Whereas demonstrating outstanding progress, Sui navigates inherent challenges, together with intense market competitors, adoption hurdles, and evolving regulatory uncertainties. This analysis supplies an in-depth examination of those aspects, providing a balanced perspective on Sui’s present standing and future trajectory.

Into the Sui Community

Sui, a decentralized, permissionless Layer-1 blockchain, launched in 2023, developed by Mysten Labs. The workforce, composed of former Meta engineers from the Diem (previously Libra) undertaking, gained invaluable R&D expertise in addressing scalability, safety, and regulatory compliance for world monetary programs. This background supplied Sui a considerable head begin in technological maturity and robustness, shaping its design philosophy in the direction of enterprise-grade options and mass adoption. Their prior publicity to stringent regulatory scrutiny additionally equips Sui with a proactive strategy to the advanced regulatory panorama, accelerating its mainstream integration with an institutional-first mindset.

Sui’s core intention is to allow environment friendly, low-latency, and speedy digital asset administration, essentially reshaping blockchain infrastructure. It’s constructed for high-performance, minimal-fee real-world purposes in gaming, Decentralized Finance (DeFi), commerce, and Non-Fungible Tokens (NFTs). This deliberate market positioning and pragmatic, user-centric strategy are designed to foster sustainable development and entice a wider consumer base past mere hypothesis, aiming for deep integration into broader financial and social actions.

Sui homepage

Sui’s Foundational Expertise

Object-Centric Knowledge Mannequin

Sui’s core innovation is its object-centric information mannequin, the place each digital asset is a definite, mutable object with a novel proprietor. This granular strategy permits for considerably quicker possession transfers and immediate updates, usually bypassing world consensus.

This redefinition allows parallel transaction execution, resulting in exceptionally excessive throughput, ultra-low latency, actually dynamic NFTs, and simplified composability. It supplies an intuitive “physical world” illustration of belongings, lowering friction for builders and customers, notably in high-interaction purposes like gaming and DeFi.

The Transfer Programming Language

Transfer is the revolutionary sensible contract language powering Sui, initially developed for the Diem blockchain. It’s designed to be “secure by default,” “intuitive by design,” and “expressive by nature,” mirroring bodily world asset possession and shortage.

Transfer’s inherent security measures forestall malicious assaults and scale back developer cognitive load, accelerating dApp growth and attracting high expertise. Its succinct tagline, “less code, more secure,” encapsulates this worth.

Transfer on Sui options enhancements like its distinctive object-centric world storage mannequin, module initializers, and particular use instances for the entry key phrase. It encourages formal verification and auditing, considerably enhancing safety.

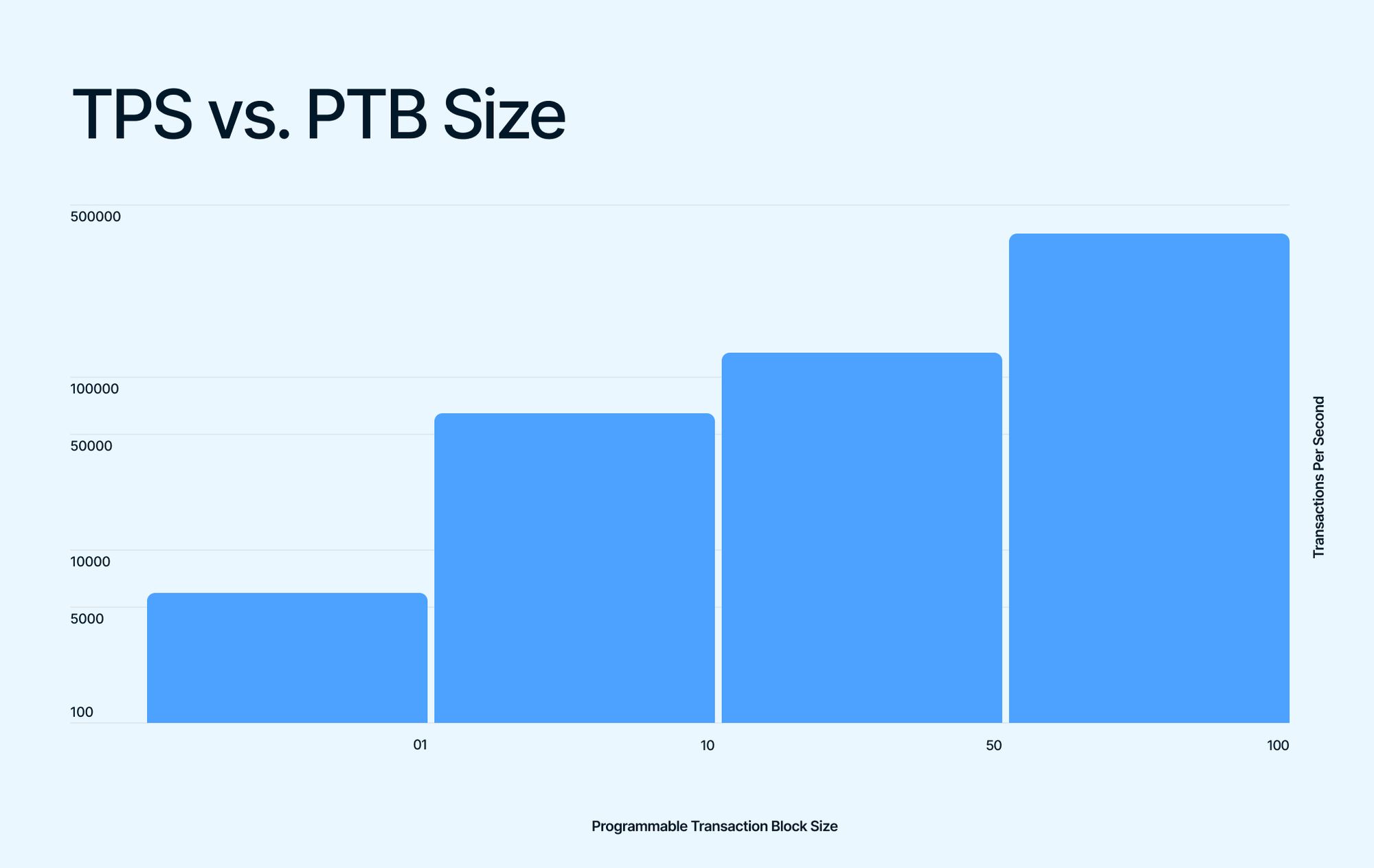

Programmable Transaction Blocks (PTBs) are a standout characteristic, permitting a single Sui transaction to atomically name up to 1024 separate Transfer features. This functionality allows wealthy and protected code composability, dramatically enhancing fuel effectivity and simplifying advanced sensible contract logic by shifting composition from the contract stage to the transaction stage.

Programmable Transaction Blocks (PTBs)

Dynamic Fields additional improve composability and suppleness, permitting builders so as to add or take away object fields on the fly, hyperlink objects collectively, and manage information into intuitive object hierarchies. Builders actively constructing on Sui reward Transfer for enabling atomic and dynamic operations, lowering programming issue, and offering sturdy sort security, resulting in quicker and safer product growth.

Consensus Mechanism and Scalability Improvements

Sui operates on a permissionless Delegated Proof-of-Stake (DPoS) system. At its core, it employs Mysticeti, a novel Byzantine Fault Tolerant (BFT) consensus protocol. This protocol optimizes validator communication, permitting easy transactions to settle in milliseconds by bypassing full consensus, whereas advanced ones use the total energy of Narwhal and Bullshark for sturdy ordering.

This clever dual-path mechanism instantly contributes to Sui’s distinctive excessive throughput and ultra-low latency, avoiding sequential processing bottlenecks. Sui achieves spectacular scalability by parallel transaction execution and helps horizontal scalability by partitioning its state house into independently manageable objects, guaranteeing the community scales with demand by including extra validators.

Key Consumer-Centric Options

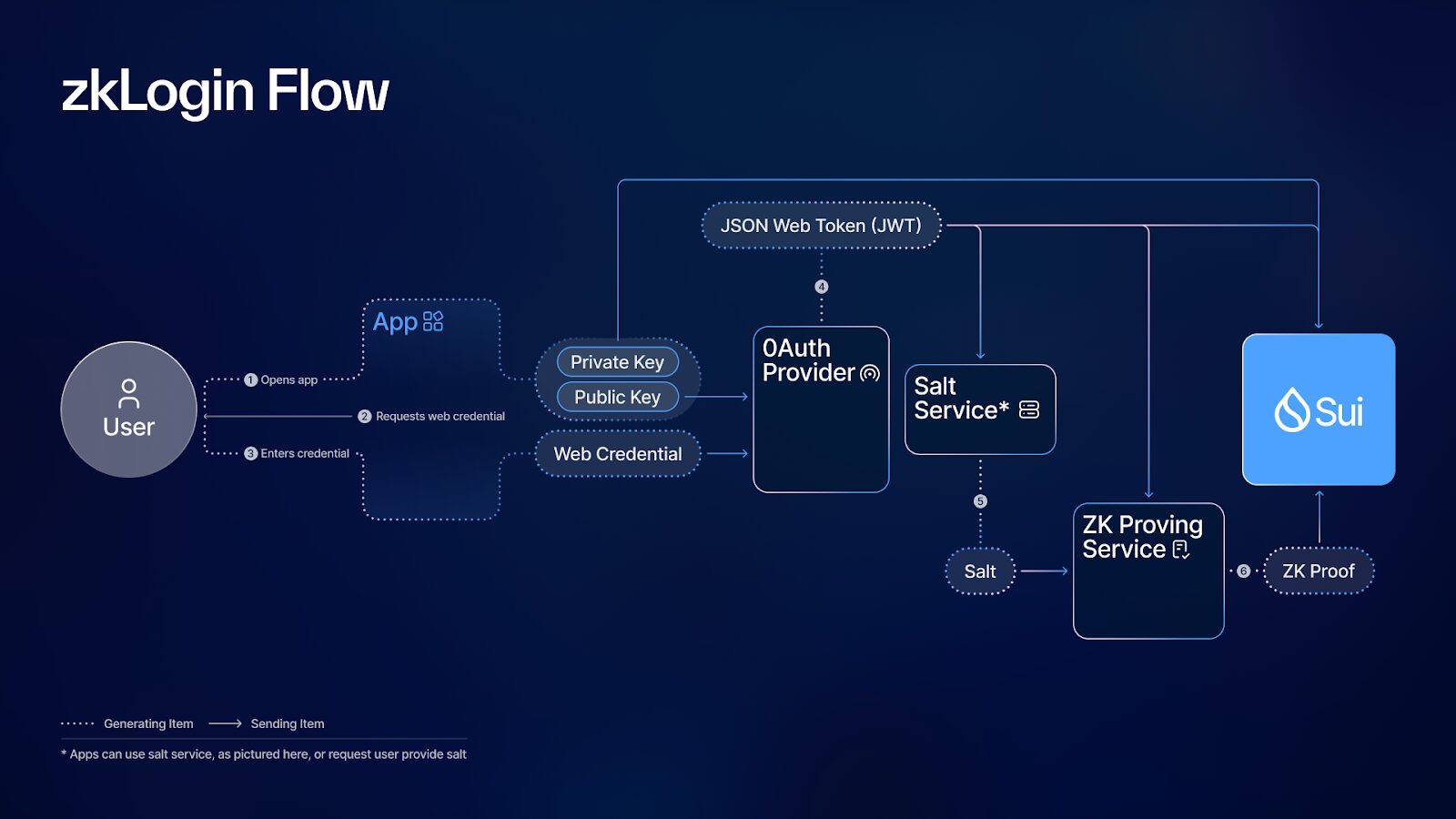

Zero-Data (ZK) Login is a vital innovation that permits customers to entry dApps on Sui utilizing present Web2 credentials (e.g., Google accounts), fully bypassing conventional personal keys or seed phrases. This considerably lowers the barrier to entry for mainstream customers, making blockchain interactions extra accessible and user-friendly and demonstrating Sui’s sturdy give attention to consumer expertise.

Past ZK Login, Programmable Transaction Blocks (PTBs), as talked about earlier, are central to advanced dApp creation, providing fuel effectivity and safe atomic operations. Sui additionally ensures digital belongings are saved instantly on-chain for integrity and true possession, and its modular structure permits for seamless future upgrades.

zkLogin Movement

Sui Efficiency Metrics

The next desk supplies a quantifiable overview of Sui’s technical capabilities and the tangible development of its ecosystem, providing vital information for assessing its efficiency and aggressive standing.

| Metric | Worth |

| Theoretical Transactions Per Second (TPS) | 297,000+ |

| Present Transactions Per Second (TPS) | ~1,800 |

| Time to Finality (Easy Transactions) | Milliseconds |

| Time to Finality (Mysticeti) | ~39ms (at 100k TPS) |

| Common Time to Finality | ~400ms |

| Complete Worth Locked (TVL) (as of June 2025) | $1.8 Billion |

| Stablecoin Market Capitalization | >$860 Million |

| Month-to-month Stablecoin Switch Quantity | >$70 Billion |

| Complete DEX Quantity | >$110 Billion (cumulative) / $398 Million (24-hour) |

| Activated Wallets | >8 Million |

| Complete Transactions Processed | >2.64 Billion |

SUI Tokenomics and Utility

Sui Token

SUI is the native token of the Sui community, serving as the basic asset that powers each motion and transaction on the platform.

SUI utility:

- Gasoline Charges: SUI is used to pay the computational prices for executing transactions and storing information on the community. A key design goal ensures these fuel charges stay low and steady, largely unaffected by community congestion, distinguishing Sui from many different blockchains.

- Staking and Community Safety: SUI holders can actively take part within the community’s safety and operation by staking. By delegating their SUI tokens to validators inside the Delegated Proof-of-Stake (DPoS) system, they contribute to community safety and earn rewards. Validators, who collateralize SUI, obtain fuel charge rewards and share them proportionally with their delegators.

- Governance: SUI token holders possess governance rights, enabling direct participation in on-chain voting. This contains vital selections relating to protocol upgrades, community parameters, and the general strategic route of the Sui ecosystem.

- Versatile Utility and Ecosystem Asset: SUI is designed as a flexible and liquid asset for various purposes throughout the ecosystem. It features as a unit of account, medium of change, and retailer of worth, facilitating advanced functionalities by sensible contracts, interoperability, and composability. Throughout the Sui ecosystem, SUI tokens are actively utilized for buying and selling on Decentralized Finance (DeFi) platforms, for creating and managing Non-Fungible Tokens (NFTs) in video games and collectibles, and because the main foreign money for interactions inside DeFi and gaming dApps.

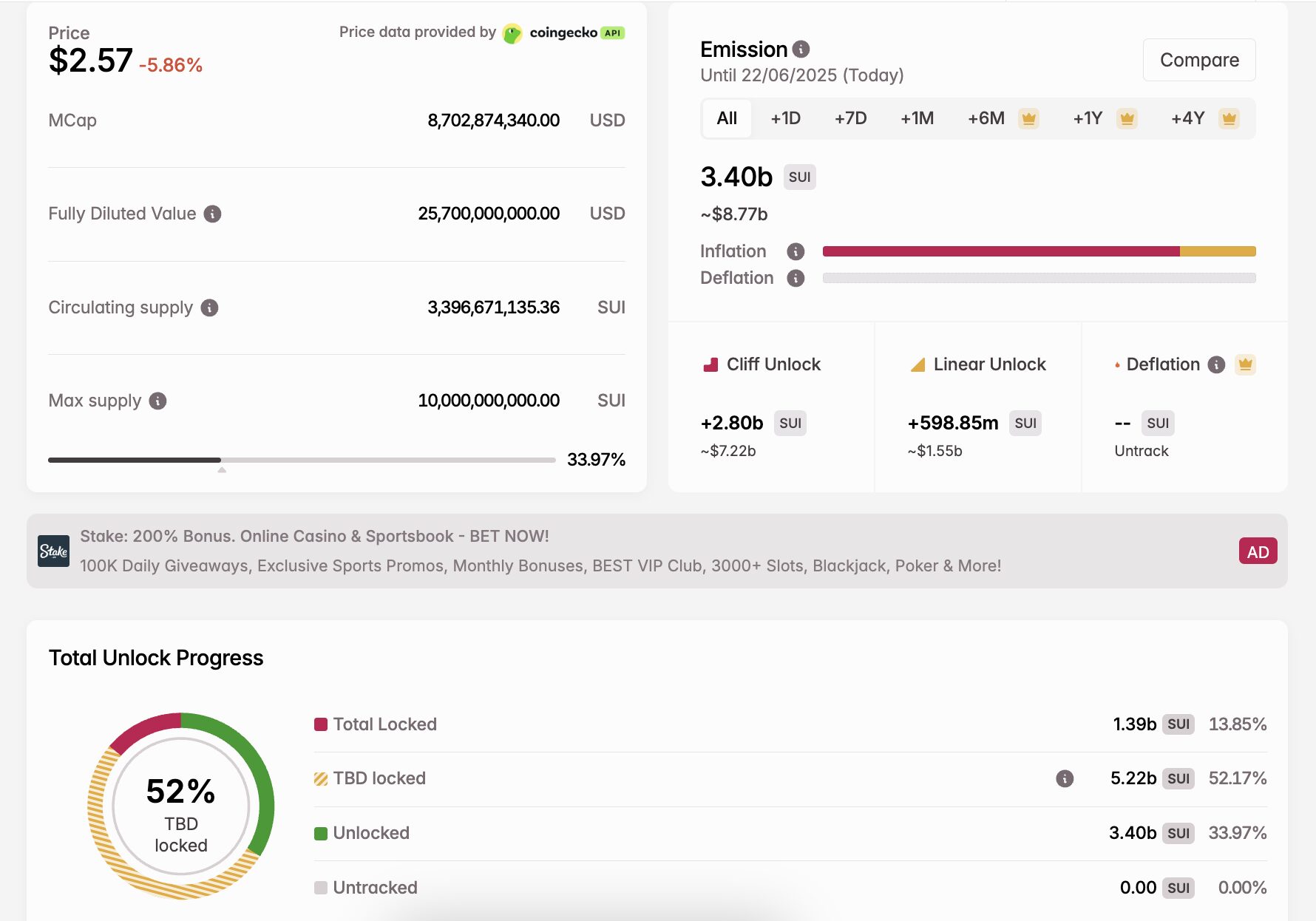

Token Distribution and Vesting Schedule

The entire provide of SUI tokens is capped at 10 billion. The distribution of this provide is structured throughout a number of key classes:

| Class | Allotted Quantity (SUI) | Share (%) | Vesting Schedule/Particulars |

| Complete Provide | 10,000,000,000 | 100% | Capped Provide |

| Early Contributors | 2,000,000,000 | 20% | 12-month cliff, non-linear vesting over subsequent yr |

| Traders (Collection A & B) | 1,400,000,000 | 14% | 12-month cliff, linear vesting |

| Mysten Labs Treasury | 1,000,000,000 | 10% | |

| Group Entry Program (Public Sale) | 600,000,000 | 6% | 1/13 unlocked at TGE, 1/13 month-to-month for 12 months |

| Group Reserve | 5,000,000,000 | 50% | ~29.55% unlocked at launch, the rest vests steadily over a number of years; contains Stake Subsidies (9.49%) unlocking linearly over 7 years |

You will need to word that token unlock occasions are a typical phenomenon within the crypto business and might considerably influence market dynamics as a result of sudden enhance in circulating provide.

For instance, a scheduled unlock in February 2025 launched over 64 million SUI tokens. This represented about 1.2% of the overall provide, valued then at round $51 million.

This course of presents an inherent stress. Whereas token unlocks actually introduce short-term market threat, as a consequence of potential promoting stress, they’re additionally very important. Importantly, they progressively decentralize token possession. Moreover, these unlocks reward key stakeholders, together with early contributors and traders, who helped develop the community. Finally, they foster broader group participation.

Sui token emission and Unlock progress

The “paradox of capital inflows,” the place excessive influx quantity may not signify steady, long-term assist , makes these unlock occasions much more delicate.

Sui’s problem is to handle these periodic provide will increase with out undermining market confidence, ideally by guaranteeing that demand from new use instances and sustained ecosystem development can soak up the elevated provide. This highlights the continuing want for sturdy ecosystem growth to counteract potential sell-side stress.

Financial Mannequin and Incentives

Sui’s financial mannequin meticulously aligns incentives for customers, SUI token holders, and validators, fostering long-term viability and decentralization. Vesting schedules mitigate sell-offs, guaranteeing a group invested in sustained success.

A vital “storage fund,” fueled by transaction charges, subsidizes future validator rewards for information storage. This forward-thinking mechanism ensures sustainable information persistence, attracting institutional adoption in search of predictable growth.

The Delegated Proof-of-Stake (DPoS) mannequin incentivizes validators for top efficiency, as their rewards tie on to delegated SUI. Customers, as delegators, select validators primarily based on efficiency and fee charges, fostering competitors and total community well being.

Challenges and Limitations

Safety Dangers

Safety dangers are inherent in any new platform, particularly these utilizing a novel language like Transfer. Whereas Transfer and Sui’s object-based information mannequin supply sturdy security ensures (e.g., stopping double-spend), audits stay essential for figuring out logical flaws and validating customized enterprise logic.

🔊UPDATE: Now we have not acquired any communication from the hacker. We encourage the hacker to sincerely take into account our supply phrases.

Concurrently, with the assist of Inca Digital and monetary assist from Sui Basis, we’re asserting a bounty of $5M for related info…

— Cetus🐳 (@CetusProtocol) Could 23, 2025

A notable incident was the Cetus Protocol breach in Could 2025, the place an estimated $260 million was in danger as a consequence of a flaw within the protocol’s mathematical features, not Sui’s core infrastructure or Transfer language.

In response, Sui dedicated $10 million to boost safety, specializing in superior analytical instruments, elevated monitoring of high-risk parts, and technical audits. This incident highlights that regardless of inherent language security, complexity in a quickly increasing ecosystem can introduce new application-layer vulnerabilities.

We’re kicking this off by committing to spend a further $10M on safety initiatives. These funds will probably be spent on audits, bug bounty applications, formal verification, and different methods to harden Sui — we’ll work out the main points in collaboration with our developer group.

— Sui (@SuiNetwork) Could 26, 2025

The community’s response demonstrates a dedication to resilience, however the inherent trade-offs between velocity, decentralization, and safety will stay a vital focus for Sui’s long-term viability. Moreover, the diploma of validator centralization in DPoS, whereas enabling excessive efficiency, necessitates sturdy governance and group oversight to forestall potential abuses or systemic dangers.

Adoption Hurdles

Sui faces robust adoption challenges. Particularly, it should compete fiercely with established blockchains like Ethereum and Solana for builders and initiatives. Consequently, its “build it and they will come” technique hinges on overcoming sturdy community results. Certainly, regardless of Sui’s technical benefits—velocity, scalability, and low charges—older platforms possess massive, loyal communities and sturdy ecosystems.

Subsequently, Sui’s problem entails fostering long-term, utility-driven engagement. This implies shifting past attracting short-term speculative capital. As an alternative, it requires not solely sturdy know-how but in addition sustained effort in group constructing. Moreover, demonstrating constant real-world worth encourages deep integration and loyalty. Thus, providing developer grants, hackathons, and and complete tooling is essential to decreasing entry boundaries for brand spanking new initiatives.

Ecosystem Progress and Regulatory Uncertainty

Ecosystem development is crucial for Sui’s success, necessitating a various vary of cost options, DeFi purposes, gaming platforms, and sturdy partnerships with enterprises and infrastructure suppliers. A thriving and various ecosystem is vital for sustaining consumer and developer curiosity.

Moreover, regulatory uncertainty poses one other vital problem. The worldwide blockchain panorama is topic to ever-changing legal guidelines and insurance policies, as seen with SEC delays on SUI ETF selections (e.g., July 2025).

Sui’s means to adapt to those rules whereas sustaining its core performance will probably be essential for constructing belief amongst establishments, builders, and customers. Proactive engagement with regulators and adherence to compliance necessities can mitigate these dangers and assist place Sui as a reliable, compliant platform in an evolving authorized surroundings.

For extra: The Progress Potential of Sui?

Sui Opponents

Blockchain Layer-1 house is very aggressive, with Sui vying towards main gamers like Ethereum, Solana, and Aptos. Every community provides distinct benefits.

Sui vs. Ethereum: Sui provides superior scalability, decrease charges, and quicker transaction finality in comparison with Ethereum. Nonetheless, Ethereum advantages from a longtime group and in depth community results, regardless of its decrease transaction velocity and better charges.

Sui vs. Solana: Each are high-performance Layer-1s. Solana makes use of a Proof of Historical past (PoH) and Proof of Stake (PoS) hybrid consensus, reaching roughly 2.5 seconds finality and round 2,500 present Transactions Per Second (TPS). Sui, with its object-centric Transfer language, provides fast finality for easy transactions and round 1,800 present TPS. Solana at the moment boasts a bigger developer group (over 30,000) in comparison with Sui (over 15,000).

Sui vs. Aptos: Each blockchains originated from Meta’s Diem undertaking and make the most of the Transfer programming language. Sui employs an object-centric parallel execution mannequin, specializing in specialised use instances like gaming and social dApps, optimized for real-time purposes. Aptos, however, goals to be a general-purpose blockchain, utilizing Block-STM for parallel execution and a Byzantine Fault Tolerance (BFT) consensus mannequin, with claims of being a safer, quicker, and long-term resolution for builders.