On June 4, 2025, Pi Community to Tether (PI/USDT) shaped a falling wedge sample on the 4-hour chart.

A falling wedge sample seems when price strikes between two downward-sloping, converging trendlines and usually indicators a possible bullish reversal.

If the sample confirms with a breakout above the higher crimson trendline, the price can rally 99 p.c from the present price of $0.6552 towards the projected goal of $1.2792.

Presently, the price trades barely under the 50-period Exponential Shifting Common (EMA), which stands at $0.6770. The price should break above each the wedge resistance and the EMA to activate the bullish setup.

Quantity stays secure close to 2.61 million, however the price has compressed into a decent vary contained in the wedge. This reveals declining volatility and will trace at a breakout try.

For affirmation, merchants will search for a powerful candle shut above the higher trendline, supported by elevated quantity. If that happens, bullish momentum might drive PI/USDT towards the $1.27 space.

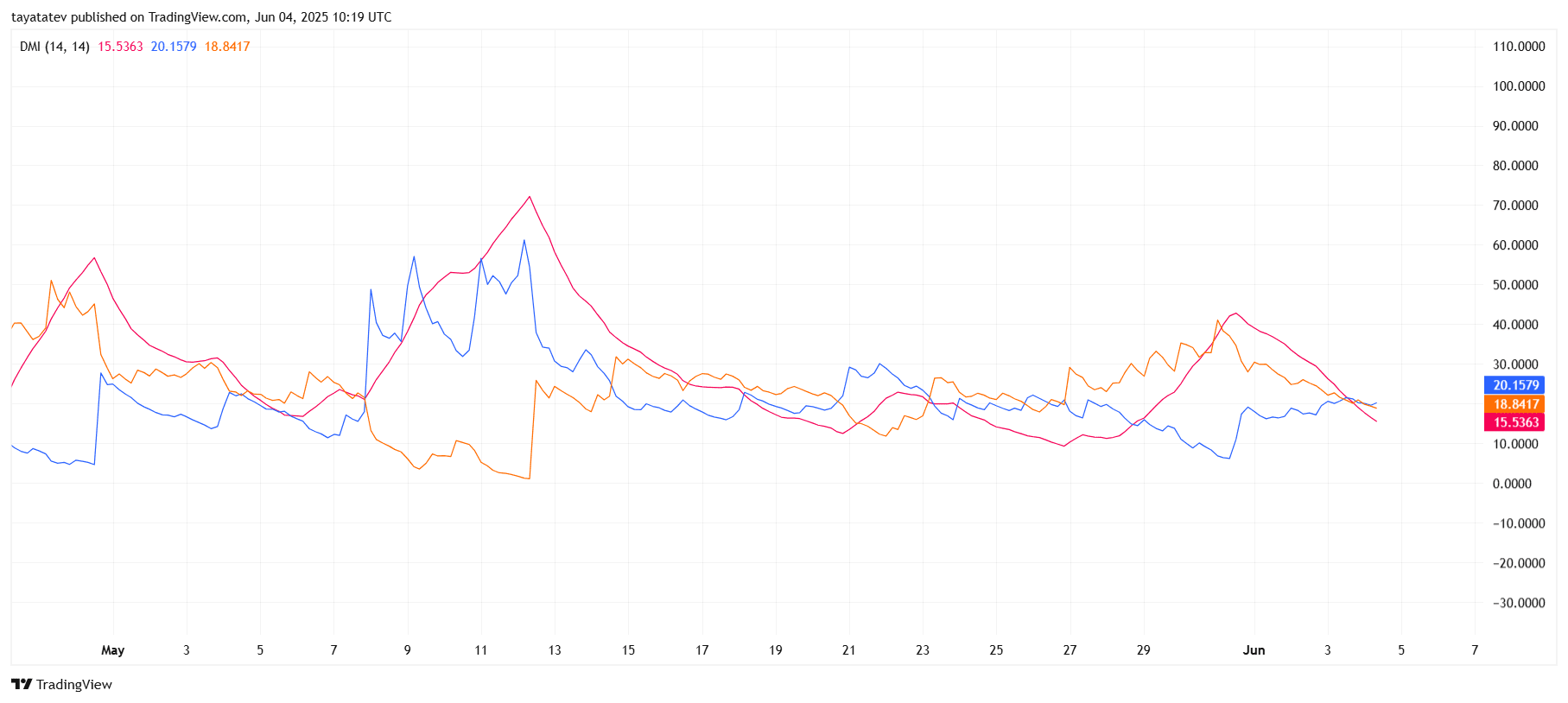

Directional Motion Index (DMI) Evaluation – June 4, 2025

The chart reveals the Directional Motion Index (DMI) for Pi Community to Tether (PI/USDT) on the 4-hour timeframe.

The DMI consists of three key elements:

-

+DI (Constructive Directional Indicator) in blue: 20.15

-

–DI (Detrimental Directional Indicator) in crimson: 15.53

-

ADX (Common Directional Index) in orange: 18.84

The +DI line is now above the –DI line, displaying that bullish energy is at the moment larger than bearish strain. Nonetheless, the ADX worth stays under 20, indicating that the development remains to be weak and lacks clear momentum.

Earlier within the chart, the –DI crossed above +DI round Might 13, confirming a bearish development that continued into the final week of Might. Since then, the +DI has progressively climbed above the –DI, displaying a possible development reversal.

Nonetheless, the low ADX studying indicators that this bullish shift wants stronger momentum to grow to be a confirmed development. For now, patrons have an edge, however quantity and volatility should rise to assist a sustained breakout.

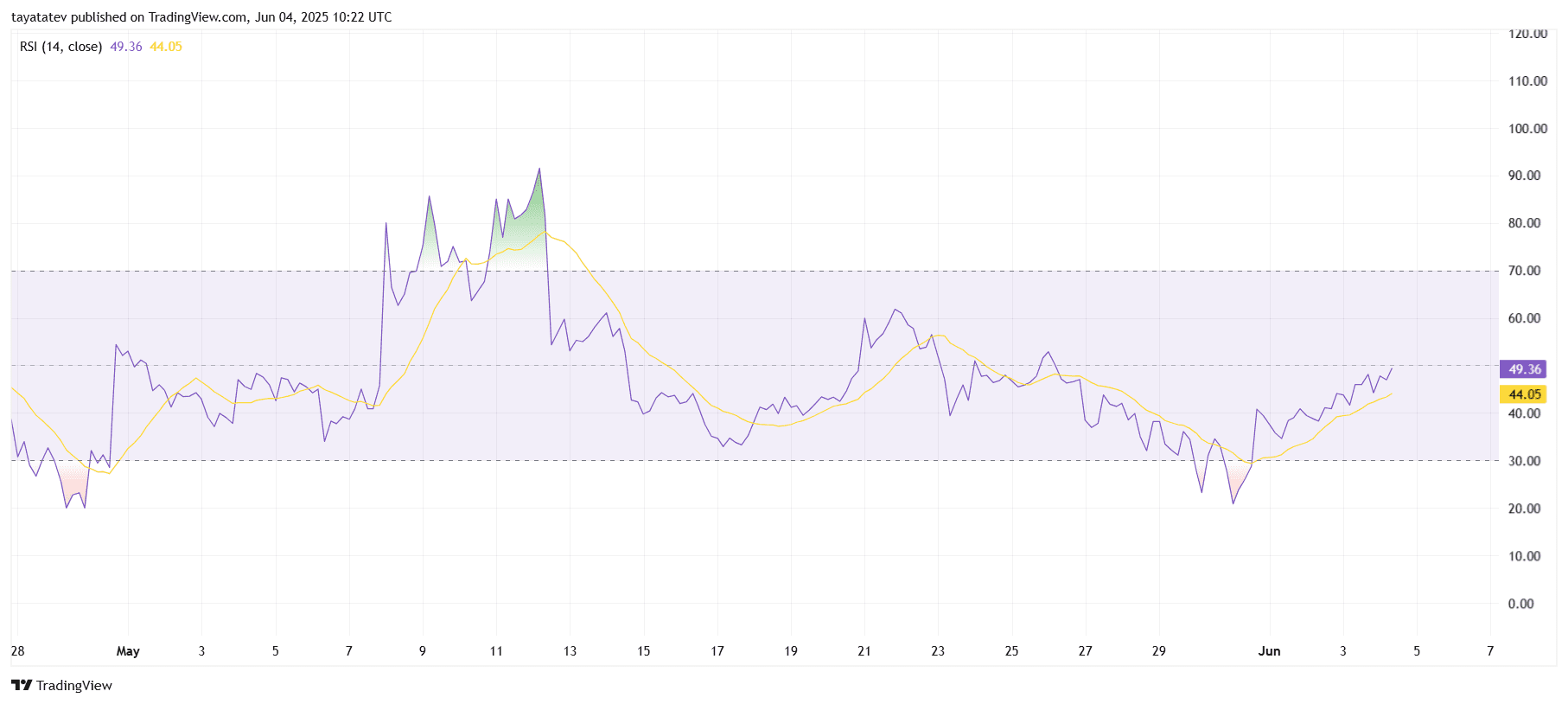

PI/USDT RSI Exhibits Bullish Momentum Constructing

The chart shows the Relative Energy Index (RSI) for Pi Community to Tether (PI/USDT) on the 4-hour timeframe. The RSI (purple line) at the moment reads 49.36, whereas its 14-period shifting common (yellow line) stands at 44.05.

RSI measures momentum by evaluating current positive factors and losses. It usually indicators overbought situations above 70 and oversold situations under 30.

Proper now, the RSI is climbing towards the midpoint of fifty, displaying bettering bullish momentum. Since RSI has crossed above its shifting common and continues to rise, this indicators a gradual shift in favor of patrons.

Earlier in June, RSI rebounded from near-30 ranges, avoiding oversold territory. This bounce aligns with current price stability and suggests potential for additional upside if RSI continues above 50.

Nonetheless, the RSI stays in impartial vary. A confirmed break above 50 would strengthen the case for a bullish continuation.

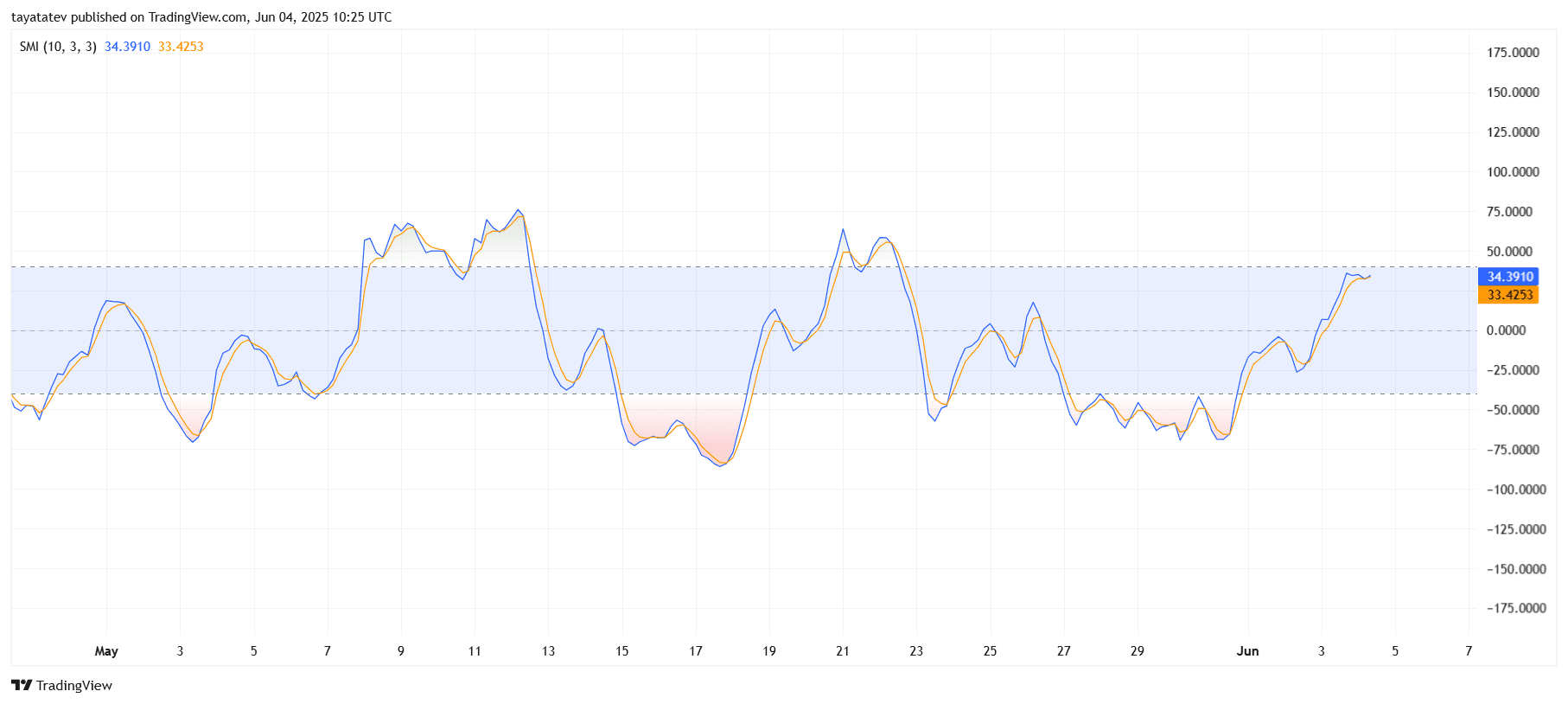

PI/USDT SMI Indicators Momentum Shift to the Upside

The chart reveals the Stochastic Momentum Index (SMI) for Pi Community to Tether (PI/USDT) on the 4-hour timeframe. The blue line (SMI) stands at 34.39, whereas the orange sign line follows carefully at 33.42.

The SMI measures momentum relative to price vary and works like an improved model of the stochastic oscillator. Values above +40 recommend bullish momentum, and values under -40 point out bearish situations.

Presently, each strains have crossed above the zero stage and are approaching the +40 zone. This rise confirms rising upside momentum. The blue SMI line leads the sign line, displaying bullish management.

Earlier in Might, SMI made a number of failed makes an attempt to carry above zero. However now, the graceful breakout suggests stronger purchaser presence. If the indicator breaks and holds above +40, it could affirm a transparent bullish momentum section.

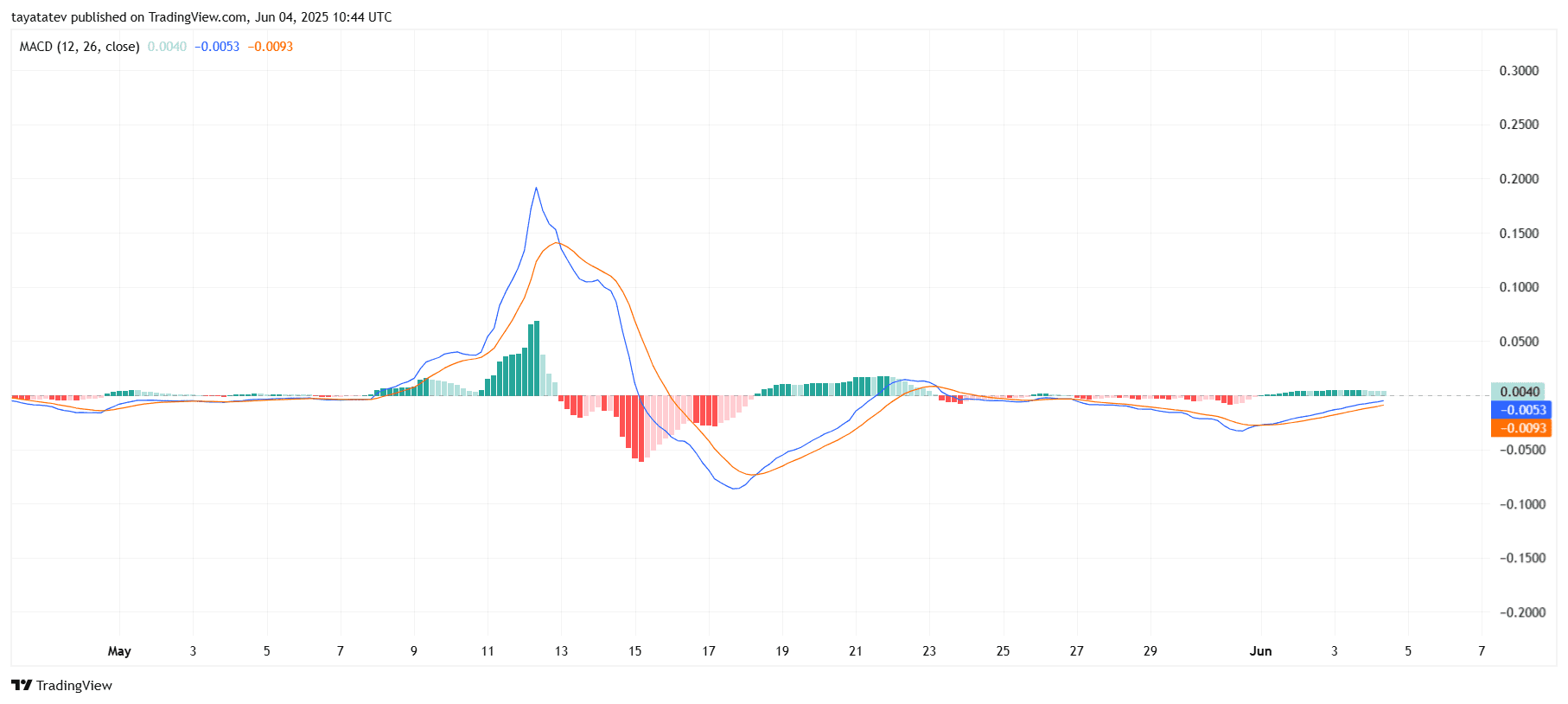

PI/USDT MACD Histogram Flips Inexperienced, Indicators Early Bullish Shift

The chart reveals the Shifting Common Convergence Divergence (MACD) for Pi Community to Tether (PI/USDT) on the 4-hour timeframe. As of June 4, 2025, the MACD line (blue) is at –0.0053, and the sign line (orange) is at –0.0093, whereas the histogram has turned barely constructive at 0.0040.

MACD identifies development shifts and momentum energy. A crossover of the MACD line above the sign line signifies a possible bullish development, particularly when it occurs under the zero line.

Presently, the blue MACD line is shifting nearer to crossing above the orange sign line, and the histogram bars are inexperienced and growing. This indicators early bullish momentum forming.

The final crossover occurred round Might 10 throughout a powerful rally. Now, the setup once more reveals early indicators of a shift, with the histogram turning inexperienced and the space between the strains narrowing. If the MACD line crosses above the sign line, it could affirm bullish divergence.

Pi Community Braces for June Token Unlock Value $176 Million

Pi Community is making ready for a serious token unlock in June, releasing 276 million PI tokens into circulation. At present market charges, the unlocked tokens are valued at roughly $176 million, in line with knowledge from PiScan.

The occasion raises considerations amongst market contributors already coping with bearish sentiment and declining buying and selling quantity. The Pi Coin price has struggled to get well after current losses, and this token unlock might additional weigh on its efficiency.

Traditionally, large-scale token releases typically introduce extra promoting strain, particularly when total demand stays weak. In Pi’s case, the timing seems unfavorable. Market situations are already fragile, and the sudden enhance in provide might speed up a transfer towards decrease price ranges.

The Pi Community workforce has not publicly commented on the unlock’s market affect. Nonetheless, traders proceed to look at carefully because the token launch approaches, in search of indicators of elevated liquidity or early selloffs.