Picture supply: Getty Photos

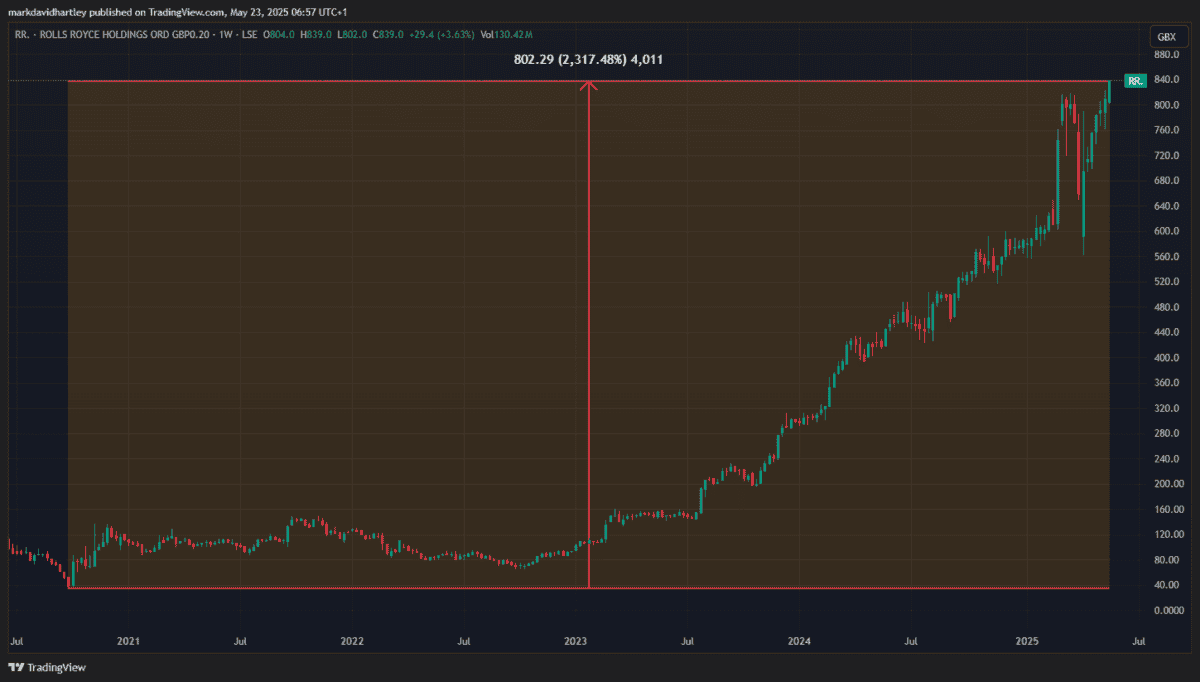

When the pandemic first struck in early 2020, Rolls-Royce shares took a pointy plunge. Like many on the time, the aerospace engineer’s price collapsed — falling from 244p to 35p inside a matter of months.

at present’s price, it’s virtually unbelievable to assume it was that low simply 5 years in the past. On the time, airways had been grounded the world over and panicked shareholders had been dumping inventory by the barrel.

However amongst them had been undoubtedly some savvy buyers, the sort who take to coronary heart the recommendation of legendary buyers like Warren Buffett: “Be fearful when others are greedy, and greedy when others are fearful.”

A courageous soul who grabbed the chance to purchase the shares again then can be very pleased with their returns at present. The inventory — now buying and selling at round £837p — is up by over 2,300% for the reason that lowest level throughout Covid.

As little as £1,000 invested at that degree would now be value an eye-watering £24,170 — equating to an annualised return of roughly 90% per yr!

Sadly, I used to be not a type of buyers. So, have I missed out solely, or will one other alternative come up?

Looking undervalued shares

Rolls-Royce has made a spectacular restoration however I don’t anticipate it to achieve one other 2,000% by 2030. To capitalise on at present’s market, I have to discover one other undervalued inventory on the point of a multi-year lengthy rally.

Listed here are 4 core ratios that may assist buyers establish undervalued shares with development potential:

- Value-to-earnings (P/E)

- Value-to-book (P/B)

- Enterprise worth to EBITDA (EV/EBITDA)

- Value-to-earnings development (PEG)

Ideally, the P/E ratio ought to be under the UK market common — normally about 15. Each the P/B and PEG ratios ought to be under 1 and the EV/EBITDA under 10. These should not onerous and quick guidelines — they usually differ based mostly on which business the corporate is in — but it surely’s a superb place to begin.

A profitable mixture

When making use of these filters to a inventory screener, one FTSE 250 firm stands out to me: TP ICAP (LSE: TCAP). This main UK-based monetary companies agency specialises in interdealer broking, market infrastructure and knowledge options.

With a market cap of £1.98bn, it’s sufficiently big to be thought-about steady whereas sufficiently small to nonetheless get pleasure from a long time of development. It has average P/E and P/B ratios of 12.25 and 0.98, respectively, and an honest EV/EBITDA ratio of 4.17. Most promisingly, it has a really low PEG ratio of 0.1, suggesting earnings development far forward of its price.

However its fortunes might nonetheless be derailed. Since Brexit, the UK has grow to be much less engaging as a monetary hub, resulting in a decline in over-the-counter rate of interest derivatives buying and selling. Now, TP ICAP lags behind US rivals like BGC when it comes to income development and dealer productiveness. If this development continues, TPICAP might have to innovate to remain within the sport.

To satisfy this problem, it has thought-about itemizing its knowledge division, Parameta Options, in New York. Nonetheless, mitigating elements have delayed the IPO.

Regardless of these dangers, I nonetheless assume it reveals indicators of promising development potential. With robust fundamentals and a profitable mixture of ratios, I consider it’s among the best UK shares to contemplate at present for long-term development.