As Sophon gears up for its Token Technology Occasion (TGE), investor consideration is sharply targeted on how the mission’s consumer-first Layer-2 technique and $73 million in funding will translate into its market debut, particularly in comparison with friends like Starknet, Scroll, and up to date Binance HODLer airdrop tokens.

Overview of Sophon

Sophon is an rising Layer-2 mission constructed on the ZK Stack – a modular blockchain growth toolkit powered by zkRollup expertise from zkSync. In contrast to infrastructure-focused Layer-2s corresponding to Scroll or Starknet, Sophon positions itself as a “consumer chain,” designed particularly to serve mainstream Web3 purposes, together with gaming, AI brokers, social networks, and prediction markets.

On the monetary entrance, Sophon efficiently raised $10 million in a seed spherical in March 2025, backed by outstanding buyers corresponding to Maven11, Paper Ventures, OKX Ventures, HTX Ventures, and dao5.

Along with conventional enterprise fundraising, the mission launched a community-driven node sale, securing an extra $63 million. This brings the entire capital raised by Sophon to over $73 million – a formidable determine, significantly in a bearish market, underscoring the mission’s robust enchantment to each institutional buyers and the broader builder group.

Supply: Crypto Fundraising

Sophon Tokenomics

Token Allocation

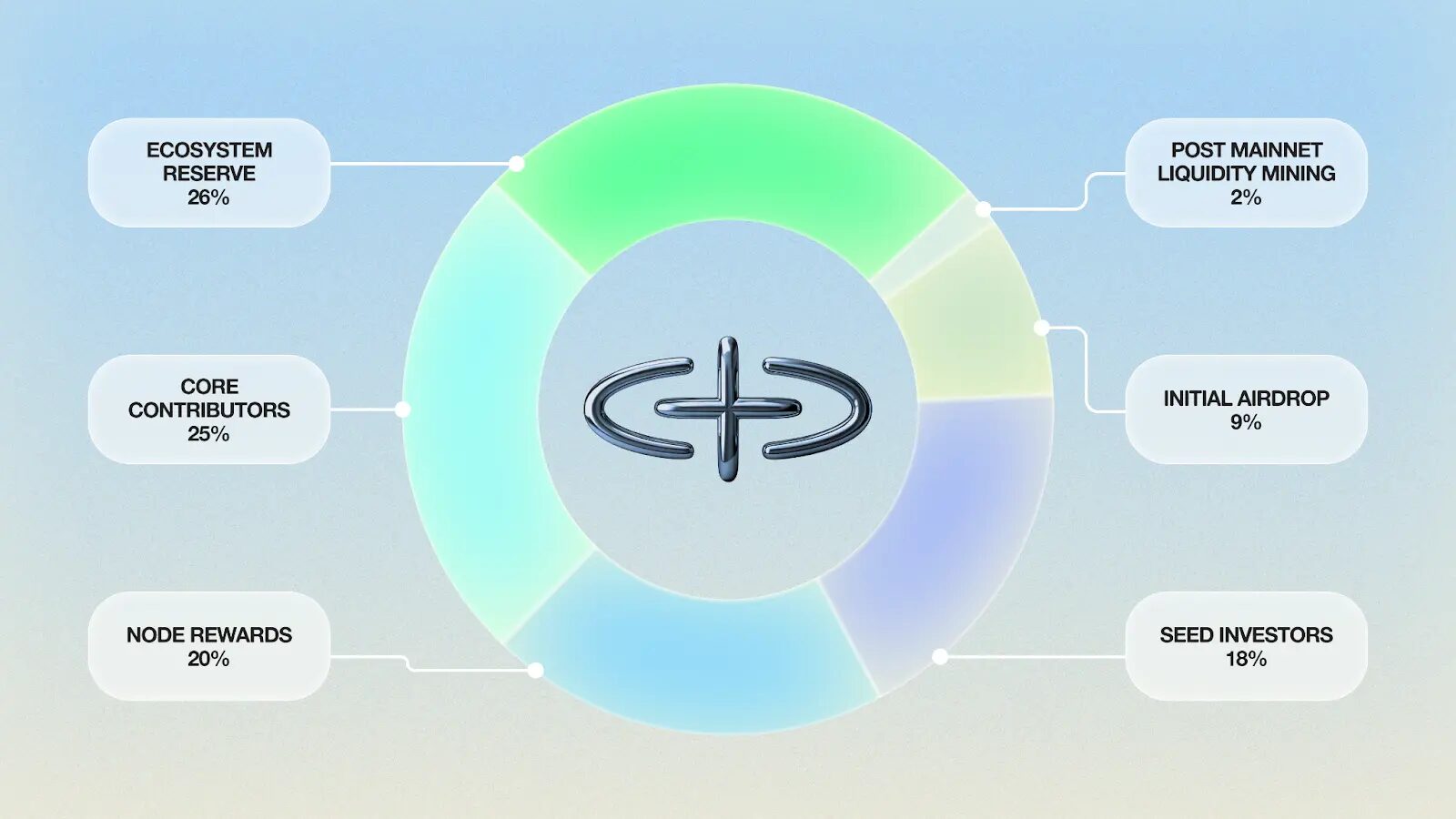

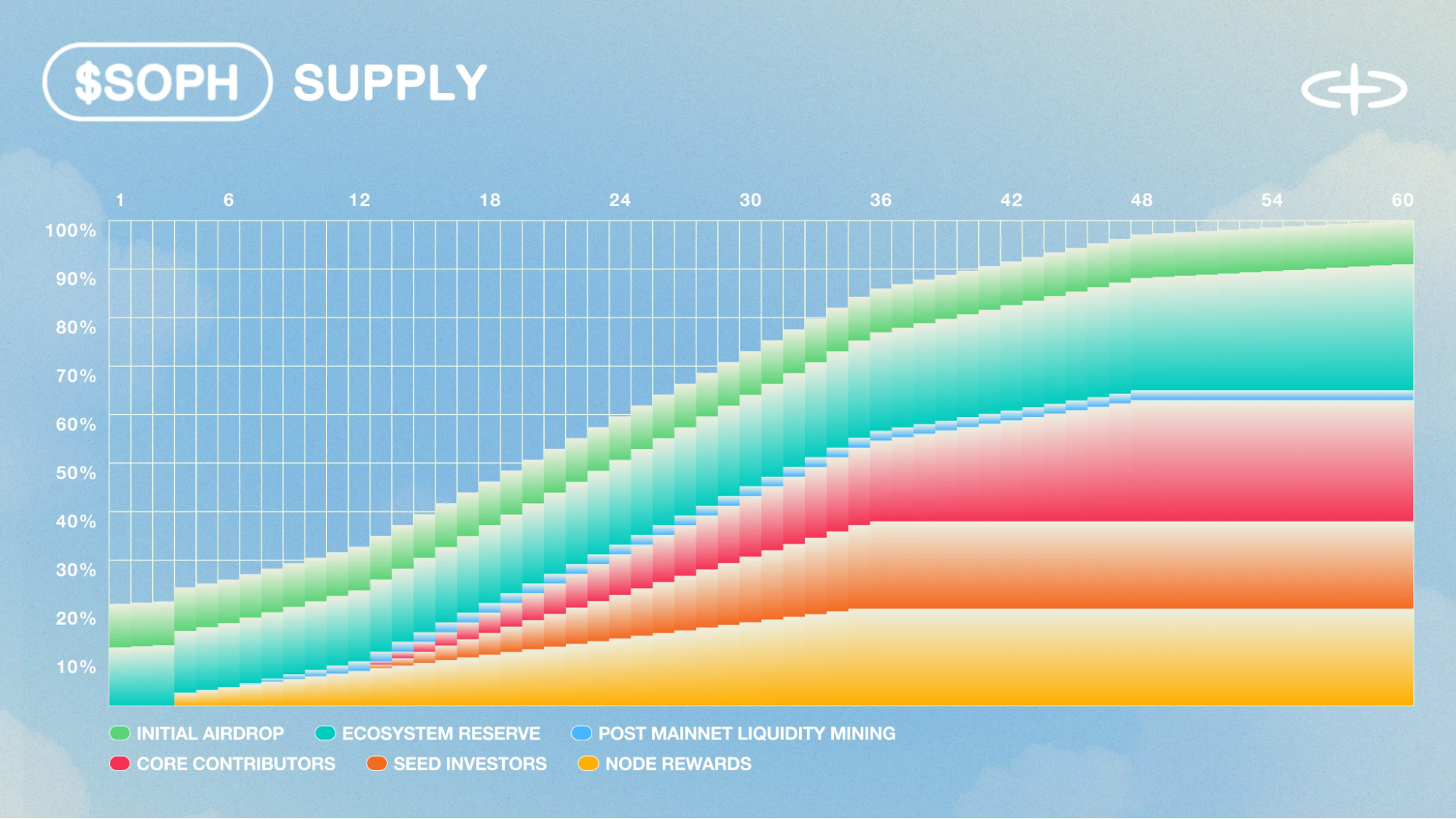

The SOPH token has a hard and fast complete provide of 10 billion. Its distribution is structured as follows:

- Ecosystem Reserve: 26%

- Core Contributors: 25%

- Node Rewards: 20%

- Seed Buyers: 18%

- Preliminary Airdrop: 9%

- Submit Mainnet Liquidity Mining: 2%

Supply: Sophon

One notable disadvantage in SOPH’s token distribution lies within the disproportionately excessive allocation to inside stakeholders – with 25% allotted to the core contributors and 18% to seed buyers, totaling 43% of the entire provide. This raises issues about potential centralization of management and market affect, particularly within the early phases.

SOPH’s tokenomics is thoughtfully designed with a long-term orientation, that includes optimistic parts corresponding to a managed launch schedule, robust incentives for node operators, and a considerable reserve for ecosystem progress.

Nonetheless, the big allocation to seed buyers and core contributors poses a big danger that warrants shut monitoring, particularly if the vesting schedule is accelerated or if any adjustments to the discharge phrases are made with out clear communication.

Supply: Sophon

Market Comparability

Evaluating SOPH with Starknet and Scroll is acceptable, as all three initiatives belong to the Layer-2 ecosystem leveraging zero-knowledge (ZK) expertise.

SOPH vs STRK

Starknet leverages zk-STARKs and its proprietary Cairo programming language, providing excessive velocity and safety at the price of EVM incompatibility. Its father or mother firm, StarkWare, has raised over $270 million in funding, together with a $100 million Collection D spherical at an $8 billion valuation.

When Starknet launched its native token STRK on February 20, 2024, it marked a number of noteworthy monetary milestones inside the Layer-2 house. The full provide of STRK was capped at 10 billion tokens, with roughly 728 million STRK (7.28% of the availability) launched into circulation at TGE via an airdrop and preliminary distribution.

STRK debuted at round $1.90, implying a FDV of $19 billion – an exceptionally excessive determine relative to different Layer-2 initiatives on the time. On that foundation, Starknet’s circulating market capitalization at launch was roughly $2.55 billion. Backed by hype and powerful branding, STRK jumped to $5, with FDV hitting $50B and cap $3.6B.

Supply: CoinGecko

Nonetheless, following the preliminary hype, STRK skilled a pointy decline, falling under $0.20 per token. FDV now sits round $1.6B, down over 97%, displaying how harshly the market corrects weak demand.

In distinction, Sophon has adopted a extra measured and pragmatic strategy. The mission raised $10M in seed funding and $63M from a node sale, avoiding inflated early valuations.

The workforce plans to launch round 20% of the entire provide at launch, minimizing potential liquidity shocks.

Extra importantly, Sophon doesn’t rely solely on speculative narratives round new programming languages or deep technical ZK improvements. As an alternative, it focuses on low-cost, user-friendly instruments and simple Web2 integration for broader adoption.

Primarily based on these fundamentals, Sophon’s FDV at TGE might vary from $1.5B to $3B. This might put SOPH’s launch price between $0.15 and $0.30.

SOPH vs SCR

Scroll raised $50 million in a Collection B spherical in March 2023, reaching a valuation of $1.8 billion. When the Scroll (SCR) token launched in October 2024, the mission introduced a complete provide of 1 billion SCR, with roughly 190 million tokens – 19% of the availability, launched into circulation at TGE.

The token opened at round $1.10, giving Scroll an preliminary market capitalization of roughly $209 million and a completely diluted valuation (FDV) of about $1.1 billion. This was seen as a cautious launch technique, balancing token distribution with market expectations for a newly launched zkEVM Layer-2 community.

Supply: CoinGecko

Shortly after launch, SCR dropped under $1 and finally stabilized between $0.30 and $0.40. Its present FDV is now beneath $400 million. This development illustrates two key takeaways: (1) regardless of a big fundraising and mainnet launch, Scroll opted for a comparatively modest FDV; and (2) market demand for ZK infrastructure tokens stays exploratory and tentative.

In distinction, Sophon (SOPH) represents a brand new path for zk-Rollups. Quite than competing within the infrastructure arms race, Sophon goals to seize actual consumer demand by specializing in consumer-facing verticals.

If SOPH can ship participating dApps, corresponding to AI brokers, mini-games, and prediction markets, it could be higher positioned to keep up price stability post-TGE, in contrast to SCR.

The Scroll case highlights the significance of aligning token valuation with each progress potential and present fundamentals. For SOPH, an affordable FDV at TGE would vary between $1.5 billion and $3.0 billion, implying a token price of $0.15 to $0.30.

This locations SOPH in a impartial valuation zone: increased than Scroll resulting from its consumer-centric narrative, however much more conservative than Starknet, whose preliminary $35 billion FDV proved unsustainable within the face of actual market scrutiny.

Comparability with Current Binance Hodlers Airdrop Initiatives

Beneath is a comparability of SOPH with a number of latest token initiatives that adopted the airdrop mechanism for BNB holders (HODLers): Nexpace (NXPC), Signal (SIGN), Hyperlane (HYPER), StakeStone (STO), and Haedal (HAEDAL). These initiatives characteristic massive complete token provides and launched through Binance’s HODLer Airdrop program.

- Nexpace (NXPC): A token inside the MapleStory (Avalanche) gaming ecosystem. Circulating provide at itemizing was ~169 million out of 1 billion (16.9%). Preliminary itemizing price was ~$3.03, equal to ~$3.0 billion FDV; ATH price reached ~$3.70 (FDV ~$3.7 billion).

- Hyperlane (HYPER): A permissionless cross-chain messaging protocol. Listed at $0.27, FDV round ~$280 million; ATH price $0.35 (FDV ~$350 million).

- StakeStone (STO): Whole provide of 1 billion. Preliminary circulating provide ~225.3 million (22.5%). Listed round $0.12 (FDV ~$190 million); ATH $0.215 (FDV ~$210 million).

- Haedal Protocol (HAEDAL): Whole provide of 1 billion. Listed at $0.17 (FDV ~$170 million); ATH $0.213 (FDV ~$210 million).

- Signal (SIGN): Whole provide of 10 billion, preliminary circulating provide ~1.2 billion. Listed at ~$0.08 (FDV ~$0.8 billion); ATH price $0.127 (FDV ~$1.27 billion).

Generally, these airdropped tokens had an FDV at TGE often under $1 billion, in some instances just a few hundred million USD, resulting from massive complete provide and low preliminary circulation. Their ATH costs had been often 1–3x the itemizing price, with FDVs peaking under ~$3–4B, besides NXPC.

In comparison with these initiatives, SOPH’s projected multi-billion FDV suits effectively inside the anticipated vary. With a complete provide of 10 billion, SOPH’s token price would doubtless be within the tens of cents. With an FDV of $2–3B, the workforce targets a SOPH launch price between $0.20 and $0.30.

SOPH Value Prediction: Pre-TGE

Drawing from these comparables, a conservative SOPH TGE price could be ~$0.10–0.20 (FDV $1–2 B), with an optimistic higher certain close to $0.30 (FDV $3 B) if market situations are very bullish. This vary aligns with Layer-2 friends and modestly under Starknet’s excessive valuation.

In all instances, FDV at launch is a key reference level, and SOPH’s strongest comps (Scroll, Manta) recommend a mid-single- to low-double-digit cent price beneath regular market situations.

Learn extra: Trading with Free Crypto Indicators in Night Dealer Channel