Crypto currencies generate a pile of hype and headlines, for causes each good and dangerous – however not too long ago, the explanations have been good. For the reason that starting of final yr, the flagship crypto, Bitcoin, is up greater than 300%, the features fueled by the approvals of BTC spot ETFs, and the April 19 ‘halving’ occasion, when the reward for every solved blockchain hyperlink was minimize in half, to three.125 Bitcoins.

This latter occasion occurs roughly each 4 years, and ensures the crypto’s most respected trait, its shortage. Traditionally, the halving occasion has served as a catalyst for a Bitcoin bull market.

This highlight on Bitcoin naturally extends to Bitcoin-related shares, particularly Bitcoin miners, with Cantor Fitzgerald analyst Brett Knoblauch drawing consideration to their potential for development.

“We remain optimistic about the bitcoin mining sector,” Knoblauch mentioned. “Bitcoin prices have remained elevated, and at current Bitcoin levels and global network hash rate (~600 EH/S), every publicly traded Bitcoin miner can mine Bitcoin profitably. Bitcoin miners remain an attractive and leveraged way to play Bitcoin, as they can effectively mine Bitcoin at a discount to what one would acquire Bitcoin for at spot prices.”

Knoblauch goes on to put out a particular case for buyers: “We favor miners that are low-cost, have scale, and have liquidity. Miners that can mine Bitcoin cheaper generate higher gross margins, which results in greater ability to acquire additional rigs to add additional scale.”

We’ve used the TipRanks platform to tug up the small print on two of his picks – seems each rated Sturdy Buys by the analyst consensus, too. Let’s see why they’re drawing plaudits throughout the board.

Riot Platforms (RIOT)

The primary Cantor choose we’ll take a look at is Riot Platforms, a Texas-based Bitcoin miner with two knowledge middle mining operations on-line in its house state. The chief of those services is Rockdale, which the corporate boasts is the biggest Bitcoin mining facility working in North America primarily based on energy capability. The Rockdale mining knowledge middle has an influence capability of 700 megawatts.

The Rockdale facility is complemented by the Corsicana facility. This Bitcoin mining knowledge middle remains to be beneath building and improvement, however the first constructing within the advanced, Constructing A1, is nearing full deployment of its miner rigs – and has come on-line. This constructing has an influence score of 100 megawatts, only a fraction of the deliberate 1 gigawatt whole capability of the Corsicana advanced. As of the top of Might, Riot reported that its self-mining capability, together with the brand new capability introduced on-line at Corsicana, had reached 14.7 EH/s. The corporate expects to succeed in a complete capability of 20.1 EH/s later this yr.

At first of this month, Riot reported its Bitcoin manufacturing numbers for the month of Might. These figures confirmed a major discount within the variety of Bitcoin mined for the month, by 68% year-over-year, to 215. On the similar time, the corporate didn’t must promote any Bitcoin throughout Might, and completed the month with 9,084 Bitcoin available. As well as, the corporate’s energy technique generated $7.3 million in energy and demand response credit throughout the month, which is utilized to mining actions and reduces the corporate’s price to mine.

These information occasions adopted Riot’s 1Q24 launch, which confirmed that the corporate generated $79.3 million in income throughout the first quarter of this yr. That was one thing of a combined outcome, up greater than 8% year-over-year, however lacking the forecast by over $16 million. On the backside line, Riot reported an EPS of 82 cents per share. This EPS was seemingly not similar to the anticipated determine, a lack of 21 cents per share. Administration reported that the first-quarter earnings included a number of one-time fees, together with a $234.1 million change within the honest worth of Bitcoin, a $32 million non-cash stock-based compensation expense, and a $32.3 million depreciation and amortization.

In any case of that, Cantor analyst Knoblauch bases his optimistic outlook right here on the corporate’s constructive, however intangible attributes: its development/valuation, cost-to-mine, and threat/reward. The analyst writes, “RIOT offers the best combination of growth/valuation… RIOT has one of the lowest cost-to-mine, has meaningful scale, and has the best balance sheet across the sector. It is poised to deliver meaningful organic capacity growth over the coming 18 months… RIOT screens very attractively from a valuation standpoint, with the market valuing it at $48m per 1 EH/S based on our FY24E hash rate estimate…”

Together with this upbeat stance, Knoblauch offers RIOT shares an Obese (i.e. Purchase) score, with a $23 price goal that factors towards a strong one-year upside potential of 116%. (To observe Knoblauch’s monitor file, click on right here)

This view is according to the overall Avenue consensus right here. The 9 current analyst evaluations of RIOT, all constructive, give a unanimous Sturdy Purchase score, whereas the $18.22 common price goal implies a one-year achieve of 71% from the present share price of $10.64. (See Riot inventory forecast)

CleanSpark (CLSK)

The second inventory on our listing is CleanSpark, an organization that’s combining Bitcoin mining with using low-carbon renewable vitality – and displaying that it’s potential to succeed at each whereas turning a revenue. The corporate’s Bitcoin mining knowledge middle services are positioned in Mississippi, Georgia, and New York state, and are supported by renewable vitality investments. CleanSpark is a big purchaser of high-quality renewable vitality credit, and backs initiatives that join low-carbon energy technology to the grid.

CleanSpark owns and operates a complete of 9 Bitcoin mining services, with 134,464 mining rigs deployed as of Might 31, this yr. These preserve a hash fee of 17.97 EH/s, and the corporate boasts that it maintains an vitality effectivity of 23.05 J/TH. The corporate held, on the finish of Might, 6,154 Bitcoin amongst its property. As well as, the corporate reported mining 417 Bitcoin within the month, for a complete of three,169 on this calendar yr.

Early in Might, CleanSpark made a transfer that guarantees considerably to increase its mining capability. The corporate entered an settlement to buy two Bitcoin mining places within the state of Wyoming, and to interrupt floor on the services shortly after the acquisition closes. CleanSpark agreed to pay $18.75 million for the websites, and expects that the finished services will add 4 EH/s to the corporate’s whole manufacturing fee.

For the final full quarter reported, fiscal 2Q24 which ended on March 31, CleanSpark reported whole revenues of $111.8 million, for a formidable year-over-year development fee of 163%. The highest line beat the forecast by $2.33 million. CleanSpark’s backside line, given as a GAAP EPS determine of 58 cents per share, was a powerful turnaround from the prior-year 2Q lack of 23 cents per share.

This firm’s development caught the attention of analyst Knoblauch, who sees loads of different strengths within the firm. The Cantor analyst writes, “We believe CLSK offers the best growth story… CLSK’s biggest differentiator at present is its combination of scale, liquidity, and fleet efficiency. It has the most-efficient mining fleet at [approximately] 24.2 J/TH, which results in CLSK having the second-cheapest all-in cost to mine a Bitcoin. Combining that with accelerated rig deployments, we believe CLSK will have the largest hash rate by the end of 2024E, with our estimates for it to have ~48 EH/S. With CLSK having the third-best liquidity position, we are confident in its ability to meet our assumptions.”

For Knoblauch, all of this results in an Obese (i.e. Purchase) score on the inventory. He enhances that with a price goal of $27, suggesting a 12-month achieve of 56.5%.

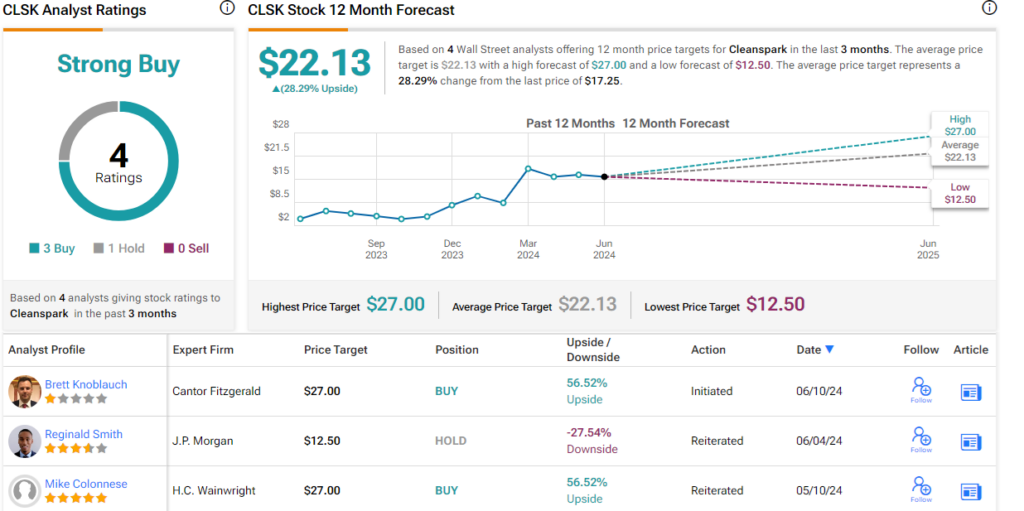

General, CleanSpark’s shares have earned a Sturdy Purchase consensus score from the Avenue primarily based on 4 evaluations that break down 3 to 1 favoring Purchase over Maintain. The inventory is presently promoting for $17.25 and its $22.13 common price goal implies a possible upside of 28% for the yr forward. (See CleanSpark inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather necessary to do your personal analysis earlier than making any funding.