Picture supply: Getty Photos

The FTSE 100 stays a well-liked place to go attempting to find dividend shares. Buyers are capable of entry some scrumptious dividend yields, a few of that are in double-digit territory.

What’s extra, UK blue-chip shares have market main positions, sturdy steadiness sheets, and a number of income streams. And to allow them to ship a strong passive earnings regardless of the climate.

Nonetheless, the index’s superiority for dividends has eroded lately. And it’s doable that purchasing small caps for a second earnings is perhaps a greater concept. Right here’s why.

Higher yields

Based on Octopus Investments, buyers can purchase a greater dividend yield by casting their internet outdoors the FTSE 100 and FTSE 250 indexes.

Based on the funding big, the yield on UK small-cap shares for this yr sits slightly below the Footsie common simply shy of 4%. Nonetheless, for 2025, the yield improves to 4.33%.

This beats the averages of three.97% and three.88% for the FTSE 100 and FTSE 250* respectively.

Superior cowl

In fact there’s extra to wise dividend investing than simply enthusiastic about yield. Dividend yields matter for little if brokers’ payout projections are constructed on sand.

But based mostly on dividend cowl, dividend forecasts for small-cap shares really look extra sturdy than these of the broader FTSE 100 and FTSE 250. Dividend cowl measures what number of occasions predicted payouts are coated by anticipated earnings.

Dividend cowl for British small caps is above thrice for 2024, and strikes above 3.5 occasions for subsequent yr, in line with Octopus. Each figures comfortably surpass the broadly regarded security benchmark of two occasions.

A high small-cap inventory

Attention-grabbing information, I’m positive you agree. However I for one don’t imagine buyers ought to merely take into account shopping for small-cap shares for dividends. Payouts at companies like these will be extra susceptible throughout financial downturns.

They will additionally expertise excessive share price weak spot on the idea of company-specific information, or adversarial trade or financial situations. As at all times, making a diversified portfolio will be one of the simplest ways to go.

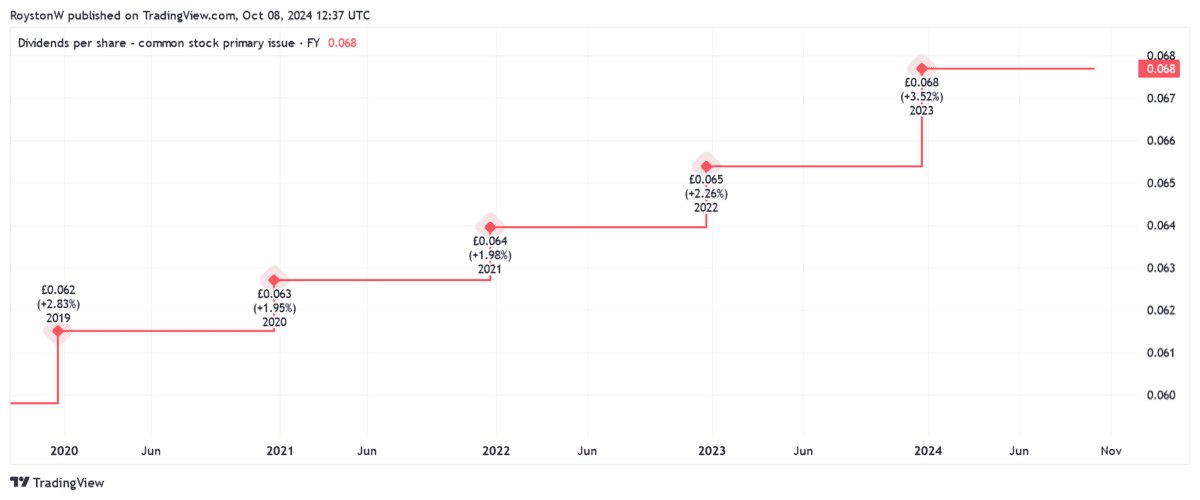

One small-cap dividend share attracting my consideration right now is Influence Healthcare REIT (LSE:IHR). At 7.8% and eight.2% for 2024 and 2025, respectively, its dividend yields are really gigantic.

Like every property inventory, the corporate is susceptible to modifications in rates of interest. Larger charges influence internet asset values (NAVs) and push borrowing prices skywards.

However on steadiness, I feel Influence — which owns and lets out residential care properties — is a rock-solid dividend inventory to contemplate. Not solely does it function in a extremely defensive market. The enterprise additionally has its tenants locked down on lengthy rental agreements (its weighted common unexpired lease time period is above 20 years).

Beneath actual property funding belief (REIT) guidelines, it’s also obliged to pay at the very least 90% of annual rental income out in dividends. This will make it a dependable and beneficiant dividend provider over time.

* Figures check with the FTSE 250, excluding info know-how shares.

Please word that tax therapy relies on the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is offered for info functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation.