Key Takeaways:

- For particular person buyers, staking crypto is a way more accessible and total higher different to mining.

- There are a number of staking strategies out there so that you can select from, together with pooled staking and liquid staking providers.

- The only method to begin staking as a newbie is thru an internet user-friendly crypto change like Coinbase.

Staking crypto belongings can look like a frightening course of, but it surely’s a lot simpler than mining or buying and selling. Through the use of centralized exchanges or staking platforms, most buyers discover it a lot simpler to leap into staking to generate wealth.

This newbie’s information covers the fundamentals of staking: strategies, platforms, and the very best crypto to stake for strong yields.

What’s Inside?

- Study how to stake common tokens like Ethereum, Cardano, and Solana proper out of your sofa.

- Uncover the very best platforms and charges for a few of our favourite staking tokens.

- A step-by-step information to beginning staking on Coinbase, Binance, and even your {hardware} pockets.

- Dangers & Rewards: Sure, there’s superb print. We cowl that, too.

How Do You Stake Crypto?

The only method to begin staking as a newbie is through an internet crypto change or platform. These sources present customers with instruments and interfaces that make staking crypto easy.

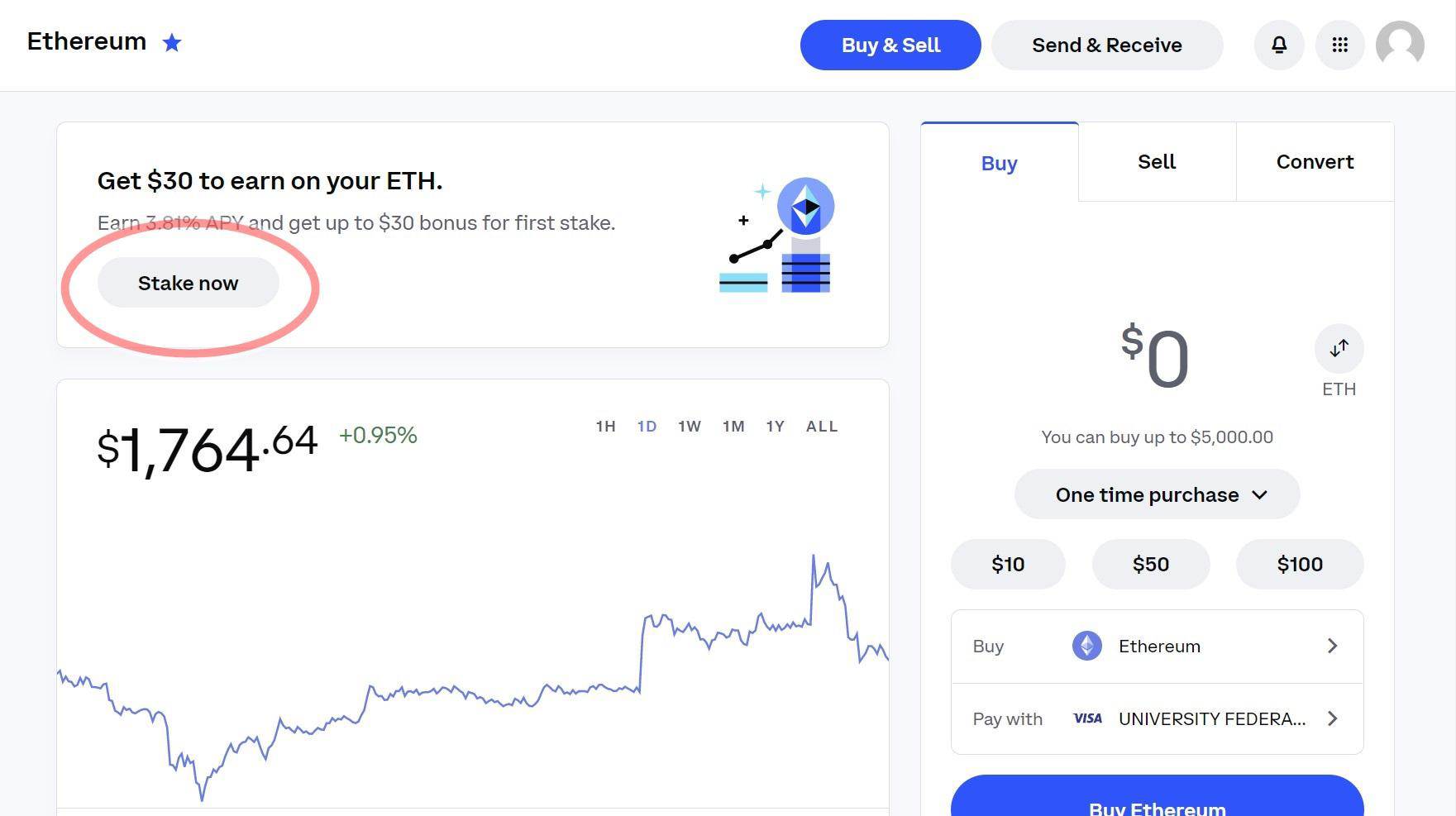

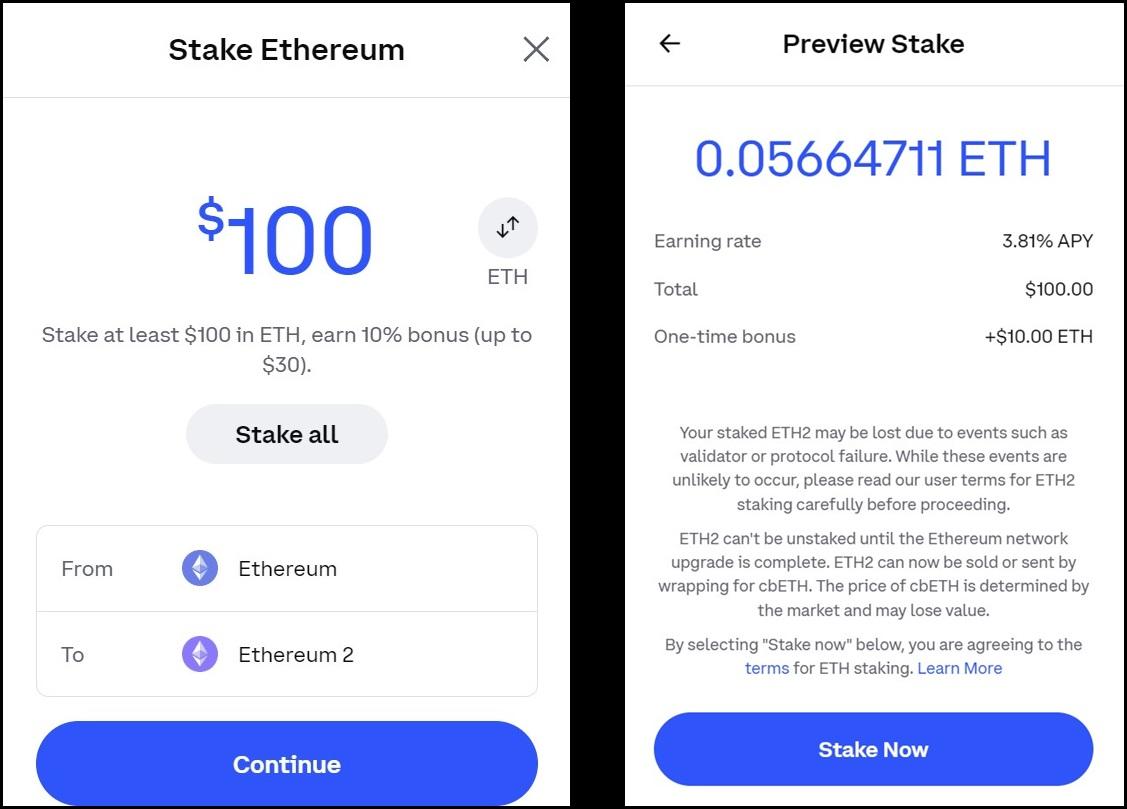

Right here’s an easy-to-follow information to getting began with staking utilizing Coinbase:

What’s Staking Crypto?

Staking crypto is a course of the place buyers can earn extra cryptocurrency by supporting validation, particularly on “Proof of Stake” blockchains.

In a PoS blockchain, lively customers put up a small quantity of crypto (the “stake”) to be thought-about for block verification. The chain will then choose a random staker to authenticate a block and earn extra crypto in return.

With the rising reputation of staking, nevertheless, it takes increasingly crypto to take part successfully:

Staking is utilizing your crypto to earn passive returns by locking a few of that crypto right into a staking pockets that the change makes use of to validate on-chain transactions. This course of is very similar to incomes “interest,” however reasonably than incomes curiosity by way of a bond or a checking account, you earn it on the change.

Generally, the staking course of entails leaving the crypto within the pockets for a predetermined time. Throughout this time, the community makes use of the locked cryptocurrency to confirm transactions and preserve the safety of the blockchain. In change for offering this service, crypto holders earn extra cryptocurrency as a reward (i.e., “staking rewards”).

Staking is an alternative choice to the energy-consuming and tedious validation processes discovered on Proof of Work chains like bitcoin. You possibly can earn curiosity earnings on cryptocurrency holdings with out buying and selling or mining it actively.

Proof of Stake vs. Proof of Work

Staking is feasible solely on blockchains that make use of the Proof of Stake (PoS) consensus algorithm. This mechanism lets community individuals agree on which transactions needs to be validated and added to newly created blocks.

Not like bitcoin’s Proof of Work (PoW) algorithm, which raises the query “Can you stake bitcoin?” (the reply isn’t any), the PoS consensus technique is a extra energy-efficient, eco-friendly different to PoW mining.

If in case you have PoS crypto investments sitting idle, staking is an choice to earn extra earnings. It’s just like incomes curiosity on a set deposit however with the potential for larger curiosity and threat.

How Crypto Staking Works

Staking entails holding a certain quantity of cryptocurrency in a particular digital pockets and locking it in place for a predetermined period of time. This course of requires person sources to help stability and safety throughout the chain, as staking wallets help the longevity of transaction verification.

To stake, customers commit a certain quantity of cryptocurrency to the community to take part in cryptocurrency staking. For instance, a minimal of 32 ETH is required to stake on the Ethereum chain. The community then selects validators from amongst staking individuals to substantiate blocks of transactions. The extra cryptocurrency customers commit, the upper their possibilities of being chosen as a validator.

As every block is added to the blockchain, new cash are created and distributed as rewards to the validator of the block. Sometimes, these rewards are paid in the identical cryptocurrency that the individuals have staked.

Staking rewards differ relying on elements like the quantity, the size of time the cryptocurrency is staked, and the demand for the cryptocurrency.

Completely different Methods of Staking

There are 4 major methods in which you’ll take part in coin staking:

Delegation

The primary and easiest method is delegating, a preferred possibility for smaller crypto buyers who don’t need to spend the cash and energy to function a validator. Reasonably than investing a big sum, smaller customers delegate their cash to a validator (corresponding to an change or staking platform), which swimming pools the staking funds from a number of buyers.

Traders then obtain a portion of the staking rewards earned by the validator in change for his or her delegation. The rewards rely on the quantity of the delegated cryptocurrency and the share it represents from the validator’s whole stake.

Delegating implies entrusting your cryptocurrency to a 3rd celebration. Subsequently, it’s important to carry out due diligence and choose a reliable validator or node with an excellent observe document and popularity within the community.

Pooled Staking

The second technique is to stake your tokens by way of a pooled staking service. Many embody Stake.fish (lined in additional element beneath) and RocketPool. Pooled staking capabilities equally to a delegated method in {that a} pool of crypto exists for staking functions. Nonetheless, this method combines a number of validators right into a pool to realize higher staking rewards. The higher the variety of tokens held in a single pool, the higher the prospect that the pool will obtain a staking reward. Swimming pools are extra superior when in comparison with delegation however are price investigating.

Liquid Staking

A 3rd technique for staking, turning into more and more common, is liquid staking providers (additionally known as liquid staking derivatives, or LSDs). Liquid staking by way of a platform like Lido (lined in additional element beneath) permits token holders to obtain staking rewards whereas retaining entry to their tokens. This offers higher flexibility and effectivity when staking. That mentioned, liquid staking could also be past these utterly new to staking.

Validator Nodes

The fourth and most superior technique for staking is as a validator. You run your staking node utilizing superior technical expertise and your {hardware} (which should at all times be stored on-line). The benefit is larger rewards and voting/controlling rights on some blockchains.

However turning into a validator takes work; you need to make investments larger sums simply to qualify. And, in fact, there’s the technical information required. Working a validator node is actually not for many learners.

In style Staking Tokens

Under are six of the extra common tokens we see staked by buyers. Their reputation stems from a number of elements, together with the challenge’s power, the APY provided, and the token’s massive market cap and liquidity.

The tokens mentioned listed here are listed so as of the full proportion of tokens staked.

Ethereum 2.0 (ETH2)

After years of anticipation, Ethereum lastly upgraded to PoS, with the Merge improve in September 2022. Many anticipated the shift to assist the blockchain overtake bitcoin as essentially the most beneficial crypto. Nonetheless, whether or not Ethereum manages to dominate the crypto market stays to be seen. At this writing, ETH has a market cap of over $356 billion, about 29% of bitcoins.

Validator nodes on the brand new PoS blockchain require 32 ETH tokens and a lock-up of one year. Delegate staking swimming pools don’t have any minimal necessities or lock-up durations, making them supreme for learners. APYs for ETH staking will differ from one platform to a different. We’ve got lots of the prime staking platforms and ETH APYs right here.

Binance (BNB)

Binance (BNB)

Binance is the world’s largest cryptocurrency change. The platform launched a local token in 2017. With a $596 per coin worth and a market cap of $88 billion, the Binance token is barely behind bitcoin, Ethereum, and USDT on the checklist of largest cryptos.

To get began with BNB delegation swimming pools, a minimal of 1 BNB is required. Nonetheless, you will want a whopping 10,000 BNB tokens to run a validator node. Each choices have a minimal lock-up of seven days, though longer durations end in larger reward charges.

Polkadot (DOT)

Polkadot (DOT)

Polkadot makes use of a posh structure of a number of chains to keep away from the excessive charges and congestion plaguing different blockchains like Ethereum. Launched in 2020, the blockchain has zoomed to the highest 15 cryptos checklist with a market cap of $9.7 billion.

Staking on this blockchain makes use of the native token DOT. The quantity of DOT wanted to stake is dynamic. primarily based on elements like how a lot stake is being put behind every validator, the scale of the lively set, and what number of validators are ready within the pool. The present requirement is 553 DOT.

To hitch a delegated pool, you want a minimal of 1 token and a lock-up interval of 28 days for what have traditionally been excessive APYs.

Solana (SOL)

Solana (SOL)

This specific blockchain launched closely on decentralized finance (DeFi). The SOL tokens have been first publicly launched in 2020 for $0.22. In 2021, SOL was price near $250, inserting it within the checklist of the highest crypto with a market cap of $74 billion. SOL was hit by the “crypto winter,” but it surely stays one of many largest cryptocurrencies, with a $65 billion market cap.

No minimal restrict is required to run a validator node on the Solana blockchain. Each delegator swimming pools and validators have a lock-up of two days. The shared rewards from a pool can herald round 6% APY.

Cardano (ADA)

Cardano (ADA)

Cardano is one other “Ethereum-killer” that has been round for almost a decade. This PoS blockchain with sensible contracts and improved scalability was launched in 2015. As of this writing, it is likely one of the prime ten largest cryptos in market cap, with $16 billion.

Staking on ADA has a number of benefits – minimal limits or lock-in durations will not be required. Customers who be a part of any massive and respected delegated pool can begin incomes rewards with minimal fuss. The APY for Cardano staking is round 3%.

Tezos (XTZ)

Tezos (XTZ)

Launched in 2014, Tezos is a programmable cryptocurrency supporting sensible contracts. It has a self-amending mechanism to keep away from “hard forks” or compatibility divergence in two variations of the identical blockchain. Whereas the full market cap is a bit low at $894 million, many buyers really feel it has future potential.

To develop into a full validator or “baker” on the Tezos blockchain, you want a minimal of 6,000 XTZ and an preliminary lock-up interval of 14 days. However when you don’t have sufficient tokens to spare, you’ll be able to take part within the delegator swimming pools for annual proportion yields (APY) of round 6%.

The place to Get Began with Coin Staking

There are three foremost locations the place you’ll be able to stake PoS cryptos:

- Centralized Exchanges (CEX) – Most main cryptocurrency exchanges, corresponding to Binance and Coinbase, present simple staking as an choice to their customers. This selection is kind of easy and lets you benefit from any helpful options or regards the platform affords.

- Staking Platforms – These on-line “staking-as-a-service” platforms focus completely on crypto staking swimming pools in change for a fee. Whereas much less complete than an change, these permit you to give attention to staking.

- {Hardware} Wallets – This technique utilizing offline crypto wallets/{hardware} wallets known as chilly staking.

Let’s take a better have a look at some common coin-staking choices from these three classes:

Centralized Exchanges

Binance (CEX)

Binance (CEX)

Binance is the most important and hottest crypto change worldwide. Aside from staking its native Binance Coin, you’ll be able to choose from over 21 POS staking choices, with APYs up to 23.5% or extra. Staking info for Binance could be discovered right here.

Coinbase (CEX)

Coinbase (CEX)

Established in 2012, Coinbase is a fully-regulated crypto change in the US. The platform affords staking on all main PoS cryptos like ETH2 and Tezos. The NASDAQ-listed firm is a prime different to Binance, particularly for US prospects. Get began by opening a Coinbase account and visiting their Earn web page for out there belongings to stake.

{Hardware} Wallets

Ledger

Ledger

Ledger is the preferred model for {hardware} crypto wallets. Utilizing the Ledger Stay app, you’ll be able to hook up with totally different Web3 providers, a lot of which permit staking. The rewards are delivered on the Ledger Stay app or to an exterior pockets. This makes many of the common tokens out there for staking by way of your Ledger pockets, together with Ethereum, Polkadot, and Solana.

Trezor

Trezor

Created within the Czech Republic in 2011, Trezor is the world’s first digital cryptocurrency {hardware} pockets. Trezor additionally helps crypto staking, however in a roundabout way. As a substitute, you’ll be able to join the Trezor to a pockets like Exodus as a staking interface. Extra superior customers can join the Trezor to a staking service like Allnodes.

Staking Providers

Lido

Lido

Lido is a safe protocol for liquid staking that’s designed to help a number of PoS cryptocurrencies, together with Ethereum (ETH), Solana (SOL), Polygon (MATIC), Polkadot (DOT), and Kusama (KSM). Lido, launched in 2020, goals to resolve the issue of the PoS staking ecosystem: illiquidity.

As a rule, as soon as a crypto person begins staking, the belongings are sometimes locked up and can’t be used or traded till the interval ends. Lido goals to deal with this by permitting customers to stake their cryptocurrency and obtain a so-called “liquid staking token” (stToken) in return. Liquid staking tokens can ultimately be traded or put to work in decentralized finance (DeFi) purposes.

This makes it simpler for customers to take part in staking and entry the advantages of staking rewards with out sacrificing liquidity.

Whereas Lido helps a number of PoS blockchains, the staking service focuses on Ethereum, the second-largest cryptocurrency by market cap, dominating the DeFi house.

Stake.fish

Stake.fish

Stake.fish is a staking platform for cryptocurrencies the place crypto holders can pool their belongings and earn rewards. Stake.fish helps staking on 18 PoS blockchains, together with Cardano, Cosmos, Ethereum, Polkadot, Polygon, Solana, and Tezos. On the time of writing, over 1, 005, 792 ETH is staked with the platform.

Launched in 2018, stake.fish has attracted over $3 billion price of cryptocurrency for staking from each retail and institutional buyers.

How one can Stake Cryptocurrency: Step-by-Step Information

The steps for staking will differ relying on the platform/technique you favor. Nonetheless, the preliminary steps stay the identical throughout all strategies. Listed below are the easy common steps on how to stake cryptocurrency:

Fundamental Steps

- Select a Crypto Asset to Stake: Take a look at elements like APY rewards, minimal stake, lock-up durations, and different points of the crypto asset. Do sufficient research earlier than selecting up unknown/obscure cryptos.

- Determine on a Validator or Delegator: The validator necessities are fairly steep for some crypto belongings. In addition they require desktop PC {hardware} with 24/7 web connectivity. Setting up the node additionally requires superior expertise. Most learners will select the delegation route. On this case, selecting a delegator with an excellent historical past and popularity is greatest.

For Crypto Exchanges

- Create an account: Go to the crypto change and signal up for an account. Hyperlink your crypto pockets to your account.

- Purchase Stakeable Property: If you happen to don’t have already got specific cash or tokens in your pockets, purchase them from the change.

- Go to Staking Web page: Discover the devoted staking web page for the crypto on the web change. Coinbase is right here, and Binance right here.

- Enter Staking Info: Utilizing the platform’s interface, set your staking quantity and settings. Some exchanges supply totally different swimming pools with various lock-ups, APYs, and different particular options.

For Personal Staking (Crypto Wallets)

- Obtain App: Software program wallets help staking straight on the app. Some examples are Exodus and Belief Pockets.

- Decide an Asset that Helps Staking: Most PoS blockchains, corresponding to Ethereum, Cardano, or Solana, will help staking. Make certain to carry your crypto belongings on the app.

- Set Stake: Launch staking by tapping “earn now” or “start earning.” You possibly can calculate potential rewards straight on the app.

Delegating (Platforms)

- Choose a staking platform, corresponding to Lido or Stake.fish. Some platforms, corresponding to Stake.fish, require registration, so register.

- Go to the staking web page that lists all supported cash for staking. Select a crypto asset that you just need to stake.

- Join a pockets the place you may have your cryptocurrency saved. Some staking platforms, corresponding to Lido, help a number of wallets, together with MetaMask, Ledger, Belief Pockets, and Exodus.

- Begin the staking course of after confirming the quantity and checking the reward price.

Mining vs. Staking

For particular person buyers, staking is a significantly better different to crypto mining. The vitality points related to mining are one of many main the reason why Ethereum shifted to PoS. After the shift, the Ethereum blockchain noticed its vitality prices lowered by 99%.

The next desk illustrates the primary variations between mining and staking on cryptos from an investor perspective:

| Mining Execs | Mining Cons |

| Potential for Excessive Returns: Profitable mining operations can yield important income, particularly when the worth of the mined cryptocurrency appreciates over time. | Excessive Preliminary Funding: Setting up a mining operation requires a major preliminary funding in specialised {hardware}, software program, and infrastructure, which could be expensive. |

| Diversification of Funding Portfolio: Mining offers a chance for buyers to diversify their funding portfolio, probably decreasing total portfolio threat. | Operational Prices: In addition to preliminary setup prices, miners incur ongoing operational bills corresponding to electrical energy, cooling, upkeep, and web connectivity, which may eat into income. |

| Passive Revenue Era: As soon as established, a well-configured mining rig operates regularly, and so not directly acts as a constant supply of passive earnings. | Environmental Considerations: Some buyers could have reservations concerning the environmental affect of mining on account of its substantial vitality consumption. |

| Staking Execs | Staking Cons |

| Decrease Entry Barrier: PoS staking sometimes requires much less preliminary funding in comparison with mining, because it doesn’t contain buying costly {hardware} gear. | Dependency on Third Events: Delegating staking to third-party providers introduces counterparty threat, as buyers should belief these entities to handle their staked belongings securely and distribute rewards pretty. |

| Potential for Passive Revenue: By staking cryptocurrencies, buyers can earn rewards with out actively buying and selling or monitoring markets. | Market Volatility: The worth of staked belongings could fluctuate on account of market volatility, affecting the general returns earned by way of staking rewards. |

| Decrease Power Consumption: Not like mining, PoS staking requires considerably much less vitality, making it less expensive and environmentally pleasant. | Diminished Liquidity: In some types of staking, staked belongings are sometimes locked up for a interval, limiting buyers’ potential to react to market modifications or seize different funding alternatives. |

The STAKEaway: How one can Stake Crypto and Make Cash

Staking doesn’t contain steep upfront/working prices of mining: no GPUs or mining rigs are required. It doesn’t spike your vitality payments and is extraordinarily eco-friendly. For learners, the easiest way to attempt staking is through an internet platform.

Like all crypto-related investments, staking has a good diploma of volatility and threat. Decide established crypto belongings, and keep away from less-known altcoins to reduce threat publicity.

To study the fundamentals, contemplate beginning small with common belongings like Ethereum (ETH) or Cardano (ADA). Then, do thorough research and at all times train warning when investing/staking crypto belongings.

To study extra about incomes cash on crypto investments, together with the very best staking charges, subscribe to our Bitcoin Market Journal publication.

Crypto Staking Incessantly Requested Questions

What’s staking in cryptocurrency?

Staking refers to taking part in a proof-of-stake consensus mechanism by holding a certain amount of cryptocurrency in a pockets to help the community’s operations.

How does staking work?

When you stake your cash, they’re ‘locked’ for a sure interval and used to validate transactions and create new blocks. In return, you earn staking rewards.

What are the advantages of staking?

- Passive Revenue: You possibly can earn extra cash as staking rewards.

- Low Entry Barrier: Usually, you don’t want specialised {hardware} as you’ll for mining.

- Power Effectivity: It’s extra eco-friendly in comparison with PoW techniques.

- Community Safety: By staking cash, you contribute to the community’s robustness.

What are the dangers concerned?

- Locked Funds: Your staked cash will not be liquid, that means you’ll be able to’t promote or switch them till the staking interval is over (although LSDs try to deal with this draw back).

- Slashing: In some PoS networks, misbehaving nodes could lose a few of their staked cash.

- Market Volatility: The worth of your staked cash can fluctuate, affecting your returns.

How one can stake cryptocurrency?

- Do Analysis: Study concerning the particular cryptocurrency you have an interest in staking.

- Select a Pockets: Go for a staking-compatible pockets.

- Switch Funds: Transfer your cash to your staking pockets.

- Comply with Staking Directions: Every cryptocurrency and platform may have its distinctive staking course of, typically outlined of their official web site.

Can I unstake my cash?

Sure, however it could require ready earlier than you’ll be able to entry your staked cash. The time and situations could differ primarily based on the cryptocurrency.

Is staking higher than buying and selling?

Staking and buying and selling are totally different methods with their very own risk-to-reward profiles. Staking is usually extra passive and fewer dangerous than lively buying and selling however could supply decrease potential returns.

What is the minimal quantity required for staking?

This varies from one cryptocurrency to a different. Some would possibly permit you to stake with as little as one coin, whereas others could require a extra substantial minimal funding.

How does staking examine to bonds?

Staking and bonds supply passive earnings however differ in threat and regulatory oversight. Bonds are typically lower-risk and well-regulated, whereas staking affords probably larger returns however with extra volatility and fewer regulation.

Are you able to stake Bitcoin?

No, you can’t stake Bitcoin because it makes use of a Proof-of-Work consensus mechanism, not Proof-of-Stake. Nonetheless, some monetary providers supply to ‘stake’ your Bitcoin for you, however that is extra akin to lending reasonably than true blockchain staking.