common. On high of that, after a 29% share price decline over the previous 5 years, I feel Diageo now gives me respectable worth.

Sure, there are dangers that assist clarify that slide. Weaker gross sales in Latin America may very well be an early warning of declining demand for premium merchandise globally in a weak financial system.

As a long-term investor, nonetheless, I just like the outlook right here in addition to the continuing dividend potential.

Spirax

Whereas Diageo’s manufacturers are well-known, the corporate itself just isn’t a family title.

That’s even more true of one other FTSE 100 Dividend Aristocrat, Spirax (LSE: SPX). As a enterprise focussed on industrial prospects and working with numerous totally different models, Spirax lacks widespread model recognition, together with with some buyers.

However its rise has not gone unnoticed within the Metropolis and certainly, ongoing success is what propelled it into the FTSE 100 in 2018.

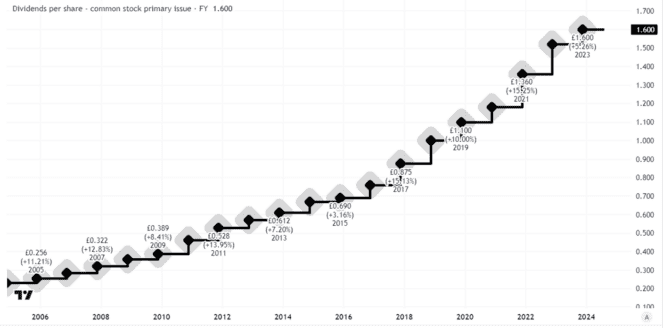

That was an extended journey: the engineering specialist had been listed on the London market because the late Fifties. it has grown its dividend yearly because the Nineteen Sixties. That is without doubt one of the most constant information throughout the London market.

Created utilizing TradingView

With its specialised know-how, established buyer base, and deal with essential features for companies, I just like the enterprise mannequin.

Dangers embody a slowdown in spending by shoppers in Asia. Certainly, working revenue final yr fell by 11%. However my predominant cause for not proudly owning the shares is valuation.

The shares have fallen 4% in 5 years, however nonetheless commerce on a price-to-earnings ratio of 30. That’s too excessive for me.

Nonetheless, Spirax might properly be on my procuring checklist if the share price falls significantly from right here. That may additionally push up the yield, which at its present 2.1% doesn’t excite me a lot.