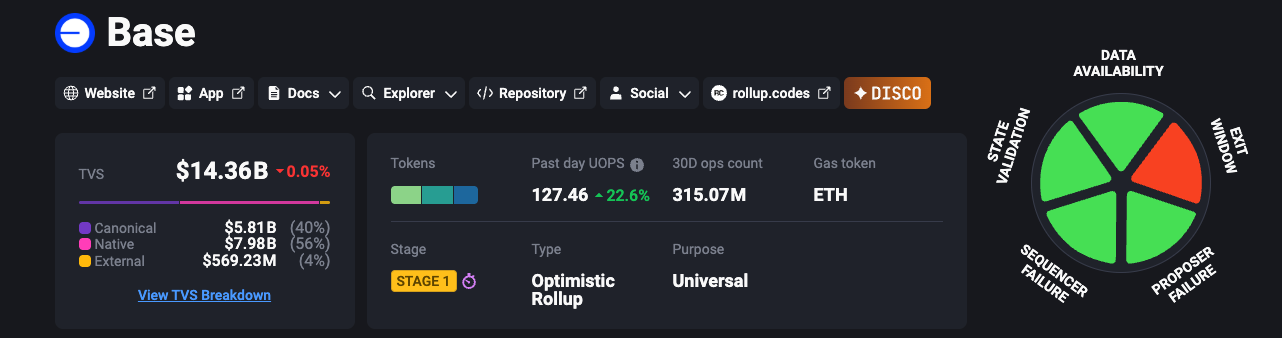

Base, Coinbase’s OP-Stack rollup, has quietly turn out to be the biggest real-world-asset (RWA) playground in crypto after Ethereum itself.

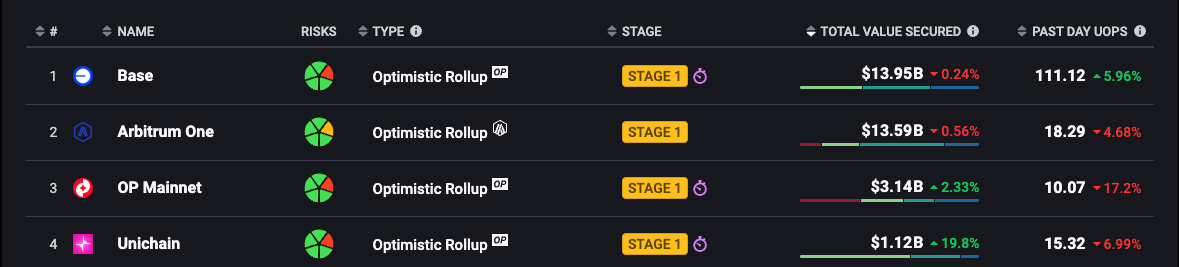

Worth secured on the community now tops $14.3 billion – up 173% year-to-date -putting Base simply forward of Arbitrum for first place amongst L2s by whole worth secured (TVS) and roughly $13.7 billion in whole worth locked (TVL) throughout bridges and native property.

Supply: L2Beat

In opposition to that backdrop, RWA specialists have flocked to Base:

- Keeta (KTA) delivered eye-popping throughput and a 6× price run-up previously month.

- Tangible (TNGBL) is bringing fee-sharing actual property NFTs to L2 rails.

- OpenEden’s tokenized U.S. Treasury suite now spans three chains, with its flagship USDO and TBILL vaults pushing a mixed $450 million of Treasuries on-chain.

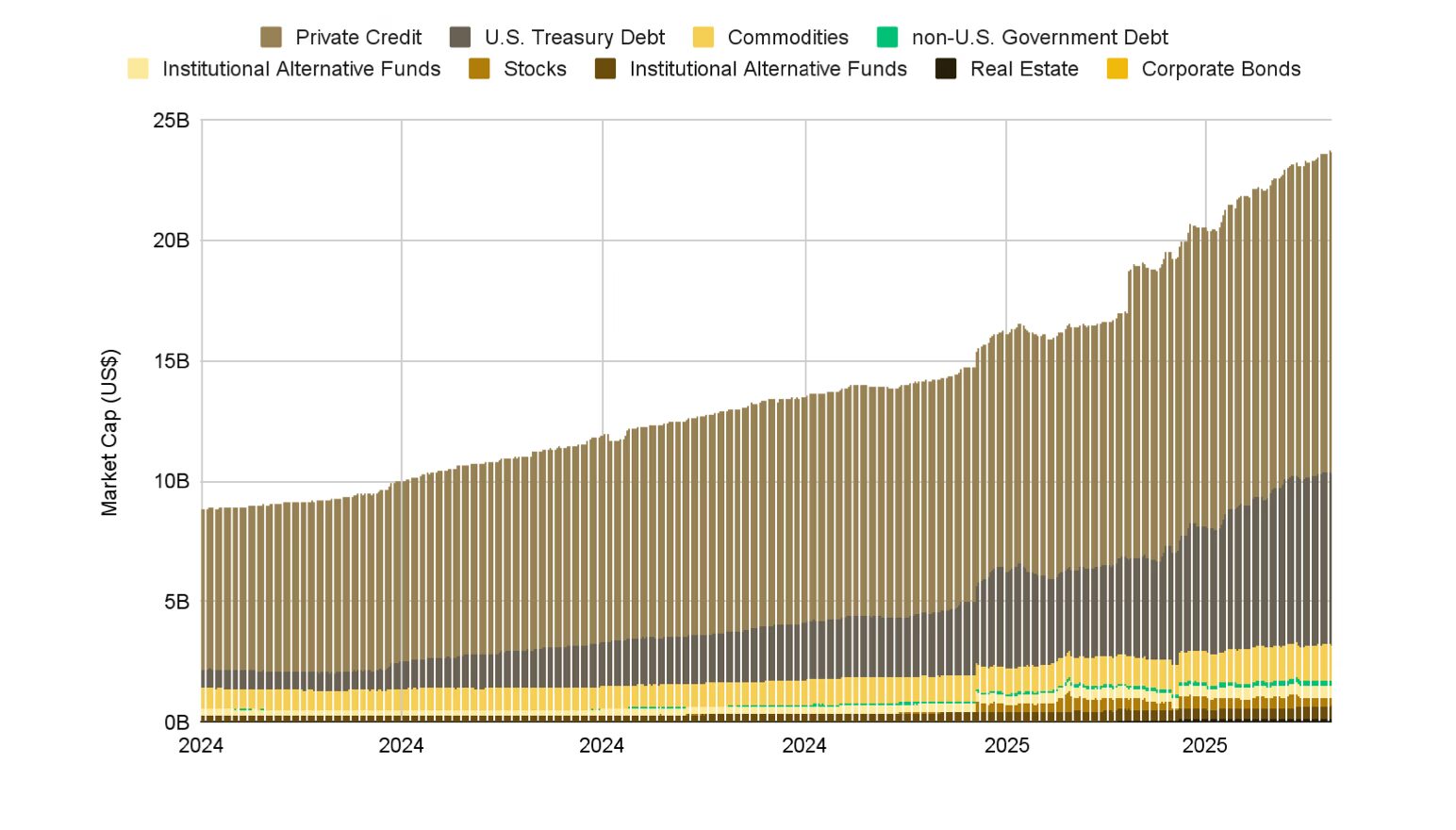

Collectively, these tasks showcase why RWAs are the fastest-growing crypto vertical—sector capitalization has already ballooned 260% to $23 billion in 2025 alone.

KTA: The Quiet Large with Loud Numbers

Keeta’s advertising and marketing writes itself: 10 million TPS, sub-second finality, and ex-Google CEO Eric Schmidt on the advisory roster. After debuting on Base in early Could, the token climbed from $0.22 to $1.18 (+435%) and briefly crossed $600 million in circulating market cap.

Information protection has amplified the transfer. A 99Bitcoins deep dive highlighted Keeta’s “8× rally in two weeks,” crediting the surge to BitMart’s itemizing and investor urge for food for compliant L1s.

Coindesk’s March Daybook first flagged Keeta’s public testnet, framing it as a key RWA catalyst for Base.

Supply: TradingView

Whereas every day active-wallet metrics stay opaque, on-chain dashboards tracked the token amongst Moralis’s top-five “trending assets” by 24-hour tackle rely earlier this week.

Different Pipelines: Tangible & OpenEden

Tangible has ported its actual property market from Polygon to Base to slash settlement prices and faucet native liquidity. TNGBL modifications arms close to $0.27 right now, up roughly 40 % over the previous fortnight after the protocol launched USDC-denominated lease distributions.

Tangible presently controls about $43 million of tokenized property, wine, and gold, nonetheless totally on Polygon however earmarked for migration to a Base vault later this yr.

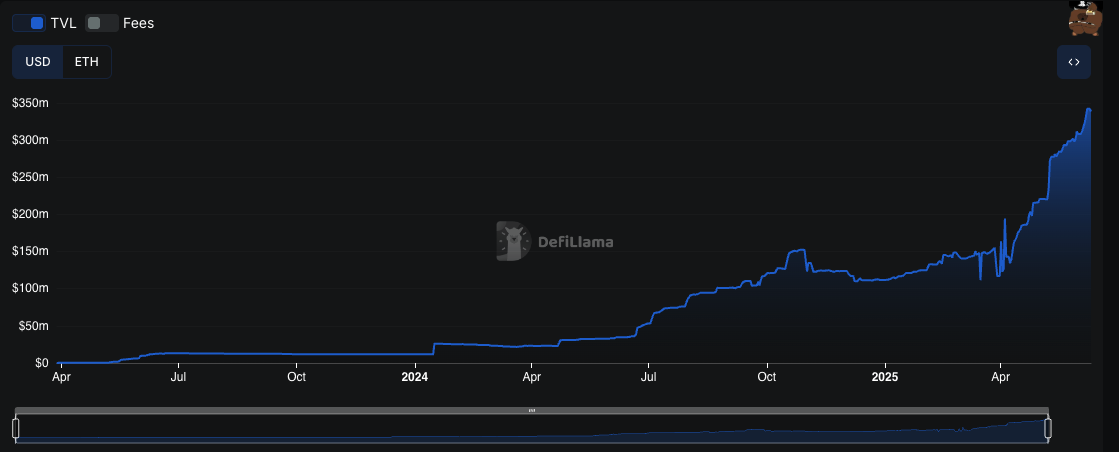

Supply: DefiLlama

The twin-fee mannequin funnels 66.7% of market charges to USDC dividends whereas burning the steadiness, an incentive that has helped TNGBL outperform broader RWA indices throughout flat markets.

Yield-hungry DAOs have flocked to OpenEden’s tokenized T-bill merchandise. The USDO stablecoin vault holds roughly $262 million, spreading collateral throughout Ethereum, Arbitrum, and a freshly whitelisted Base locker.

A separate TBILL good contract vault provides one other $190 million in tokenized sovereign debt, pushing the group’s whole regulated Treasury publicity above $450 million. Morpho-hosted technique on Base shifts idle USDC to USDO, auto-capturing risk-free price.

New RWA builders goal Base’s compliance stack and liquidity, past large names.

- Untangled Finance has signaled plans to deploy invoice-backed credit score swimming pools on Base after piloting the mannequin on Celo. The protocol goals to bridge personal credit score markets into DeFi, giving emerging-market fintechs a less expensive funding route.

- Realio Community is exploring an Optimism-stack bridge to develop its digital-equity platform, which tokenizes private-equity stakes and securitized actual property.

Each tasks underscore a broader migration of alternative-asset tokenizers towards Base’s compliance-first ecosystem.

RWAs as Base’s Killer App

The tokenized-asset sector has exploded 260% to $23 billion in 2025 as U.S. Treasury yields hover close to 4%, driving on-chain demand for dollar-denominated carry.

Coinbase’s model and compliance stack give Base a novel edge with regulated-asset issuers. Base secures over $14B and hosts extra native property than rival L2s, with tasks launching instantly.

Delphi Digital calls Base a “gateway drug for TradFi,” with KYC-ready design easing institutional tokenization.

With $14B TVL and Coinbase help, Base is ready to steer compliant asset issuance. Three milestones to observe over the subsequent 12 months:

- RWA‑backed stablecoins displacing non‑yielding tokens in cash markets

- Automated KYC wallets enabling permissioned swimming pools for establishments

- Cross‑margin RWA collateral – tokenised Treasuries funding derivatives or actual‑property NFTs with out leaving Base.

2025 could possibly be the yr tokenisation goes mainstream—beginning with Base-powered real-world property.

Learn extra: Coinbase vs Binance 2025: Which Alternate is Higher?