Solana Faces Heavy Resistance at $200

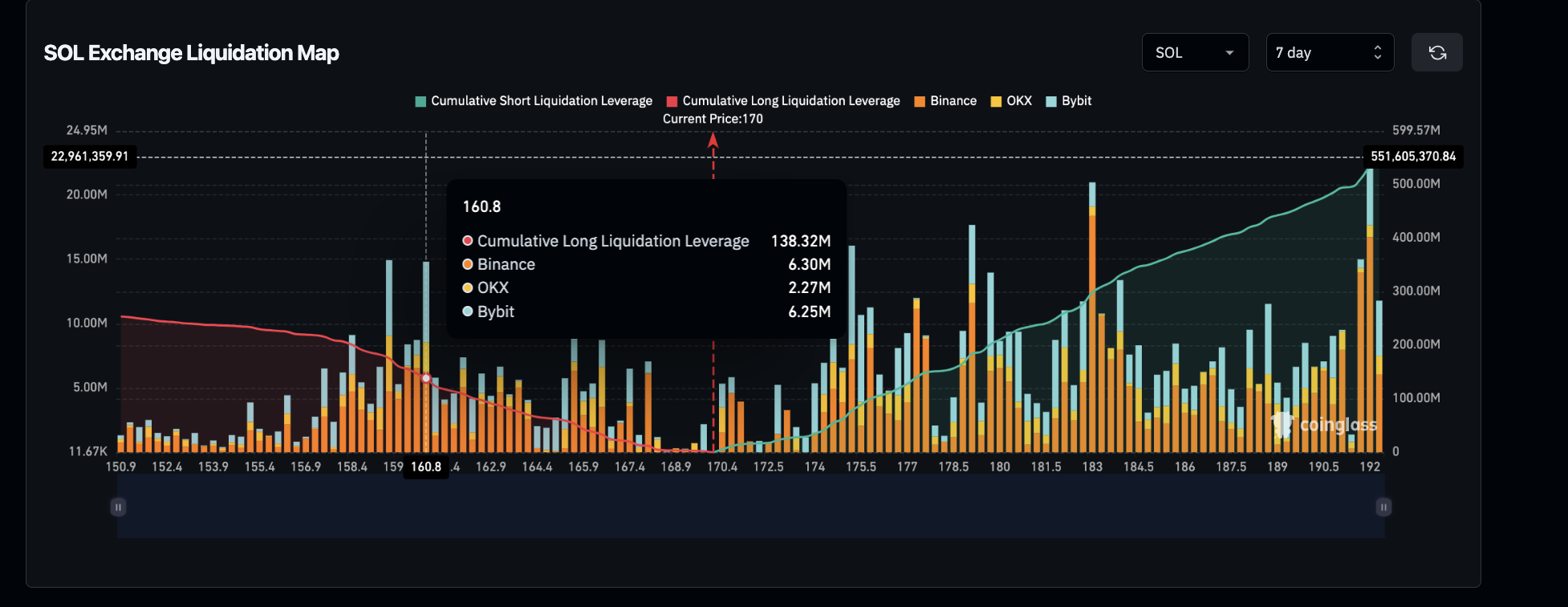

Solana price is caught in a downward trajectory, with robust resistance forming across the $200 mark. Bulls have to push previous this degree to regain momentum, however the odds seem stacked in opposition to them. Knowledge from Coinglass reveals that brief leverage positions in Solana exceed $551 million, far outweighing lengthy positions at $253 million. This imbalance highlights the market’s bearish stance, with merchants betting on additional draw back.

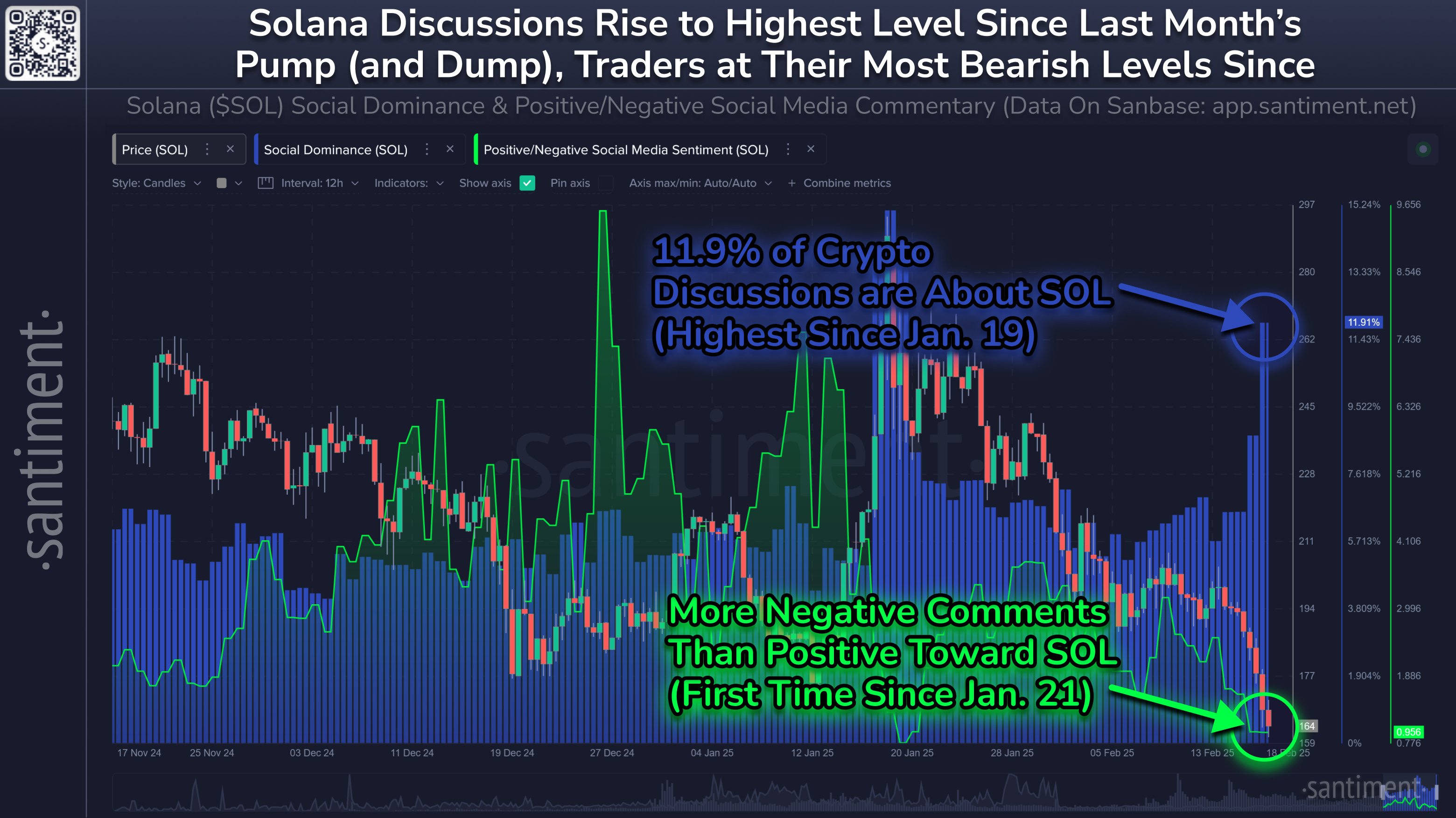

If bears capitalize on weak help ranges, Solana may slide towards $160.8, which stays the subsequent vital demand zone. With out a surge in shopping for curiosity, SOL’s path to restoration stays unsure. The fading meme coin hype, which as soon as fueled Solana’s explosive rally, has now became a serious legal responsibility, additional dampening investor confidence.

Solana’s DeFi Ecosystem Booms Regardless of Value Struggles

Regardless of the bearish price motion, Solana’s decentralized finance (DeFi) ecosystem is increasing quickly. Knowledge from DeFi Llama reveals that the community has attracted $3.2 billion in stablecoin inflows, marking a 37.3% enhance in simply 50 days.

Main protocols like Jito and Jupiter have skilled exponential progress, with Jito’s complete worth locked (TVL) skyrocketing from $700 million to $2.8 billion over the previous yr. Jupiter’s TVL has surged from $210 million to $2.53 billion, a staggering 1,100% leap. In the meantime, Raydium, Solana’s largest decentralized change, recorded a pointy enhance in buying and selling volumes, reaching $61 billion in Dec. 2024.

Solana price is at a vital juncture. Holding above $170 is essential for bulls to regain management, however the lack of robust shopping for curiosity raises crimson flags. A decisive break above $185 may restore confidence and push SOL again towards $200. Nevertheless, if promoting stress continues, a drop to $160 or decrease stays an actual risk.