Solana price surged by 61.37% over the previous month, rising from round $109.46 in early April to a excessive of $176.63 on Could 10, 2025. The transfer is seen on the SOLUSD 1D chart from TradingView. This marks Solana’s highest stage since early March 2025.

The price is now approaching a key resistance zone between $176 and $180. In January 2025, Solana failed to carry above this vary and dropped quickly after testing it. The identical zone stays a problem within the present construction.

Trading quantity throughout this one-month rally totaled 36.26 million SOL. Whereas the uptrend stays intact, the chart exhibits price motion starting to gradual close to resistance, reflecting elevated promoting stress.

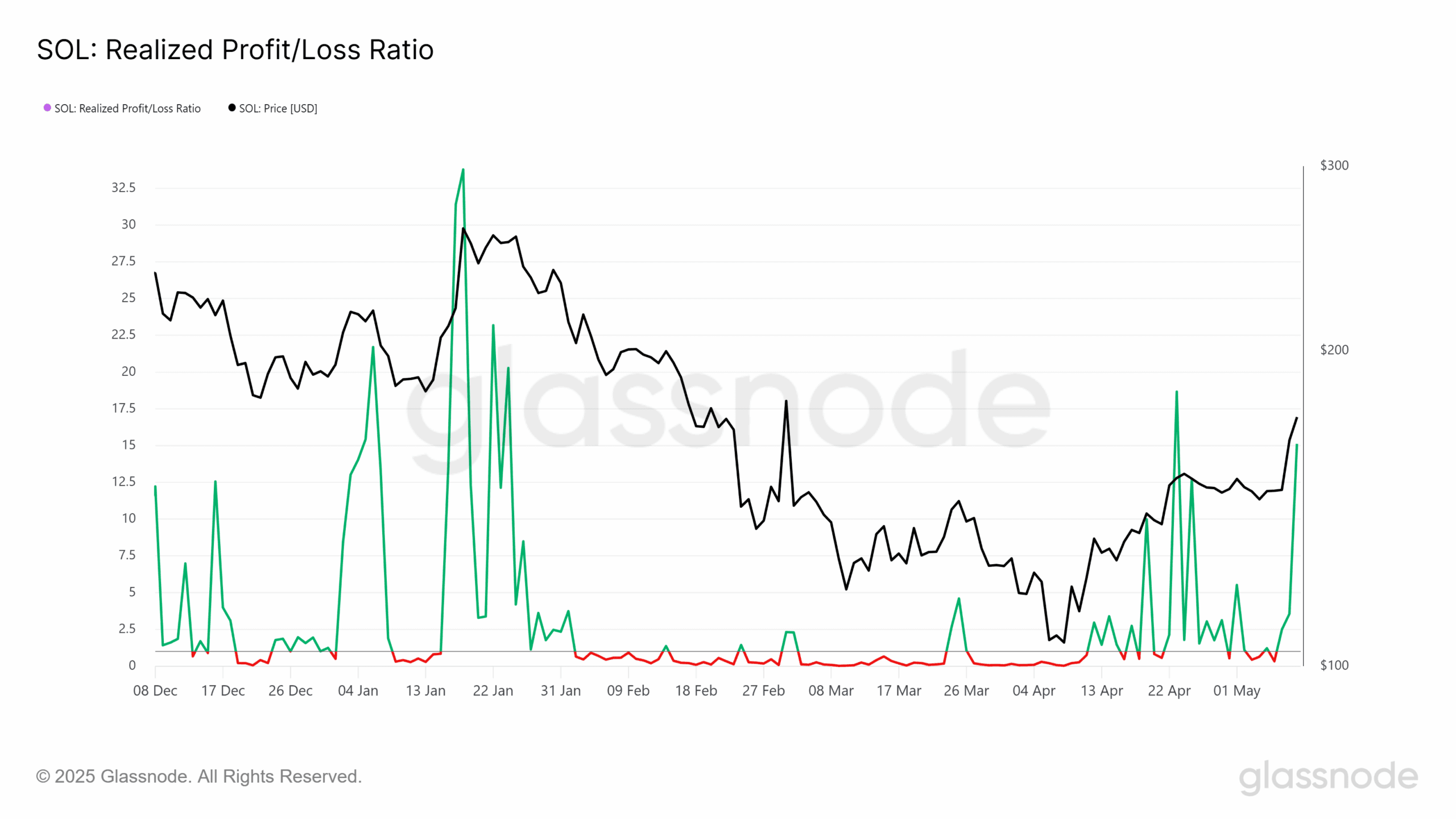

Promoting Stress Rises as Solana Realized Revenue/Loss Hits 15.0

Solana promoting stress has elevated, based mostly on information from Glassnode. The Solana Realized Revenue/Loss ratio reached 15.0 this week. This metric exhibits how a lot revenue traders lock in throughout trades. Traditionally, ranges above 10.0 have preceded short-term price drops.

Extra merchants are promoting Solana to safe earnings from the latest price rally. The sharp rise within the Solana Realized Revenue/Loss ratio displays this shift in investor conduct. When this ratio goes excessive, it typically means volatility is rising.

In January 2025, Solana confirmed related information. That interval additionally noticed the Realized Revenue/Loss ratio cross 10.0 earlier than the Solana price fell. The present numbers present that profit-taking is once more shaping short-term market exercise.

This promoting stress can gradual down additional features and make it more durable for SOL price to interrupt previous the $200 resistance.

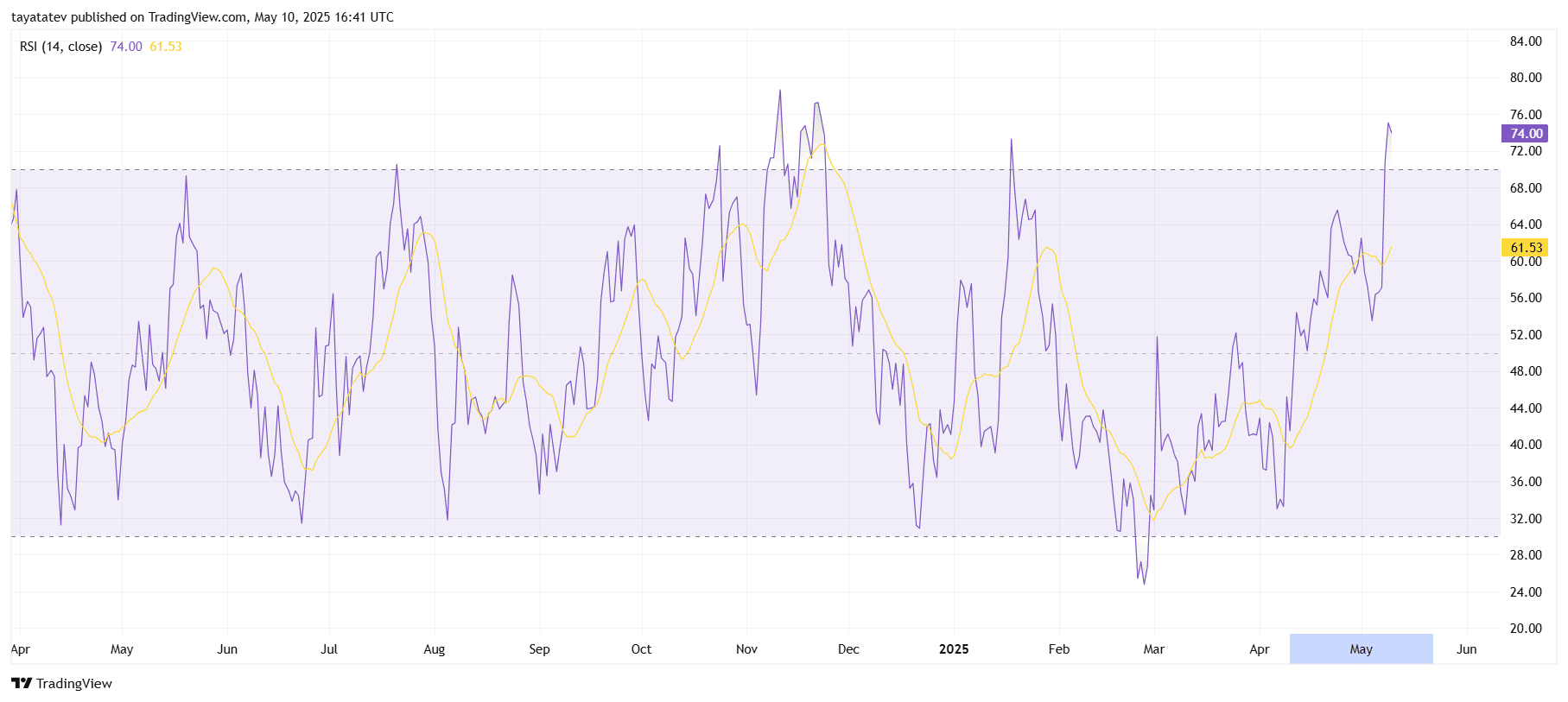

Solana RSI Crosses Overbought Zone at 74.00 on Could 10

Solana’s Relative Power Index (RSI) reached 74.00 on Could 10, 2025, based mostly on the every day chart printed on TradingView. The indicator has now moved into the overbought zone, which usually begins above 70.00. This stage is usually related to robust shopping for momentum, however it may well additionally sign that the asset could also be overheating.

The earlier time Solana RSI crossed related ranges was in January 2025. After that peak, the price declined from above $180 to almost $140. The RSI in that interval mirrored related situations now seen once more in Could.

Within the present chart, the yellow 14-day transferring common line is at 61.53, whereas the RSI line sharply rises above it. This divergence displays robust price acceleration in latest days. When paired with the latest rise in Solana’s Realized Revenue/Loss ratio, the info highlights elevated market exercise and elevated promoting threat.