Ethereum (ETH) has been experiencing volatility primarily as a result of its alignment with broader market developments.

Regardless of the approval of spot ETH ETFs, the occasion has not but impacted the price. Nevertheless, this might change within the close to future.

Do Ethereum ETFs Have a Vivid Future?

Spot ETF actions may considerably influence Ethereum’s price within the coming few months. Earlier this week, the US Securities and Alternate Fee (SEC) permitted itemizing spot ETFs by the start of July. This has elevated traders’ expectations massively.

“We expect the net inflows into ETH ETFs to be 20-50% of the net inflows into BTC ETFs over the first five months, with 30% as our target, implying $1 billion/month of net inflows,” Galaxy Analysis Staff’s Vice President Charles Yu said.

Nevertheless, this optimistic forecast doesn’t look totally real looking. To place it into perspective, spot Bitcoin ETFs have solely seen $857 million in inflows as of June 21, regardless of holding 84% of the complete ETF market share, with futures ETFs accounting for simply 14%. This raises doubts about whether or not spot Ethereum ETFs will obtain $1 billion in month-to-month inflows.

Learn extra: Ethereum ETF Defined: What It Is and How It Works

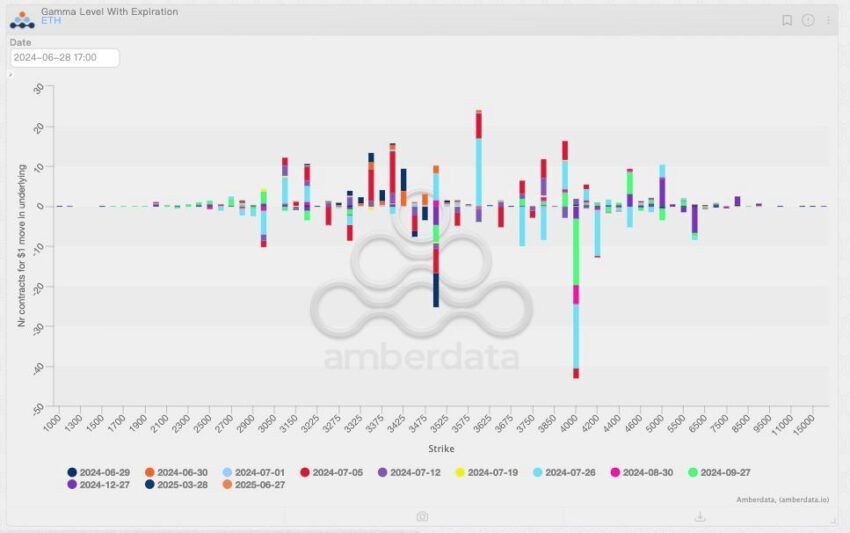

The uncertainty concerning the success of ETH ETFs in a comparatively bearish market may additionally result in a surge in market makers’ premiums. Gamma distribution danger, involving the sensitivity of choices to price adjustments, makes market makers alter their methods. With the added uncertainty of ETH ETFs, they’re prone to elevate premiums to cowl potential excessive price swings.

“ETH can still obtain effective support from market makers hedging on the downward path. As one of the solutions to the above-mentioned gamma distribution risk, market makers have also slightly raised their pricing for tail risk. Due to the additional uncertainty brought by ETH ETFs, the pricing for ETH tail risk is relatively high,” Griffin Ardern, Head at BloFin Analysis & Choices, instructed BeInCrypto.

Put merely, market makers may cost extra to account for the possibility that the price of ETH can be affected by one thing very uncommon and excessive. This implies traders have to pay additional to hedge their bets, which may discourage extreme hypothesis and scale back volatility.

Learn Extra: Easy methods to Put money into Ethereum ETFs?

Regardless of the actual fact the energetic danger administration may also help stabilize its price by offering assist and mitigating vital price drops, Ethereum’s price may battle to profit instantly from the launch of spot ETFs.

ETH Value Prediction: Eyeing New Highs

Ethereum’s price of $3,395 is way from establishing a brand new all-time excessive. The second-largest cryptocurrency rallied by over 30% following the approval of spot ETH ETFs, however practically half of this was worn out when ETH fell by 13% at first of the month. The uncertainty surrounding the launch drove the price down, together with the bearish broader market cues.

The state of affairs may shift because the market approaches the launch of ETFs. Bitcoin’s price began to development upward following the introduction of its spot ETFs, and the same final result is anticipated for Ethereum.

Ought to Ethereum’s price handle to capitalize on the potential bullishness and rise to flip $3,829 into assist, it might have managed to flip the 61.8% Fibonacci Retracement into assist. This line, often known as the bull market assist flooring, would translate to ETH’s additional positive factors.

Learn Extra: Ethereum (ETH) Value Prediction 2024/2025/2030

Whereas a brand new all-time excessive continues to be far-off, ETH will at the very least have a shot at making an attempt its hand at breaching $4,000. A profitable breach can be key in pushing the altcoin additional upwards.

But when this fails to occur, Ethereum’s price can be inclined to remaining consolidated underneath $4,000. The probably assist stage may stand between $3,700 and $3,800. Shedding this might invalidate the bullish thesis.

Disclaimer

According to the Belief Undertaking pointers, this price analysis article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal research and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.