On June 1, 2025, Pi Community (PI/USDT) traded at $0.6400 on OKX, slipping practically 2% on the day. The token dropped beneath its short-term help zone whereas failing to reclaim key Fibonacci resistance ranges.

The chart reveals two Fibonacci retracement ranges. The first retracement spans from the $0.0970 low to the $3.00 peak. Inside this vary, the 0.618 degree sits at $1.1428—typically known as the golden zone, the place robust reversals are inclined to occur. Nevertheless, PI failed to interrupt previous this zone throughout its Could rally.

A second, more moderen retracement vary runs from $0.6000 to $1.2377. Key resistance ranges embody the 0.5 mark at $0.9189 and the 0.618 zone at $0.8436. These ranges acted as native ceilings in late Could. Value didn’t maintain momentum above them and has since trended decrease.

At present, PI trades near its instant help close to $0.6400. If bears push the price beneath $0.6000—the bottom of the latest Fibonacci vary—the subsequent draw back goal may fall again to earlier April ranges. The chart reveals fading quantity over latest classes, pointing to weakening bullish curiosity.

The 50-day Exponential Transferring Common stands at $0.8009, now performing as resistance. Bulls would want to reclaim this degree to shift momentum upward. Till then, the development stays tilted to the draw back.

With Pi Community buying and selling beneath key resistance zones and failing to keep up bullish construction, the technical outlook alerts continued bearish strain except $0.6000 holds.

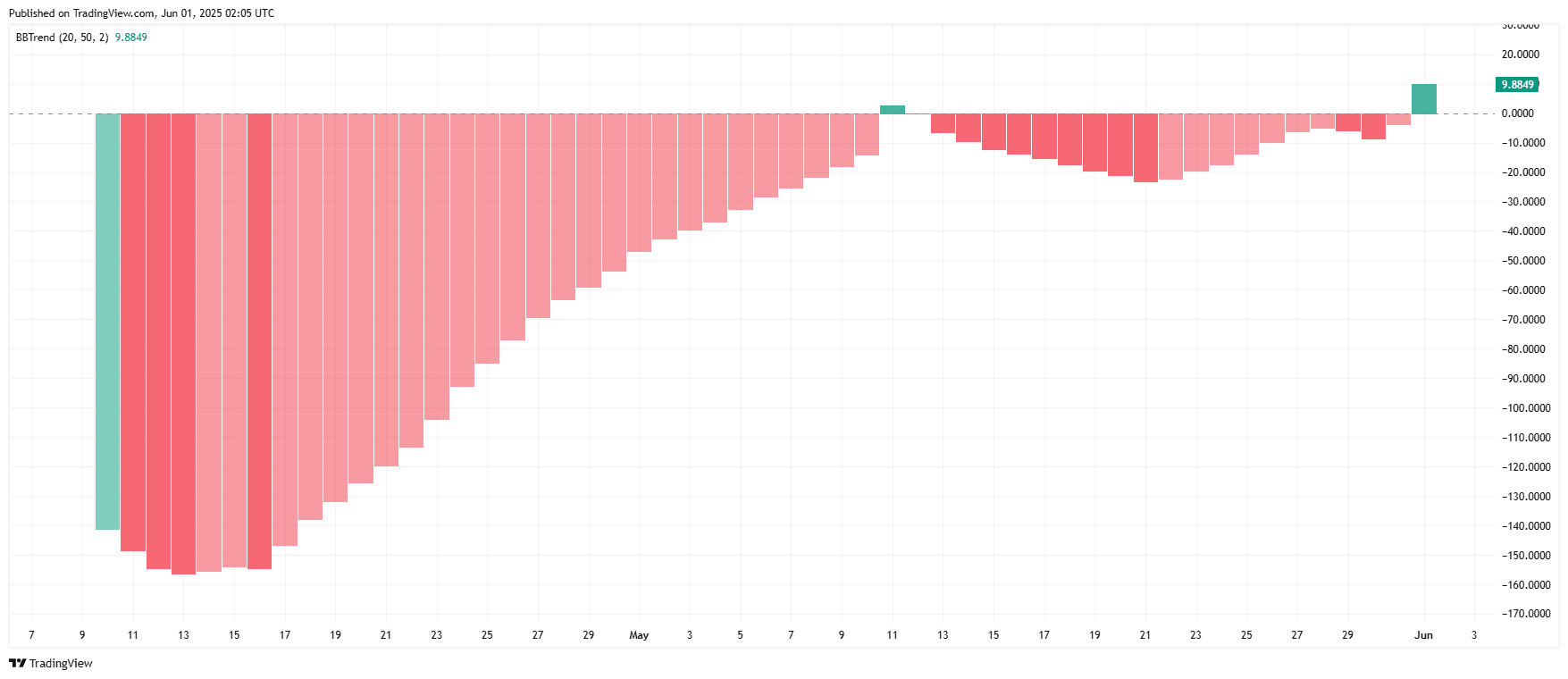

Pi Community Development Reversal Confirmed as BBTrend Turns Constructive on June 1

The Pi Community (PI/USDT) BBTrend indicator flipped into optimistic territory for the primary time since April. The indicator, which stands for Bollinger Band Development, rose to +9.8849, signaling a attainable momentum reversal after practically two months of persistent promoting strain.

From April 10 to Could 30, the BBTrend remained unfavorable, marking a steady downtrend. Throughout this era, the indicator fell as little as -165, reflecting robust bearish sentiment. Nevertheless, the development started moderating in late Could, regularly recovering towards the zero mark.

On Could 31, the BBTrend briefly crossed into optimistic territory earlier than dipping once more. The total affirmation got here on June 1, when the studying surged to +9.8849. This breakout marks the strongest optimistic shift in over two months.

The BBTrend combines Bollinger Bands with development energy to measure momentum. A optimistic BBTrend worth suggests bullish momentum, whereas a unfavorable one factors to sustained promoting. The upper the worth, the stronger the directional energy. The system sometimes makes use of a setting of (20, 50, 2), as proven on this chart.

This bullish crossover comes after PI/USDT’s price hit the $0.6400 zone, the place some patrons began stepping in. Though price stays below key Fibonacci resistance, the development indicator’s flip means that bearish momentum has weakened for now.

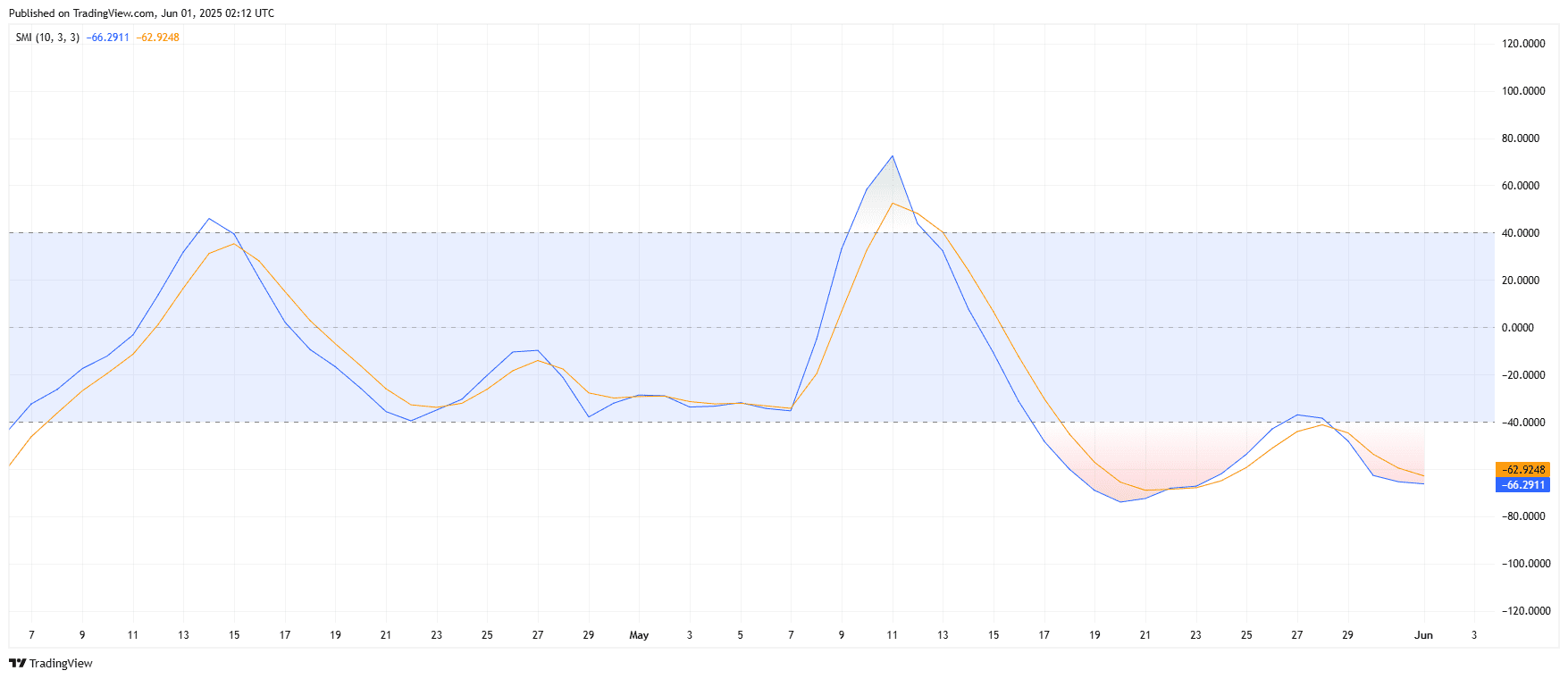

Stochastic Momentum Index Reveals Weak Restoration for Pi Community

On June 1, 2025, the Stochastic Momentum Index (SMI) for Pi Community (PI/USDT) remained in deep unfavorable territory, with values at -66.29 for the primary line and -62.92 for the sign line. This means that bearish strain continues, though the hole between the strains is narrowing.

The SMI measures the place of the present shut relative to the midpoint of latest highs and lows. Not like conventional stochastic indicators, it smooths each the momentum and sign elements for clearer reversal alerts. Values beneath -40 typically present robust bearish momentum.

Since peaking on Could 12, each strains have steadily dropped. The index crossed beneath zero by Could 16 and entered oversold territory below -40 by Could 18. Regardless of a minor uptick on Could 27, the indicator stays beneath crucial reversal zones.

The blue line (SMI) crossed above the orange sign line briefly in late Could however failed to carry. That fake-out indicated weak bullish curiosity. As of June 1, the strains are shut once more however nonetheless slope downward, displaying no clear affirmation of a development reversal.

The present studying beneath -60 suggests continued draw back momentum except the SMI crosses above -40 and the primary line overtakes the sign line. Merchants typically watch this conduct for early alerts of potential bounce formations.

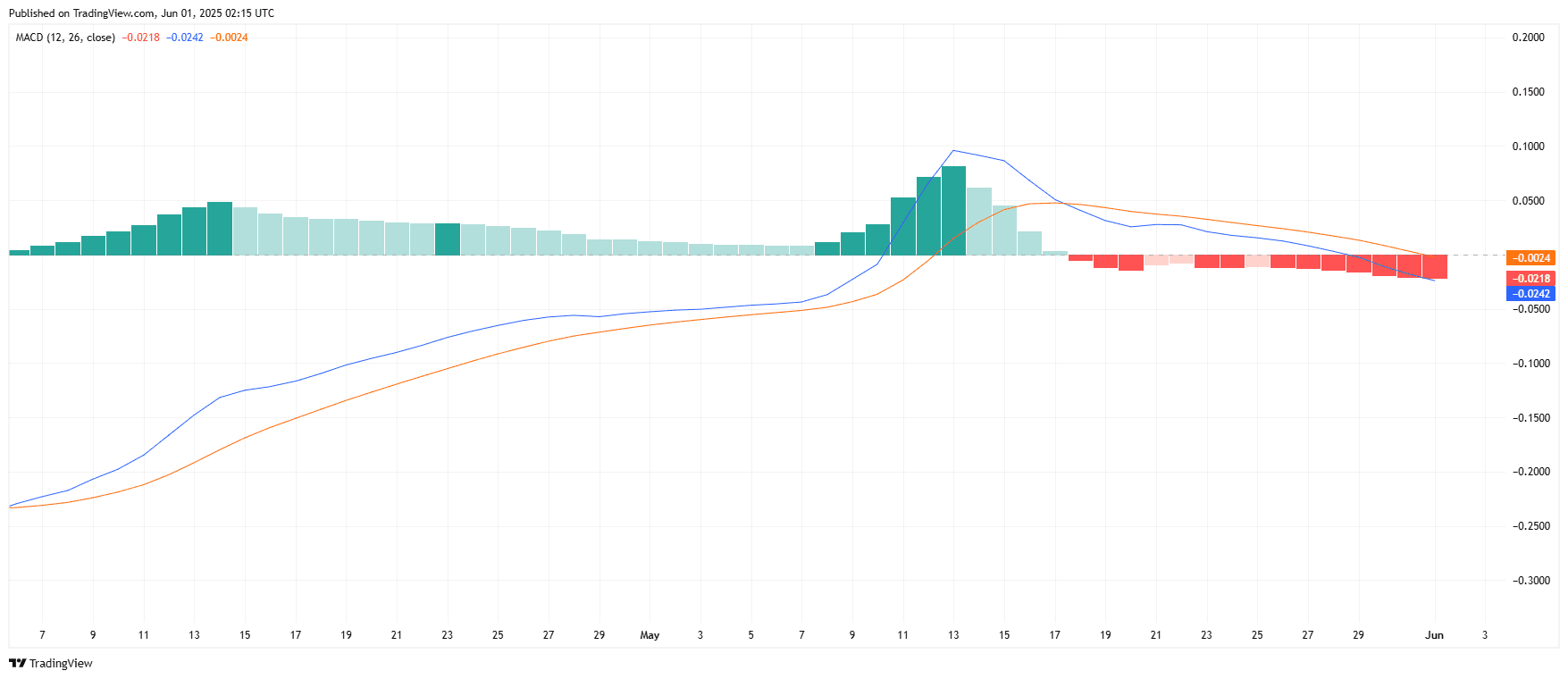

MACD Turns Bearish for Pi Community as Momentum Slips Under Zero

In the meantime, the Transferring Common Convergence Divergence (MACD) indicator for Pi Community (PI/USDT) confirmed bearish momentum. The MACD line dropped to -0.0242, whereas the sign line stood at -0.0024. The histogram additionally printed a unfavorable bar of -0.0218, extending a downtrend that began mid-Could.

The MACD, calculated utilizing the 12-day and 26-day exponential transferring averages, crossed beneath the sign line on Could 18. This crossover marked the top of bullish momentum that had pushed costs up earlier in Could. The histogram has remained purple for over 13 consecutive classes, displaying rising draw back strain.

The bullish run started in early Could and peaked round Could 12, when the MACD line reached its highest degree above 0.15. Since then, each the MACD and sign strains have declined steadily, with the hole widening all through late Could.

As of June 1, there isn’t a bullish divergence between price and MACD. The development continues to weaken, and each strains stay beneath the zero mark. Merchants sometimes look forward to a bullish crossover and a histogram flip above zero to substantiate restoration.

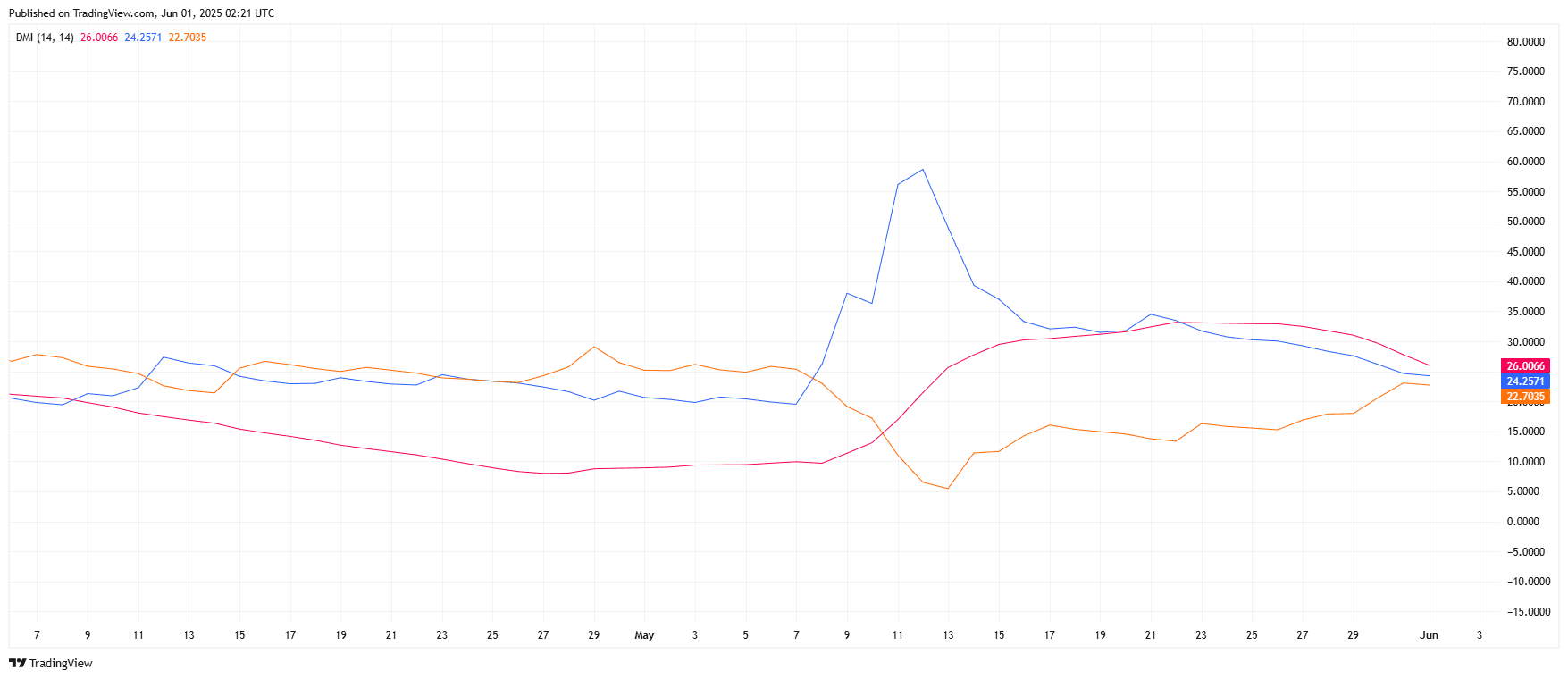

Directional Motion Index Reveals Weakening Development Power for Pi Community

On June 1, 2025, the Directional Motion Index (DMI) for Pi Community (PI/USDT) signaled declining development energy, with the Common Directional Index (ADX) at 26.0066, barely above the baseline threshold of 25. The optimistic directional index (+DI) printed 24.2571, whereas the unfavorable directional index (–DI) stood at 22.7035.

The ADX, which measures total development energy no matter route, peaked above 70 on Could 12, confirming a powerful uptrend through the Pi price rally. Since then, the ADX has steadily dropped, displaying weakening momentum in both route. A studying above 25 sometimes alerts a sound development, however the present drop towards 25 suggests development exhaustion.

The +DI (blue line) and –DI (orange line) stay shut, with the hole narrowing over the previous week. The bullish benefit seen in early Could has principally disappeared, and neither aspect reveals dominance. This convergence factors to a attainable range-bound or indecisive part except a contemporary breakout happens.

If the ADX drops beneath 25 within the coming classes, it could affirm a non-trending market, the place price motion could flip sideways. A widening hole between +DI and –DI can be wanted to substantiate any new route.