YEREVAN (CoinChapter.com) — Caroline Crenshaw, Commissioner on the U.S. Securities and Change Fee (SEC), criticized the company’s newest stance on stablecoins. She mentioned the SEC stablecoin steering comprises authorized and factual errors. Crenshaw accused the company of making a “distorted picture” of the USD stablecoin market.

The SEC not too long ago acknowledged that some USD stablecoins are usually not securities. It additionally mentioned these cash could also be exempt from transaction reporting. Crenshaw objected to those claims in an announcement dated April 4. She argued that the stablecoin market has critical dangers, and the company’s new strategy fails to replicate that.

She pushed again on the SEC’s declare that issuer actions — like preserving the token steady or guaranteeing redemptions — cut back threat. Crenshaw acknowledged that the company’s view overlooks how these mechanisms truly work in observe.

The SEC mentioned some USD stablecoins can be found to retail customers solely by means of intermediaries. Crenshaw mentioned that is deceptive. She argued that almost all USD stablecoins are offered this fashion, not just some.

She mentioned,

“It is the general rule, not the exception, that these coins are available to the retail public only through intermediaries who sell them on the secondary market, such as crypto trading platforms.”

Crenshaw added that over 90% of USD stablecoins in circulation are distributed on this manner.

This level exhibits a significant distinction between Crenshaw’s evaluation and the SEC stablecoin steering. She emphasised that the market construction is totally different from what the general public could assume primarily based on the SEC’s wording.

Business Responds to SEC Stablecoin Steering

Components of the crypto trade responded to the SEC’s replace. Whereas Caroline Crenshaw expressed issues, some trade leaders welcomed the clarification.

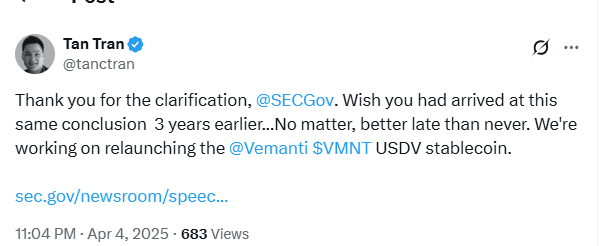

Ian Ballina, founding father of Token Metrics, mentioned the steering shifts focus to essential issues. Tan Tran, CEO of Vemanti Group, mentioned he had hoped to see this modification earlier. Ian Kane of Midnight Community mentioned it helps these following the foundations.

Regardless of constructive reactions from some sectors, Crenshaw warned that the steering doesn’t replicate actual stablecoin dangers. She mentioned the brand new strategy could give a false sense of safety to the general public.

Crenshaw additionally disputed the SEC’s assurance that full reserve backing reduces threat. The SEC mentioned that if a USD stablecoin issuer holds reserves equal to the token provide, it might deal with limitless redemptions.

Crenshaw disagreed. She mentioned,

“The issuer’s overall financial health and solvency cannot be judged by the value of its reserve.”

Crenshaw defined that reserve ranges don’t present the issuer’s liabilities or different monetary dangers.

She added that stablecoin dangers embrace insolvency, publicity from different monetary actions, and stress throughout market downturns. Based on Crenshaw, these points stay even when the stablecoin seems totally backed.

Tether Audit Highlights Broader Stablecoin Market Issues

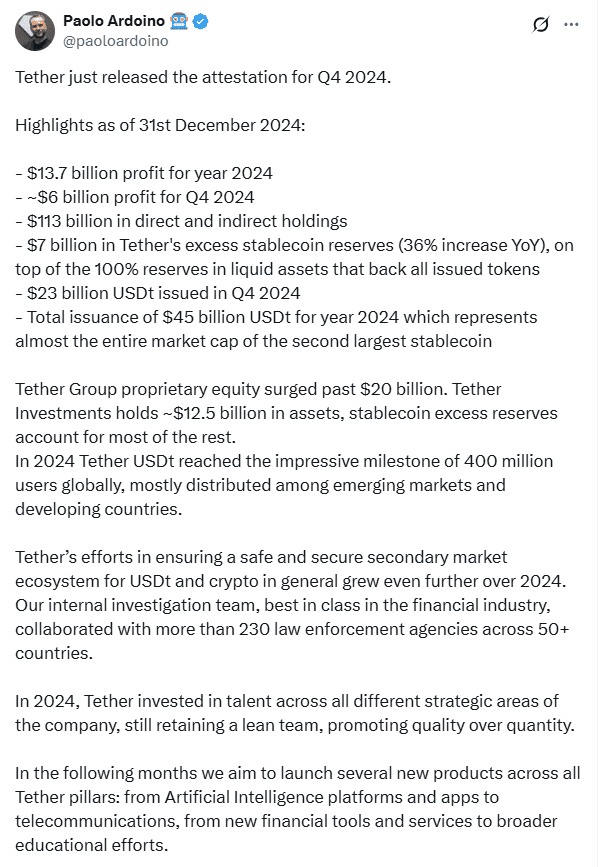

The stablecoin debate comes weeks after Tether started working with a Huge 4 accounting agency. The purpose is to audit its reserves and ensure its USDT stablecoin is totally backed.

On March 22 Tether CEO Paolo Ardoino mentioned this course of might transfer sooner if Donald Trump returned as U.S. President. Trump is seen as extra supportive of crypto.

The Tether audit raises new questions on how USD stablecoins are backed and the way clear issuers actually are. Crenshaw’s feedback join to those broader issues about stablecoin dangers and the construction of the stablecoin market.