NAIROBI (CoinChapter) — Solana has surpassed Ethereum in Q1 2025 community income, producing $819.08 million from transaction charges and out-of-protocol income, in keeping with knowledge by The Block. That determine is sort of thrice increased than Ethereum’s $282.07 million and dwarfs Bitcoin’s $51.97 million.

The income leaderboard locations Tron subsequent after Solana and Ethereum with $156.86 million, adopted by BNB Chain with $70.71 million. The entire Layer-1 and Layer-2 income mixed stood at $1.42 billion, with Solana accounting for over 57% of that complete.

The numbers sparked reactions throughout the crypto group. “BREAKING: Solana generated more revenue in Q1 2025 than all other L1 & L2 chains combined,” wrote SolanaFloor in a put up on X.

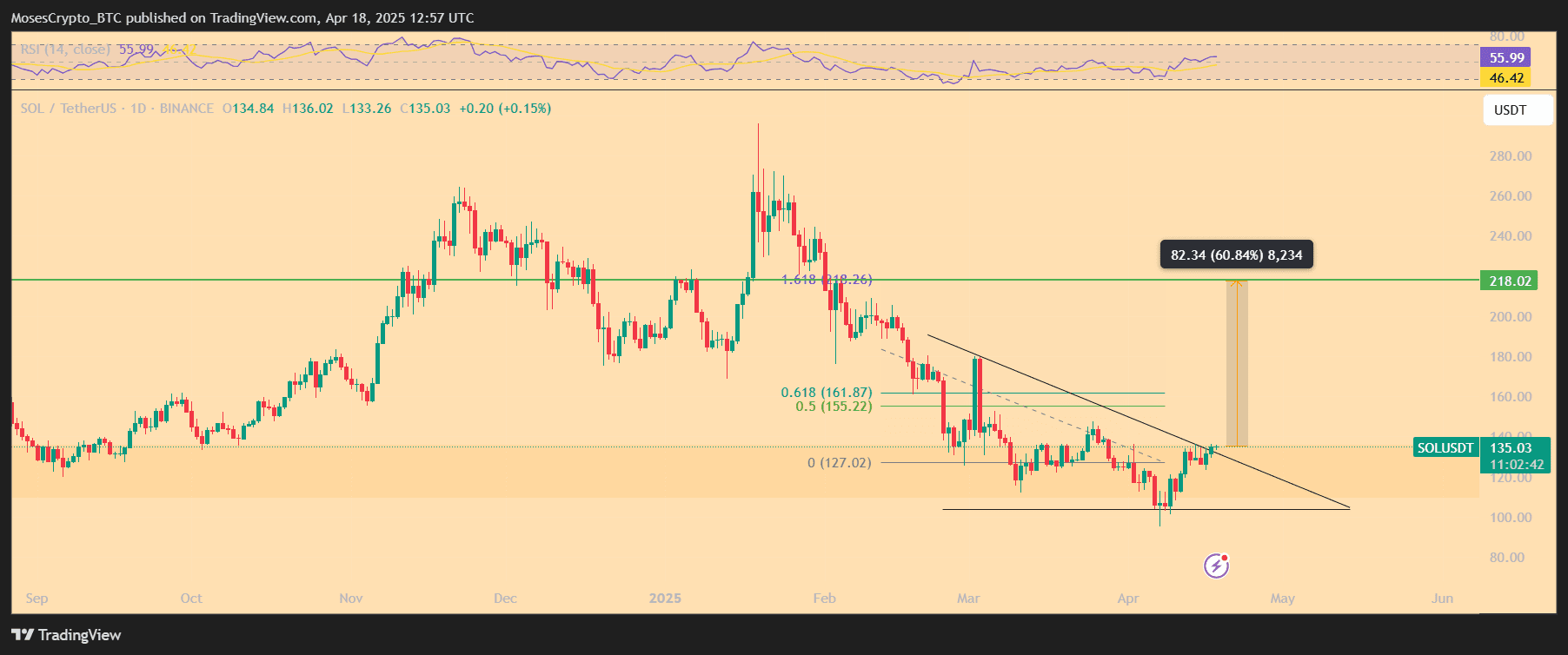

SOL Worth Breakout Eyes $218 as Bullish Setup Features Traction

Solana’s technical setup now factors to a 60% rally towards $218. The SOL/USDT chart exhibits the token breaking out of a descending wedge sample, a construction that always indicators a bullish reversal. On the time of writing, SOL traded at $133.99, down barely intraday however above current lows.

In line with knowledge from TradingView Solana price tasks a price goal of $218 primarily based on Fibonacci ranges. The transfer implies a 60.84% upside from the breakout level. Nonetheless, a rejection at $142 earlier this week highlighted short-term promoting strain.

Dealer Alexia warned that failure to reclaim $135 may push SOL towards help zones at $112 and $100. “Weak price action = bearish trend,” she added, citing the current rejection as a key resistance affirmation.

Whales Look to Purchase the Dip as ETF Momentum Builds

Regardless of the rejection, some market contributors stay optimistic. Analyst CryptoBullet posted that he expects a short-term pullback to the $118–$109 area earlier than one other leg increased. He plans to enter lengthy positions in that vary, citing a possible “mid-term wave up.”

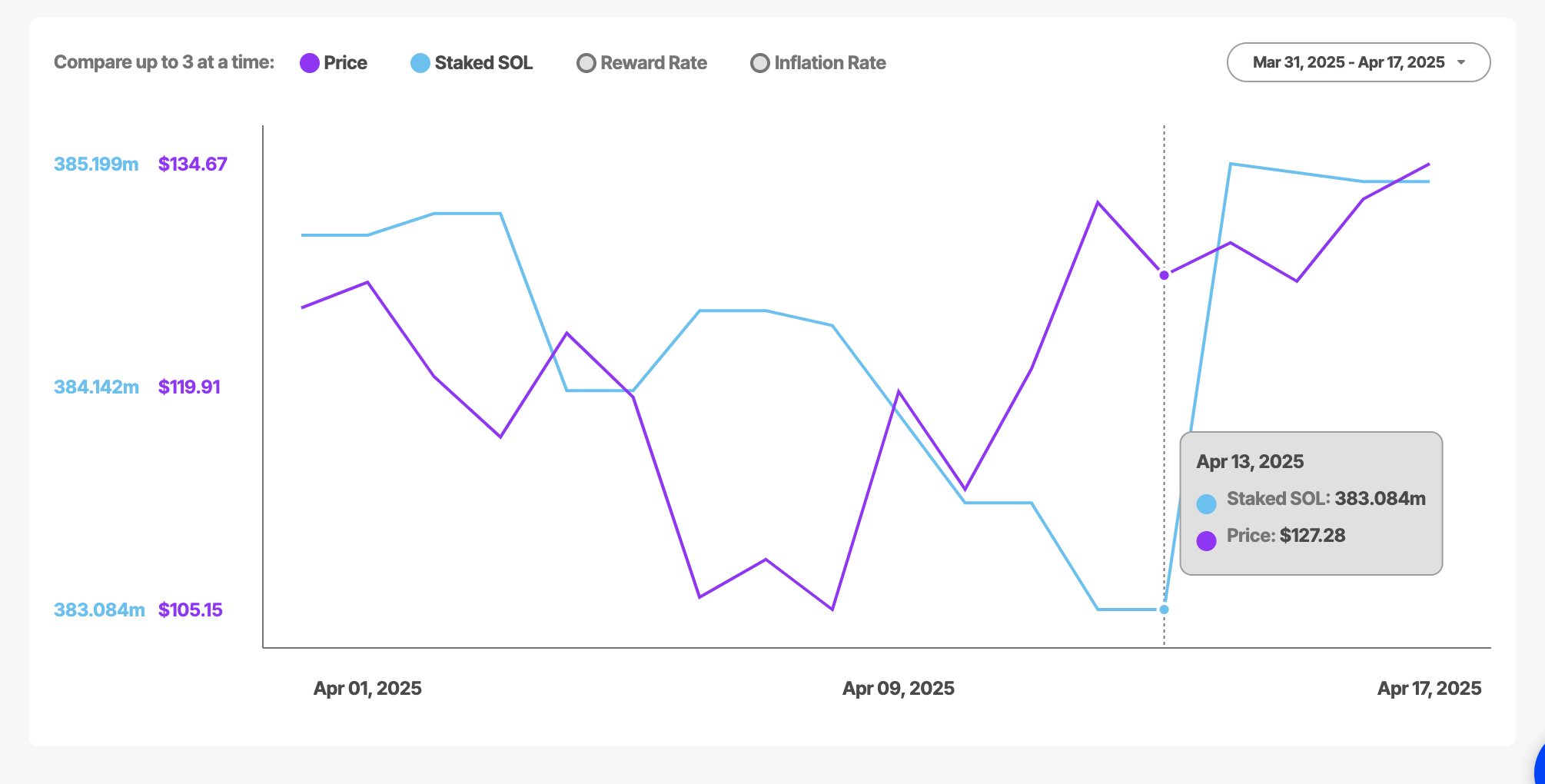

Including to bullish sentiment is a spike in institutional curiosity. Over a four-day interval ending Apr. 17, Solana noticed over $270 million value of latest staking deposits. The entire staked provide elevated by 2 million SOL—from 383.1 million to 385.1 million—in keeping with knowledge from StakingRewards.

This surge in staking, considered by market contributors as a bullish dedication, reduces liquid provide and amplifies upward price strain. It additionally follows the repeal of a DeFi-related regulation by U.S. President Donald Trump, a transfer that has reinvigorated Solana’s decentralized finance sector.

DeFi and Coverage Tailwinds Gasoline Lengthy-Time period Progress Case

Solana’s rise comes amid a broader rotation into various Layer-1 blockchains. The community’s complete worth locked (TVL) has elevated sharply because the repeal of the DeFi regulation final week. This regulatory shift could have catalyzed each the bounce in staking exercise and a possible ETF push.

Market watchers additionally interpret the income surge as greater than a brief development. “This is not just about fees. It’s a structural shift in how institutions view altcoin exposure,” one put up learn, suggesting the Q1 income numbers may mirror rising long-term institutional confidence.

By way of fundamentals, the relative power index (RSI) for SOL sits round 55, indicating impartial momentum. With bullish patterns forming and macro tailwinds in play, merchants stay divided on the short-term outlook however seem aligned on long-term power.

Notably, Solana’s Q1 efficiency has positioned it forward of Ethereum when it comes to community income and stoked momentum within the token’s technical construction. Furthermore, whereas short-term volatility stays, data-driven conviction—starting from staking to DeFi development—could proceed to help SOL’s upward trajectory. The $218 stage now stands as the subsequent main goal, supplied bulls can maintain key help zones and take in incoming promoting strain.