The Pi Community coin (PI) fell 50% prior to now week, going from an area excessive of $1.60 on Could 12 to commerce at round $0.73 on Could 20. The decline put an finish to what had been an early rally, which noticed PI’s worth rise because of hypothesis of a giant announcement at Consensus 2025 and the launch of a $100 million Pi Community Ventures fund.

As a substitute of presenting a mainnet replace or data on token utility, the mission’s co-founder, Nicolas Kokkalis, took to the stage to speak about AI, decentralization, and digital belief, which didn’t embrace any mainnet or PI token updates.

His imprecise language led to a sell-off nearly without delay. Kokkalis suggested the viewers to “be cautious,” whereas doubling down on Pi Community’s long-term imaginative and prescient, however did not make clear timelines or deal with considerations round token circulation.

That omission stoked criticism throughout social media, the place Pi supporters demanded accountability and solutions.

On-chain observers flagged suspicious actions across the similar time. A pockets linked to the mission transferred over 12 million PI to exchanges throughout peak price motion. Though the staff framed it as a person migration-related transaction, skeptics allege insider dumping through the rally. Tokenomics additionally stays murky, with no public vesting schedules and a majority of the availability nonetheless locked beneath centralized management.

Pi Coin Struggles Under Key Resistance as Promoting Stress Returns

Pi Coin continues to bleed worth after its failed breakout, now buying and selling close to $0.73. The price has slipped beneath the 20-day EMA (pink), reflecting a breakdown in short-term momentum. Trading quantity has additionally dried up, signaling declining curiosity from each bulls and bears.

Though the token has been shifting laterally, the price motion appears muted, suggesting an absence of bulls from the market.

The speedy resistance sits close to $0.85, marked by the 0.618 Fibonacci degree. This degree beforehand acted as a pivot through the rally and now caps any restoration makes an attempt. Flipping the speedy resistance would goal the resistance close to $0.97, which aligns with the 0.786 Fib zone.

This degree rejected the price sharply through the Could 16 spike, confirming its significance. Above that, the ultimate marked resistance stands at $1.13, the 1.0 Fib retracement. It represents the failed breakout degree that triggered the reversal and now acts as a serious ceiling.

On the draw back, the Pi Community coin is hanging simply above the marked help close to $0.68. A day by day shut beneath this space would open the door to the subsequent marked help close to $0.57, the place the 0.236 retracement aligns with historic consolidation ranges.

RSI hovers round 47, providing no edge to bulls. The dearth of momentum and repeated failures at key resistance zones counsel distribution. The latest rejection from $1.13 confirmed the exhaustion in speculative demand. With out a catalyst or structural help, Pi dangers slipping additional into decrease demand zones.

The development has flipped bearish once more, and any upside transfer now requires a clear reclaim of $0.85 with quantity. Till then, Pi stays weak to deeper corrections

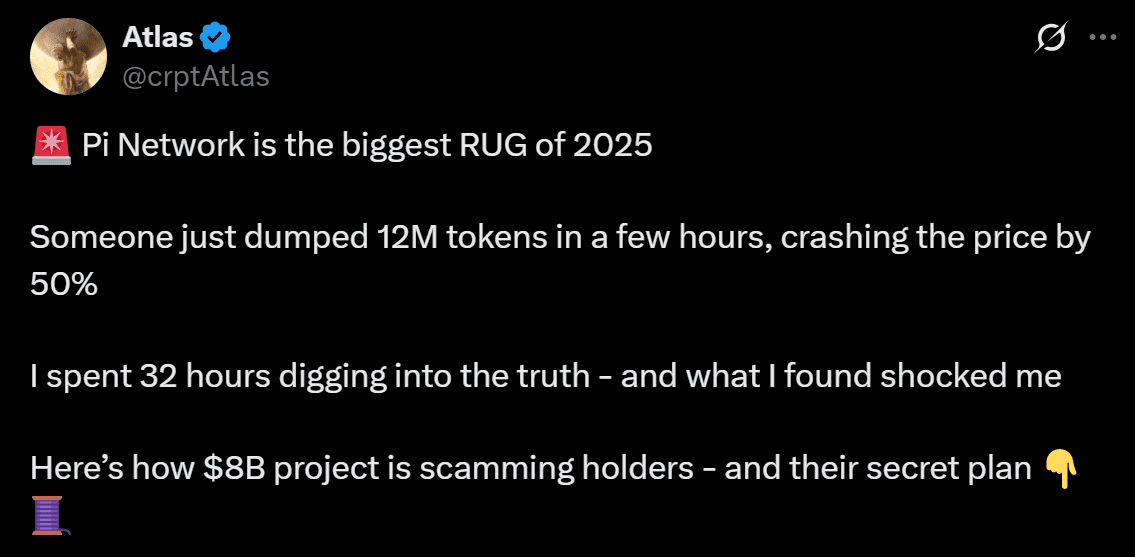

Rug Pull Allegations Erupt After Consensus 2025

Allegations of a calculated rug pull engulfed the Pi Community following its look at Consensus 2025. Crypto analysis X accounts Dr. Picoin and Atlas accused the Pi Core Workforce of engineering a price spike forward of the occasion, solely to dump thousands and thousands of tokens throughout peak euphoria.

Dr. Picoin triggered the controversy on Could 17, flagging what he referred to as a “coordinated dump” tied to the hype round a supposed Pi Ecosystem rollout and the launch of 100 DApps. None of these materialized. As a substitute, the Core Workforce introduced a $100 million Pi Community Ventures fund, which critics say was used to masks the absence of actual progress.

In the course of the rally, the Pi Community token surged from $0.40 to $1.60. Blockchain information reveals a 12 million PI switch from a pockets allegedly linked to the staff. Dr. Picoin claimed the staff timed the dump to use peak retail curiosity earlier than the crash.

Atlas doubled down on Could 20, calling it “the biggest rug pull of 2025,” estimating the transfer netted insiders $8 billion. He dismissed explanations that the switch was a part of the mainnet migration and pointed to the dearth of documentation or audit trails from the Core Workforce. In accordance with Atlas, the staff holds over 89% of the availability and makes use of its management to orchestrate a gradual liquidation disguised as ecosystem improvement.

Supporters of Pi Community, together with X account Pinewszone, declare the deal with in query—GABT7EMP—was used for inside distribution, not gross sales. They accused critics of misreading Piscan information and sparking panic. However the Core Workforce’s silence solely deepened the backlash. The mission’s failure to launch any official clarification has intensified investor doubts about its management and token integrity.