Picture supply: Getty Photos

The Prudential (LSE: PRU) share price seems to be prone to proceed recovering after its full-year 2024 outcomes had been launched final evening (19 March).

The inventory has already made a spectacular 22% restoration this 12 months after falling 56% all through 2023 and 2024. Now, with income beating estimates for the primary time in years, I think it’ll proceed climbing.

Right here’s why I feel it’s a inventory value contemplating in 2025.

Full-year 2024 outcomes

Adjusted working revenue earlier than tax elevated 10% to $3,13m, with adjusted working revenue after tax up 7% to $2,58m.

Earnings per share (EPS) got here in at 89.7c, far surpassing estimates of 80c per share. Income adopted the same sample, at $6.42bn — smashing estimates of $3.98bn. The corporate’s income has been on a gradual decline for a number of years now, down from $44.67bn in 2018. That is the primary time since 2018 that income got here in forward of estimates.

Promisingly, a last dividend of 16.29c was introduced, elevating the full-year dividend by 12.99% to 23.13c per share. This equates to a 2% yield on price with a sustainable payout ratio of 64.9%.

As well as, it accomplished over $1m in share buybacks, progressing its $2bn program introduced in June 2024. The remaining buybacks are anticipated to be accomplished this 12 months.

Give attention to Asia

Prudential is a British multinational insurance coverage and asset administration firm, headquartered in London and Hong Kong that depends closely on the Chinese language market. Not too long ago, the agency has undergone a major restructuring, together with a demerger from UK and US operations. Now largely targeted on Asia and Africa, there’s a danger this technique might not repay.

Sluggish development within the area has been impacting its efficiency currently. Though it reported an 11% enhance in new-business revenue to $3bn, that is notably decrease than the 45% rise achieved in 2023.

In as we speak’s report, CEO Anil Wadhwani highlighted the numerous alternatives Asia has to supply. It’s a area with low insurance coverage penetration and a rising demand for long-term financial savings, wealth administration and retirement planning. But regardless of these prospects, when accounting for adjustments in rates of interest and alternate charges, new-business revenue truly declined by 2% in 2024.

Restrained development potential

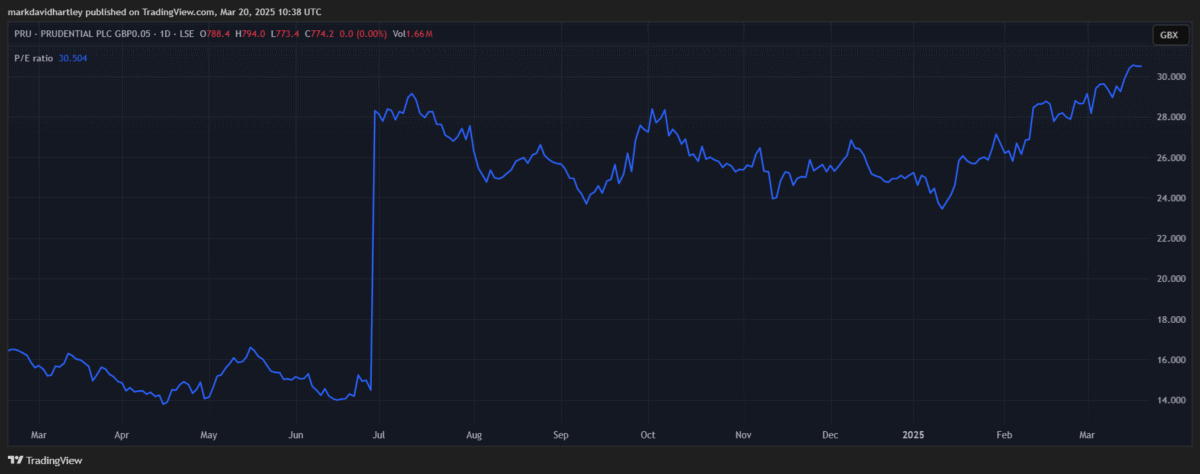

Everybody loves a rising price however with it comes the growing potential for a pullback. The inventory’s price-to-earnings (P/E) ratio has now surpassed 30 — nearly double the FTSE 100 common of 18. That would restrict the variety of new traders concerned with shopping for the inventory at such a excessive price. Even with earnings forecast to develop 23% within the coming 12 months, there’s no assure this can move on to the share price.

Any small hiccup might ship issues south.

General, the corporate seems to be working properly regardless of income subdued by development limitations in Asia. Analysts stay overwhelmingly optimistic concerning the inventory, with 12 out of 17 sustaining a Sturdy Purchase score. The common 12-month price goal is 1094p, a 41.3% rise from present ranges.

I feel the share price has a great likelihood of climbing between 20% and 25% this 12 months – notably because it edges ever nearer to its 52-week excessive. After as we speak’s outcomes, it’s firmly on my watchlist for 2025.