Higher Markets Inc., a nonprofit group targeted on monetary markets, has filed an amicus temporary to assist the U.S. Securities and Trade Fee (SEC) in its lawsuit towards Ripple Labs. The temporary argues that XRP, Ripple’s cryptocurrency, meets the Howey Check and needs to be labeled as a safety when offered on exchanges.

An amicus temporary, that means “friend of the court,” is a authorized doc submitted by people or organizations indirectly concerned in a case. The aim of such a short is to offer further arguments or experience that will assist the courtroom make its determination.

Higher Markets Argues XRP Meets the Howey Check

In its temporary, Higher Markets introduced three key arguments supporting the SEC’s place. The group claims that XRP gross sales to retail traders meet the third prong of the Howey Check. This take a look at determines whether or not a transaction qualifies as an funding contract and, due to this fact, a safety below U.S. legislation.

The submitting emphasised that XRP’s classification as a safety doesn’t change primarily based on how it’s offered on digital platforms. Higher Markets argued that the district courtroom’s 2023 ruling in favor of Ripple conflicts with the Supreme Courtroom’s definition of an funding contract within the Howey take a look at. It additionally said that the ruling discovered no assist within the authorized definitions of securities.

Did the District Courtroom Get It Unsuitable? Higher Markets Pushes for Reversal

Higher Markets criticized the district courtroom for allegedly overlooking the financial realities of XRP transactions. In response to the group, traders might moderately hyperlink their earnings to Ripple’s efforts, making XRP gross sales on exchanges resemble securities. The temporary urged the appellate courtroom to reverse the district courtroom’s determination, which declared that XRP gross sales on exchanges should not funding contracts.

This submitting follows the SEC’s attraction of the 2023 ruling by Choose Analisa Torres. The SEC claimed that the courtroom made authorized errors in figuring out that XRP gross sales on exchanges weren’t securities. The company is now in search of to have this portion of the ruling overturned.

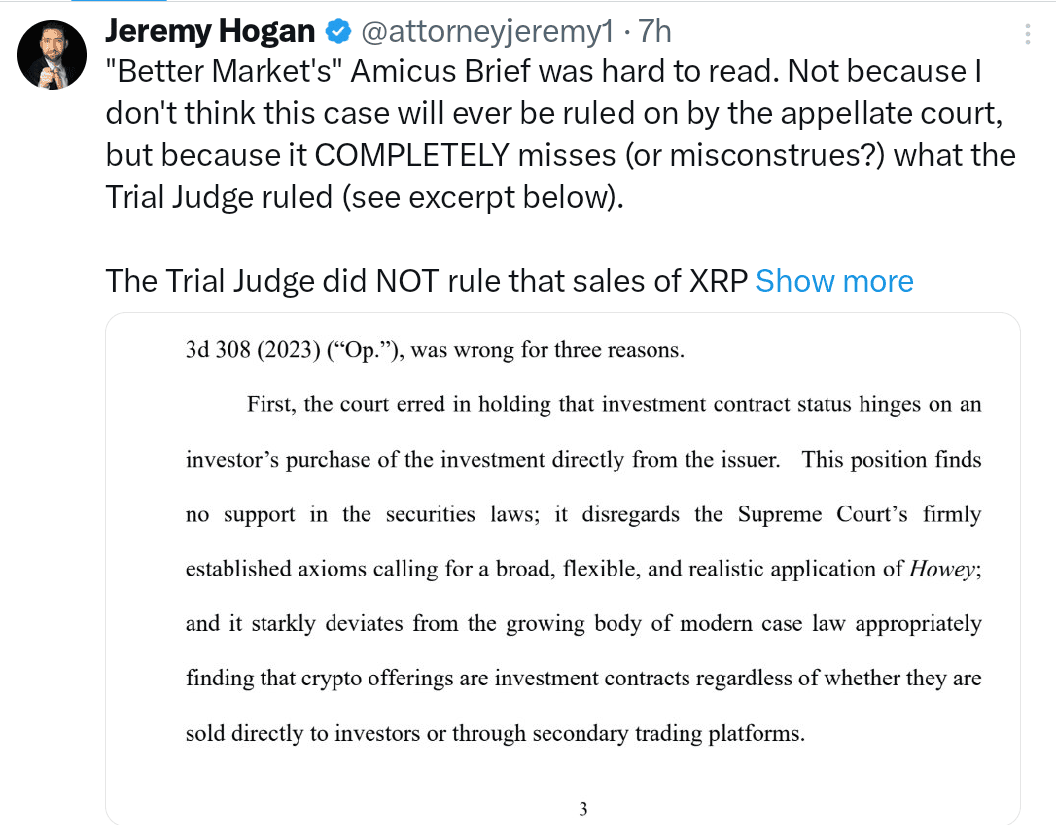

Lawyer Jeremy Hogan Dismisses Amicus Temporary Claims

Lawyer Jeremy Hogan, a distinguished determine within the Ripple group, criticized Higher Markets’ arguments. He said that the temporary misinterpreted the district courtroom’s reasoning.

Hogan defined that the decide’s ruling was primarily based on the character of “blind bid/ask” transactions. These transactions happen when consumers have no idea if they’re buying XRP from Ripple or one other get together. In consequence, the consumers couldn’t depend on Ripple’s efforts to extend XRP’s worth—a key think about figuring out whether or not a sale qualifies as an funding contract.

Hogan additional argued that Higher Markets failed to handle the authorized reasoning behind the courtroom’s determination and as a substitute targeted on broad criticisms.

Ripple v/s SEC Case Decision in Sight? Specialists Predict Settlement Could Be Weeks Away

The Ripple lawsuit has been a serious authorized battle because it started in December 2020. The SEC accused Ripple of promoting XRP as an unregistered safety, prompting widespread debate about how cryptocurrencies needs to be labeled below U.S. legislation. Whereas the district courtroom dominated in Ripple’s favor for XRP gross sales to retail traders, the SEC is interesting that call.

In the meantime, modifications in SEC management have added a brand new dimension to the case. Performing SEC Chair Mark Uyeda has quickly changed Gary Gensler, who stepped down earlier this 12 months. Uyeda is thought for his pro-crypto stance, elevating hopes amongst Ripple supporters for a extra collaborative method to resolving the lawsuit.

Professional-crypto lawyer Marc Fagel has steered {that a} settlement could possibly be weeks away, particularly if a everlasting SEC chair like Paul Atkins, who can be seen as crypto-friendly, is confirmed. Ripple beforehand settled a associated matter by agreeing to pay $125 million for institutional XRP gross sales, however specialists imagine a extra complete settlement could also be attainable.