Solana (SOL) could also be on the verge of a serious price breakout as optimism builds round a possible spot ETF approval, in line with crypto analyst @CryptoGodJohn.

The analyst, who has practically 1 million followers on X, advised his viewers on June 11 that Solana is “on the verge of a massive breakout on the daily,” citing each the technical setup and the rising probability of an ETF resolution within the subsequent 2–3 weeks.

“Wouldn’t be surprised to see Solana go on a run soon,” he wrote.

Solana Worth Will Climb Towards $250, Analyst’s Chart Reveals

CryptoGodJohn connected a Solana price chart to assist his upside outlook.

In it, observers can word SOL/USD approaching a descending trendline resistance that has capped price rallies since late 2024. A confirmed breakout above this line — at the moment close to $170 — may open the door to a retest of the $188.59 and $237.58 resistance ranges, beforehand established throughout Solana’s final main uptrend.

CryptoGodJohn’s name provides to a rising refrain of bullish voices backing Solana as the subsequent institutional crypto asset after Bitcoin and Ethereum. If the SEC approves even one spot Solana ETF, it may unleash new capital inflows, notably if bundled with staking yield merchandise.

Eric Balchunas Sees ‘Altcoin ETF Summer’ With SOL within the Lead

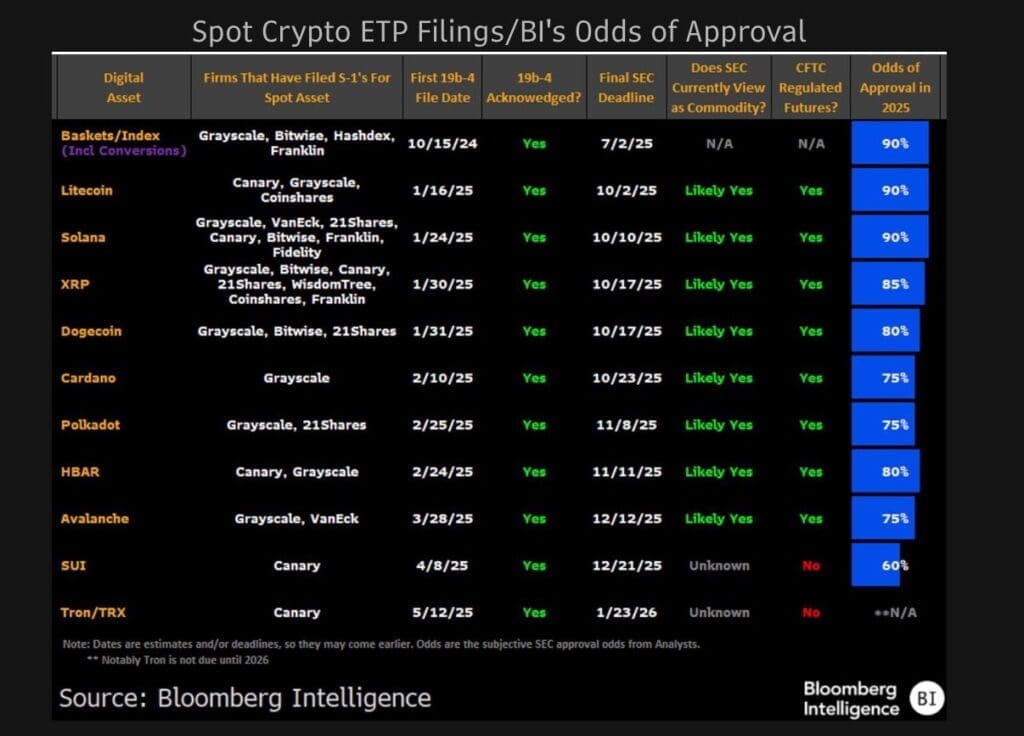

CryptoGodJohn’s feedback adopted a publish by Bloomberg’s senior ETF analyst Eric Balchunas, who stated buyers ought to brace for a “potential Altcoin ETF Summer,” with Solana seemingly main the cost. He highlighted a brand new Bloomberg Intelligence dashboard exhibiting recent odds for all spot crypto ETF filings.

The information reveals a number of spot Solana ETF functions from main issuers, together with Grayscale, VanEck, Bitwise, and 21Shares. A number of of those filings have already been acknowledged by the SEC, with ultimate resolution deadlines as early as July and working via December 2025.

Balchunas famous that the SEC might take a extra proactive strategy to altcoin ETFs following its current approvals of Bitcoin and Ethereum spot merchandise. The Bloomberg dashboard additionally suggests some Solana filings might embody a staking yield characteristic, doubtlessly making them extra engaging to establishments.

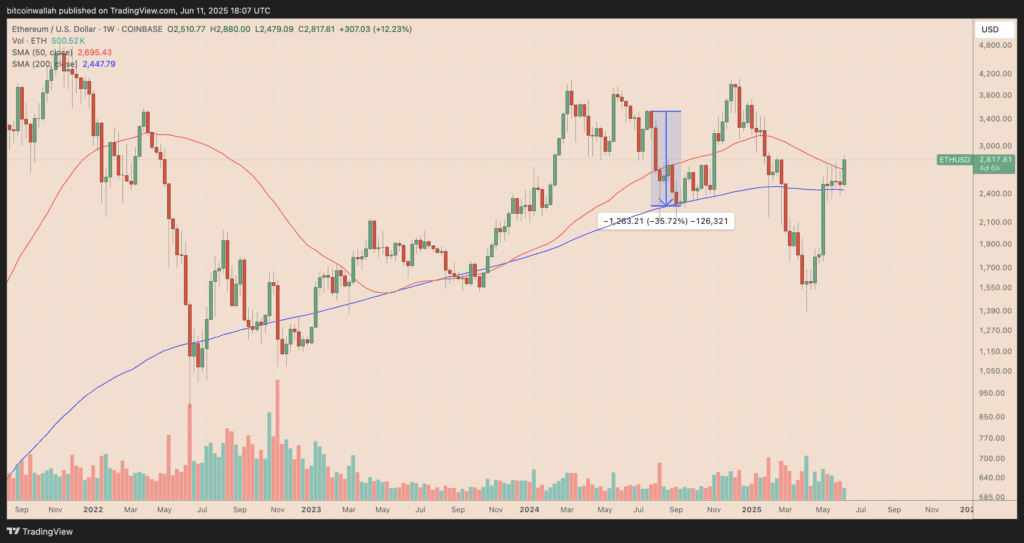

ETFs might not assure a full-fledged bull run instantly after launch, however they might allow speculative upside strikes in Solana markets. That’s akin to how Ethereum rallied forward of its spot ETF launch in July, solely to say no sharply afterward, suggesting a “sell-the-news” phenomenon.