On June 13, a number of corporations up to date their Solana ETF filings with the U.S. Securities and Trade Fee (SEC). The adjustments purpose to reply the SEC’s earlier questions. Nonetheless, the regulator just isn’t in a rush to approve them, in line with a supply who spoke to Reuters.

The up to date filings got here from a number of candidates, together with Canary’s Marinade Solana ETF, the 21Shares Core Solana ETF, and the Bitwise Solana ETF.

These firms hope to launch exchange-traded funds that observe the price of the Solana token. Whereas the amendments are supposed to transfer the method ahead, there’s nonetheless no timeline for when—or if—the SEC will approve them.

X Suspends A number of Solana Initiatives, Together with Pump.Enjoyable, Over API Misuse and Coverage Issues

On June 17, a number of Solana-based crypto initiatives misplaced entry to their official X accounts. The suspended accounts embrace meme token platform Pump.Enjoyable, GMGN, BullX, and Eliza OS. X didn’t give a public rationalization for the bans, leaving the crypto neighborhood confused.

Essentially the most mentioned principle facilities round Pump.Enjoyable allegedly utilizing X’s API with out correct authorization. Stories declare the platform scraped information with out subscribing to X’s paid developer entry. This may breach X’s API phrases and should have triggered the suspensions.

Some unconfirmed reviews additionally recommend that different accounts beneath the identical umbrella could have hosted inappropriate livestreams. Although not verified, these claims have elevated public scrutiny of the affected platforms.

Pump.Enjoyable has already confronted criticism for enabling rip-off tokens. Customers on X have claimed that “99% of tokens launched on Pump.Fun are rug pulls.” In March 2025, the platform geo-blocked Indian customers with out discover, possible attributable to native crypto laws.

The bans increase considerations about the way forward for Solana-based memecoins and decentralized launchpads. Pump.Enjoyable helped gas this 12 months’s memecoin wave, however its sudden removing from X could shift customers towards extra regulated platforms. Belief in Solana’s meme token infrastructure seems to be weakening.

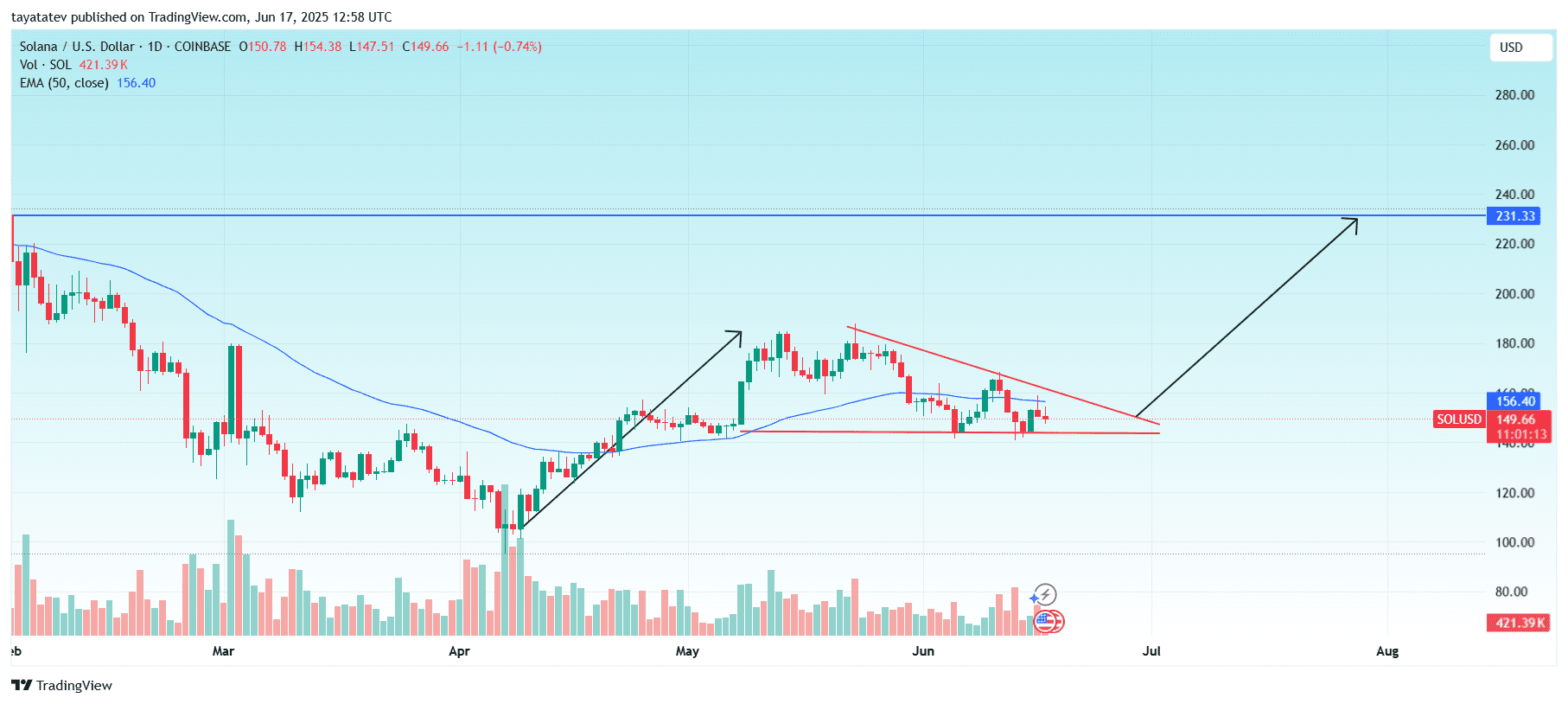

Solana Kinds Bullish Triangle, Eyes 82% Rally Towards $272

Solana (SOL) has created a bullish triangle sample on the day by day chart. The chart exhibits the token buying and selling at $149.66, consolidating inside a narrowing vary fashioned by a horizontal help line and a descending resistance line.

A bullish triangle—additionally known as a bullish symmetrical triangle—kinds when price motion creates decrease highs whereas sustaining a steady help degree. This construction exhibits that sellers are shedding momentum, whereas consumers proceed to defend a key price degree. Because the triangle tightens, strain builds. A breakout above the higher trendline usually triggers robust upward motion.

If Solana confirms a breakout above the triangle’s resistance, the sample suggests a possible rally of up to 82% from the present price. Based mostly on this projection, SOL may rise from $149.66 to just about $272.

Quantity throughout the sample has decreased, which inserts typical triangle formation conduct. A breakout accompanied by a spike in quantity would possible verify the transfer.

As of June 17, SOL trades beneath the 50-day EMA at $156.40. A transparent transfer above each the EMA and the triangle resistance would sign power and will set off the bullish goal zone.

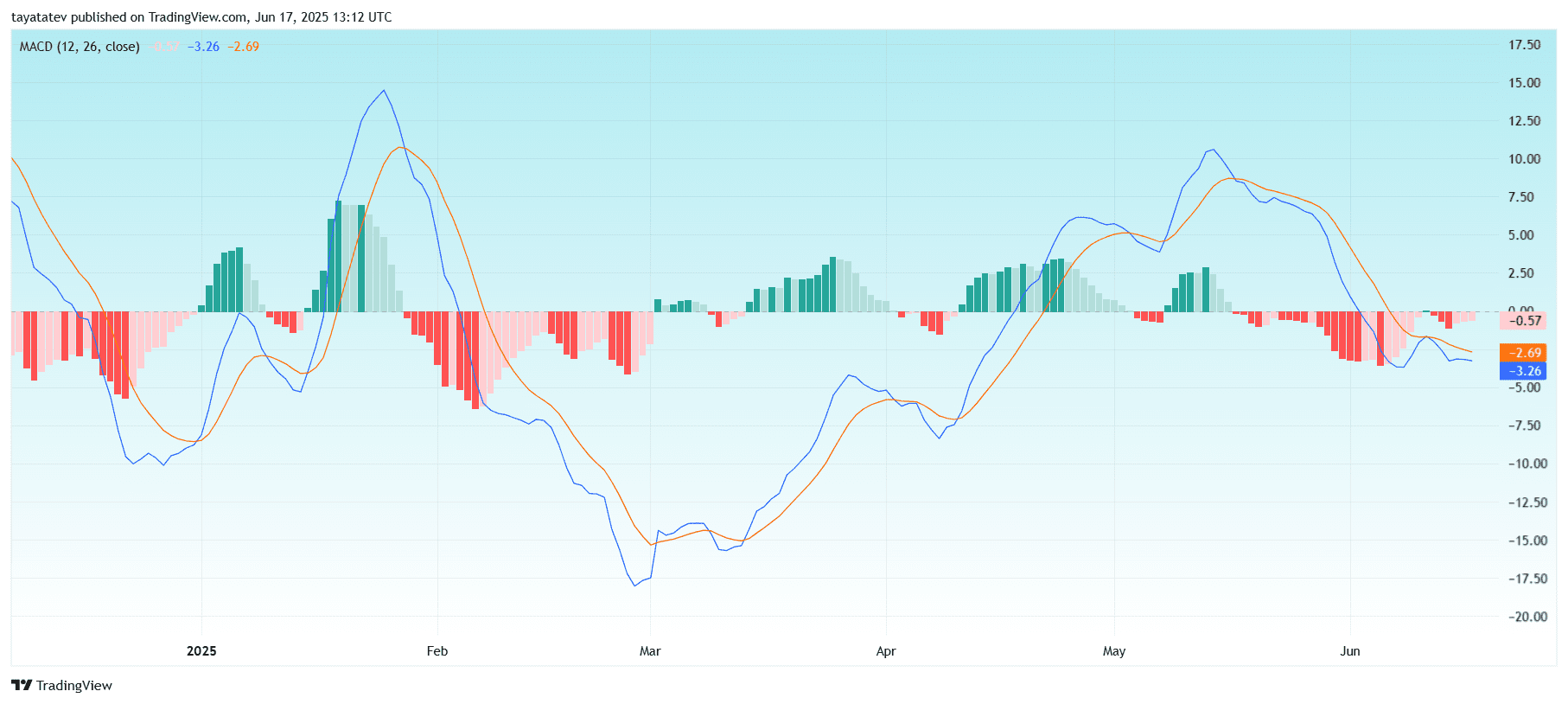

MACD Indicators Weak Momentum for Solana

As of June 17, 2025, the MACD indicator for Solana (SOL) exhibits weak momentum with no confirmed bullish reversal. The MACD line stands at –3.26, whereas the sign line is barely larger at –2.69. Each stay beneath the zero line, confirming that downward momentum continues to be lively.

Though the histogram has began to shrink, with the most recent bar at –0.57, this solely signifies a slight discount in promoting strain. A bullish crossover has not occurred, which means the MACD line has not but crossed above the sign line. Till that occurs, the chart doesn’t verify any upward development. The setup nonetheless leans bearish, and a transparent crossover above the sign line is required to help the case for a breakout.

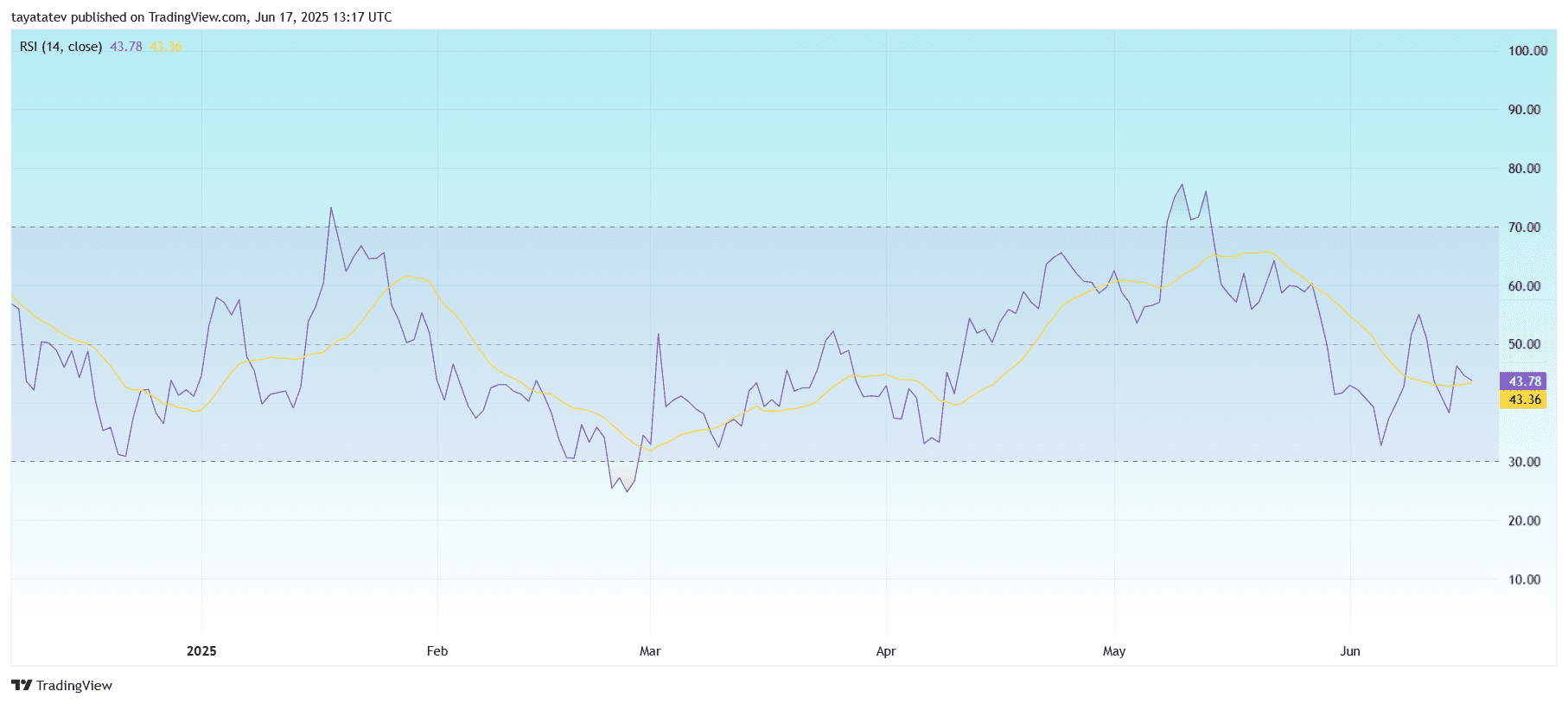

Solana RSI Hovers Under 50 With Weak Momentum

The Relative Power Index (RSI) for Solana (SOL) presently reads 43.78, with its 14-day easy transferring common at 43.36. The RSI is a momentum indicator that measures the pace and magnitude of latest price actions to evaluate whether or not a cryptocurrency is overbought or oversold. The usual RSI scale ranges from 0 to 100. Ranges above 70 usually sign overbought circumstances, whereas ranges beneath 30 point out oversold circumstances.

As of now, Solana’s RSI sits beneath the impartial midpoint of fifty. This means that the asset is in a bearish or weakening momentum part. When the RSI stays within the 30 to 50 vary, it often displays consolidation or downward strain in price motion. For the reason that RSI and its transferring common are transferring sideways and stay shut to one another, this confirms the dearth of robust directional momentum.

There’s additionally no seen bullish or bearish divergence between the RSI and the price chart. Divergences usually present early alerts of a development reversal, however on this case, each indicators proceed to align with weak price motion.

If RSI drops towards 30, the token could enter the oversold zone. That degree has traditionally attracted some shopping for curiosity, however present readings present that Solana continues to be hovering in a neutral-to-bearish space with no clear sign of a reversal but.

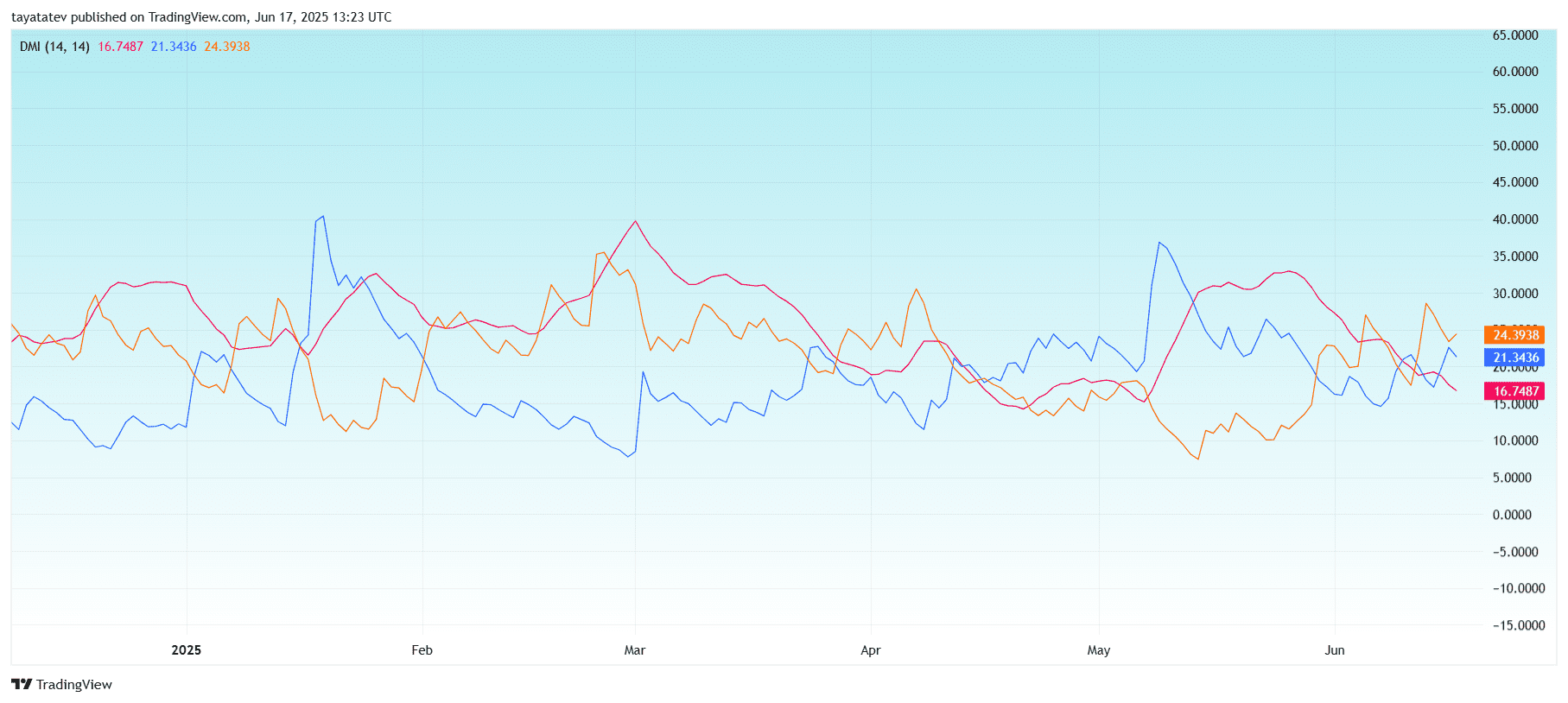

Directional Motion Index Exhibits Combined Development Indicators for Solana

The Directional Motion Index (DMI) for Solana (SOL) makes use of three traces to guage development power and path: the Optimistic Directional Indicator (+DI), the Damaging Directional Indicator (–DI), and the Common Directional Index (ADX). These are plotted right here with the next values:

-

+DI (orange line): 24.39

-

–DI (blue line): 21.34

-

ADX (pink line): 16.74

The +DI is presently above the –DI, which usually signifies bullish strain. Nonetheless, the ADX stays beneath 20, suggesting that the continuing development is weak or not well-established. The ADX measures development power no matter path. Readings beneath 20 usually point out an absence of development or uneven market conduct.

Over latest weeks, the +DI and –DI have crossed a number of occasions, displaying indecision and back-and-forth motion between consumers and sellers. At current, consumers maintain a slight edge, however with out robust ADX help, any directional transfer lacks affirmation.

For the sign to show stronger, ADX would wish to rise above 20–25, ideally whereas +DI stays above –DI. Till then, Solana’s price motion could proceed sideways or expertise short-term fluctuations with out sustained motion