- Technique paused Bitcoin purchases between March 31 and April 6, 2025.

- Bitcoin fell beneath $80,000 after Trump introduced new US commerce tariffs.

- Technique’s present Bitcoin holdings stand at 528,185 BTC.

Michael Saylor’s firm, Technique, has halted its Bitcoin purchases for the primary time in latest reminiscence, marking a shift from its common shopping for spree.

This growth comes amid a pointy correction in crypto markets, which fell in response to US President Donald Trump’s new 10% tariff on almost all international items.

The pause in Technique’s Bitcoin accumulation, confirmed in a 10-Q submitting with the US Securities and Alternate Fee (SEC) on April 7, coincided with a broader wave of investor warning after Trump additionally threatened to double tariffs on Chinese language imports to 50%.

Technique holds 528,185 BTC

In accordance with the SEC submitting, Technique made no Bitcoin purchases between March 31 and April 6.

The corporate nonetheless holds 528,185 BTC, gathered since 2020 when it first adopted a Bitcoin-centric treasury technique below Saylor’s management.

Whereas the agency didn’t promote any of its holdings throughout this latest pause, it recorded $5.91 billion in unrealised losses on its Bitcoin holdings within the first quarter of 2025.

This sharp decline in worth displays Bitcoin’s fall beneath $80,000, a reversal from the features seen after Trump’s re-election.

The SEC doc didn’t make clear whether or not the pause was non permanent or a part of a broader strategic shift, nevertheless it highlighted that market circumstances and geopolitical uncertainty have influenced acquisition exercise.

Trump warns of fifty% China tariffs

The pause in Technique’s Bitcoin shopping for was not an remoted choice.

It coincided with market instability triggered by Trump’s tariff insurance policies, which have induced disruption throughout conventional monetary markets and digital asset exchanges.

On April 7, the president posted on X, previously Twitter, stating: “Be Sturdy, Brave, and Affected person, and GREATNESS would be the outcome.”

Nonetheless, investor sentiment deteriorated sharply after Trump escalated threats to extend tariffs on Chinese language imports from 34% to 50% except Beijing eliminated its retaliatory measures.

This added additional strain on asset costs globally, resulting in capital outflows and a droop in risk-on property, together with cryptocurrencies.

Technique’s unrealised losses increase considerations about BTC treasury mannequin

The $5.91 billion in unrealised losses has drawn consideration to the potential dangers of a Bitcoin-focused company treasury mannequin.

Though Technique has lengthy advocated for Bitcoin as a retailer of worth, latest occasions have reignited debates about volatility publicity.

The corporate’s unrealised losses within the first quarter illustrate how geopolitical developments—akin to modifications in US commerce coverage—can instantly influence steadiness sheets tied to crypto property.

Whereas Technique didn’t remark within the SEC submitting on its future acquisition plans, the absence of latest purchases throughout a interval of heightened market uncertainty suggests a extra cautious stance within the brief time period.

Ackman requires tariff reversal

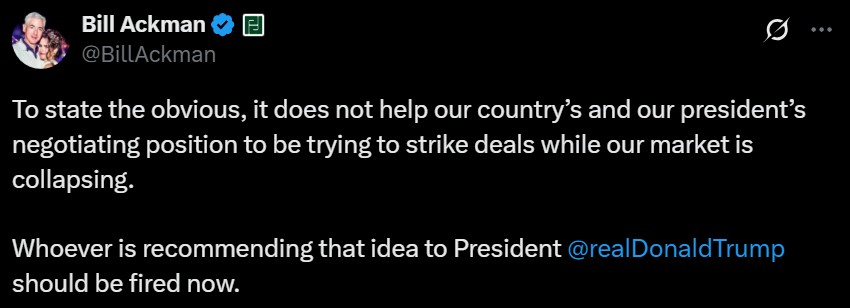

Billionaire investor Invoice Ackman, who beforehand voiced help for Trump, criticised the brand new tariffs and their influence on market stability.

On April 7, Ackman posted on X that the insurance policies undermine US negotiating leverage and ought to be reversed instantly.

His feedback replicate rising concern amongst traders in regards to the broader implications of commerce coverage on asset markets, significantly as shares and crypto property come below simultaneous strain.

Technique’s choice to pause Bitcoin shopping for provides to this narrative, suggesting that some companies are actually reassessing aggressive crypto accumulation methods amid macroeconomic headwinds.

Whether or not this pause turns right into a longer-term coverage shift might rely upon how Bitcoin costs reply to the evolving world financial surroundings and additional political developments.

The submit Technique hits the pause button on Bitcoin after $5.9B loss appeared first on CoinJournal.