Though digital belongings have been round for over a decade, many buyers nonetheless discover the crypto market overwhelming. Nevertheless, opposite to in style perception, getting began with a first-time crypto funding is pretty easy.

This information explains how buyers can enterprise into the house of cryptocurrencies. We additionally share some helpful recommendations on how to get into cryptocurrency safely whereas minimizing the general dangers.

10 Prime Recommendations on The best way to Get Into Cryptocurrency in 2024

Listed below are some helpful tricks to comply with when making an attempt to get into the crypto house as a newbie:

- Discover low-cost, high-potential crypto tasks like Dogeverse

- Be taught in regards to the crypto market

- Develop a technique

- Be taught how to retailer cryptocurrency safely

- Select a crypto alternate or dealer

- Diversify your funding portfolio

- Make investments with a dollar-cost averaging technique

- Acquire publicity to cryptocurrency not directly

- Earn passive earnings with crypto staking

- Use leverage rigorously

For full learners, we’ve an intensive information on what cryptocurrency is, explaining how digital tokens work and the way they’re totally different from different belongings comparable to shares and commodities.

A Nearer Take a look at The best way to Get Began in Cryptocurrency

Beginning in cryptocurrency can appear daunting, however with the suitable strategy, you possibly can doubtlessly discover the following cryptocurrency to blow up and perceive how to get wealthy with crypto.

This part guides you thru the ten important steps for getting began in cryptocurrency: from figuring out promising low-cost crypto tasks and understanding market dynamics, to incomes via crypto staking and utilizing leverage properly.

1. Crypto Presales: Get Into the Crypto Market at a Low Entry Value

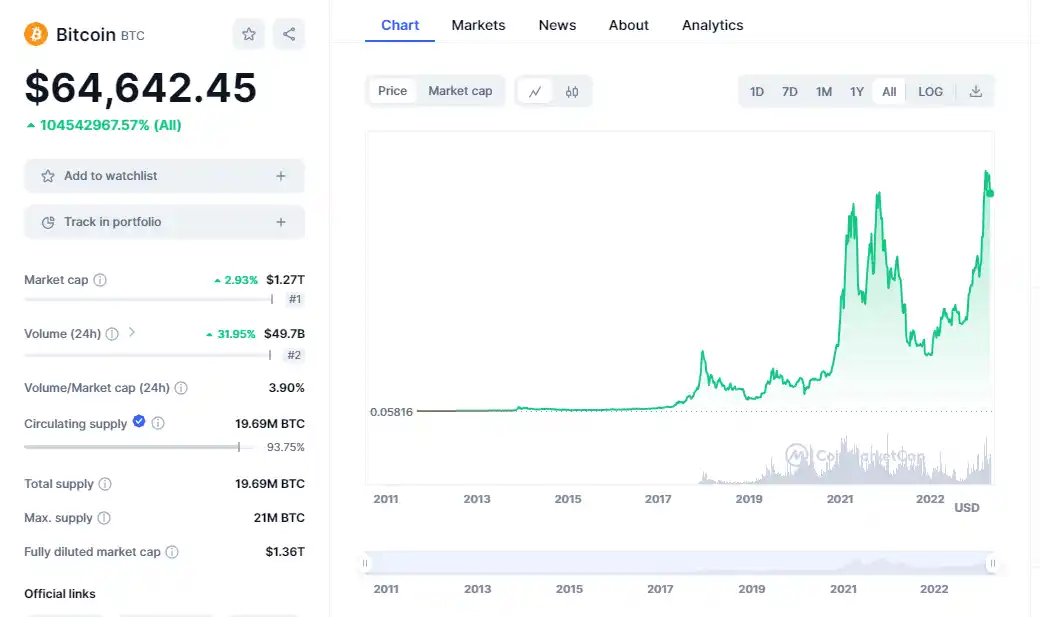

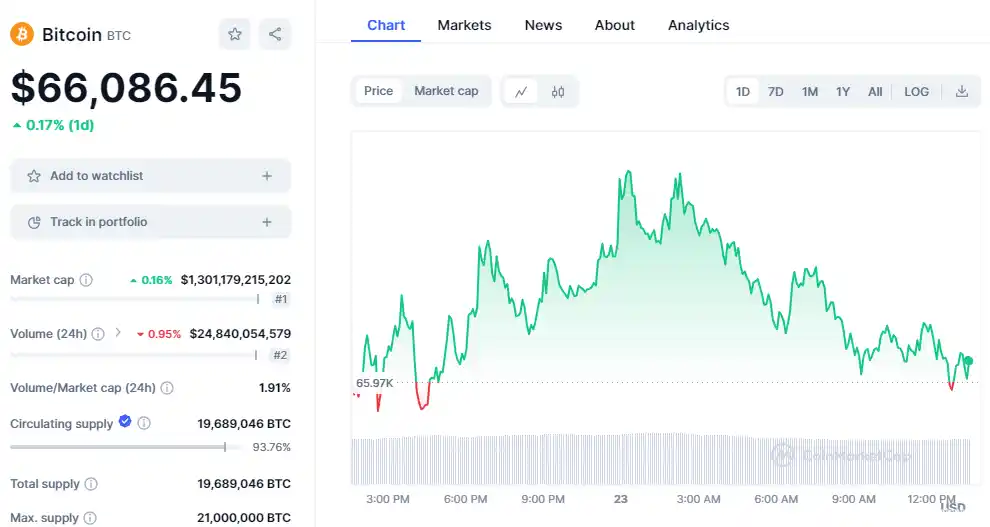

Buying cryptocurrencies throughout their presale stage permits buyers to enter the crypto market at a low value. Not like established cryptocurrencies like Bitcoin and Ethereum, which can appear costly with present costs round $60,000 and $3,000 respectively, presale cryptos supply a extra accessible entry level.

Crypto presales happen earlier than the tokens can be found on public exchanges and goal to boost funds for brand new crypto tasks. These early-stage investments enable buyers to purchase tokens at considerably decrease costs than their potential future market worth, offering excessive upside potential with out requiring giant investments.

For instance, Ethereum’s presale in 2014 priced tokens at simply $0.31 every. By 2021, the price had surged to over $4,900. Early buyers in profitable presales like Ethereum have seen substantial returns.

With this in thoughts, we’ve researched various upcoming crypto presales which have each likelihood of mirroring the success of Ethereum, dogwifhat, and different notable tasks. These presales could be a good way to get began within the crypto house with out risking giant quantities of cash.

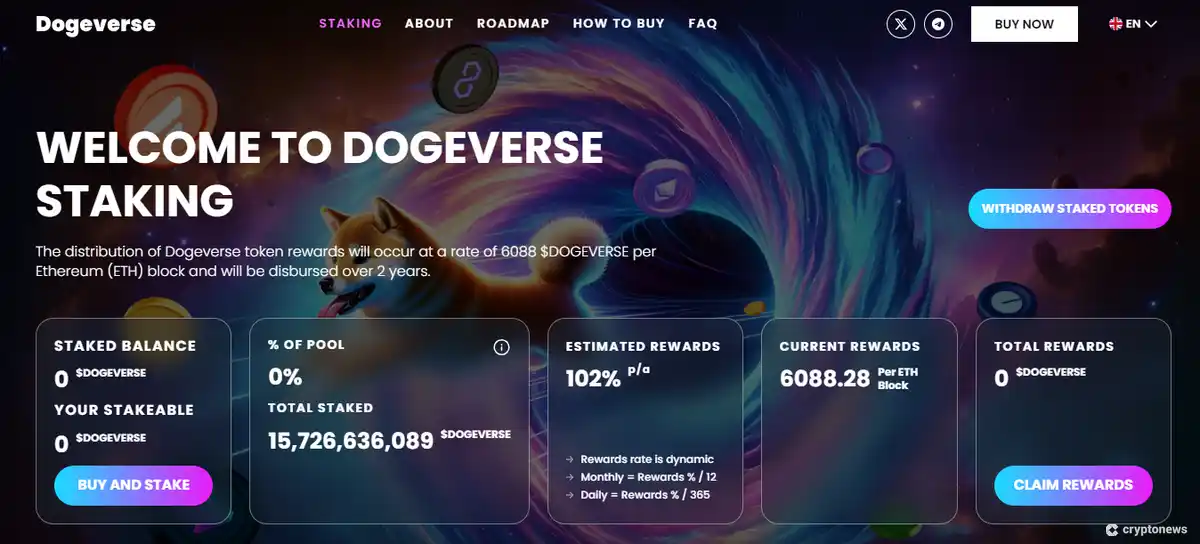

Dogeverse: The First-Ever Multichain Meme Coin

Dogeverse, an rising multichain meme coin, has rapidly captivated the crypto neighborhood by elevating $13 million up to now in its presale. Modeled after Shiba Inu, this token leverages its cross-chain capabilities, aiming to revolutionize meme coin functionalities throughout numerous blockchain ecosystems.

Constructed on a multichain community that features Ethereum, BNB Sensible Chain, Polygon, Avalanche, Base, and Solana, Dogeverse permits purchases via numerous cryptocurrencies, together with USDT. As well as, this multichain strategy avoids the energy-intensive Proof-of-Work consensus, aligning with extra sustainable blockchain operations.

With plans for CoinGecko and CoinMarketCap listings and subsequent DEX and CEX listings, Dogeverse is positioned for vital progress. The platform additionally affords staking choices on Ethereum, offering passive earnings alternatives to token holders.

Go to Dogeverse

Sponge V2: Meme Coin Providing a P2E Sport and Staking Rewards

Sponge V2, the sequel to the favored memecoin Sponge V1, has a powerful worth proposition and stable progress numbers up to now, making it probably the most in style crypto presales proper now.

Within the 2023 bear market, Sponge V1 registered a $100 million market cap, ensured presence in additional than ten centralized exchanges, and gathered 13,000+ holders. Sponge V2 has added much more to the proposition by introducing a play-to-earn (P2E) recreation.

Holders may also earn extra $SPONGEV2 by staking their tokens on the official web site. When it comes to tokenomics, Sponge V2 spends much less on advertising and extra on CEX liquidity.

Go to Sponge V2

Smog: Finest Various to a Crypto Presale, $100 Million Market Cap

Smog is a brand new meme token that has supplied enormous returns since its alternate itemizing. In February 2024, $SMOG was listed on the Jupiter decentralized alternate. The preliminary market cap was solely $2 million, which soared previous $100 million in simply a few days.

This cryptocurrency guarantees to conduct one of many largest crypto airdrops on the Solana blockchain. From a complete provide of 1.4 billion tokens, 490 million might be supplied as airdrops. Customers can signal up for the airdrop marketing campaign with Zealy and begin finishing duties and challenges to earn airdrop factors.

The $SMOG token may also be staked on the good contract to generate passive earnings. Greater than 10 million tokens have been locked on the good contract.

To advertise the venture, Smog is allocating 50% of the token provide for advertising functions. Smog might be eyeing new listings on tier-one exchanges. This may also help improve buying and selling quantity and supply additional progress within the long-term.

Go to Smog

2. Be taught Concerning the Crypto Market

Buyers ought to have a very good understanding of the crypto market. To get began, they need to familiarize themselves with the preferred cryptocurrency phrases.

When navigating the crypto house, buyers will come throughout many new phrases, comparable to HODL, crypto wallets, NFTs, meme cash, and exchanges, which could have a distinct that means elsewhere.

It’s additionally essential for buyers to have a transparent concept about cryptocurrency rules of their nation. Though cryptos are largely unregulated, some international locations have insurance policies that restrict the buying and selling of digital belongings, and every has distinct guidelines relating to crypto tax.

3. Develop a Technique

In relation to creating a technique to get in cryptocurrency, buyers can take two approaches:

Lengthy-Time period Investing

Lengthy-term crypto holding, typically referred to as “HODLing,” includes shopping for and holding cryptocurrencies with the expectation that their worth will improve through the years.

Buyers on this technique are much less involved with short-term fluctuations and extra centered on the potential substantial features sooner or later. These long-term investments are sometimes much less hectic than day buying and selling, since they don’t require fixed market monitoring.

Lengthy-term holders typically depend on basic analysis, evaluating the broader market tendencies and the technological potential of a cryptocurrency. This strategy is extra suited to those that favor a “set it and forget it” funding model, which could be notably interesting to learners.

Whereas long-term holding requires persistence, it may be extremely rewarding as cryptocurrencies have proven the potential for appreciable appreciation over time. Buyers can modify their long-term methods primarily based on their monetary targets and threat urge for food as they grow to be extra acquainted with the crypto market.

Quick-Time period Trading

Crypto day buying and selling includes speculating on short-term price actions to make income. Merchants open and shut positions rapidly, typically inside hours and even minutes, to capitalize on price fluctuations.

For instance, a dealer would possibly purchase Bitcoin anticipating its price to rise by day’s finish and promote it a couple of hours later for a small revenue. These income can accumulate from a number of trades.

Merchants use numerous methods, together with technical analysis and crypto instruments to information their buying and selling selections. Additionally they use derivatives like CFDs to revenue from each rising and falling costs. Not like long-term buyers, merchants deal with short-term crypto features somewhat than the long-term progress potential of the belongings.

Crypto buying and selling requires a very good understanding of market mechanisms and is much less fitted to full learners. As merchants acquire expertise, they will tailor their crypto day buying and selling methods to suit their threat tolerance and monetary targets.

4. Be taught The best way to Retailer Cryptocurrency Safely

Earlier than shopping for digital belongings, buyers and merchants ought to find out about how to retailer cryptocurrency safely. Tokens are saved in crypto wallets, which basically have two elements:

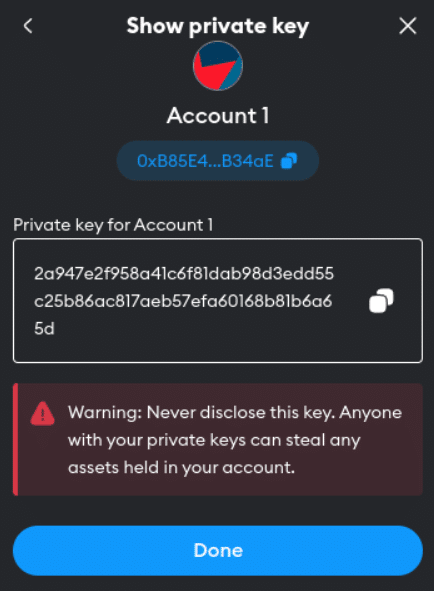

- The public key is used to create pockets addresses that may be considered by everybody. It’s product of numbers and letters and could be shared with others to obtain cryptocurrencies. Public keys are routinely created when setting up a crypto pockets.

- The non-public key, quite the opposite, just isn’t publicly viewable — it really works like a password. Buyers must have this non-public key to ship cryptocurrencies from their wallets.

As well as, new crypto wallets additionally generate a seed phrase through the preliminary setup. This seed phrase is used to get better the crypto within the pockets in case the password is misplaced. With out the restoration phrase, pockets customers received’t be capable of entry their tokens in the event that they lose the password.

That is why it’s at all times essential to preserve the non-public key of the pockets protected. Furthermore, the protection of the cryptocurrencies can even be decided by the kind of digital pockets chosen.

Software program wallets

Software program wallets come within the type of functions that may be downloaded to a tool, comparable to a laptop computer, pill, or cellphone. Any such pockets is available in each custodial and non-custodial varieties.

- Custodial wallets come built-in with exchanges or brokers like eToro and OKX. They provide comfort and consumer help however contain third-party management over your belongings, risking potential safety breaches.

- Non-custodial wallets offer you full management and enhanced safety however require extra consumer accountability for managing keys and safety.

{Hardware} Wallets

{Hardware} wallets are bodily gadgets that retailer cryptocurrency offline, offering excessive safety for long-term buyers who maintain belongings for months or years.

Nevertheless, they require bodily entry to the system for each transaction, which could be much less handy than software program wallets. For that motive, {hardware} wallets are perfect for these with a “buy and hold” technique, whereas energetic merchants would possibly favor the accessibility of software program wallets.

5. Select an Trade or Dealer

Choosing the proper platform is essential when shopping for cryptocurrencies. The most effective cryptocurrency exchanges present a mixture of safety, user-friendly interfaces, and a wide range of buying and selling choices. Examples embody:

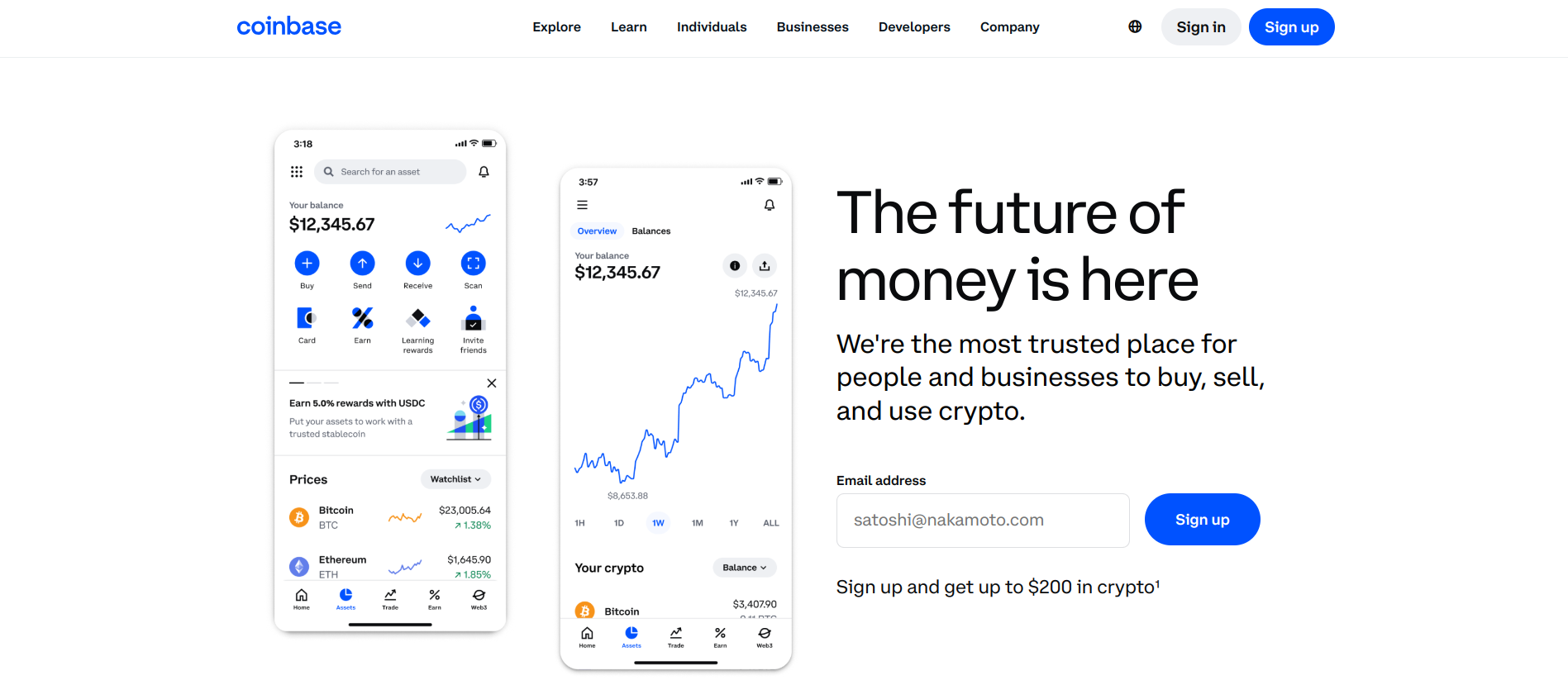

- Coinbase, recognized for its beginner-friendly interface and regulatory compliance

- Binance, favored for its versatile buying and selling choices and in depth coin choice

- MEXC, which fees no spot buying and selling charges and offers high-speed transactions

- Kraken, recognized for its professional-grade platform and superior buying and selling options

- Gate.io, which affords the most important collection of tokens in comparison with different CEXs

When selecting an alternate, take into account components comparable to transaction charges and the safety measures in place. Moreover, take into account the liquidity of the alternate, as greater liquidity signifies extra seamless transactions with out vital price modifications.

Lastly, make sure the alternate is compliant with monetary rules in your jurisdiction to safeguard your investments.

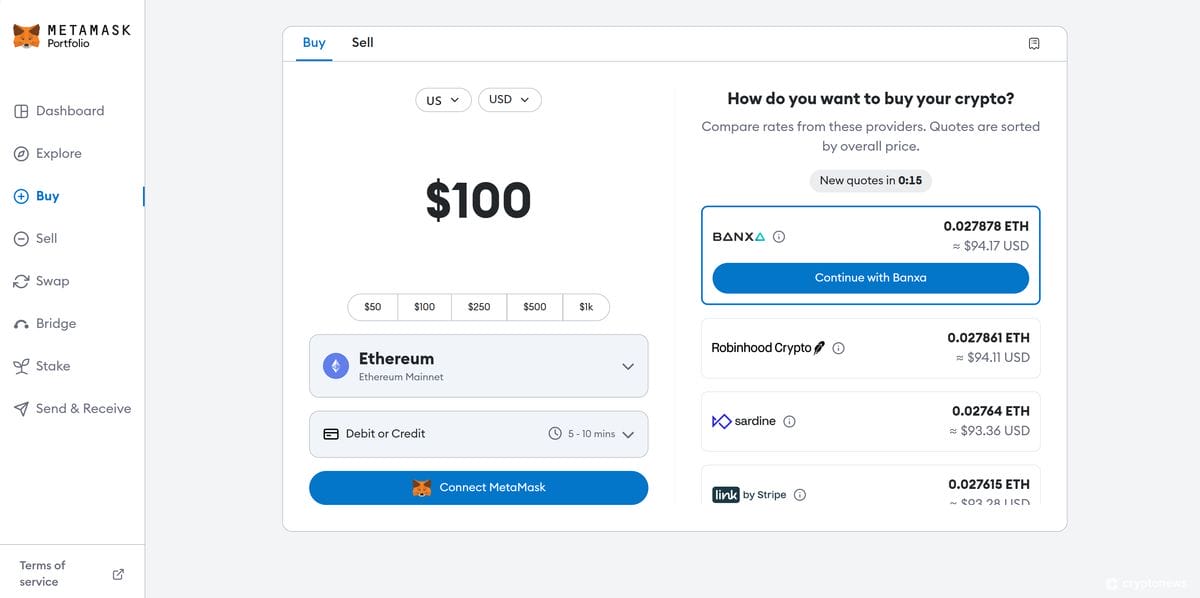

Along with exchanges, you would possibly think about using a cryptocurrency dealer, which acts as an middleman between you and the exchanges.

Not like exchanges the place you commerce straight with different market individuals, brokers supply a hard and fast price for cryptocurrencies, normally including a premium for his or her companies. This setup simplifies the shopping for course of however can come at a better value.

When selecting a dealer, search for transparency in pricing and status for reliability. Guarantee they’re regulated and supply buyer help to help with any inquiries or points it’s possible you’ll encounter.

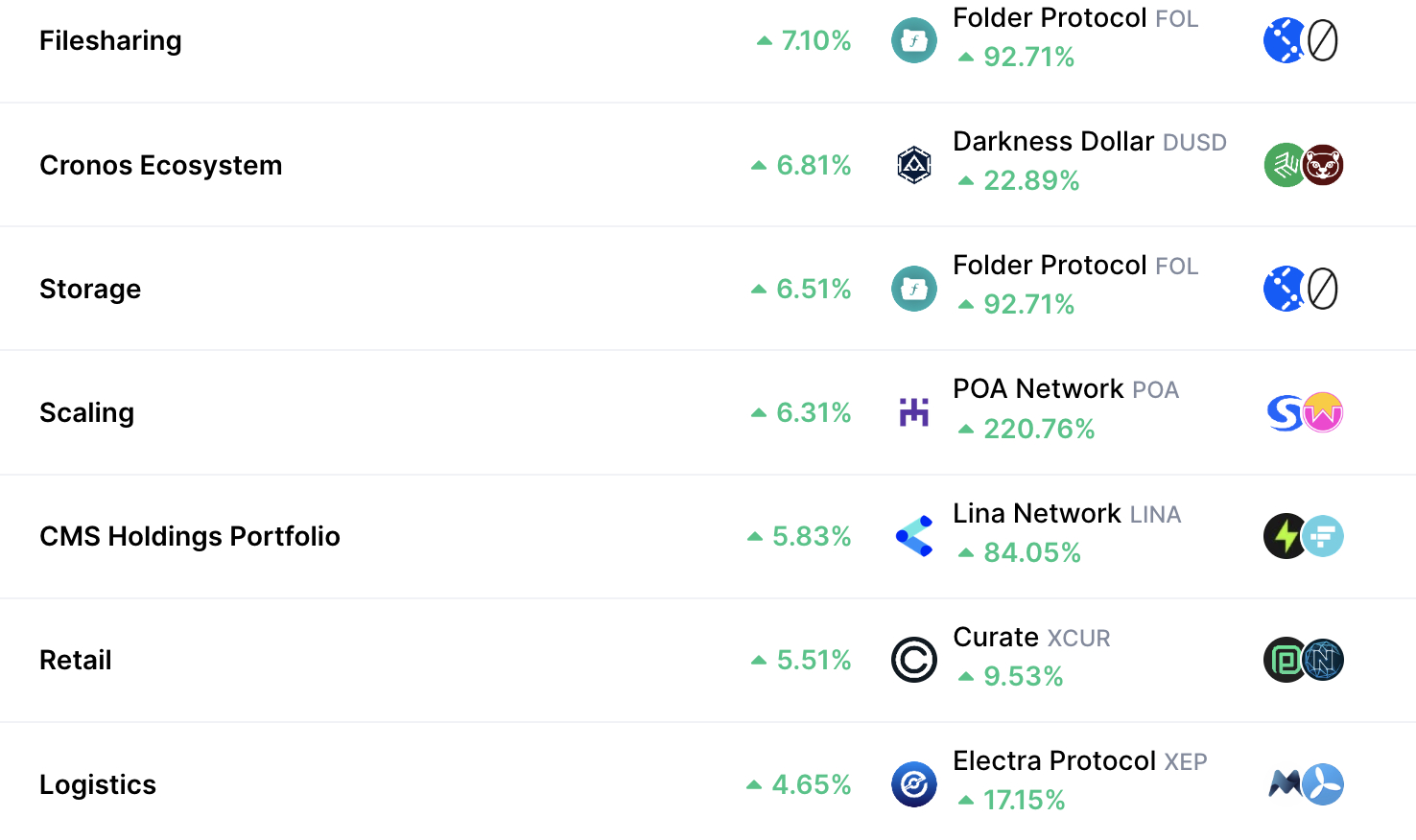

6. Diversify Investments

Investing in cryptocurrencies includes inherent dangers because of the market’s excessive volatility. A major occasion can drastically scale back the market’s worth in simply sooner or later. To mitigate these dangers, a diversified, balanced portfolio is essential.

This technique includes spreading your funding throughout numerous cryptocurrencies somewhat than investing multi function. With a stable crypto portfolio allocation that included established cash and promising new tokens you possibly can restrict potential losses.

Moreover, incorporating totally different asset courses past crypto can defend your portfolio from vital losses if one sector underperforms. This strategy reduces publicity to volatility and enhances the soundness of your investments.

7. Make investments With Greenback-Value Averaging

Greenback-cost averaging (DCA) is an funding technique the place you recurrently make investments a hard and fast sum of money into an asset, no matter its price on the time. This methodology reduces the impression of volatility by spreading the funding over a number of intervals.

For instance, investing $100 in Bitcoin each month, whatever the price, averages the funding value over time. Whether or not the market is up or down, the technique prevents giant losses on account of poor timing and capitalizes on the potential long-term progress of cryptocurrencies.

Along with lowering the danger of dangerous timing, it simplifies investing by taking the stress out of deciding the “right” time to purchase and minimizes emotional investing, making it superb for learners.

8. Acquire Publicity to Cryptocurrency Not directly

If investing in a cryptocurrency straight doesn’t really feel like the suitable selection, there are different methods to realize publicity to the blockchain business, comparable to:

- Investing in firms linked to blockchain: Purchase shares in firms that function within the crypto house like Coinbase, PayPal, or Sq..

- Investing in crypto ETFs: This rising asset class permits buyers to realize publicity to a number of digital belongings with one funding, offering diversification.

Now we have a information on the perfect crypto ETFs that explains how exchange-traded funds work. As with every funding, crypto shares and ETFs additionally carry threat. Buyers ought to at all times consider their targets and monetary state of affairs earlier than staking cash on any crypto-related asset.

9. Increase Crypto Investments With Staking

Crypto staking is especially interesting to long-term buyers. In easy phrases, as an alternative of getting the digital belongings sitting idle in digital wallets, buyers can deposit them right into a crypto staking platform and earn curiosity.

Right here is an instance of how crypto staking works:

- Suppose that an investor has $1,000 price of Ethereum, which is likely one of the greatest staking cash.

- They will deposit Ethereum right into a crypto staking platform providing 10% annual proportion yield.

- Over the course of a yr, $1,000 price of Ethereum would yield $100 in passive crypto earnings.

The yield supplied and the phrases of staking range from one platform to a different — and never each cryptocurrency could be staked.

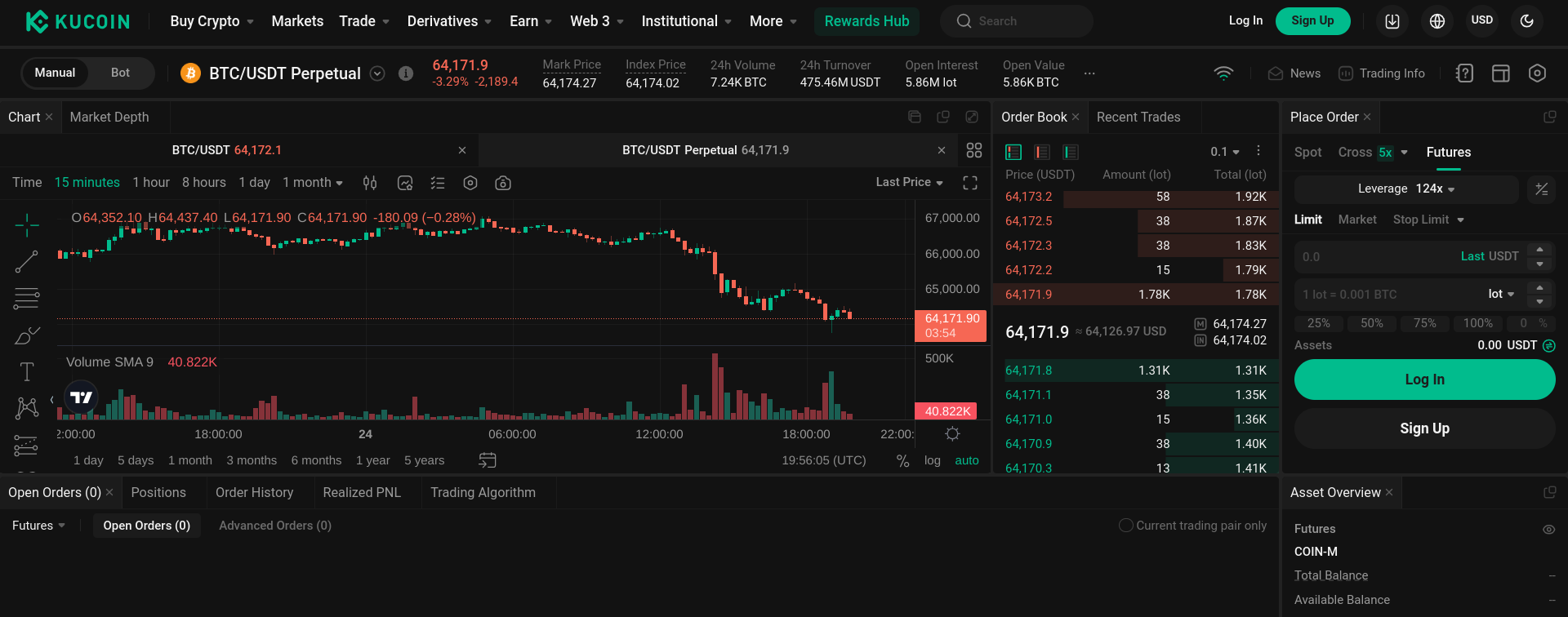

10. Use Leverage Rigorously

Leveraging in cryptocurrency means utilizing borrowed cash from a dealer or alternate to extend the potential measurement of an funding. For instance, with a 1:10 leverage, you solely make investments $10 to regulate $100 price of cryptocurrencies.

This could amplify income but in addition magnifies losses if the market strikes in opposition to you. As a consequence of its excessive threat, not all exchanges supply leverage buying and selling and it’s usually really helpful that learners keep away from utilizing leverage till they’re extra skilled with the crypto markets.

The best way to Get Into Crypto Mining

Crypto mining is the method of validating cryptocurrency transactions and minting new cash. Initially, anybody with a strong laptop and technical abilities might mine cryptocurrencies profitably. Nevertheless, right this moment’s crypto mining requires vital investments in specialised {hardware}, excessive vitality prices, and substantial technical information.

For these searching for an easier route, utilizing the perfect Bitcoin mining websites affords a passive strategy. These platforms handle the mining operations and supply returns to buyers, although these returns could be small and will require an extended wait to build up substantial cryptocurrency quantities.

Conclusion

Cryptocurrencies have emerged as a large pressure in finance. As our information has mentioned, there are a lot of methods for buyers to get into crypto and enhance their probabilities of making income. Top-of-the-line methods to enter the crypto market is by investing in cryptocurrencies which have low entry costs however excessive potential to develop.

Buyers would possibly need to take into account buying Dogeverse, an progressive multichain meme coin. Because the begin of its presale, buyers have pledged over $13 million to the venture, denoting excessive curiosity and momentum. The token may also be staked to earn excessive annual yields.

Go to Dogeverse

FAQs

How can a newbie begin in cryptocurrency?

Step one is to find out about cryptocurrency. It’s necessary for learners to know the way they work and the other ways to revenue from them. As soon as prepared, buyers can proceed to purchase cryptocurrency by way of a web based dealer or alternate.

What’s the best solution to get into crypto?

The simplest solution to get into crypto is by buying it via a good cryptocurrency alternate. Select a platform, create an account, confirm your identification, deposit funds, and purchase the cryptocurrency of your selection.

How do I begin investing in cryptocurrency?

To begin investing in cryptocurrency:

- Select a good alternate.

- Create and confirm your account.

- Deposit funds.

- Analysis and choose cryptocurrencies.

- Begin with small investments to know market dynamics.

- Think about using a safe pockets for storage.

Are you able to get wealthy on cryptocurrency?

Whereas some buyers have profited drastically from cryptocurrencies, many have misplaced cash. To get wealthy with cryptocurrency, learners want to seek out the perfect cryptos to purchase and time their investments accurately, which is not any straightforward feat.