SEC Requests Revisions on Solana ETF Proposals

The U.S. Securities and Trade Fee (SEC) is shifting ahead in its overview of Solana (SOL)-based spot exchange-traded fund (ETF) proposals, signaling a attainable inexperienced mild for approval later this yr. A number of issuers, together with Grayscale, VanEck, 21Shares, Canary, Bitwise, Franklin, and Constancy, have obtained requests from the SEC to replace their S-1 registration filings within the coming week.

The SEC’s request reportedly focuses on revisions to the redemption mechanism inside the proposed ETFs, together with the swap construction between ETF shares and SOL tokens. One other space of regulatory consideration is whether or not staking SOL tokens inside the fund construction will likely be permissible, a subject that is still legally ambiguous however is more and more related given the yield-generating nature of many Layer 1 belongings.

These developments signify a notable shift within the regulatory posture towards Solana. Bloomberg analysts have now raised the likelihood of a Solana spot ETF approval to 90%, up from an earlier estimate of 70%. The earliest potential approval date is at present projected for October 10, 2025, although trade watchers imagine a closing SEC choice might come as early as July if progress continues on the present tempo.

“The SEC asking for updated S-1s is a very positive signal,” stated Eric Balchunas, Senior ETF Analyst at Bloomberg Intelligence. “It means they’re engaging with the filings rather than outright rejecting or delaying them indefinitely.”

Accelerated Timeline and Market Impression

Based on reporting from BeInCrypto and Blockworks, the SEC is predicted to return feedback on the up to date S-1 filings inside 30 days. If issuers reply shortly, approval might arrive as quickly as late July, properly forward of the official October deadline. This has sparked renewed optimism out there, with prediction platform Polymarket displaying a pointy improve within the odds of a July approval.

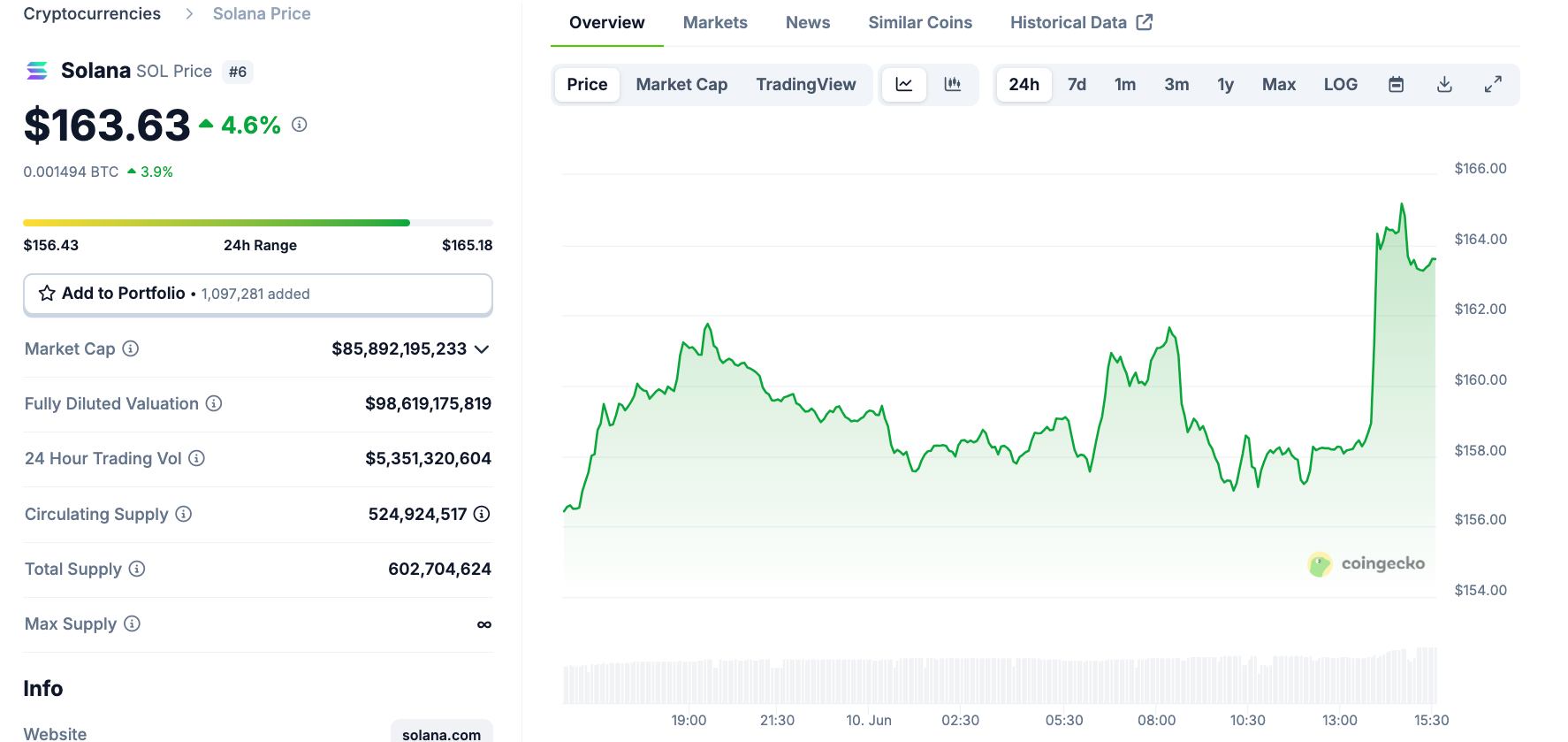

Amid this hypothesis, SOL surged by over 4.5% intraday. Technical analysts famous that SOL broke above its 50-day shifting common and is now testing a descending channel, with a possible goal close to $183 if bullish momentum continues.

Supply: CoinGecko

The elevated optimism round Solana ETFs follows a broader pattern of rising institutional acceptance of crypto-based funding merchandise. Following the profitable rollout of spot Bitcoin ETFs earlier this yr, consideration has turned to different high-cap belongings equivalent to Ethereum, and now Solana, as logical subsequent steps.

Solana’s community has gained traction with builders and retail customers alike, notably resulting from its excessive throughput and low transaction prices. Whereas the SEC has but to formally declare SOL a commodity, analysts imagine it’s “likely” that the asset falls beneath the identical regulatory remedy as BTC and ETH.

Learn extra: Is Solana a Good Funding in 2025? A Complete Evaluation