Picture supply: Rolls-Royce Holdings plc

Yesterday (27 February), Rolls-Royce (LSE: RR.) unveiled its full-year earnings for 2024, and the outcomes have been nothing in need of spectacular. The British aerospace titan not solely soared previous revenue expectations but additionally introduced a profitable plan for rewarding shareholders.

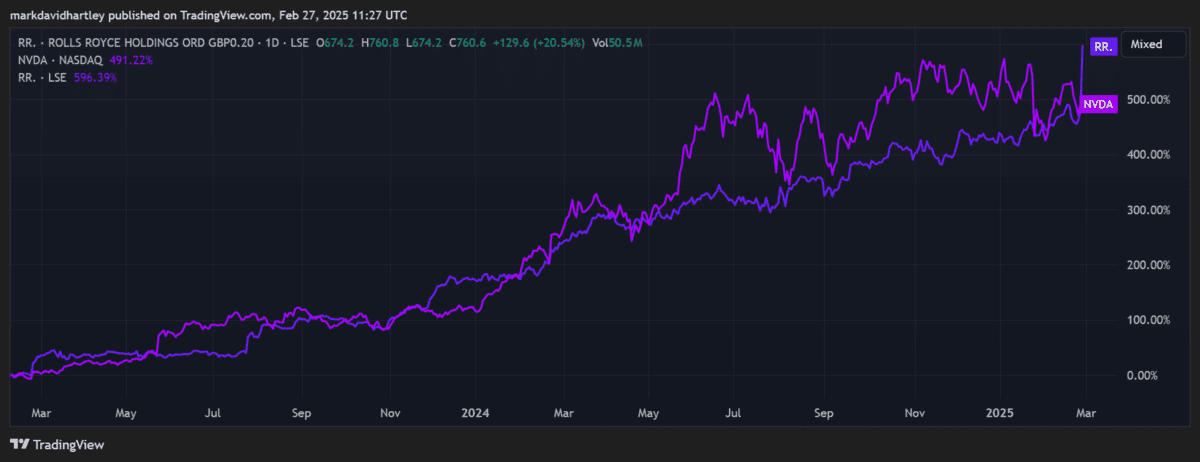

The inventory surged 18% on the information, bringing its year-to-date (YTD) positive factors up to twenty-eight%. It’s now even outperformed Nvidia over the previous two years.

The earnings report has despatched ripples by the UK market, bolstering the aerospace sector and contributing to a 0.1% uptick within the FTSE 100 index.

Full-year 2024 outcomes

In 2024, Rolls’ underlying working income rose a outstanding 55%, reaching £2.5bn, and gross sales soared by 15% to £17.8bn. The expansion was fueled by a resurgence in air journey and heightened protection spending amid world geopolitical shifts.

However the information that significantly despatched traders into an eagerness was the reinstating of dividends. Initially, it plans £500m in funds supported by the launch of a £1bn share buyback programme. Dividends will probably be paid at 6p per share initially, equating to a 1% yield.

This marks the primary dividend distribution for the reason that pandemic, solidifying an simple monetary restoration. CEO Tufan Erginbilgiç as soon as once more emphasised the significance of rewarding shareholders to draw future investments.

Extra progress coming?

Below the affect of Erginbilgiç, who took the helm in 2023, Rolls has sharpened its give attention to monetary efficiency, implementing cost-saving measures and renegotiating contracts to spice up profitability.

The corporate now anticipates attaining its mid-term revenue targets two years forward of schedule, with projections of working income between £3.6bn and £3.9bn by 2028.

Nonetheless, the speedy positive factors may severely restrict additional progress. The common 12-month price goal is now 13.7% decrease than the present price. These could also be up to date barely within the coming days, however I wouldn’t count on a lot change. The price-to-earnings (P/E) ratio is now greater than common at 27, including threat {that a} pullback might be imminent.

With the price overvalued and at excessive threat of a correction, I wouldn’t contemplate shopping for the inventory now.

There’s additionally the ever-present threat of extra journey disruptions, which may harm the price once more as Covid did. Moreover, any vital dip in defence spending may reverse the shares’ upward trajectory.

But, regardless of these dangers, Rolls has one other trick up its sleeve that might nonetheless assist the corporate proceed to develop in 2025.

Nuclear enlargement

Rolls is especially well-positioned to profit from the UK’s plans for nuclear energy. Because of its experience within the improvement of small modular reactors (SMRs), it’s a key contender to assist the nuclear technique.

Not like conventional large-scale nuclear crops, SMRs are smaller and sooner to construct, lowering development dangers. They’re additionally extra cost-efficient at round £2bn per unit in comparison with the tens of billions wanted for full-scale crops. Since a lot of the development is completed in manufacturing facility circumstances earlier than meeting on-site, it’s a lot simpler to deploy them.

The UK authorities has already backed Rolls-Royce’s SMR mission with a £210m grant, and the corporate has raised further personal funding. If nuclear enlargement accelerates, additional authorities contracts or subsidies may move to Rolls-Royce, serving to to fund improvement and manufacturing.