NOIDA (CoinChapter.com) — U.S. President Donald Trump triggered a recent wave of market volatility on Apr. 2, 2025, by asserting a sweeping set of import tariffs that hit practically each nation—and at the very least one uninhabited island group. The baseline 10% levy applies to all international items getting into the US, with larger “reciprocal” charges concentrating on particular commerce companions. The coverage imposes 20% tariffs on the European Union, 25% on South Korea, and as excessive as 54% on Chinese language items, in line with a White Home memo launched the identical day.

Whereas international markets reacted sharply, the administration’s resolution to incorporate distant and uninhabited areas like Australia’s Heard and McDonald Islands drew ridicule. Based mostly on Census Bureau information, the islands haven’t any human residents, no recognized exports, and no recorded commerce with the U.S. in 2024. The U.S. assigned them a ten% tariff, apparently after an information labeling glitch misattributed unrelated imports.

The political backlash was rapid. China demanded an “unconditional rollback” of the measures, the EU retaliated with $28 billion in levies on U.S. items, and South Korea’s appearing president vowed an “all-out” response.

Canada and India signaled sharply divergent paths—Ottawa condemned the transfer outright, whereas New Delhi hinted at a attainable compromise to protect entry to U.S. markets. In the meantime, the S&P 500 dropped practically 5%, and Nasdaq’s futures turned sharply decrease as merchants digested the potential fallout of a globally entangled tariff struggle.

Penguins of Heard and McDonald Islands Plot Their Icy Revenge

The U.S. imposed a ten% import tariff on the Heard and McDonald Islands—a desolate Australian territory with no inhabitants, financial system, or postal code value memorizing—triggering confusion and a quick existential disaster for worldwide commerce logic. The one residents are penguins and seals, none of whom filed W-2s or export paperwork in 2024. Nonetheless, the U.S. assigned the islands a tariff after an information labeling glitch misattributed unrelated shipments to the subantarctic outpost.

In a chilling response from the area, the penguins waddled into the highlight, livid over the Trump administration’s resolution to tax their non-existent exports. The barren volcanic islands, listed by UNESCO as certainly one of Earth’s final untouched ecosystems, grew to become collateral harm in a commerce struggle they didn’t know they’d joined. “This is an outrage!” Emperor Waddlebottom, a king penguin, instructed CoinChapter in an unique interview. “We’ve been sliding on our bellies for centuries, and now the U.S. wants to tax our ice? We’ll show him.”

U.S. import information from 2022 inexplicably attributed $1.4 million in “machinery and electrical” imports to the area, regardless that neither Australia nor the penguins reported such exports. Commerce officers now consider automated programs or nation code misassignments triggered the inclusion, successfully turning a glitch into coverage. Australia’s commerce ministry confirmed that the territory conducts no export exercise, until penguins have been delivery frozen sardines by a shadow financial system.

In the meantime, Norfolk Island suffered the same destiny. U.S. information linked Timberland boots and outside gear to the island regardless of zero native manufacturing. Prime Minister Anthony Albanese didn’t miss the irony, telling reporters that “even Antarctica isn’t safe anymore.”

The penguins, undeterred, known as a snowy emergency convention. Admiral Flippers, an Adélie penguin and self-appointed negotiator, introduced a seafood embargo on American seals and promised a live-streamed “waddle-in” protest. Unconfirmed rumors recommend the area has contacted the penguins featured within the film ‘Madagascar’ to plot some revenge.

As memes of militant penguins flooded X, the actual joke is perhaps on the worldwide markets: if phantom islands present up in actual U.S. commerce coverage, what else is damaged within the system?

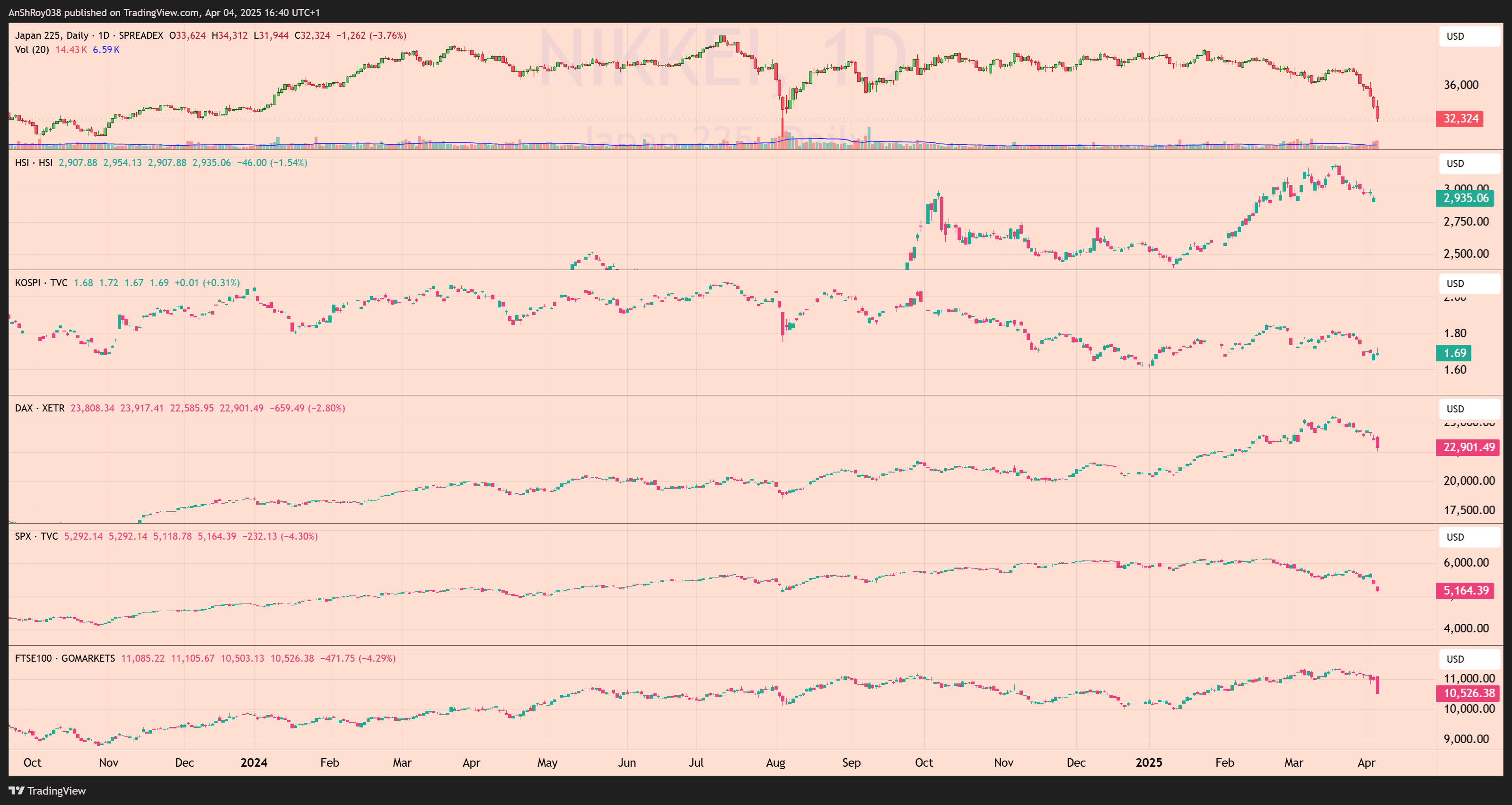

Markets Shudder Worldwide as Trump Tariff Shockwaves Ripple Throughout Exchanges

The worldwide fairness market response to the Trump administration’s April 2 tariff announcement was swift and extreme. The Japan 225 index shed 2.82% by April 4, marking a pointy retreat amid fears over deteriorating commerce flows with the US. The FTSE 100 in London declined 2.79%. Germany’s DAX fell over 3%, signaling rapid investor concern over the European Union’s retaliatory posture and the anticipated drag on key export sectors like autos and industrial gear.

In Asian markets, the Cling Seng Index rose 1.54%, at the same time as sentiment weakened over potential disruptions in logistics and expertise exports. South Korea’s KOSPI managed a muted achieve of 0.31% regardless of the Trump tariff debacle, although merchants attributed the resilience to prior corrections already pricing in geopolitical stress.

In the meantime, the S&P 500 registered a steep 4.3% loss, its worst session in over a 12 months. The market motion mirrored Wall Avenue’s unease with coverage unpredictability and potential knock-on results on multinational earnings.

The synchronized drop throughout areas underscores international markets’ systemic publicity to abrupt coverage shifts from Washington. Whereas some humor nonetheless circulates on-line, the broader actuality is way extra sobering: the Trump tariff commerce struggle threatens to destabilize provide chains and dampen investor confidence at a precarious second for international development. Traders at the moment are bracing for heightened volatility as retaliatory measures unfold throughout key economies.