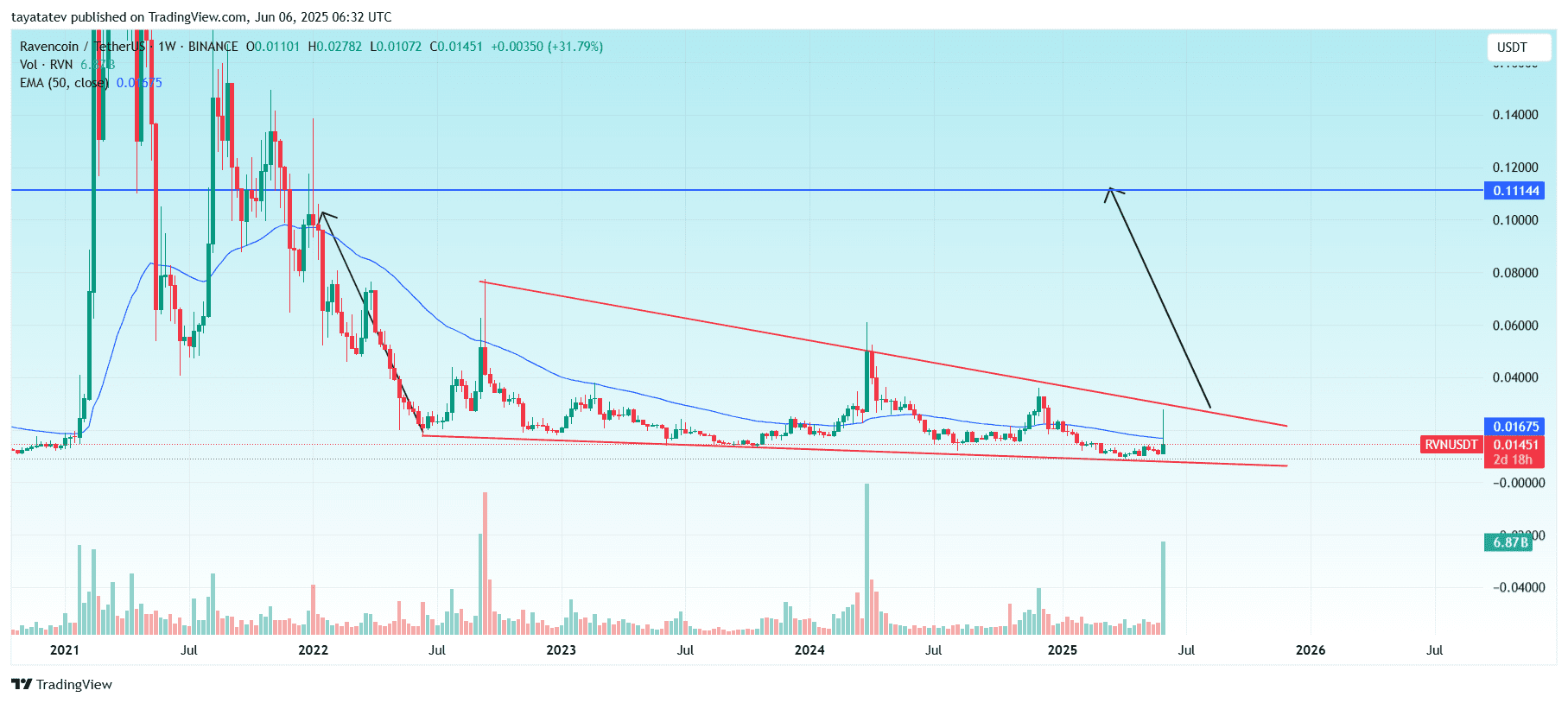

On June 5, 2025, the RVN/USDT pair jumped 152.52% in simply at some point, rising from round $0.011 to a excessive close to $0.0278. The spike got here with a buying and selling quantity of 6.73 billion. Nevertheless, the price rapidly pulled again the following day and now trades close to $0.01446, giving up greater than half of the beneficial properties.

On June 6, 2025, the RVN/USDT weekly chart created a bullish falling wedge sample.

A bullish falling wedge is a chart sample fashioned by converging downward-sloping trendlines, often signaling a possible pattern reversal to the upside.

If this sample confirms, the RVN/USDT price can surge 657% from the present degree of $0.01451 to the projected goal of round $0.11144.

This sample developed after a protracted downtrend from its 2021 highs. The wedge’s resistance line, marked in pink, has been touched a number of instances over the previous two years. The current breakout try got here with a spike in weekly quantity, which jumped to six.87 billion RVN, indicating robust shopping for strain.

Furthermore, the price has now closed above the 50-week Exponential Transferring Common (EMA), at the moment close to $0.01675, for the primary time since early 2023. This breakout above EMA and wedge resistance strengthens the case for a possible bullish reversal.

If the price holds above this vary and beneficial properties momentum, a rally towards the wedge’s projected goal stays doable.

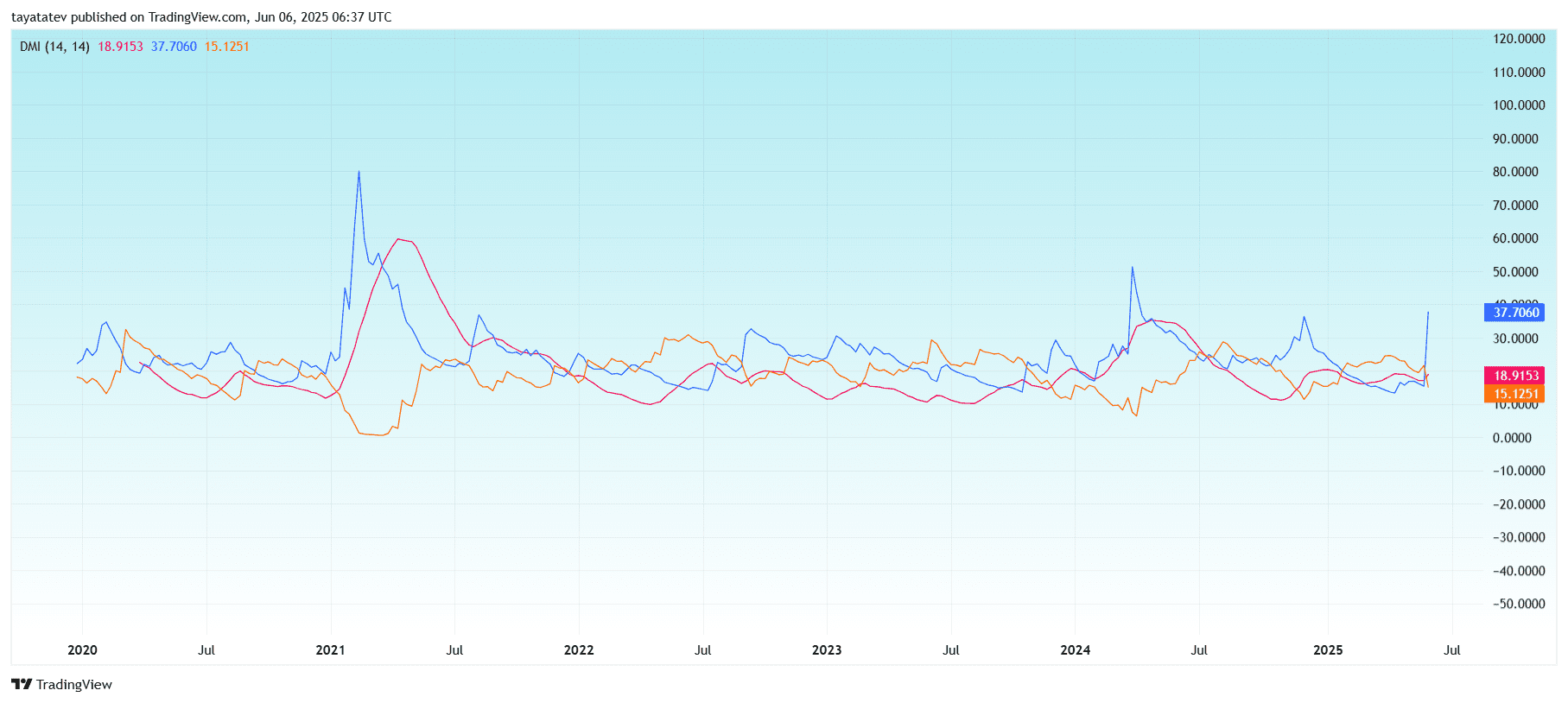

RVN/USDT DMI Flashes Sturdy Development Sign as ADX Surges

The RVN/USDT Directional Motion Index (DMI) confirmed a transparent pattern reversal sign on the weekly timeframe.

The Common Directional Index (ADX), marked in blue, surged to 37.71, crossing the important thing 25 degree. This transfer alerts a robust pattern forming. The ADX measures pattern energy no matter path. A studying above 25 confirms a sound pattern.

The +DI (constructive directional index), proven in orange, sits at 15.13, whereas the –DI (destructive directional index), proven in pink, is increased at 18.92. This setup means sellers nonetheless barely dominate by way of directional strain, however the robust ADX rise signifies {that a} main pattern shift may very well be underway if +DI crosses above –DI.

All through 2024 and early 2025, the ADX remained principally flat, reflecting a sideways market. However the sharp vertical rise now aligns with the breakout seen on the price chart, confirming that momentum is constructing.

If +DI overtakes –DI within the coming weeks, and the ADX continues rising, it’ll validate a sustained bullish transfer in RVN/USDT.

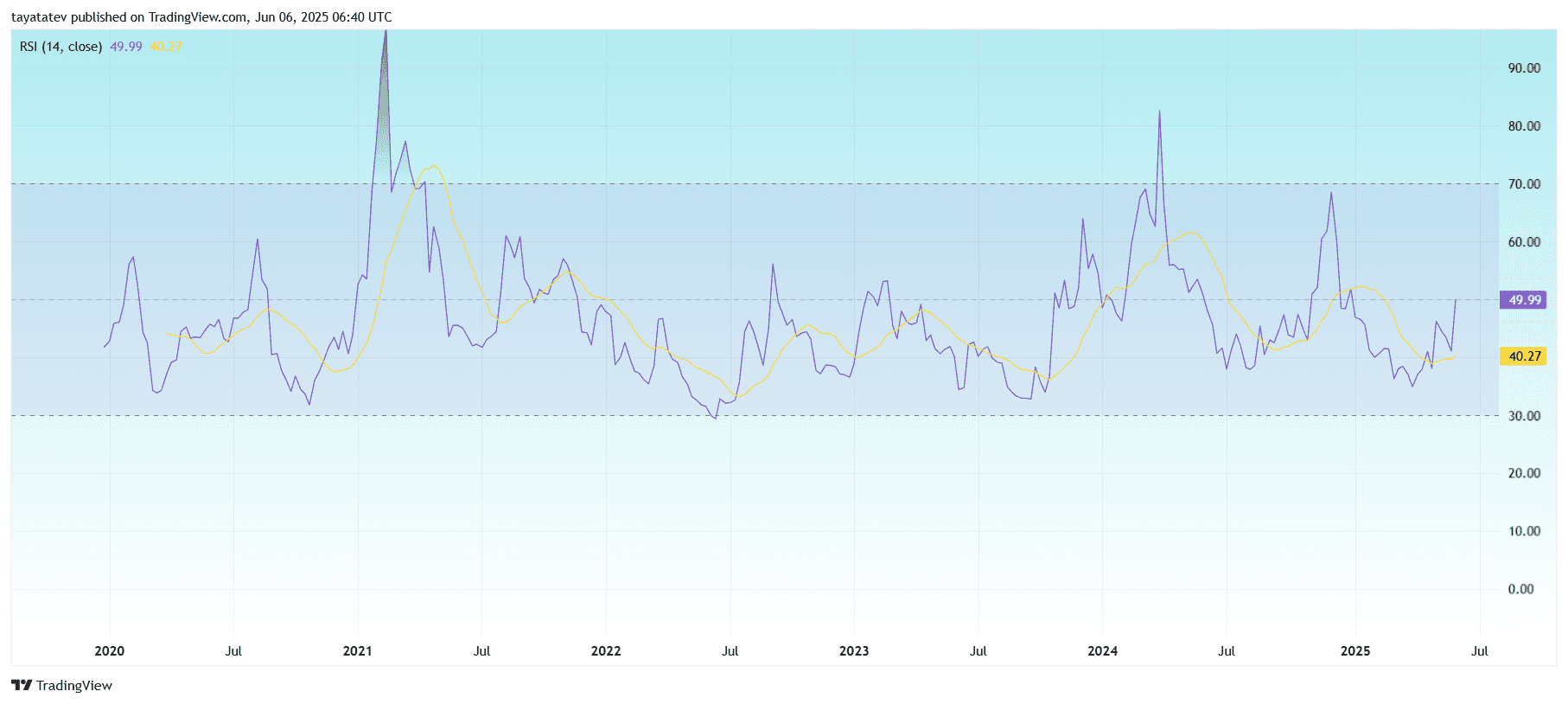

RVN/USDT RSI Nears Midpoint as Momentum Builds

On June 6, 2025, the Relative Energy Index (RSI) for RVN/USDT on the weekly chart printed 49.99, whereas the RSI-based transferring common stood at 40.27.

The RSI measures the velocity and alter of price actions on a scale of 0 to 100. A studying beneath 30 alerts oversold situations, whereas a studying above 70 alerts overbought. A degree close to 50 signifies impartial momentum with a possible shift relying on price path.

Presently, the RSI has crossed above its personal transferring common, suggesting a short-term momentum shift to the upside. It additionally approached the midpoint (50), which regularly acts as a pivot between bearish and bullish zones.

This crossover follows a protracted consolidation interval with a number of failed breakout makes an attempt in 2024 and early 2025. The current upward RSI slope aligns with the falling wedge breakout and excessive quantity spike seen on the weekly price chart.

If the RSI breaks and holds above 50 within the coming weeks, it could verify a stronger bullish pattern forming.

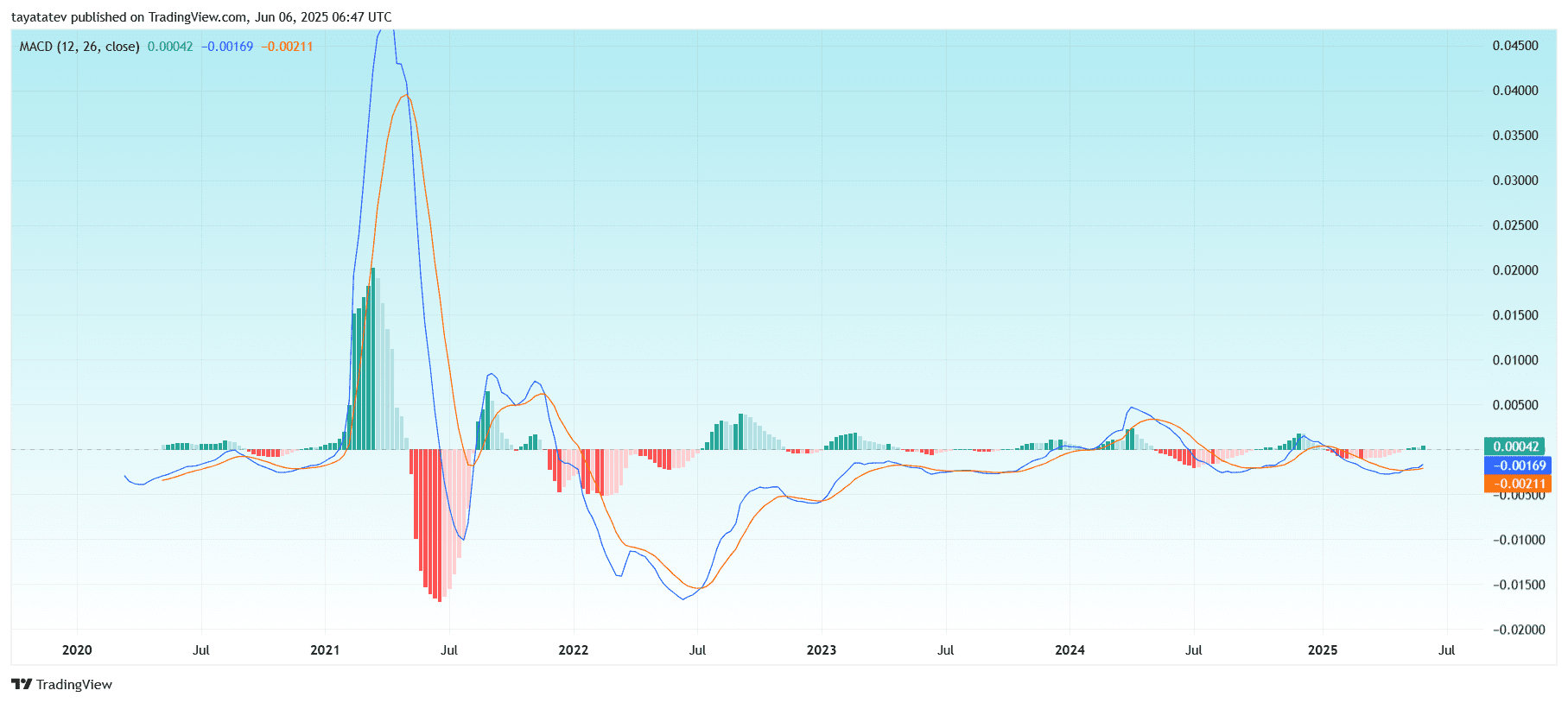

RVN/USDT MACD Approaches Bullish Crossover on Weekly Chart

On June 6, 2025, the RVN/USDT weekly Transferring Common Convergence Divergence (MACD) indicator confirmed early indicators of a possible bullish shift.

The MACD line (blue) is now at −0.00169, whereas the sign line (orange) is at −0.00211. Though each values stay beneath the zero line, the MACD line has crossed above the sign line for the primary time in months. This crossover signifies an early bullish momentum sign.

On the identical time, the MACD histogram has flipped barely constructive, at the moment printing +0.00042. A inexperienced histogram above the zero degree confirms the crossover and helps a doable pattern reversal.

Traditionally, robust uptrends in RVN/USDT have adopted sustained MACD crossovers and inexperienced histograms. Earlier bullish waves in 2021 and early 2023 started with comparable crossovers.

If the MACD continues rising and crosses the impartial zero line, it might additional verify a momentum shift towards a full bullish cycle.

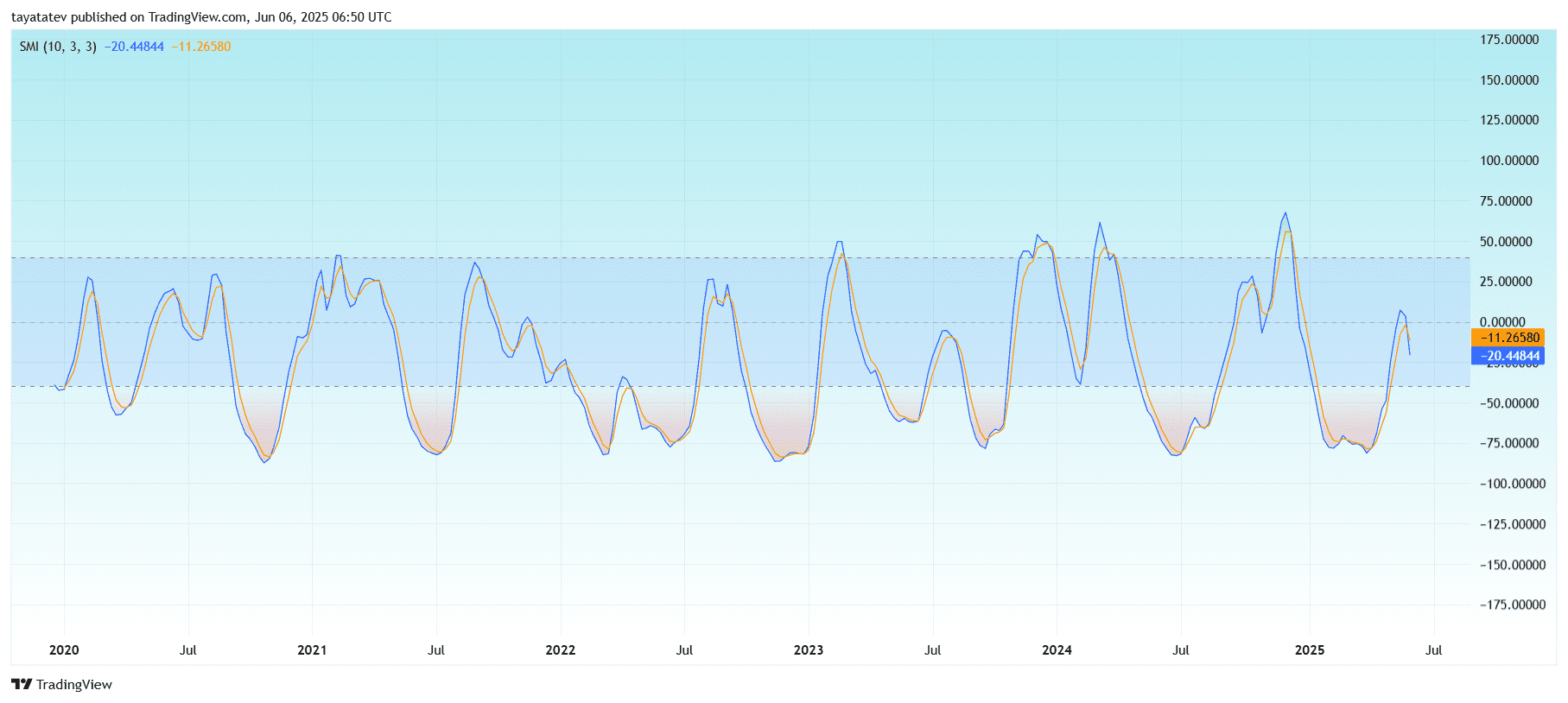

RVN/USDT Weekly SMI Pulls Again After Sharp Rebound

In the meantime, the Stochastic Momentum Index (SMI) for RVN/USDT confirmed a slight pullback after a robust restoration from oversold territory.

The SMI blue line at the moment reads −20.45, whereas the orange sign line is at −11.27. Each traces have turned downward after a steep rise, indicating a quick lack of momentum following the price spike seen earlier this week.

The SMI measures closing price momentum relative to the median of the excessive/low vary and is extra refined than the normal Stochastic Oscillator. Values above +40 counsel robust upward momentum, whereas values beneath −40 point out robust downward momentum.

Earlier, RVN/USDT’s SMI had crossed above −40 and moved towards the zero line, displaying preliminary bullish momentum. Nevertheless, the newest dip suggests consolidation or hesitation amongst consumers. For pattern continuation, the blue line should flip upward and break above the sign line once more.

This transient SMI rejection echoes the short-term price retracement after RVN’s 152% breakout.